Blog

D&O Insurance Guide for Foreign IPOs and Direct Listings, 2023 Edition

Non-US companies are attracted to going public on a US exchange for a variety of reasons, such as access to capital, increased liquidity, and in some cases, more flexible rules and regulations compared to other markets. Unfortunately, listing on a US exchange comes with the risk of D&O litigation.

In fact, in 2022, the rate of securities class actions filed against foreign filer companies went up approximately 14%.

There has been a steady rate of filings against foreign companies over the past decade, which has resulted in a 10-year average of 15% of the annually filed securities class actions. In addition, settlements for these cases reached a 10-year high in 2022, totaling $955 million.

Placing a D&O insurance program to protect directors and officers can be complex, and that complexity is somewhat amplified if you are a foreign issuer.

Unfortunately, too many companies do not realize that the D&O process is one that needs to be managed well. Getting this piece right can mean the difference between a smooth IPO process and unnecessary delays.

Remember: Private companies must have their public company D&O insurance program ready to bind before the IPO or direct listing.

For the time being, many companies are holding off on IPOs as they wait and see how the banking crisis, inflation, and general economic uncertainties pan out. The upside of this slowdown for pre-IPO companies, however, is having the time to be more deliberate about things like their D&O insurance strategy.

Moreover, given that D&O insurance prices have fallen considerably, foreign issuers have better options than previous years.

Woodruff Sawyer’s Guide to D&O Insurance for Foreign IPOs and Direct Listings, 2023 Edition, highlights the steps that foreign filers need to take to ensure that D&O insurance coverage is ready to respond by the first day of trading.

Get instant access to the report here, and read on for highlights:

