Blog

Insights from the SVB Bankruptcy: Insurance Lessons for Directors and Officers

"Strategic bankruptcy” can be a corporate strategy—but that’s not the norm. More typically, when faced with the sudden reality of bankruptcy, directors and officers have little time to plan for it. This article will review the exposures directors and officers encounter when companies go bankrupt. Using the failure of Silicon Valley Bank (SVB), we’ll also examine D&O liability insurance’s often conflicted role in paying claims against the company and defending the directors and officers. Finally, we’ll provide insight into preparing your D&O program today so that directors and officers are prepared if the unthinkable suddenly becomes inevitable.

— Priya Huskins

There were 18,926 business bankruptcy filings in 2023. The number of companies that filed for bankruptcy with $1 billion or more in liabilities was 22. Some notable companies filed for bankruptcy including RiteAid, Vice Group, WeWork, FTX and SVB. Some of these resulted in litigation and even criminal prosecution.

While a corporation will find relief from litigation when it enters bankruptcy (as a matter of bankruptcy law, litigation against the corporation is “stayed” or paused in bankruptcy, directors and officers may remain on edge because they can be sued individually or collectively—and the company is no longer able to indemnify them.

The types of litigation that directors and officers could face include:

- Shareholder and creditor suits

- Breach of fiduciary duty suits

- Wrongful or fraudulent trading suits

- Compensation clawback actions

- Undue preference actions

- Actions for unpaid wages or taxes

This is a small sample of the exposures directors and officers of bankrupt companies encounter. For a more detailed analysis, please see Corporate Bankruptcy: A Guide for Directors and Officers.

The directors and officers of each of 2023’s bankruptcy filings faced these exposures, but not all bankruptcy filings lead to litigation—actually, most don’t. That does not mean, however, it’s prudent to ignore these exposures.

Woodruff Sawyer reviewed securities class action litigation that occurred within a year before or a year after a publicly traded US-listed company filed for bankruptcy from 2014 through 2023.1

The findings are eye-opening, not necessarily for the severity of these claims but for their success rate.

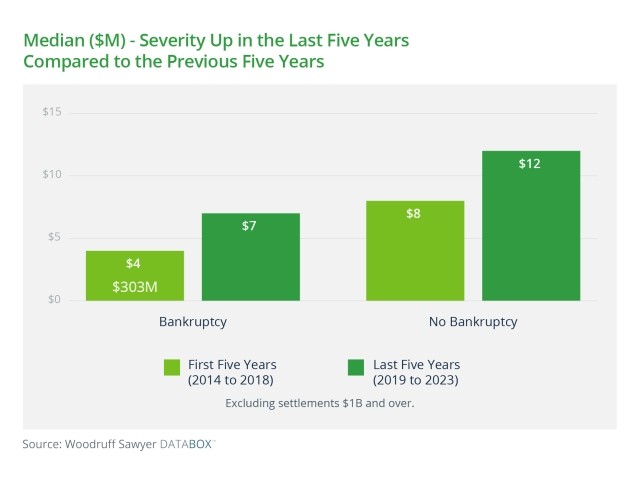

Our data show that the median settlement for securities class action settlements for the bankruptcy cohort is less than that of non-bankrupt companies.

This could be for several reasons: litigation against the company is stayed or paused, financial struggles have depressed the market cap reducing the potential settlement amount, and securities class action claims often taking a backseat to the breach of fiduciary duty claims, among others.

