Blog

Increasing Health Savings Account Participation in 2020

Health Savings Account (HSA) medical plans, consisting of pre-tax savings accounts (maximum contributions for 2020 is $3,550/individual, $7,100/family) which are paired with high deductible medical insurance plans (minimum deductibles for 2020: $1400/individual, $2800/family), are proving to be a way for many employers and employees to better control health care costs. Nationwide, employee participation in HSA plans have steadily increased since they were established by law in 2004 as part of the Medicare Prescription Drug, Improvement, and Modernization Act, indicating general acceptance and success of these programs.

According to Devinir Research (June 2019), there are over 26 million HSA participants with an estimated $64 billion in assets overall and an average account balance of $15,982. It is estimated that 31% of HSA contributions come from an employer (avg: $648), 52% from employees (avg: $1,121), and the remaining 17% from other sources, mainly rollovers from other individual or former employer HSAs (avg $1,546).

Once people understand how HSAs work, they actively use them, either to cover health plan deductibles and coinsurance, to invest and grow the balance as another retirement savings vehicle, or both. So how do employers drive greater participation so it is a win-win for them and their employees?

Consumerism and HSAs

It's no secret that health care costs continue to rise, affecting both our national and personal economics. Medical, pharmaceutical, and technological advancements as well as regulatory mandates, greatly impact practitioners, healthcare institutions, prescription drugs, and related services financially and administratively. Employers pay for over 50% of our national health care costs, but have little control of those costs.

Who can control health care costs? While employers are using many strategies, employees are key in controlling health care costs. If we remember that employees are also consumers who drive healthcare purchases, we can educate and help point them in the direction of more informed choices whenever possible. Much like any product or service, given the right tools, employees can search for cost and quality, looking for the best combination that serves their needs. Most insurers offering high deductible medical plans provide wonderful provider finder, cost transparency and telehealth (an easy, less expensive way to avoid costly emergency room, urgent care and office visit costs) tools on their websites, which also tend to be available via smartphone or apps.

The Lively Report analyzed HSA contributions for 2019. They found that 50% of contributions are used to pay for provider visits, 16% for dental expenses, 10% for prescription drug costs, and 5% for vision and eyewear. The remainder is often invested in funds provided by the HSA administrator, often a bank. While an HSA can be a good investment tool for the future, this study shows that employees are indeed using their HSA to cover healthcare costs and not sacrificing getting the care they need when they need it.

These plans, therefore, help people manage their healthcare costs and save for the future. As with 401(k) balances, HSA funds used to cover health care expenses cannot be prematurely withdrawn without IRS penalty, creating an incentive for employees to invest and grow unused account balances.

Creating Your Strategy for Success: Incentives

Whether this is your first HSA offering or you've had HSAs for a while and just want to capture that last 20% of your employee population, you'll need a thoughtful approach to help increase HSA participation.

Since HSAs are required to be paired with a high deductible medical plan, it can be difficult for an employee to understand and trust how the new plans will work for them. To encourage enrollment, employers often contribute to employee HSAs, typically contributing 50% of the annual medical plan deductible (generally $750–$1500 for an employee only, double that for employees with dependents). Incentivizing with real money tends to work!

Another strategy aimed at helping people feel more comfortable enrolling in a higher deductible medical plan is to offer low cost employee-paid (voluntary) supplemental health plans which provide lump sum payments to a person who becomes hospitalized, suffers an accident, or is diagnosed with a critical illness. People might be concerned about not having enough money in their HSAs to cover their portion of those costs or wish to preserve the balances they have for the future. These plans can bridge that gap. They can also allow an employer to provide medical plans with higher deductibles and correspondingly lower premiums (and employee contributions) since employees can pay down deductibles with supplemental health plan lump sum payments. I have seen employers cover the cost of these voluntary plans for employees (and sometimes their dependents too) as doing so, in those cases, was less expensive than the premium for a lower deductible plan and employees were no more financially exposed.

One other cool thing about supplemental health plans is that some of them offer "wellbeing" incentives. Getting $50 for a preventive screening such as a mammogram or colonoscopy is an example of this approach.