Foreign IPOs: The 5-Step Process for Placing D&O Insurance

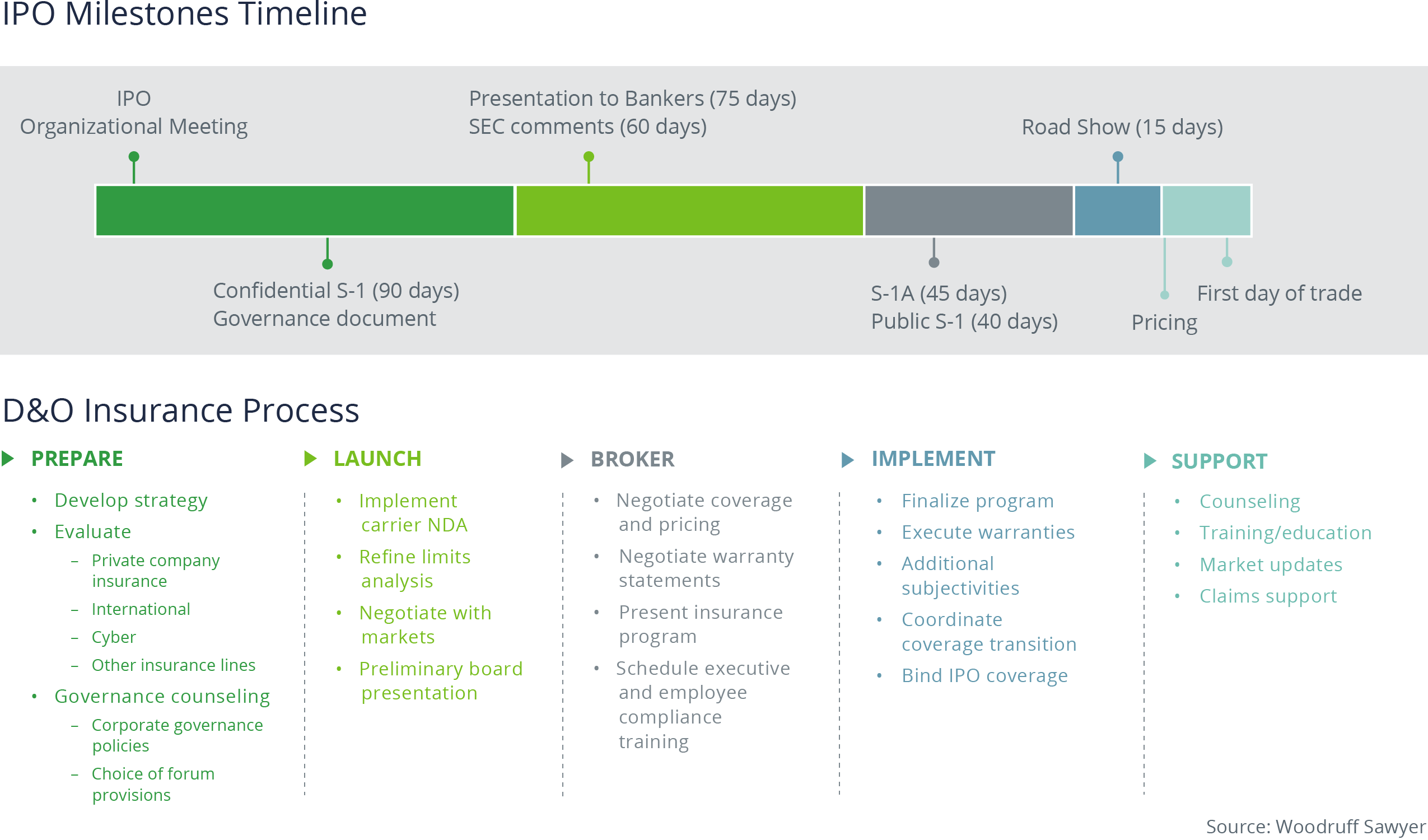

A well-brokered D&O program comprises five steps that coincide with key milestones for foreign companies on their journey to the IPO, as illustrated in the image below:

An experienced broker that specializes in foreign IPOs can take you through a seamless process, and it all starts with the preparation phase.

1. Prepare

Around the time of the IPO organizational meeting, your broker should start preparing the D&O program strategy. Ideally, this happens 90 days out (or more) from the IPO.

A good broker will ask questions such as: What is your philosophy on risk transfer versus retaining risk? Do you have any special or unusual risk exposures? How involved do you want the board to be in making decisions about D&O insurance?

During the strategy phase, the broker should also evaluate all insurance coverages, and:

- Make recommendations for placing private company D&O insurance ahead of the IPO.

- Provide you with a framework for how to assess the right limit of insurance to purchase.

- Ensure international local policies are in place as needed.

- Review other risk transfer products like cyber insurance.

2. Launch

The launch phase is when your broker will be engaged in activities such as refining limits, negotiating with insurance markets, briefing the board, and more.

This typically starts about 75 days out and coincides with milestones such as your presentation to bankers and the Securities and Exchange Commission's comments on your F-1 registration statement.

A presentation on the program to board members is a best practice, as well as scheduling executive employee compliance training. This compliance training helps people transition from a private company environment to a public company one.

3. Broker

The brokering phase commences around the time of the public flip of your F-1 registration statement. This is typically around 40 days out from the IPO. During this time, your broker will negotiate things like coverage, pricing, higher limits, and warranties.

4. Implement

Around three to 15 days out from the first day of trading, most foreign filers will be on their roadshow. This is also the time to finalize the last details of the D&O insurance program, including executing warranties and the timing for binding the coverage.

5. Support

Congratulations! You’ve completed your initial public offering. But that doesn't mean support from your D&O insurance broker should stop there.

One of the reasons clients seek out Woodruff Sawyer for D&O coverage is our ongoing support for newly public companies, which includes counseling, training, and aggressive claims advocacy.

Learn More

Download Woodruff Sawyer’s Guide to D&O Insurance for Foreign IPOs and Direct Listings, 2023 Edition, to learn more about the process of placing a D&O insurance program ahead of an IPO.

Experience matters when it comes to selecting your D&O insurance broker for your IPO or direct listing. You want to be sure your broker can anticipate and handle potential D&O insurance issues that arise before, during, and after the process of a foreign filer going public on a US exchange.

This extensive experience is why private, foreign companies seek out Woodruff Sawyer as their broker partner for their IPOs and public company life as a foreign filer listed on a US exchange.

Authors

Table of Contents