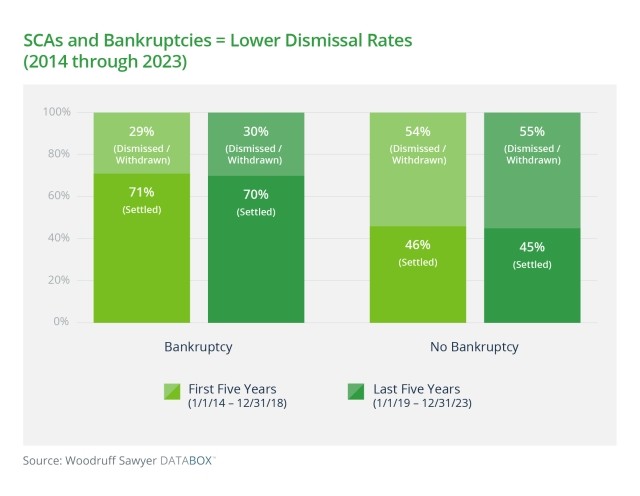

However, the success rate is remarkable. Securities litigation against the directors and officers of bankrupt companies is more than 50% more likely to survive a motion to dismiss than non-bankrupt companies.

This suggests that the general narrative around bankrupt companies is persuasive (poor or selfish decision-making by the directors and officers resulted in bankruptcy).

The high success rate makes the exposures faced by directors and officers of bankrupt companies very real.

The company is typically not able to indemnify the directors and officers. If directors and officers do not have access to a well-crafted D&O liability program, they could be paying for these exposures out of pocket as highlighted in SVB’s recent bankruptcy litigation.

SVB: A Cautionary Tale

SVB’s collapse is the second-largest bank failure in US history. Bank failures aren’t uncommon, but it is unusual for a bank of SVB’s size to fail.

There were a lot of reasons that SVB failed, but ultimately a run on the bank caused its collapse. SVB was concentrated in the tech sector, which was negatively impacted by rising interest rates.

Higher rates made it difficult to secure cash from venture capital funds, so struggling tech companies had to draw down on deposits. This created a run on the bank as other companies saw this and drew down deposits.

Social media amplified and accelerated the impact of these withdrawals. Ultimately, the FDIC stepped in.

Following the failure, seven class actions were filed against SVB’s directors and officers. Regulators also began proceedings against the directors and officers.

The directors and officers sought advancement of their legal expenses from SVB’s bankruptcy estate. The estate declined to advance without court approval. The directors and officers then submitted claims directly to the D&O insurers which also required court approval.

The directors and officers filed a motion seeking the court’s approval to use D&O proceeds to pay for their legal expenses.

The official committee of unsecured creditors objected, arguing the D&O proceeds were the property of the bankruptcy estate and the “uncontrolled payment of defense costs has the potential to severely diminish” the D&O proceeds that would otherwise be available to pay for the unsecured creditors’ claims.

The creditors’ committee also noted that the committee was itself investigating, bringing claims against the directors and officers, and thus wanted the D&O program to be available to fund its potential judgments against the directors and officers.

The court sided with the directors and officers, holding they could access SVB’s D&O insurance program to pay for their legal expenses.

SVB Case Takeaways

It’s important to understand why the court sided with the directors and officers, particularly since the court also noted that, even where the insurance program provides coverage to the directors and officers, the insurance proceeds can still be the property of the bankruptcy estate if depletion of the insurance limits would hurt the estate.

The court found that SVB’s directors and officers had shown cause to lift the automatic stay, so the court did not determine whether the insurance proceeds were property of the estate.

The court found the directors and officers showed cause based on the D&O program’s terms and conditions. The court highlighted the D&O program’s priority of payment provision, a provision that clearly gave the directors and officers first rights to the policy proceeds when the company does not indemnify, as in the case of bankruptcy.

The court acknowledged that the defense costs the directors and officers would incur could deplete most or all the D&O policy proceeds. This would leave insufficient or no policy proceeds for the estate to pay claims asserted against SVB, the corporation.

The court, however, concluded the priority of payments provision dictated this outcome—“even if it is true that the Directors’ and Officers’ will deplete the policy, they are entitled to use the proceeds first … the Debtor is last in line for the insurance proceeds.”

Why did the creditors think they had a claim on the D&O insurance policy in the first place?

After all, the policy is literally titled “Director and Officer” insurance. The answer relates to the fact that SVB, like most companies, purchased two types of D&O insurance policies, one of which also insures the corporate entity.

