Blog

Market Volatility Puts Trustees in the Hot Seat

The turbulence of certain currencies and cryptocurrency trading platforms and market volatility can create stress for beneficiaries and put the trustee in the hot seat.

The news headlines have been exciting over the past year, covering the fluctuating stock market, the turbulence of certain currencies and cryptocurrency trading platforms, and the tug-of-war between Democrats and Republicans over environmental, social, and corporate governance (ESG) investment.

What does this have to do with fiduciaries of trusts? Quite frankly, everything. Trusts are created to manage the wealth of grantors for the benefit of the beneficiaries. This market volatility can create stress on behalf of the beneficiaries and put the trustee in the hot seat. Additionally, beneficiaries may have strong ideas about ESG considerations and other alternative asset classes, such as cryptocurrencies.

ESG and Cryptocurrency: How Should Trustees Respond?

Trustees have the responsibility of using their powers in the best interests of current and future beneficiaries. However, competing viewpoints on hot topics and market instability affecting investments may make the right decisions unclear.

In November, the Department of Labor released a final rule under the Employee Retirement Income Security Act (ERISA), clarifying that fiduciaries may consider climate change and other ESG factors when they make investment decisions. While the new ruling is specific to ERISA plan fiduciaries, the fiduciary obligations are the same:

- A fiduciary has the duty to act prudently, requiring diversification of investments to minimize the risk of large losses.

- A fiduciary has the duty of loyalty, which requires trustees to act solely in the interest of the trust’s beneficiaries and for the exclusive purpose of providing benefits to beneficiaries

- A fiduciary must maintain a primary focus on financial returns and risk to beneficiaries. But this duty does not preclude making investment decisions that reflect ESG considerations, prudence, and loyalty requirements.

Further evidence of how this discussion impacts all facets of investment management and related fiduciary responsibility is revealed by the fact that some states have recently pulled their funds from BlackRock, the investment management company. One such state is Florida.

"Whether stakeholder capitalism, or ESG standards, are being pushed by BlackRock for ideological reasons, or to develop social credit ratings, the effect is to avoid dealing with the messiness of democracy," Jimmy Patronis, Florida's chief financial officer, said in a statement. "I think it’s undemocratic of major asset managers to use their power to influence societal outcomes."

BlackRock is facing the opposite view from other groups. New York City Comptroller Brad Lander blasted the firm in September, accusing it of not doing enough to fight climate change and issuing a veiled threat that the city would be "reassessing our business relationships with all of our asset managers, including BlackRock, through the lens of our climate responsibilities."