Getting the Word Out

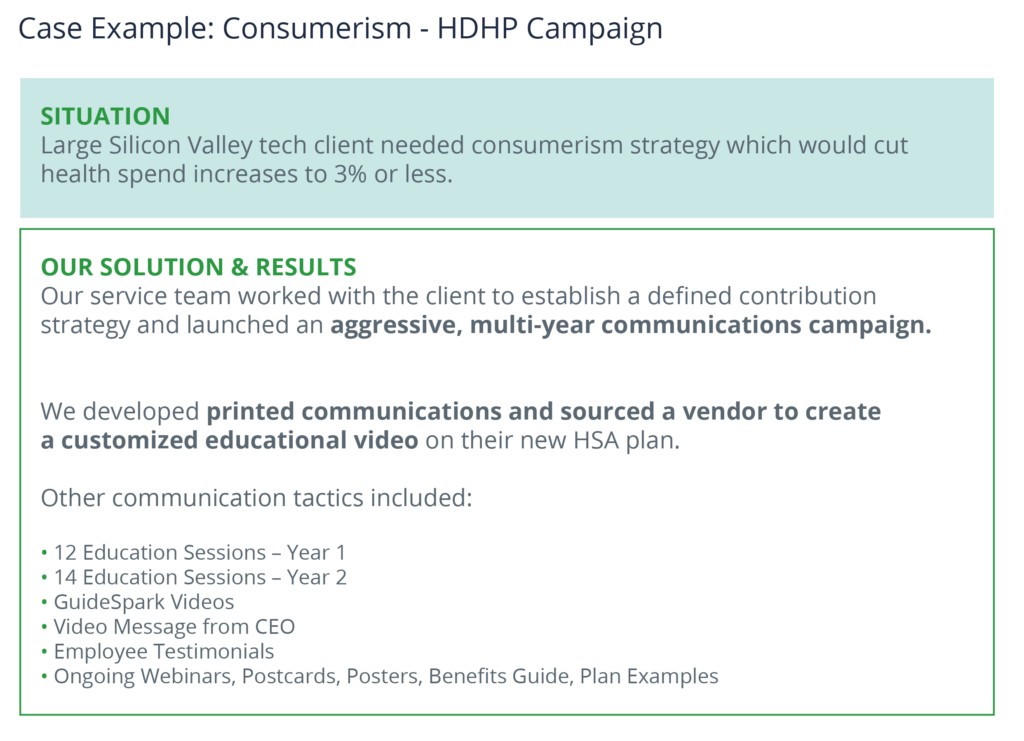

Remember that old advertising adage about people needing to see or hear a message at least seven times before they act on it? That goes for HSAs too. Educating your employees about HSAs requires ongoing messaging, often before, during, and after your annual open enrollment. You'll need to get the message out not just when you're first implementing the program but on an ongoing basis as well.

Communication is key. Employees need to understand and trust that an HSA program will work for them. In addition to a focused and thoughtful communications campaign, strong executive support and HR/Benefits professionals who understand and can explain to employees how HSAs work are critical in helping to build trust in your program.

You'll need to be consistent and publicize the plan on multiple channels. Sharing explanatory and testimonial videos are helpful as well as emails, handouts, and information on your intranet. A Woodruff Sawyer client had an HSA program in place for a while, but wanted to capture the remaining employee population. We designed a program that included 12 videos per year, a CEO Message, and access to numerous tools. As a result, the client was able to capture a significant percentage of the remaining employee population to markedly increase participation. Educational videos, handouts, vendor tools and old fashioned one-to-one conversations will help convince employees not only that they can benefit from the plan, but they can also effectively manage the plan over time.

Make Employee Communications Engaging

Most educational materials will stress the factual information about tax savings and qualified medical expenses. But if you want employees trust the program, you'll need to take a personal approach and help them understand how the HSA will affect their lives. Below are tips for employees to help them understand what to expect and how the program can work for them and their families.

- You own the account. Unlike other accounts, the HSA is a bank account that you own. You control the money and decide how and when to use it. It is yours even if you move to a new employer.

- You don't have to spend it all in one year. There may be confusion with Flexible Spending Accounts (FSAs) with "use-it-or-lose-it" provisions that generally require the employee to spend the entire balance within 12 months. Not so with an HSA. The money rolls over from year to year, helping to save for future expenses.

- You can invest your HSA money. Once you have set aside a certain dollar amount in your account, you can invest that money in funds provided by the HSA administrator, much like a 401(k) plan.

- You can use your HSA card like a debit or credit card. Wonder if you have enough cash to pay your doctor's copay or prescription? Receive a balance due bill from your provider and don't know how to pay it? With a funded HSA account, just use your HSA debit card to pay for those expenses without affecting your personal bank account.

- You and your family can use your HSA card. You can use your HSA funds for your qualified dependents expenses as well, regardless of whether or not they are covered under your medical plan.

- You can assign a beneficiary. Not sure if you'll use your entire account but want to make sure your loved ones are cared for? Your HSA administrator allows you to assign a beneficiary and give you greater peace of mind.

- You have a triple tax advantage. Your first tax advantage is that you contribute pre-tax earnings to your HSA. Second, the interest you earn on your HSA account is also tax-free. Finally, your withdrawals to pay for health care costs are tax free.

Helping your employees understand and trust that an HSA is a great investment for them and their family will go a long way to increase overall participation.

Is an HSA Right for Every Organization?

Despite the tax benefits, lower premiums, and long term investment opportunities, some employers still don't offer HSAs. Since HSAs must be paired with high deductible medical plans, when compared to strong HMOs in certain geographic regions, the HSA plan pricing may not work for the employer. Your benefits broker/consultant advisor can provide you the cost analyses necessary to help you make the best decision for your company.

Next, some employers believe that one more benefit plan will add unnecessary administrative burden to the HR and Payroll teams. HSA administrators now offer convenient tools for participants and may integrate with your payroll provider and benefits administration system. Ask for a demonstration to find out if it would truly add more tasks to your teams' already full plates.

Finally, some employers aren't sure that employees are good consumers. They've seen their healthcare costs increase and may have incurred some costly expenses as a result of employee health issues, which are difficult to predict. Adding employee consumerism to that may seem risky. Providing employees with the tools they need to make sound healthcare decisions, such as medical cost transparency tools, can help mitigate some of that concern.

If you're still unsure if an HSA is right for you, Woodruff Sawyer's benefits team can help you take a big picture view of your current plan offerings and help you determine what programs will align with your business goals in this new decade.

Want to learn more about HSAs and emerging employee benefit plan issues? Download Woodruff Sawyer's Looking Ahead: Employee Benefit Trends and Solutions in 2020 for more engaging perspectives on today's leading trends.

Table of Contents