Blog

Protecting Against the ERISA Litigation Surge

Read more for a breakdown of the issues and advice for mitigating risks in this evolving exposure area.

The article written by my colleague demonstrates the increasing legal and regulatory pressure on plan fiduciaries. Now is the time for comprehensive fiduciary education to ensure you’re meeting your responsibilities. ---Priya

Expand your knowledge of fiduciary education by joining a one-hour webinar on January 26, 2022 from 11:00am-12:00pm PT, Fi360 Fiduciary Fundamentals for Plan Sponsors.

Fiduciary Fundamentals is an educational program for retirement plan fiduciaries and others involved in the defined contribution investment process. Developed in partnership with Fi360, this program is designed to help plan sponsors understand the importance of fiduciary education and fiduciary decision-making.

ERISA litigation has exploded in the past few years, particularly cases alleging excessive fees. Last year was the high-water mark for ERISA class actions with over 200 cases filed, an 80% increase from 2019. 2021 is on track to be another peak year. Unsurprisingly, the insurance that responds to this type of litigation, Fiduciary Liability Insurance, is becoming increasingly expensive. (As a reminder, D&O insurance typically excludes ERISA-related claims.)

Given the increase in the litigation, losses stemming from ERISA-related claims, and the anticipation for more settlements in the future, companies and directors and officers will want to implement strategies to mitigate their ERISA liability risk.

Some employees are applying increased scrutiny to their retirement and welfare plans, perhaps due to the recent pandemic-driven economic downturn. Other factors driving this litigation include:

- Department of Labor (DOL) rule changes

- An increase in DOL enforcement actions

- Plaintiff-favorable US Supreme Court (SCOTUS) rulings

- An increase in the number of plaintiffs’ firms bringing lawsuits

What is ERISA?

As a refresher, the Employee Retirement Income Security Act of 1974 is a federal law that sets minimum standards for most voluntarily established pension and health plans in the private industry. Its purpose is to protect individuals in these plans. Depending on a person’s role or function within a benefit plan, a person may be classified as an ERISA fiduciary. ERISA holds such a fiduciary to a “prudent person” standard. This is to say that plan fiduciaries are to act “with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.” Unfortunately, the prudent person subjective standard can open the door to different interpretations and, often, litigation.

The DOL is responsible for enforcing ERISA regulations. Plan participants and beneficiaries can also bring lawsuits against ERISA fiduciaries. ERISA lawsuits typically name the plan sponsor, plan administrator, and plan fiduciaries. Of course, when directors and officers serve as plan fiduciaries, they can face ERISA liability. Unfortunately, directors and officers can also be named in an ERISA suit even if they are not designated plan fiduciaries.

The ERISA Litigation Landscape

While there have been waves of increased ERISA litigation in the past, the recent surge in suits is unprecedented. Historically, larger plans ($1B+ in assets) were the main targets. Now, however, plans of all different sizes are being sued.

