Blog

Insurance Coverage for Secondaries: Market Trends

The popularity of private equity secondaries transactions is continuing to grow. My colleague, Emily Maier, covered the rise of private equity secondaries in an April 2022 M&A Notebook post. Today’s article serves as an update on that market.

As background, secondary transactions have proven useful to both limited partners (LPs) and general partners (GPs) who are looking to manage their portfolios during a stale or sluggish economic market. GPs in particular use secondaries to offer liquidity to their legacy fund investors while holding on to promising portfolio companies that need more time to mature.

The use of a derivation of the traditional reps & warranties insurance (RWI) product is growing in popularity for these deals. Like in the traditional RWI setting, buyers purchase the RWI product in these transactions to protect against breaches of the seller’s reps in the purchase agreement when some of the fund’s existing investors liquidate their holdings and new investors purchase interest in the fund. Investors are typically the ones paying for the cost of the RWI, as it is often classified as the fund’s administrative expense.

Some recent market trends are interesting.

Who Are the Players?

Larger investment funds pioneered the use of reps and warranties insurance in secondary transactions. Given the wide usage of RWI in private equity mergers and acquisitions (M&A), many participants were already familiar with the nature of the product and were open to applying it to a new, growing area like secondary fund transactions. Its use has now trickled down to mid-size and even smaller funds as well as to funds of funds. Most commonly, the product is used in GP-led deals but has been used in LP-led transactions as well.

On the insurer side, CFC pioneered the product and still leads the market in placements. Anecdotally, the consensus is that CFC is the primary carrier (the first layer of coverage) on 90% of all secondary transactions. Being the primary carrier, CFC is the insurer that sets the wording for the policies and thereby the market standard for coverage. Other insurers, like VALE, Euclid, Liberty, QBE, Themis, and Mosaic, have written primary coverage for these deals as well, but many tend to gravitate towards excess coverage (to sit on top of the primary layer). Other RWI insurers are only comfortable offering excess coverage.

