Blog

Improving Employee Confidence with Financial Wellness Programs

If your employees look stressed, it might not be due to the latest project you gave them. They might be thinking about their kids, the errands they have to do—or the debt load they're carrying. While employers are clamoring for top talent and providing a suite of health and employee benefits, there's one more element they should consider: financial wellness programs.

Millennials on your staff may be carrying an average of over $34,000 in school loan debt. The Gen X'ers (a generation older than Millennials) have close to $40,000 in debt, and even those Baby Boomers may have close to $36,000.

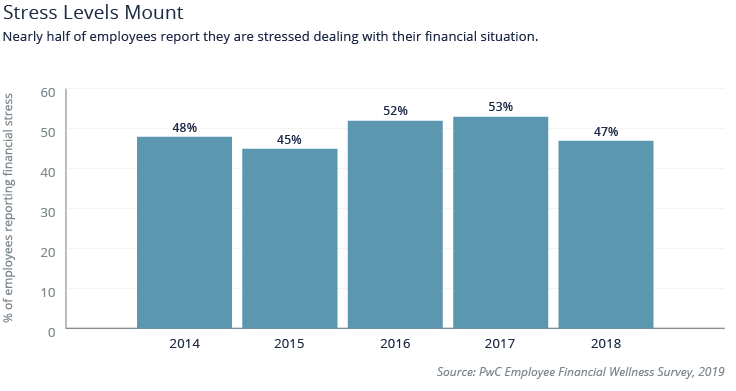

And that's just school loans. Credit cards, mortgages, car loans; it all adds up. As an employer, you may be paying them a competitive wage, but dealing with the stresses of work, debt, health, and relationships can become overwhelming. Lower productivity and higher healthcare costs are a common side effect of financial stress and nearly half of all employees are feeling the pressure.

Traditionally, the employer's role in financial planning was in the retirement space, offering 401ks and retirement planning services. Given today's heavy debt load, employees may not think retirement is even possible and may need more than just long-term advice. Financial wellness can seem out of reach.

What Can Employers Do to Improve Financial Wellness?

Can employers empower employees to improve their financial wellness? Yes, but you need to be strategic about it and understand your employee population and the details of the current benefit programs you offer.

You may already have an Employee Assistance Program (EAP), which offers limited counseling at a free or reduced rate, to help employees get over a short term stressor. Mental health benefits may also be part of your existing benefits program. Communicating what benefits are currently available (other than just at enrollment time) can help employees cope with existing short or long-term financial stress.

The next approach involves savings programs. Consider offering a Health Savings Account (HSA) program, as it's a proven way to save money on healthcare costs. Once you implement this highly popular plan, you'll need to educate your staff on its benefits. Other tax-free benefits like Dependent Care Assistance Program (DCAP), transportation, and similar Section 125 benefits should also be part of your benefit suite and ongoing communication program. Providing real-world tax savings examples can show employees how the program works and how easy it is to use.

Financial planning services may also be helpful, but should be carefully considered. Choose your partners wisely. In recent years, some partners have asked for a lot of employee data and then experienced data breaches, so vet your financial partners carefully. In addition, easy access to payday loans might seem like a great benefit for temporary setbacks, but many companies charge triple digit interest rates. Look beyond the sales brochure before you sign on.

Tuition assistance can help your employees improve their skills. Employer contributions offset tuition and professional education expenses, allowing employees to earn degrees and certifications at a lower cost. These programs may also enhance the loyalty to your firm.

SmartDollar Reduces Debt and Stress

What your employees may need most is education and personal financial planning. They probably need more than a budgeting app and may not know a checking account from a savings account, let alone how to pay off mountains of debt.

SmartDollar, founded by money adviser Dave Ramsey, gives your employees a step-by-step debt elimination and savings plan that has real world results. Bell Partners implemented the SmartDollar program in 2017 and had one-third of their 1,500 employees join the "baby step" program to improve their finances.

The results? The 503 employees (combined) eliminated nearly $260,000 in debt and saved over $400,000 in the first year. By the second year, over 40% of the staff had joined, and debt elimination totals rose to $433,000 with nearly $470,000 in savings.

While those are hard numbers, the perception of the staff changed too, shifting from "scared" to "confident." Which type of employee would you rather have handling important projects? One who knows they are personally in charge of their finances—or one who is continually distracted by financial stress?

Employers are in the unique position of not only employing staff members, but changing their lives for the better. Relieving one of the greatest stressors in your employees' lives through financial wellness programs can—and does—lead to greater confidence, productivity, and performance.

Having an expert on your team can help you wade through the complexities of employee benefits. For more insight into how you can help develop and improve your financial wellness program, reach out to your Woodruff Sawyer Account Team.

Table of Contents