Guide

Guide to D&O Insurance for SPAC IPOs, 2023 Edition

Our Guide to D&O Insurance for SPAC IPOs will help you take a sophisticated approach when it comes to securing the right D&O insurance coverage for your SPAC.

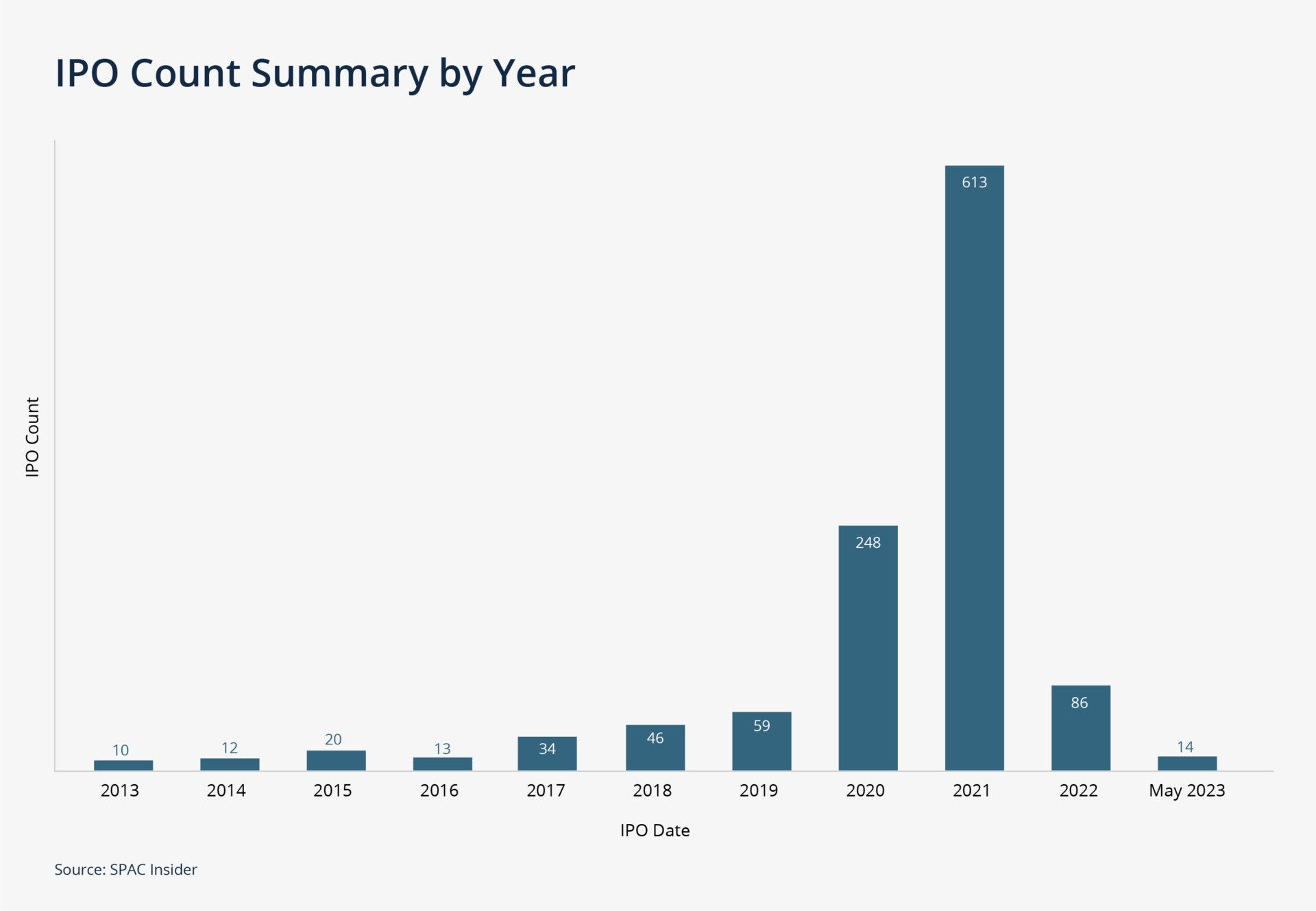

The Special Purpose Acquisition Company (SPAC) frenzy of 2020 and 2021 is clearly behind us, allowing the number of SPAC IPOs to lapse back closer to their normal annual rate. Here are the numbers from SPAC Insider from the last decade through May 2023:

While the SPAC IPO party is over, SPAC IPOs and SPAC mergers (aka de-SPACs) are certainly still happening.

SPACs face a wide range of hurdles as they go through the IPO and merger and acquisition (M&A) process, including regulatory, legal, and business challenges. That is why insurance is a critical piece in a SPAC company’s life cycle.

A piece of good news this year is that the price of D&O insurance for SPAC IPOs is much more reasonable now than at the height of the 2021 SPAC frenzy.

