Blog

Tax Liability Insurance: Overview & 2024 Market Update

It is well known that two things in life are certain—death and taxes—and the world of Mergers & Acquisitions (M&A) is no exception. Navigating various tax systems is challenging, even with the best advisors because there are differences between tax jurisdictions on the domestic and global front. These differences are why tax liability policies are invaluable.

What Is Tax Liability Insurance?

Representations & Warranties Insurance (RWI) will cover breaches of tax covenants that were unknown and occurred prior to the acquisition. But what about known tax exposures? Compromising tax positions can lead to stalled or hostile M&A negotiations, even causing parties to walk away from a deal.

Tax liability insurance addresses these known tax exposures, thereby eliminating the buyer’s need to self-insure the risk or negotiate an indemnity escrow. The purpose of Tax Liability Insurance is to protect the insured if a taxing authority (local, state, federal, or foreign) prevails in challenging the insured’s tax position. Subject to certain terms and conditions, Tax Liability policies provide coverage for taxes owed, as well as any associated interest, fines, penalties, and costs of defending your tax position.1 In addition, coverage may include a “gross-up” to reimburse the buyer for any income taxes assessed after a covered insurance claim has been paid out.

What’s Covered and What's Excluded?

There is no standard form for Tax Liability policies, as each policy is tailored to the individual tax position. The different types of taxes covered include Sales Tax, Corporate Income Tax, Property Tax, and Capital Gains Tax. A few specific examples of insured risks include:

- Tax-free Reorganizations

- Debt Equity

- Capital gains vs. Ordinary income treatment

- Tax positions under audit or challenged by a tax authority

- Net Operating Losses/Section 382 change of control

- Transfer Pricing (positions on cross border transactions)

- S-corporations

- REIT Status

- Renewable Energy (Investment Tax Credits and Production Tax Credits)

Standard exclusions an insured can expect in addition to any deal specific exclusions are:

- Changes in Law (typically limited to changes in Treasury regulations and Internal Revenue Code)

- Inconsistent Tax Filings (where insured files a tax return with a position that differs from the position covered under the policy)

- Material Misrepresentations in the Representation Letter

Nearly all carriers will list the above exclusions; however, some may also exclude Fraud and Settlement without Consent from coverage.

As with RWI, Tax Liability Policies are non-renewable. They have a one-time premium payment, an aggregate self-insured retention—the amount of which is determined on a case-by-case basis—and a typical cover period of seven years. The period can be extended to up to 10 years for an additional premium.

Read more about tax liability insurance, policy elements, coverage triggers and more in our blog, “Tax Liability Insurance: The Basics".

What Are Current Trends In Tax Liability?

Carriers across the tax liability space report that tax submissions are on the uptick in general, with a particular spike in tax credit policies. Many carriers note that renewable energy policies concerning ITCs (Investment Tax Credits) and PTCs (Production Tax Credits) make up half to two-thirds of their business as of 2023 some already seeing placement double between Q3 2023 and Q1 2024. Therefore, carriers assume this trend will continue throughout 2024 and beyond.

Green Energy: The Driving Force

Much of the increased activity in the renewable energy space can be attributed to the passage of the Inflation Reduction Act (IRA) of 2022. The IRA incentivizes private sector investment in clean energy and manufacturing - including solar, hydropower, pumped storage hydropower, and marine energy projects via its creation or enhancement of more than 70 different tax incentives.2