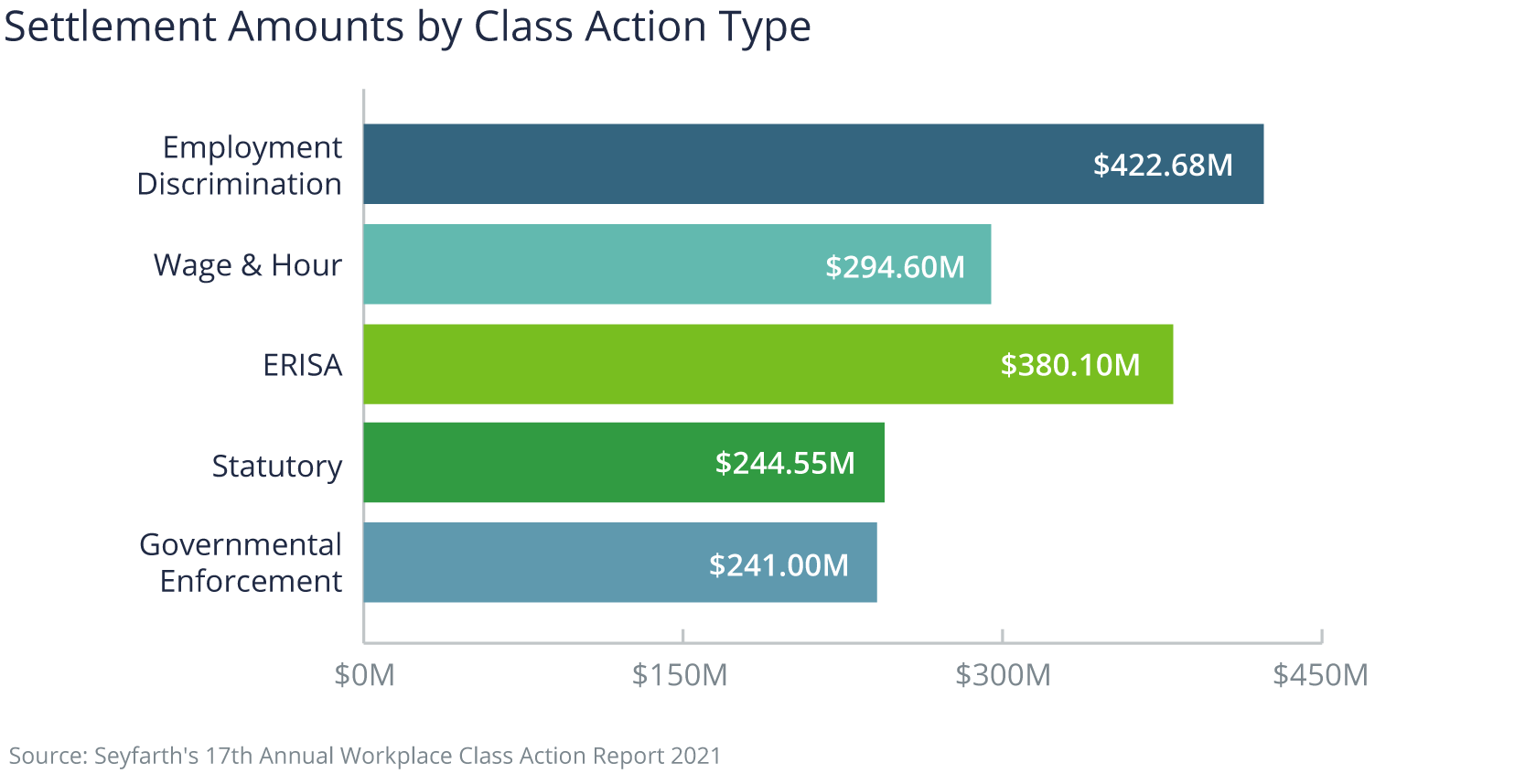

The severity of settlements is also climbing.

According to Seyfarth’s 17th Annual Workplace Class Action Report, released in 2021, the top ten ERISA class action settlements totaled $380.01M last year, slightly up from $376.35M in 2019 and $313.4M in 2018. These figures are lower than the period from 2014–2017, which averaged $992.23M. Unfortunately, this is of scant comfort to fiduciaries, sponsor organizations, and insurance carriers given the increased frequency of litigation.

