Guide

2026 D&O Looking Ahead: What Boards Need to Know About Emerging Risks and Insurance Trends [Report]

This week’s blog features insights from our 2026 D&O Looking Ahead Guide, including analysis of the insurance market, D&O insurance pricing insights, and benchmarking statistics. Plus, watch our webinar where our experts break down the latest D&O trends and industry hot topics. —Priya Huskins

Directors and officers continue to operate in an environment of both opportunity and heightened scrutiny.

As we look ahead to 2026, the question is not whether risks will persist, but whether boards and management teams will be effective at navigating the risk environment.

Our annual D&O Looking Ahead Guide brings together exclusive perspectives from D&O insurance underwriters, a deep-dive review of the hot-button issues shaping litigation, and our analysis of where the D&O insurance market is headed.

In this article, I will share some highlights from the 2026 Guide, which you can access instantly here.

Underwriters Weigh In™ 2026: A Survey of D&O Insurance Underwriters

Our Underwriters Weigh In survey is a perennial source of insights—and this year was no exception.

We are grateful to our underwriter friends not only for responding to our survey, but also for providing written commentary—some of which, no surprise, was written in a highly entertaining manner.

(Personal note: I’m so sad that not everyone gets to read all the comments, particularly some of those comments that were a bit too spicy for the masses. Rest assured, however: We see you and we thoroughly appreciate your wit.)

Geopolitical tensions, artificial intelligence, tariffs, and cyber threats are just a handful of the risks that directors and officers (and underwriters) cite as concerns.

As you look out into 2026, should companies be more worried about shareholder litigation or government enforcement actions?

2025 Survey Results: Underwriters continue to think companies should be more worried about shareholder litigation.

Source: 2026 D&O Looking Ahead - Woodruff Sawyer, a Gallagher Company

Whether the risks are old or new, the stakes are higher than ever for underwriters as well as for directors and officers.

Read the Guide to learn more—and be sure to flip to the end of the survey to check out our summary infographic. A picture really is worth a thousand words.

Hot Topics in Focus

Part of the job of directors and officers is to grapple with shifting risks. Some are familiar, others are newly emerging, but all have the potential to shape board decision-making and litigation in 2026.

Here are a few of the most pressing issues:

Securities Class Actions

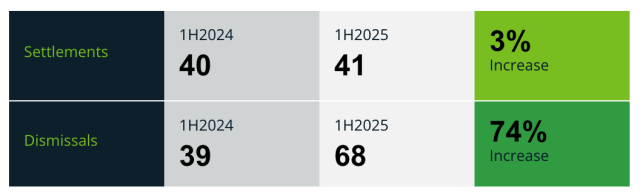

Securities class action filings were slightly down in the first half of 2025, and dismissals were up. However, settlements remain substantial. (We dive further into this topic in our D&O Databox™ Mid-Year Report.)

Settlements and Dismissals (1H 2024 vs. 1H 2025)

Source: 2026 D&O Looking Ahead - Woodruff Sawyer, a Gallagher Company

Artificial Intelligence

AI risks are abundant: Just consider AI “washing,” the risks of misinformation coming from AI agents, rapid adoption without truly understanding AI models, and the SEC’s scrutiny of disclosures. Watch to learn how can companies proactively protect themselves?

Trade Policy

Businesses value certainty, which makes the rapid rollout of new rules like those tied to trade policy and international supply chains particularly challenging. This leaves boards and management in a bind, given that earnings guidance remains a staple of corporate practice. So, what can companies do? Watch to find out.

Incorporation Trends

In 2025, companies are openly debating whether Delaware is still the best home for incorporation, or whether Nevada and Texas offer a more business-friendly alternative. The long-term implications of incorporating outside of Delaware could include fewer fiduciary duty suits and a reduced demand for dedicated Side A coverage. Hear Priya Huskins thoughts on the long term implications of incorporating outside of Delaware.

Access the Full Report for D&O Liability and Insurance Insights

The full 2026 D&O Looking Ahead Guide offers the depth and detail directors and officers need to prepare for what is ahead. Inside, you will find:

- More insights from the Underwriters Weigh In survey, including advice from underwriters to directors and officers.

- A deep dive into each of the hot topics mentioned here and more—including DEI backlash, cyber risk, and FCPA enforcement.

- In-depth analysis of the D&O insurance market, including data-driven trends, pricing insights, and benchmarking statistics.

As rising risks and overlooked exposures are top of mind for underwriters, this year’s Guide helps boards prepare their D&O insurance program accordingly.

DIsclaimer: The information contained herein is offered as general industry guidance regarding current market risks, available coverages, and provisions of current federal and state laws and regulations. It is intended for informational and discussion purposes only. This publication is not intended to offer financial, tax, legal or client-specific insurance or risk management advice. No attorney-client or broker-client relationship is or may be created by your receipt or use of this material or the information contained herein. We are not obligated to provide updates on the information contained herein, and we shall have no liability to you arising out of this publication. Woodruff Sawyer, a Gallagher Company, CA Lic. #0329598.

Author

Table of Contents