Guide

Managing Transactional Risk in 2025: Our Strategy Guide

What will the second half of 2025 hold for the private equity deal landscape? The resurgence in deal values and volumes throughout 2024 provided a positive boost to the mergers and acquisitions (M&A) market. We expect this upward trend to carry on through 2025, with promising signs for dealmaking as the year progresses.

Woodruff Sawyer’s 2025 Guide to Transactional Risk: Insurance Due Diligence for Private Equity & M&A explains how we help our clients through their M&A transactions. This guide is for private equity, growth equity, special purpose acquisition company (SPAC) and de-SPAC, and strategic acquirers. Here are some highlights from the updated Guide.

The Deal Landscape: Bright Signs for 2025

In 2024, the private equity deal landscape experienced a resurgence in Q4, largely driven by the Federal Reserve's monetary easing policies, which fostered a favorable financing environment. According to EY’s “Private Equity US Market Insights and Trends,” deal values surged by 26% and volume by 24% compared to 2023. In addition, the average debt/EBITDA ratio in deals rose to 5.2, up from 4.9 in 2023.

Although PitchBook notes there could be reduced fundraising activity in 2025, a pickup in realization activity and a decline in interest rates could expedite the exit recovery and sustain fundraising throughout the year.

Additionally, the Trump administration's deregulation agenda could boost transaction activity. However, new tariff regimes add uncertainty, with supply chain issues being the biggest concern, according to EY’s Private Equity Pulse.

Due Diligence Matters

With more than 25 years of experience working in the private equity and M&A community, Woodruff Sawyer recommends performing insurance due diligence on every transaction.

Here’s the critical information due diligence provides:

- How EBITDA is being protected at the company level

- The foundation of insurance, general risk management strategy, and approach to employee benefits offerings

- Implications on the total cost of risk and opportunities for cost structure improvement post-close

- How to avoid exclusions or issues with the representations and warranties insurance (RWI) process

- Understanding historical losses

- Coordination of run-off policies

- Knowledge of evidence-based benchmarking

- Value-added resources

- Potential new program needs

- How to respond to lender requests

Including an expert insurance advisor on the due diligence bench will enhance a deal team's understanding of the target acquisition pre-close—ensuring that no surprises come up post-close. It is never in the best interest of the private equity buyer if a brokerage firm uses an outsourced diligence team or centralized broker marketing model.

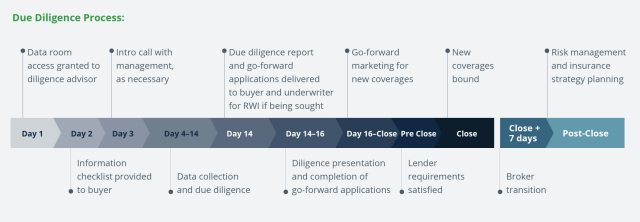

Transaction Timeline from an Insurance Perspective

In any given transaction, various situations can arise that will affect the transaction timeline. The two main insurance-related workstreams are the RWI and due diligence processes. Understanding how these two simultaneous workstreams weave into the broader transaction timeline will help you avoid delays at the end of the process.

Phase 1: Pre-LOI Through Execution of LOI

The pre-LOI period is often when a buyer engages an RWI broker to approach the marketplace to obtain quotes for the transaction. This first phase of the RWI brokerage process includes submitting several pieces of key information to the broad RWI marketplace.

Phase 2: Period of Exclusivity and Insurance Due Diligence

Once the LOI has been executed and the deal moves into exclusivity, the buyer will kick off all third-party diligence workstreams. Insurance and employee benefits due diligence should always be one of these workstreams.

First, the diligence team becomes acquainted with the target company by having a call with the management team to provide clarity on the insurance process and answer any insurance checklist-related questions. As more information is gathered and supplied to the buyer’s team, the insurance diligence team begins their work.

The insurance advisor should be considered an extension of the deal team and a partner in EBITDA protection, risk mitigation, and overall insurance strategy.

The result of the diligence process should be a comprehensive, clear, and concise due diligence report outlining key findings, recommendations, and next steps as the transaction process moves forward.

Phase 3: Pathway to Close and Closing

Once the initial due diligence is completed, here is what needs to happen prior to closing.

- RWI Phase II underwriting process

- Coordination of run-off coverage for any policies that have a change in control provision

- Go-forward coverage solicitation

- Certificate of insurance coordination

Phase 4: Post-Close Brokerage and Implementation

After the deal closes, the real work and partnership begin between the operating partners of the private equity firm, the management team of the newly acquired company, and the insurance broker team.

The advisor begins implementing any recommendations that were not implemented at close. It is also when the due diligence advisory team works with the management team to develop a comprehensive insurance and risk management strategy for the short, medium, and long term.

5 Key Insurance Due Diligence Findings from 2024

Here are key findings that Woodruff Sawyer has identified in middle-market private and growth equity transactions.

- No comprehensive, strategic approach to insurance and risk management: While a foundation of coverage has been established, no long-term insurance strategy for EBITDA protection has been developed or implemented. The insurance advisor should recommend ways to both professionalize the program and raise the level of sophistication of the insurance program post-close to maximize EBITDA protection over the lifecycle of the investment.

- Key coverages are missing: Examples include management liability (directors and officers liability), commercial crime, cyber liability, and product recall liability.

- Limits are inadequate: Examples include cyber liability, business income and extra expense, contingent business income, and product liability.

- RWI continues to be used on most transactions: It’s increasingly being used on deals that are smaller than $50 million, given market conditions.

- Management teams should expect varying premium/rate developments, depending on product and industry on property, casualty, and management liability coverages.

For an in-depth look at the insurance due diligence process and how it can help you close deals faster and with more certainty, download your copy of the updated Guide to Transactional Risk: Insurance Due Diligence for Private Equity and M&A.

Authors

Table of Contents