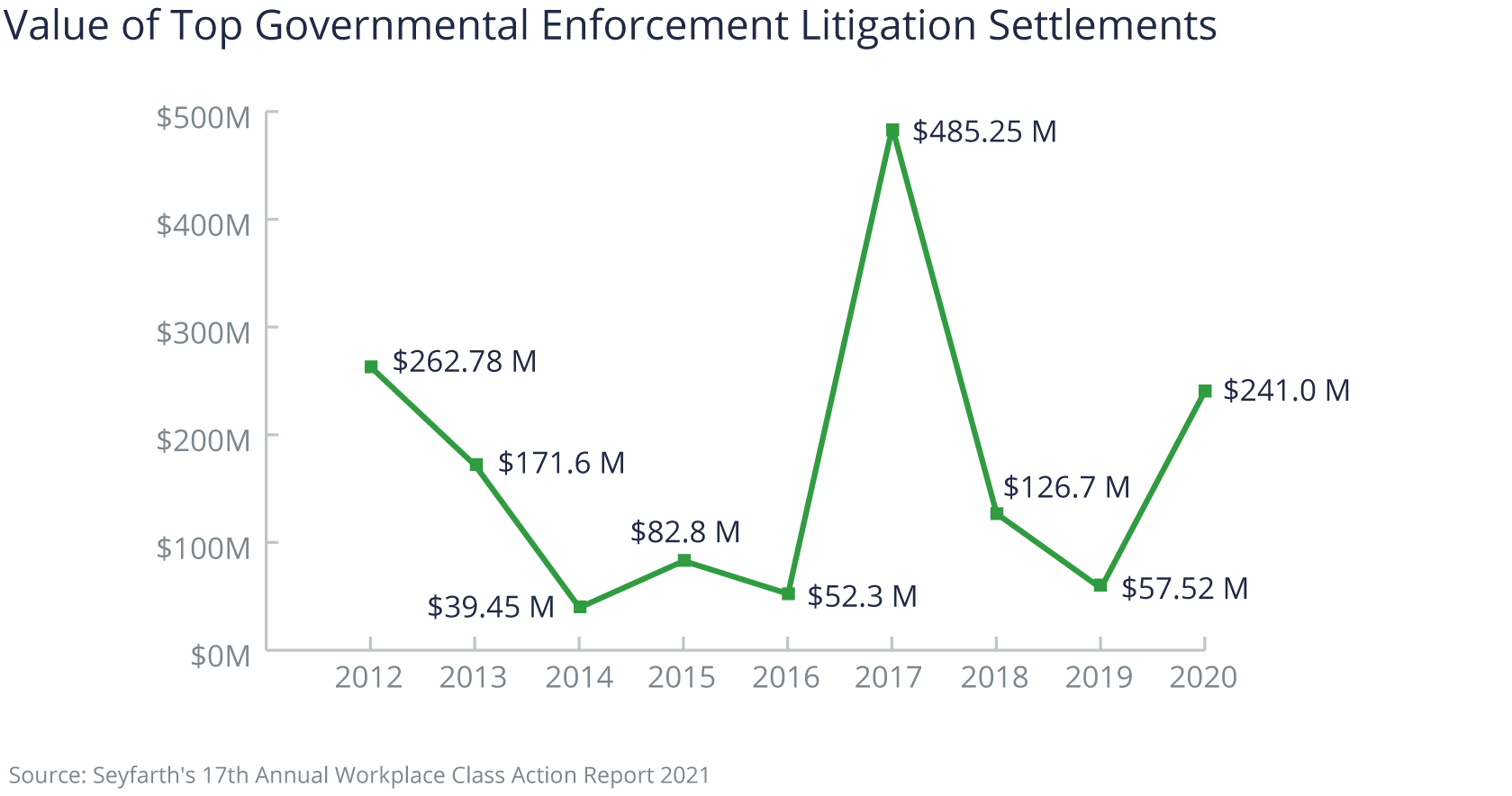

In addition to private litigation, governmental investigations and suits are also a concern. This is another area where we are seeing high-dollar settlements.

Similar to private suits, government investigations are costly given the amount of eDiscovery, document production, and experts needed.

ERISA Claim Allegations

Common ERISA claim allegations include denial of benefits, under performance, and arbitration clauses and class action waivers. Some more recent claim trends include:

- Excessive fees

- Conflicts of interest

- COBRA notices

- Cybertheft

- ESG (environmental, social, governance) related issues

Excessive Fee Litigation

The recent uptick in the number of excessive fee cases filed has been notable. In 2020, the number of excessive fee cases were five times the number of suits filed in 2019.

One reason for the increase is partly due to new plaintiffs’ firms entering the scene.