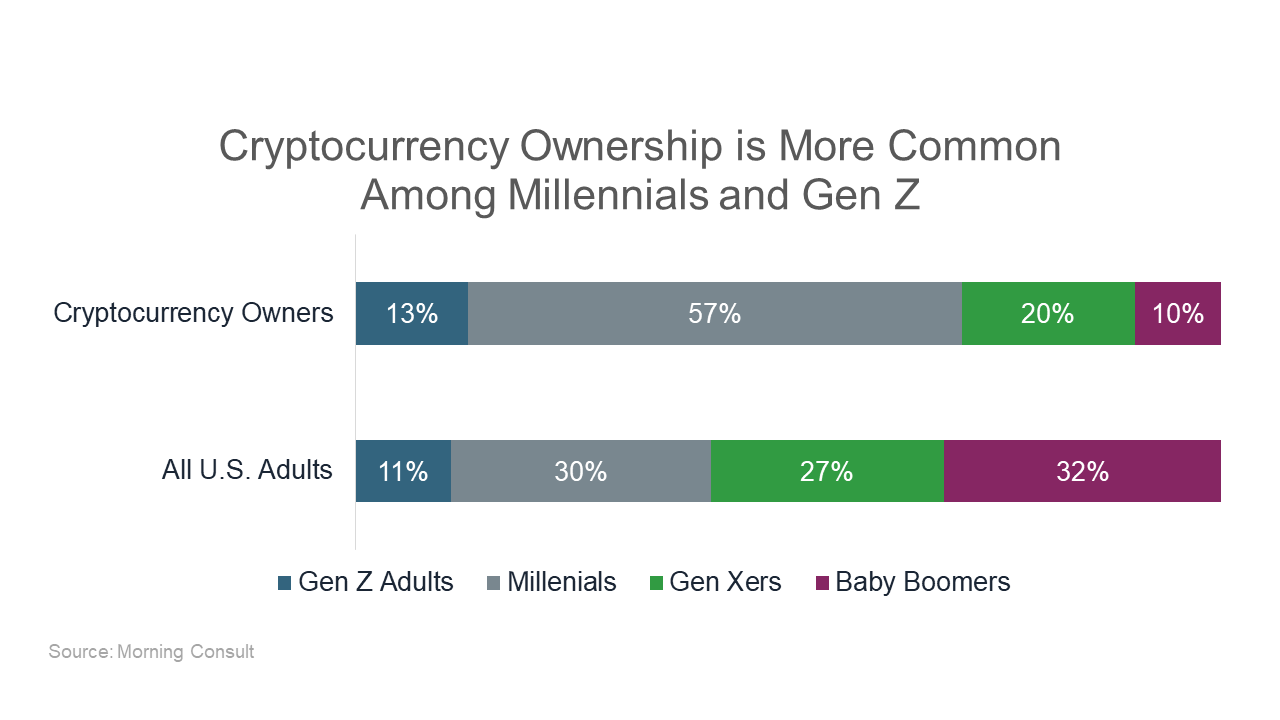

Given that the bulk of beneficiaries today are millennials and Gen Z’ers, it’s important to recognize their power and attitudes. A recent survey by asset management firm Amundi and the Business Times found that 82% of Gen Z and close to two-thirds of young millennial investors have exposure to ESG investments. Also Morning Consult reports that 57% of all cryptocurrency owners in the US are millennials and 13% of Gen Z own cryptocurrency.

The volatility of cryptocurrency is indisputable, especially after the catastrophic events of this year. After the collapse of the Terra stablecoin/Luna cryptocurrency in May and the bankruptcy filing of cryptocurrency exchange FTX in November, fiduciaries may be making changes to their crypto investments—or they already have.

Protecting Trustees from Liability

How can trustees embrace these potentially competing views of beneficiaries’ goals and objectives while protecting themselves from liability? Here are some tips:

- Draft an investment policy statement with the help of a qualified investment professional and be open to input from the grantor (if they are still active) and beneficiaries.

- Take into consideration the guidance codified in the Uniform Prudent Investor Act of 1994 (UPIA) that embraces Modern Portfolio Theory and the Uniform Trust Code (UTC), most recently revised in 2003.

- Be mindful of the prudent investor rule that requires due diligence and diversification, which follows the UPIA thought process.

- Communicate with the beneficiaries to establish viable investment policies that take into consideration risk versus return, as well as family values.

- Follow the trust instrument in terms of guidance but do your due diligence for both investment preference and investment advisors. Remember that trustees have an obligation to review guidance based on changing environments.

- Periodically interview investment professionals to ensure proper investigation and understanding of the market and relevant investment policy statements.

- Discuss options with experts beyond investment professionals, such as lawyers and certified public accountants.

- Establish peer networks or join educational organizations such as the Independent Trustee Alliance or the Purposeful Planning Institute.

| It's also important to hire risk management professionals who understand your roles and responsibilities, understand risk management protocols specific to trustees, and can place an insurance policy to transfer your personal liability to an insurance company comfortable insuring the risk. |

Lastly, in the unfortunate situation where you have a claim, it is critical that both you and your insurance company cooperate in hiring knowledgeable fiduciary defense council and that your insurance broker understands the trustee professional well enough to be your advocate.

Table of Contents