The type that also insures the corporate entity (albeit on a limited basis) is sometimes referred to as an “ABC” policy, while the type that only insures directors and officers when the corporate cannot is referred to as a stand-alone Side A policy.

The court—and the creditors—conceded that the debtor estate had no claim on the Side A policies; everyone agreed that the Side A policies were for the benefit of the directors and officers alone.

The court’s decision to lift the stay related only to the ABC policies that also insured the corporate entity. Indeed, the court explicitly did not reach the question of whether the ABC policy proceeds are property of the estate.

How to Prepare Your D&O Policy for Bankruptcy

The SVB decision provides some key lessons for all companies and their insurance brokers.

No. 1: Maintain a Robust D&O Insurance Program

A robust D&O insurance program includes:

Adequate policy limits. A thoughtful approach to insurance limits includes taking a look at “normal” exposures as well as catastrophic situations. Catastrophes tend to be when the “Side A” part of the D&O insurance program matters the most.

Higher Side A limits lessen the likelihood that multiple insureds must compete for policy proceeds at a time when cooperating on the defense strategy should be the higher priority.

A specialized broker and policy negotiator. Unlike some other lines of insurance, D&O insurance requires a specialist, not a generalist. Ideally, you will work with a broker that has helped many companies before yours through bankruptcies. This is an area where experience matters.

Consider the vital timing and technical issues surrounding policies. An experienced broker can walk you through the issues.

Remember, too, that insurers are more willing to embrace broad bankruptcy terms the further away from bankruptcy your company is. An experienced broker knows this and will often make a point of negotiating broad bankruptcy policy coverage well before anyone else might think this sort of negotiation is important.

A financially solid, dependable insurance carrier. It may be tempting to select your insurance coverage based on price, but there are other things to consider when evaluating a carrier.

A critical issue for the directors and officers of a company facing bankruptcy is the financial health of the insurance carrier. Another important consideration is the carrier’s track record of paying claims.

Insurance carriers that are unable or unwilling to pay legal bills timely are carriers that are leaving directors and officers in a lurch.

The “Side A” insuring agreement. “Side A” is the common term for the insuring agreement in a D&O policy that responds when a director or officer is sued and the corporation is unable to respond, including due to bankruptcy.

This insuring agreement should require no payment of a self-insured retention (like a deductible) before the policy will begin to respond.

Most public companies and many private companies purchase Side A as part of a broader D&O insurance policy and purchase Side A insurance on a standalone basis. When the Side A policy is part of a broader policy that also includes coverage for the corporate entity, the policy is often referred to as an “ABC policy.”

The standalone Side A insurance is often referred to as “Side A Differences In Conditions” or “Side A DIC.” The DIC provision means that if, for some reason, your traditional ABC insurer(s) doesn’t respond, the Side A DIC insurer(s) will drop down to pay a covered loss.

No. 2: Include a Clear Priority of Payments Clause

This clause in a D&O insurance policy dictates how the company’s insurance program will pay out on significant claims involving the individual directors and officers and the company.

As demonstrated in SVB’s bankruptcy litigation, this clause will be used by courts when determining whether the directors and officers have access to the policy proceeds even when such access may deplete the limit to the disadvantage of the company and claimants.

No. 3: Plan for the Unlikely and Unexpected

Directors and officers need to have a well-negotiated D&O policy before their company’s finances start to deteriorate. Your D&O policy terms are unlikely to improve as a company gets closer to bankruptcy. With insurance policies, the devil is in the highly-negotiated details.

The first time you ask, “What does our D&O policy say in case of bankruptcy?” shouldn’t be when you are about to file for bankruptcy.

As demonstrated in the SVB case, a creditor’s committee (or bankruptcy trustees) may be eager to prevent directors and officers from accessing the D&O program to the detriment of the bankruptcy estate.

The terms that are most protective to directors and officers may not be available to you when your company is heading toward bankruptcy, making it all the more important to work with a D&O expert well in advance of when your company may file for bankruptcy.

Authors

Table of Contents