These firms have realized that filing excessive fee litigation is fairly easy to pursue due the publicly available information in Form 5500 filings, annual reports filed with the DOL that contain information about an employee benefit plan.

Plaintiffs bringing excessive fee lawsuits typically allege that the fee paid to an outside administrator is higher than the average or that the plan’s recordkeepers or advisors are collecting excessively high fees. Plaintiffs file this litigation notwithstanding the fact that ERISA does not require fiduciaries to use the cheapest fee options and cost alone cannot demonstrate the imprudence of an investment. In the absence of a bright line rule related to the assessment of the reasonableness of a fee, plaintiffs have realized that they can make money on these cases.

Excessive fee cases are expensive to defend and resolve. These cases typically involve extensive electronic discovery that can significantly increase the cost of litigation. Given the cost to defend against this type of litigation, it is no surprise that most cases result in a settlement. In 2019 alone, plaintiffs secured over $231 million in fee litigation settlements, including receiving over $77 million in attorney fees.

Conflict of Interest Litigation

Another common allegation asserted in ERISA litigation is conflict of interest. ERISA was enacted to “promote the interests of employees and their beneficiaries in employee benefit plans, and to protect contractually defined benefits.”1 Thus, plan fiduciaries need to have beneficiaries’ best interests at the forefront, making it critical to avoid the appearance of or an actual conflict of interest.

A special subset of conflict-of-interest cases involves ESOPs, or employee stock purchase plans. An ESOP is a tax qualified defined contribution employee benefit plan that invests in the plan sponsor’s stock. When corporate directors and officers are also the plan fiduciaries of an ESOP, the dual-role conflict that is alleged to arise is between wearing one hat as an ERISA fiduciary and another hat as a corporate fiduciary.

ERISA lawsuits relating to ESOPs can involve various claims, for example, allegations that dual-hat-wearing shareholders sold their stock to the ESOP at an inflated price, or that the fiduciaries did not take adequate steps to protect the plan beneficiaries since they should have known the stock was overvalued. ESOP and employer stock drop ERISA suits are not new types of claims and continue to be an issue for fiduciaries and sponsor organizations. From June of 2019 to June 2020, 15 new ESOPs cases were filed, signaling a continued focus on companies including its own stock in its plan.

COBRA Litigation

Pandemic-related corporate downsizing has resulted in increased litigation activity related to COBRA notices. When employees separate from their employers, employees typically also separate from employer-sponsored health plans. ERISA requires that sponsor organizations send out notices in conformance with DOL guidelines to participants who will lose coverage.

Most of the COBRA related lawsuits allege a technical violation in the notice by failing to include all the required information or that it does not comport with the DOL’s model election notice. For example, some allegations assert that a notice fails to explain how to enroll in COBRA coverage, or includes conflicting information, or does not contain an election form. Sponsor organization can face statutory penalties for COBRA deficiencies even if an outside vendor is retained to handle COBRA compliance. Failing to provide required notices (or proper notices) to participants can lead to fines of $100 per day, per affected individual.

Cyber-Related Claims

Cyber incidents are not only giving rise to cyber claims but also may result in ERISA-related claims. ERISA plans are enticing targets for cyber threat actors given the amount of personal information regarding plan participants and their beneficiaries and large sums of money they have. Hackers may pose as an imposter of a plan participant to try to steal funds in the account or may access the recordkeepers information system to steal data. After money is fraudulently withdrawn from participants accounts or after data is stolen, participants may bring a breach of fiduciary duty suit against fiduciaries.

With the influx of attacks and ever evolving cyber threat, the DOL published cybersecurity guidance in April of 2021 for plan sponsors, plan fiduciaries, record keepers and plan participants on best practices for maintaining cybersecurity. This guidance also includes tips for hiring service providers and online security tips for participants. on cybersecurity best practices for ERISA covered plans. While Fiduciary liability insurance typically does not cover the actual loss from theft of plan assets, it will respond to allegations of breach of fiduciary. Other insurance policies such as cyber or crime may respond to the actual loss depending on the language of the policy.

