Blog

How to Minimize Risk in the Current Litigation Environment

This month's SPAC Notebook follows up on our recent discussion of risk mitigation and due diligence tips for foreign companies going public in the US. We want to share more information on the current litigation environment and offer some tips for minimizing risk.

I am joined by James Tunkey, COO of I-OnAsia, a global risk management consultancy, and my Woodruff Sawyer colleague Lilian Khanjian, a senior claims consultant on our claims team.

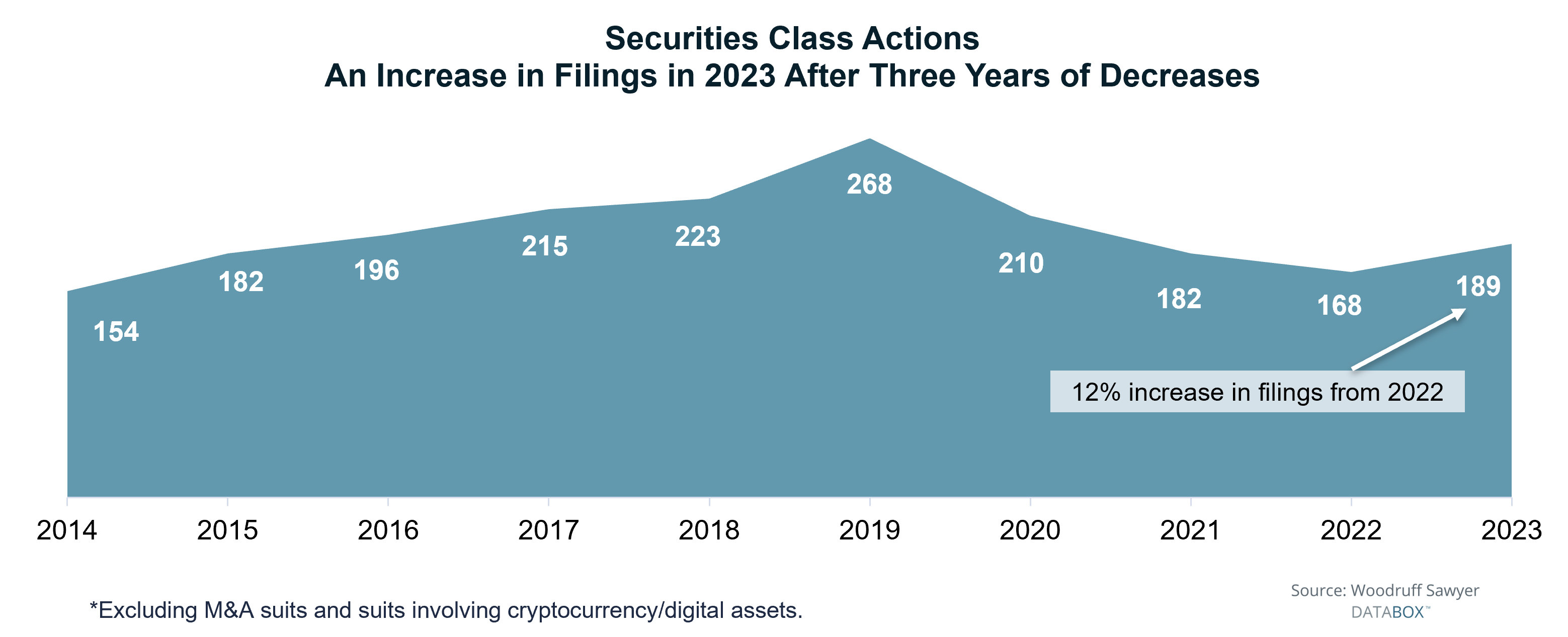

Yelena Dunaevsky: I'd like to begin with relevant information from the Woodruff Sawyer proprietary settlement database, the DATABOX. In 2023, 189 securities class actions were filed, a 12.5% increase from the previous year. More importantly, settlements paid out in 2023 totaled $4.4 billion, the largest amount in the past 10 years.

A total of $4.4 billon was paid in settlements in 2023, the highest amount in the last 10 years.

- 189 Cases Filed in 2023

- Despite a downturn in the IPO market, there has been an increase in filings.

Here are a few more statistics.

- 61% percent of the settlements were under $20 million, with 11% between $100 million and $500 million.

- Companies valued between $2 billion and $10 billion experienced an 8% increase in settlements and lawsuits.

- About 33% of the settlements were in technology, with manufacturing (19%) and biotechnology (14%) following.

2022 vs. 2023

| Industry | 2022 | 2023 | % Change |

| Increases | |||

| Manufacturing | 13% | 19% | +6% |

| Financial | 8% | 13% | +5% |

| Decreases | |||

| Trade/Retail | 12% | 6% | -6% |

| Services | 13% | 9% | -4% |

| Biotechnology | 15% | 14% | -1% |

*No changes in Technology or All Other categories.

Source: Woodruff Sawyer DataboxTM

These numbers set the stage for the risk that's out there and the preparation that is needed.

James Tunkey: It is frightening to see the uptick in class action lawsuits. As a certified fraud examiner, I can share that class action lawsuits often involve internal or external fraud. We often get called in at the very beginning when there's a credible public report.

It might be a New York Times expose on a bad business practice alleged by a whistleblower, a short seller report or a negative research report from a Wall Street research department. We get a call to help people figure out what's going on and to use our experience to provide advice on managing the public relations crisis.

