Blog

Securities Litigation Trends: Key Takeaways from a 2025 PLUS D&O Symposium Panel

The 2025 PLUS D&O Symposium brought together leading voices in the professional liability space to discuss the evolving risks corporate leaders are facing. I was privileged to moderate the panel on securities litigation, a topic that remains front and center for companies and their D&O insurance carriers.

The outstanding panelists for this discussion, Adam Hakki (A&O Shearman), Sam Rudman (Robbins Geller Rudman & Dowd), and Michelle Yoshida (Phillips ADR Enterprises), provided insights from the defense, plaintiff, and mediation perspectives respectively.

Our discussion covered the most pressing trends in securities litigation today—from the critical role of judges in motions to dismiss to the debate over risk factor disclosures and the surging value of settlements.

In this article, I’ll share highlights of the panel. With securities cases continuing to shape corporate insurance risk management strategies, these insights are more important than ever.

For Motions to Dismiss, It’s All About the Judges

During the panel discussion, a clear theme emerged: Judicial discretion plays a significant role in motions to dismiss in securities litigation. In other words, winning a motion to dismiss often comes down to which judge happens to be handling your case.

The view of the panel was clear on this point despite the fact that, across jurisdictions, motions to dismiss were fairly consistent statistically (about 44%)—a topic my colleague Walker Newell recently tackled in his series on securities motions to dismiss trends.

This statistical consistency seems to indicate that judges who are either more pro-defendant or pro-plaintiff are evenly distributed across jurisdictions.

So, what’s the takeaway here? Maybe it’s pray for a defense-friendly judge? Perhaps the more practical takeaway is to understand that you can’t bank on winning your motion to dismiss because even the best legal strategy is subject to the unpredictable element of judicial interpretation. So, make sure your D&O insurance limits take into account that you may be in litigation for longer than you’d like.

Risk Factors and the “Fraud by Hindsight” Debate

Risk factor disclosures are designed to help investors understand potential threats to a company’s future performance. But it doesn’t always go as planned.

“Fraud by hindsight” is an admittedly cheeky way to refer to the phenomenon of investors claiming a company misled them—not because of what was known at the time, but because things later went wrong.

But what if a company says in its risk factors that something might go wrong without revealing that the thing they are referring to actually has gone wrong in the past?

This turned out to be a spirited discussion for the panel.

One argument was that risk factor disclosures should be easy—after all, executives know what the risks are. However, on the corporate side, we often see executives trying to balance transparency with not overwhelming investors with every possible worst-case scenario. Laundry listing every conceivable risk may not be all that useful to investors.

To better frame the issue, the panel discussion highlighted two analogies discussed in front of the Supreme Court during arguments for the Meta risk factor case:

- Baseball tickets and rainouts: If a ticket says a game "may" be rained out, it doesn’t need to list every past rain delay. Everyone understands that rainouts happen.

- Manufacturing plant fires: On the other hand, if a company discloses that it “may” have a fire in its plant but fails to mention that one just happened six weeks ago, that starts to feel misleading.

When investors sued Meta, they alleged that the company’s risk disclosures misled them by stating that user data “may” be improperly accessed—without mentioning that it already had been, on a massive scale, in the Cambridge Analytica scandal.

The case made it to the Supreme Court, but the Court ultimately declined to rule on it, leaving the question: When does a risk disclosure cross the line into being misleading?

For companies, it can be tricky to strike the right balance in risk disclosures. And with the Supreme Court reluctant to create a clear rule, companies and their insurers are left in a gray area.

Class Certification Is a Rare—but Sometimes Strategic—Defense Play

In securities litigation, class certification is a key step that allows plaintiffs to proceed as a group rather than as individuals. Challenging class certification is often seen as an uphill battle for defendants.

The numbers back this up:

- In 2024, a motion for class certification was filed in only 17% of resolved cases, according to a NERA report.

- About 7% of those cases settled before the motion was even decided.

- Of the remaining 10% that went to a ruling, a class was certified in almost nine out of 10 cases.

Basically, there's only a slim chance defendants will succeed when setting out to fight class certification.

Given these odds, many defendants focus their energy on earlier battles, like motions to dismiss, or later strategies, like settlements.

However, there are cases where it makes sense—like in Goldman Sachs v. Arkansas Teacher Retirement System.

The Goldman case hinged on whether the alleged misstatements actually impacted the stock price, which is a key factor in class certification.

The defense used event studies—economic analyses that look at whether certain statements caused statistically significant stock price changes—to argue that the statements were too generic to have influenced investors.

The Supreme Court ultimately ruled that defendants can introduce price impact evidence at the class certification stage, a win for companies looking to fight class certification.

But as my colleague Walker Newell pointed out in his article, The Price Is Wrong: Limiting D&O Exposure at Class Certification, successfully using this argument requires expert-driven economic analysis and a very specific fact pattern—meaning it won’t work in many cases.

One point I raised during the panel is that some insurance carriers provide “event study coverage” as part of their D&O policies.

Given that price impact arguments are one of the few viable ways to challenge class certification, having the right insurance coverage to fund expert economic analysis can be a valuable tool in defense.

Why Are Settlements Getting Bigger?

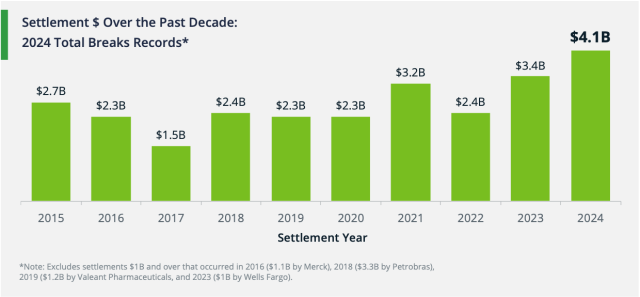

In 2024, securities class action settlements reached a staggering $4.1 billion—the highest annual total on record (excluding years with individual settlements exceeding $1 billion). This surge wasn't due to an increased number of settlements, but rather the size of the payouts.

Panelists were divided on causes, but had a few theories:

- Inflated valuations: Some suggested that the high valuations of companies in recent years have led to larger settlements when litigation arises.

- Overall inflation: Others said that general economic inflation contributed to higher settlement figures across the board.

- Pure coincidence: There was also a sentiment that the spike in large settlements during 2024 might be coincidental, possibly due to the timing of older cases reaching resolution.

Regardless of the underlying causes, $4.1 billion in settlements presents a significant concern for brokers, clients, and carriers alike. It’s worth noting that six of the top 10 settlements in 2024 came from the tech sector.

Predictions for Securities Litigation

If there was one thing the panel agreed on, it’s that securities litigation isn’t slowing down anytime soon.

As mentioned earlier, judicial appointments will play a big role in shaping securities law moving forward. As new judges take the bench, their approach to issues like motions to dismiss will set the tone for future cases.

The 2025 PLUS D&O Symposium provided a valuable forum for discussing the latest trends in securities litigation and their impact on public companies, corporate leadership, and insurers. As always, Woodruff Sawyer remains committed to monitoring these developments and providing the insights and expertise our clients need to stay ahead.

Author

Table of Contents