ESG-Related Issues

Another recent trend that can give rise to ERISA-related claims is the increased focus companies have with ESG initiatives, including offering ESG options in their plans. ERISA currently has certain limitations in place when considering ESG in plans. However, in May of 2021, a bill (the Financial Factors in Selecting Retirement Plan Investment Act) was introduced in attempt to amend ERISA to allow retirement plan fiduciaries to consider ESG criteria when selecting investments. As the ERISA landscape relating to ESG continues to change, companies and fiduciaries need to ensure they are aware of the changes, maintain compliance with ERISA, and keep in mind their fiduciary obligations before considering ESG criteria in investing.

Checklist for ERISA Fiduciary

All told, the stakes for ERISA litigation are very high—and rising. The following list of recommendations may help ERISA fiduciaries mitigate this risk.

- Fiduciaries: Identify individuals acting as plan fiduciaries and appoint with care. Keep in mind that dual hats can raise your profile as a target.

- Compliance: Stay up to date on ERISA requirements, which continue to evolve.

- Fees: Implement processes and policies for reviewing fees. Given that the fees are under a spotlight, prudent fiduciaries will want to review and evaluate annually what fees are being paid, to whom the fees are being paid, and what services are being offered in connection with those fees. Remember, plan fiduciaries can be personally liable for a breach of a fiduciary duty making well-documented, regular evaluations a prudent move.

- Notices: Review process and procedures for tracking and providing proper notice to participants who lost coverage. Use proper language in COBRA notices and timely notify participants of any qualifying events. Periodically review notices to the DOL’s model notices to ensure compliance.

- Diversification: Under ERISA, fiduciaries have a duty to diversify investments of the plan to minimize the risk of large losses, unless under the circumstances it is clearly prudent not to do so.2 Ensure diversification is considered when reviewing investment options and perform annual reviews of plans. Plan fiduciaries and sponsor organizations need to carefully evaluate, including company stock in its ERISA covered plan given the heightened attention these plans receive.

- Documentation: Keep detailed records, meeting minutes, and document decisions.

- Vendors: Ensure third parties are up to date with applicable changes and other legal developments and review your vendor agreements. Using independent vendors for claim determinations helps to avoid a potential conflict of interest. Review service agreements for indemnification language and cybersecurity provisions.

- Cybersecurity: Develop cybersecurity policies, including procedures to prevent improper use or disclosure of participant data and an Incident Response Plan if a breach occurs. Review agreements with third-party service providers. Consider obtaining cybersecurity insurance.

- M&A: If there is a merger or acquisition on the horizon, plan fiduciaries and plan sponsors should discuss and review how the transaction may affect the plan.

- Insurance: Fiduciary liability insurance is sometimes an afterthought in a management liability insurance program given that the cost is still so much less than for D&O insurance. However, fiduciary liability insurance can be a key component of your D&O liability risk management plan. D&O policies typically exclude claims arising out of ERISA fiduciary liability (there may be some coverage, however, in the case of corporate bankruptcy).

Given the increased litigation and settlements, fiduciary rates and retentions are increasing. Insurance premiums will vary depending on asset size, plan governance, and claim history. For the best results, work with a broker who stays abreast of current trends and starts the renewal process early to ensure that you benefit from the most competitive terms and pricing.

Kristina Keck, VP, Retirement Plan Services at Woodruff Sawyer, provides the following great advice:

Insurers are aware and looking to mitigate the risks they face as an insurer if the plan sponsor does not have proper plan governance and process in place and well documented. As a plan fiduciary you should be prepared to address the questions posed by your insurer, including the use by your plan of any proprietary plan services. If our clients are using a proprietary service, we will conduct a formal RFP of their services every two to three years.

1 "2020 ERISA Litigation Trends Hint At What’s Ahead This Year," January 3, 2021, Groom Law Group

2 ERISA: 29 U.S.C. §1104(a)(1)

Table of Contents