Yelena Dunaevsky: Interestingly, in the SPAC space, we've seen that at least 33% of all securities class action lawsuits are driven by short seller reports. One recent case driven by a short seller report from the Southern District of New York involved DraftKings but was thrown out of court. The judge found that the allegations in the case were not independently verified by the plaintiff’s attorneys or their teams who relied entirely on unsubstantiated information offered by a conflicted short seller.

Even though this was a positive outcome for this particular SPAC team, they still needed to spend time and attorney fees to fight this claim. Having the right people on your side from the beginning to help you dig into the allegations and uncover the facts or lack of facts behind them goes a long way.

What Happens on the Insurance Side?

Yelena Dunaevsky: If public companies disclose incorrect information or incorrectly disclose what is happening, they can be on the hook for lawsuits from shareholders or investigations from regulators.

And when a company is faced with a lawsuit, while management and the board of directors are working to respond to the allegations, one of the questions that comes up almost immediately is cost: cost of defense counsel and cost of settlement. That is when everyone’s attention turns to the company's D&O insurance policy.

What should a company do to ensure that the insurance claim process occurs as efficiently and smoothly as possible?

Lilian Khanjian: If we are in a situation where an actual lawsuit has been filed or a certain type of attorney demand letter has been received, then the company has an obligation to report that to their D&O insurers to get coverage for those claims.

When a negative report has been published, or there is a public announcement leading to a stock drop, there is no obligation to report. However, at Woodruff Sawyer, we typically recommend reporting these situations to the D&O insurers right away out of an abundance of caution. There usually is no downside, and it could benefit your company down the line. Also, your company's D&O insurance policy may pay for some losses related to handling a crisis.

We recommend being as forthright as possible with your insurance broker as early as possible and discussing the steps the company intends to take. Then, the broker can evaluate whether or not to send notice to your company's D&O insurers and guide you through the next steps.

How to Handle a Crisis Communication

James Tunkey: My first piece of advice is to contact your insurance brokers and turn to other people who are experienced in crisis management.

The role that we play and that investigators play is to get at that truth by looking at all the records, talking to whistleblowers, helping to handle internal investigations, and performing due diligence on these claims. We work closely with outside counsel to report our information, which then is framed into a defense strategy, a communication strategy, and, often, a business strategy.

A lot of people these days are pretty loose with the truth. It's increasingly important that executives take the time to look for the truth carefully. We use a word in our business called "tradecraft," which means gathering information correctly.

One of the ways to avoid the lawsuits that we see is to have good loss incident data. This data is an incredibly important part of risk mitigation practice at corporations.

Handling a Claim Scenario

Yelena Dunaevsky: We will walk you through two examples of a claims process and outcomes: one that was handled well by the company and one that could have gone better.

A Room for Improvement Scenario

Lilian Khanjian: A private company received a regulatory investigation and entered into an agreement with the regulatory agency without telling its insurance companies or their insurance broker about it.

Years later, after that company went public, shareholders filed a securities class action and derivative litigation against the company and its directors and officers in relation to the company's IPO. The allegations included those similar to the prior regulatory investigation that was never reported to the insurance carriers. Once the company reported these losses to their carriers, the carriers denied coverage because they related back to the regulatory investigation, which was not reported when it should have been.

The takeaway is that the company should always notify the insurance broker and provide copies of any regulatory proceedings, investigations, attorney letters, or anything that looks or smells like a claim. Ask your broker's claims team to evaluate whether to report the information to your insurance carrier.

Yelena Dunaevsky: Remember, the insurance broker does not represent the insurance company. The broker’s obligation is to the insured, which is the company and its directors and officers. The broker's job is to advocate on the company’s behalf and to help the company and its directors and officers through the claims process.

A Positive Claims Scenario

Lilian Khanjian: A private company was sued in a whistleblower litigation. The company notified their insurance broker of the situation, and their broker properly notified the insurers about it.

In this case, the insurance broker advocated on behalf of the company and ensured that no language in the policy would hinder coverage for any future litigation just because it related to something that existed previously. The broker ensured that the company got the coverage it was entitled to when that lawsuit eventually came, and that the insurance companies were able to fully fund the settlement as they should have under the company’s policies.

Important Takeaways on Litigation Risk

James Tunkey: Litigation risk is real. The way to respond to a claim is to collect solid information and not rely on unsubstantiated or conflicted reports. You need to do the hard work to verify the claims and surround yourself with great people who can help you respond to this crisis efficiently so that you can get back to work.

Yelena Dunaevsky: Having data at your fingertips will help you resolve your situation and your settlement that much faster.

We are often asked how often people settle and how often these lawsuits get dismissed or withdrawn. In 2023, there were more settlements than dismissals and withdrawals combined, and the average settlement time ranged between three and six years. You can imagine what that timeframe looks like in terms of attorney costs.

When thinking about covering the settlements, the money will come out of the balance sheet of the company or the D&O policy that you have in place. It is essential to consider ahead of time the limit of that policy, especially if the lawsuit may go on for six years.

Ask your insurance broker to help you make an informed decision based on where your business is, where your business is going, and where potential risk may strike.

And once again, make sure you have the right professionals on your side during this process. They will help minimize stress, costs, and time taken away from your business activities.

Author

Table of Contents