D&O insurance mitigates the common risks that directors and officers of a SPAC and its target company may encounter. This can include lawsuits from their public company shareholders, and investigations and enforcements from the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ).

Representations & warranties insurance (RWI) also plays a key role in competing for and completing a SPAC business combination. SPACs can present a more attractive offer to their target when their deal is backed by a reps and warranties policy.

In Woodruff Sawyer’s Guide to D&O Insurance for SPAC IPOs, 2023 Edition, we lead you through the process of obtaining the right type of coverage for SPACs and target companies for each stage of the life cycle.

Get instant access to the Guide.

Common Types of SPAC Litigation and Regulatory Enforcements

Directors and officers of SPAC companies want to know how they will be protected. D&O insurance covers the following types of common private lawsuits that SPACs face:

- Merger objection lawsuits, which are typical in any M&A process.

- Securities class actions, which have seen a lofty jump in the SPAC space over the past few years.

- Shareholder derivative suits, which are breach of fiduciary duty suits.

While those three types of lawsuits are most common, the plaintiff’s bar has and will continue to come up with creative lawsuits against SPACs that do not fall into the aforementioned categories—something we discuss at length in the SPAC Notebook. Rest assured, D&O insurance will respond in most lawsuits naming directors and officers of a company.

Turning our attention to the governmental regulatory environment, investigations and enforcement actions can also prove to be costly.

The SEC, the DOJ, and the Financial Industry Regulatory Authority (FINRA) continue to focus on the SPAC market.

The good news is that D&O insurance usually covers defense costs for individuals for government investigations—even if it is an informal inquiry. The bad news? Fines and penalties are generally not insurable.

For more on the types of litigation that D&O insurance covers, see: Common D&O Lawsuits and How D&O Insurance Would Respond.