Pricing, Retention, Limits, and Underwriting Fees

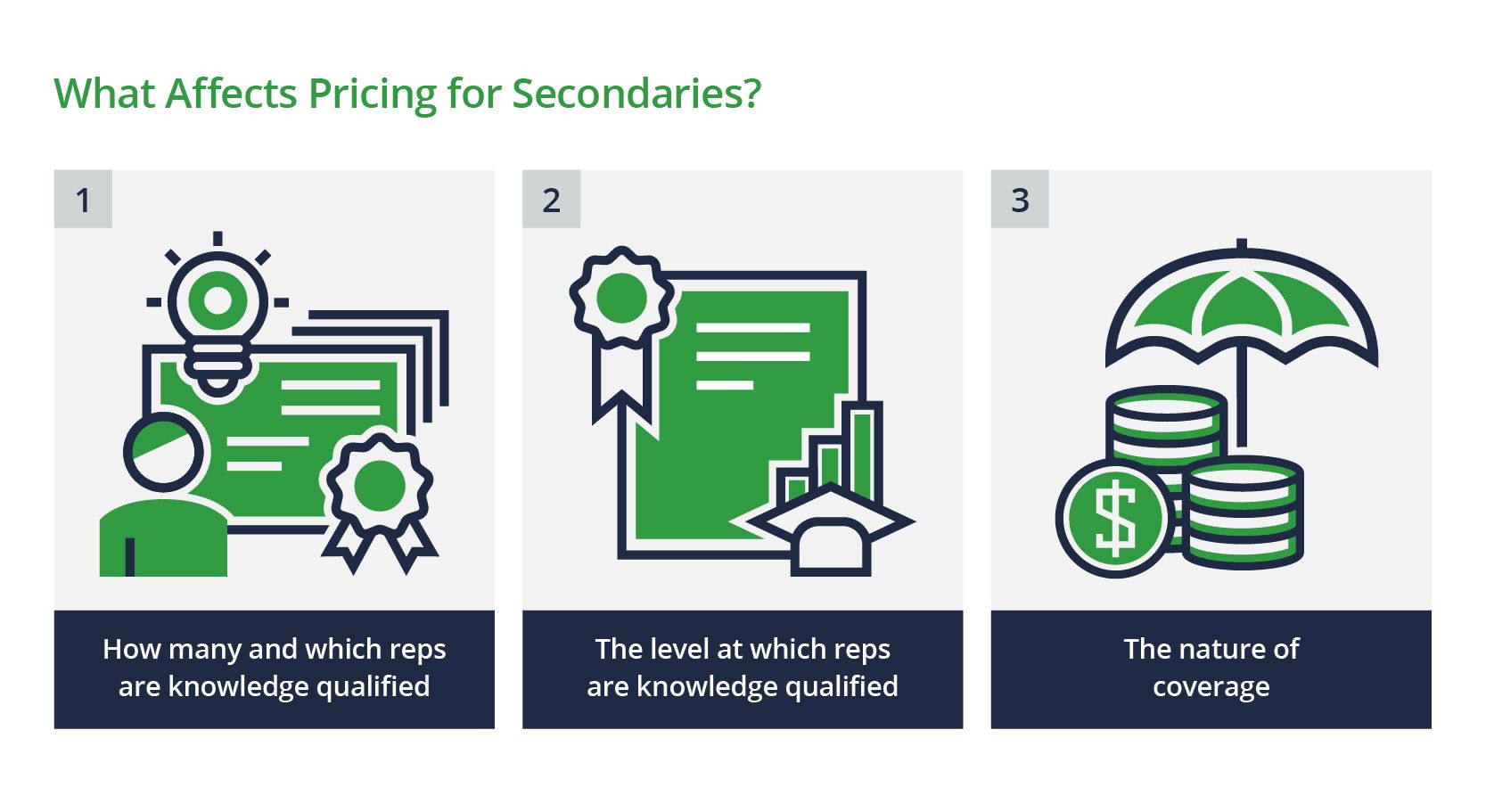

Premium pricing for these deals very much depends on which of the reps are knowledge qualified. If all of them are knowledge qualified, then premiums tend to be lower—somewhere between 1% and 2% of the limit bought. The level at which the reps are knowledge qualified, e.g., at fund level or at portfolio company level, also translates into pricing. Another pricing factor is the nature of coverage. For example, coverage for only the fundamental reps is going to be less expensive than coverage for fundamental and operational or general reps. Similarly, if what are typically referred to as “excluded obligations” are included in coverage, premium pricing might be higher.

| Knowledge qualified means the truth of the representation is conditional on the knowledge of the person giving the rep. |

Considering the growing popularity of both secondaries and RWI covering them, competition among insurance carriers is increasing and driving pricing and terms that are more favorable for buyers. For example, where carriers used to charge additional premium for including “excluded obligations” in coverage, many are now covering them without additional premium.

Considering the growing popularity of both secondaries and RWI covering them, competition among insurance carriers is increasing and driving pricing and terms that are more favorable for buyers. For example, where carriers used to charge additional premium for including “excluded obligations” in coverage, many are now covering them without additional premium.

In line with the rest of the RWI market, the current level of self-insured retention (SIR, like a deductible) for these policies is hovering around 0.6% of the net asset value (NAV) of the fund.

Although some funds are looking to cover the entire NAV of the continuation fund, most usually gravitate towards insuring 10% of the NAV. Importantly, the NAV can change up until the closing of the transaction and depends on how many original investors choose to cash out.

Underwriters vary on the amount of legal/underwriting fees they charge for these deals. Some stay within $10K–$20K and some charge closer to $40K–$50K. The underwriting fee pricing depends on the complexity of the deal and how much the underwriters need to lean on their counsel for advice.

Expanding Coverage and Limited Due Diligence

At first, only about seven or eight representations were covered by RWI policies in secondary transactions. Now, the market is moving in the direction of expanding coverage. Some carriers are willing to cover portfolio-level reps in addition to fund-level reps. Some are relaxing their knowledge qualifier standards, and some are covering excluded obligations.

However, it is still a standard in this market that very limited diligence is performed to back up the veracity of the given representations. Typical diligence is limited to lien and litigation searches. The diligence process is a lot less robust than it is in a traditional private-equity-driven or strategic acquisition where the traditional RWI product is used. Investors typically rely on the reputation of the GP and do not run an organized diligence process involving internal diligence reports or third parties providing legal or financial diligence reports.

The underwriting process consists primarily of two diligence calls: one with the GP and another, much shorter one, with the lead LP. Some underwriters ask for a no-claims declaration (NCD) from only the lead investor and others from the GP and each new investor, depending on the number of new investors, whether the limit of coverage is 10% or larger, and the percentage of rollover.

Typically, underwriters want to know the reason for the transaction, details about the GP and their track record, and which counsel is representing the parties. The timing of placement varies with each transaction and depends in large part on the timing of the deal and the responsiveness of the GP and LPs.

Where the Market Is Moving

Carriers are generally excited and optimistic about this market. Many believe it will continue to grow, but some are concerned that competition is driving coverage to expand without a corresponding expansion of due diligence requirements. Additionally, increased competition in the traditional RWI market and scarcity of plain vanilla M&A deals are pushing carriers to be more flexible and aggressive than they normally would be. It is likely their appetite for secondaries will cool somewhat once the traditional M&A market revives.

Author

Table of Contents