Blog

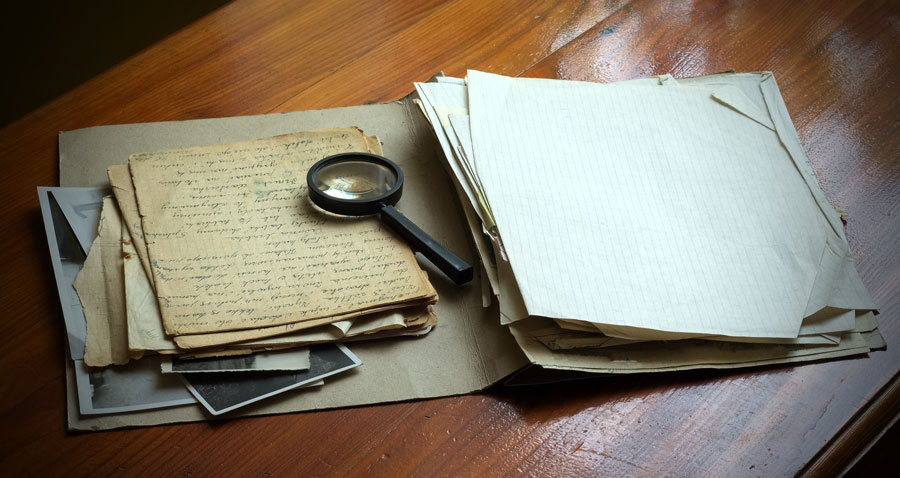

Love is Blind but Due Diligence is Not

The potential for risk in an M&A transaction increases when a buyer falls in love with a prospective acquisition target based upon a combined future vision. In this idealistic haze, they miss some key warning signs.

In today’s blog, Keeley Mooneyhan, SPHR - President & Co-Founder of HR Matters, Inc. talks us through the foundations of a solid due diligence process.

Before finalizing a sale, a buyer must cut through the haze to verify what exactly they are buying and its value.

Proper preparation provides clarity surrounding the deal purpose and value drivers, establishes the right team, and verifies the data requirements to identify risks and validate preliminary assumptions.

6 Steps to Due Diligence Preparation

-

- Define deal strategy, value drivers, and preliminary assumptions

The deal leadership and core M&A team should clarify the purpose, intent of the deal, and preliminary assumptions based upon initial information collected and discussions with the target company. In addition, the core team should formulate due diligence goals and timeline. - Educate, communicate, and pressure test assumptions

Share the deal rationale and preliminary assumptions with the due diligence team to validate the deal thesis. Every deal is different and the value drivers and business rationale and intent must be communicated to ensure the team is focused on the appropriate nuances of the details. It’s also important to outline the risk tolerance and areas which are less critical to the value of the deal. For example, if the product will be shelved post-close, then the product diligence will be focused on closing out customer obligations and any risks associated with the in-market product. - Review any documentation that already exists

If acquiring a public company, the team should look at all publicly available information before requesting data from the target company. The team should have access to all relevant data collected in the preliminary due diligence process (information provided to the acquiring business/core M&A team as part of preliminary discussions). This will help clarify information still required, speed up the process, and limit any redundant asks of the seller. - Create succinct due diligence requests and streamline the process

The buyer should develop a due diligence list by gathering requests for information/documentation from each of the functional teams and advisors, while ensuring there are no redundant or unnecessary requests. These requests will focus on what is needed to assess the business performance, operations, liabilities, risks, and challenges in advance of close. Most serial acquirers have a due diligence request list that they use across deals. This is a good starting point, but the team should review and revise the due diligence requests in each deal as to what is appropriate given the deal structure and the deal rationale. - Set expectations of seller

Communicate goals, timeline, and approach to seller to ensure cooperation and shared responsibility in the outcomes. In typical due diligence scenarios (non-auction), the lead should set clear expectations with the target company regarding what will be required, indicating what are priority items, and the process for setting up discussions to gain further insight into the information provided.

- Define deal strategy, value drivers, and preliminary assumptions

- The more you know about a potential target the better. Having a good team will help you stay objective in what can be an emotional time. It’s also good advice if you are looking to buy reps and warranties insurance for a transaction. The underwriter will evaluate the risk to a great degree on the quality of the due diligence that has been done.

Table of Contents