PTCs and ITCs

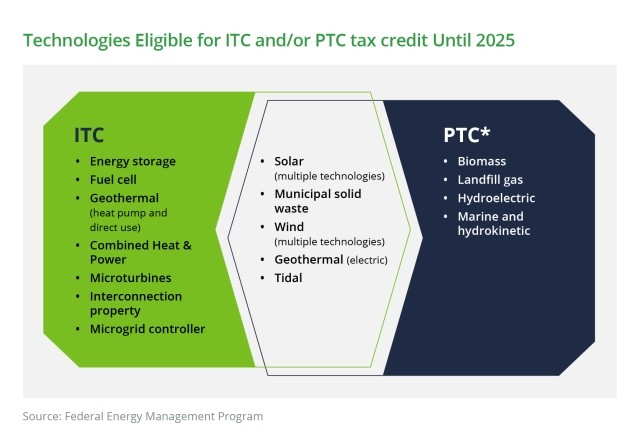

Production tax credits (PTCs) reduce a taxpayer’s liability based on the amount of electricity it generates, whereas investment tax credits (ITCs) reduce its liability based on a percentage of eligible investment costs. The diagram below from the Federal Management Program details technologies eligible for the ITC and/or the PTC tax credit until 2025.

Most businesses who claim an ITC also seek to combine this benefit with bonus depreciation deduction. As depreciation is considered an expense, a larger rate of depreciation during a tax year corresponds to a smaller tax liability. The Tax Cuts and Jobs Act of 2017 (TCJA) allowed qualified property placed in service between Sep.28, 2017 – Dec. 31, 2026, to depreciate at an increased rate, which was 100% up until 2022.3

*Per FEMP, PTC value is reduced by half for facilities using municipal solid waste or biomass.

Tax Credits & Bonus Depreciation

To take full advantage of available tax credits and bonus depreciation, developers sometimes partner with tax equity investors. Partnership flips and sale leasebacks are the two most common ways to do so.

- Partnership Flips: in this scenario, the investor contributes capital to the project and is the beneficiary of the returns, which later “flip” from the investor to the developer after the investor achieves target yields.

- Sale leasebacks: the facility is sold to the investor, rapidly increasing depreciation, and the investor then provides a long-term lease to the developer; allowing developer to utilize the tax benefits and reduce overall costs over time.

The bonus depreciation benefit, however, phases out, so there is limited time for investors to take advantage of it. The current rate of depreciation is 60%, and it will reduce by 20% each year until it reaches 0% in 2027.

Likewise, 2032 is set to be the trigger year of a four-year phase-out process of various ITC and PTC tax credits more broadly. Therefore, time is of the essence for maximum return for investors.

Transferring Tax Credits

Before the IRA, partnership flips were typically the best avenue for developers of large-scale renewable energy projects as they often did not have adequate short-term tax liability to utilize the federal credits. However, since the IRA went into effect, taxable entities can transfer qualifying renewable energy credits if the following conditions are met:4

- Credits are exchanged for cash with an otherwise unrelated 3rd party.

- Credits are subject to a one-time transfer, i.e. they may not be re-sold.

- Cash paid by the buyer is non-deductible, and cash received by seller is considered tax exempt income.

- Likewise, it is not possible to sell only a part of a credit. For example, a bonus credit cannot be transferred separately from a base credit. These rules were recently affirmed in final form with IRS regulations released on April 30, 2024. Credit transfers create a market-like system where buyers can purchase renewable energy credits at a discount. However, those savings are meritless if the credits purchased do not ultimately equate to their advertised value. For example, they fail to meet certain requirements and become subject to recapture or disallowance. To address this risk, Buyers have increasingly turned to tax liability insurance to both protect their investment and streamline the purchasing process.

Now Is the Right Time for Tax Liability

Insurance Carriers are preparing for M&A activity to increase and green energy efforts to continue. More markets are entering the space and expanding their capacity, offering higher limits with lower pricing than in previous years. While the particulars of each transaction need to be considered, average pricing ranges from 2%-5% ROL (rate on line) and is frequently less expensive for tax credit policies, which hover at 2%-3% ROL. The enthusiasm of the markets combined with the expanding breadth of options make now a great time to purchase tax liability insurance.

4https://www.bdo.com/insights/tax/renewable-energy-tax-credit-transfers-doing-well-by-doing-good

Author

Table of Contents