The SPAC Life Cycle and Insurance

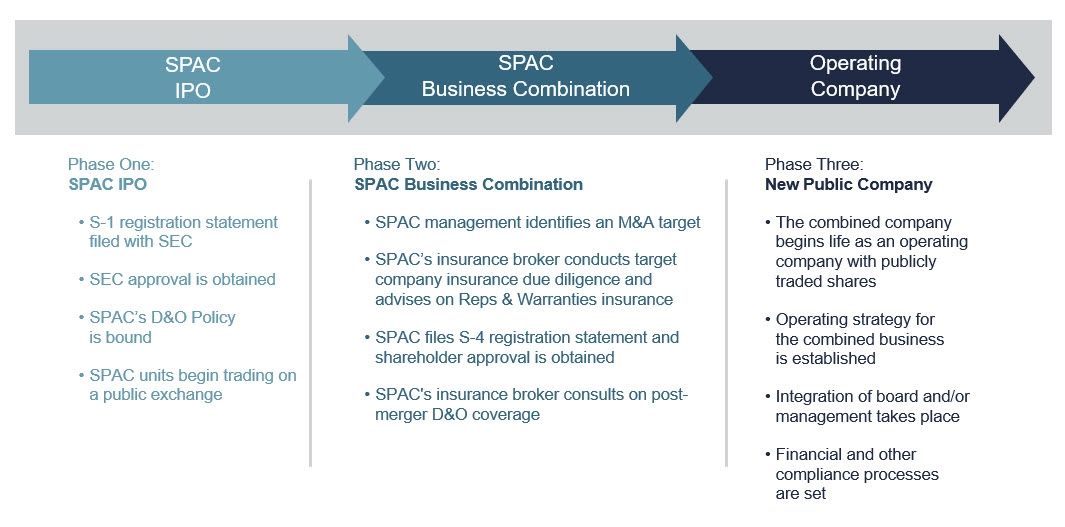

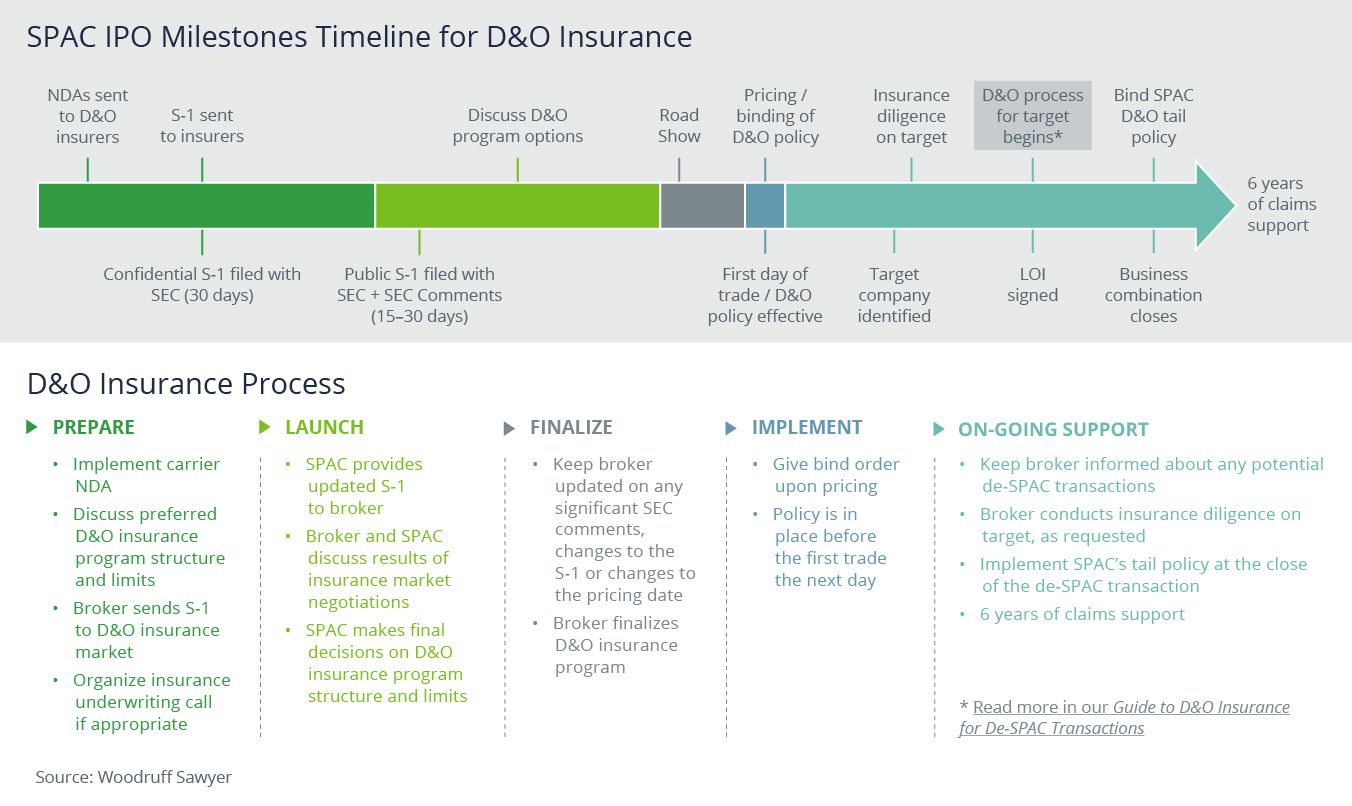

The steps of building a strategic insurance program coincide with key milestones of a SPAC’s life cycle, including the IPO, the business combination, and the newly public company.

The following timeline ensures the company has the right coverage at the right time, so the insurance piece is a seamless part of the SPAC's journey:

Phase 1: SPAC IPO – The SPAC’s D&O insurance must be bound and ready to go by the time of its IPO, the transaction that raises the money that will sit in trust as the SPAC team looks for a target to take public. The Guide goes into more detail on the steps leading up to the IPO, as outlined below:

- Preparation: Contact your trusted D&O insurance broker as you are thinking about forming your SPAC so that you can update your budget with current pricing. This is also the time to strategize with your broker about the type of D&O insurance program you want to put in place.

- Launch: The broker should be on target to send your draft S-1 registration statement to the insurance market when you file your S-1 with the SEC.

- Implement: The broker should finalize the program well before your IPO date and be ready to bind the program when your S-1 is declared effective so it is in place before your first day of trading on the market.

Phase 2: Business Combination – SPACs can use reps and warranties insurance to facilitate the M&A deal. At the time of the business combination, there are at least five D&O insurance-related considerations to keep in mind:

- Insurance diligence on the target company

- The SPAC’s tail policy

- Reps and warranties insurance

- D&O insurance for the target company pre- and post-merger

- Claims handling

Phase 3: New Public Company – Brokerage services should not end when a company goes public. For example, Woodruff Sawyer offers ongoing advisory services and director and officer training so that clients can continue to understand their true picture of risk and how to mitigate it. Strong claims advocacy is also an ongoing service.

Choosing the Right Broker

SPAC IPOs are an area of specialty, and the D&O insurance climate changes from month to month. That means hiring a broker with experience and expertise in this area is key.

Here are some questions to consider:

- What level of experience does the brokerage team you are talking to (not just the brokerage firm, but your particular team) have when it comes to placing D&O coverage for SPACs?

- What reach does the brokerage team have in the D&O and RWI markets?

- Will the broker be using a wholesaler or making a direct placement?

- Can your broker clearly articulate the business and legal risks you face?

- What experience does your broker have in terms of advocating for coverage payments with carriers on behalf of clients with complex claims?

For more details on these highlights and more, access Woodruff Sawyer’s Guide to D&O Insurance for SPAC IPOs, 2023 Edition below:

Woodruff Whiteboard Breakdowns: How Reps and Warranties Insurance Protects an Acquisition

Authors

Table of Contents