Blog

SPAC Market in Limbo: Takeaways from the Annual SPAC Conference

About 600 SPAC market participants came together June 15-16 to discuss latest developments, trends, worries, and innovations at the annual SPAC Conference organized by DealFlow Events.

The mood was decidedly more somber than at last year’s event, and the word repeated over and over in conversations, panels, and presentations was “uncertainty.” Uncertainty was the underlying theme for everything: current macro-economic environment, global political perturbations, proposed SEC rules and the general regulatory landscape. The following topics dominated individual and panel discussions throughout the two-day event and here are my observations

Proposed SEC Rules Outrage and Disappoint

Both Doug Ellenoff and Mitch Nussbaum, who usually open the conference as keynote speakers, gave impassioned speeches on how the new rules seem to be aimed at not so much improving US capital formation but at driving the SPAC vehicle out of existence.

Both experts agreed that the SEC seems to be motivated more by political agenda rather than a desire to create a safe and attractive environment for investors.

More Disclosure is OK(ish)

There were few objections to the SEC’s aims of creating additional disclosure rules for SPACs. Most participants did not take issue with additional disclosure rules outside of pointing out that many of them would not add to what is currently already disclosed as part of current market practice and that additional requirements may only serve to add more pages to already lengthy disclosure documents.

SEC is Overreaching on Liability and Making Investors Pay

However, the consensus from multiple attorneys and others in attendance was that the rules as proposed overreached on the Securities Act liability to be imposed on advisors. Many said that they feared that bankers and other advisors -- some of whom had already started limiting their SPAC operations because of the proposed rules -- would exit the SPAC market entirely, making it a lot more difficult and costly for SPAC teams and companies looking to merge with a SPAC to get deals done.

The SEC’s push towards market-wide fairness opinions was also seen as an expensive extra step the costs of which will be borne by investors.

SEC Passing Judgment on SPACs

Many participants noted that they thought the SEC was attempting to pass judgment on whether SPAC-driven deals are good or bad and to dictate how individuals should be making their investments. It was a common refrain at the conference that making these kinds of judgments is outside of SEC’s mandate to facilitate the operation of capital markets.

The disappointment in what many thought were ill-informed, heavy-handed, politically-driven and cumbersome rules from the leading US securities regulator was palpable. Most attendees, however, felt that despite dozens of comment letters that were submitted to the SEC by various organizations and individuals pointing out inaccuracies, difficulties, inefficiencies, added costs for investors, and future pitfalls of the rules, that the SEC’s chair, Gary Gensler, was not likely to steer from his pre-determined course of passing them as is.

When Do We Get Clarity?

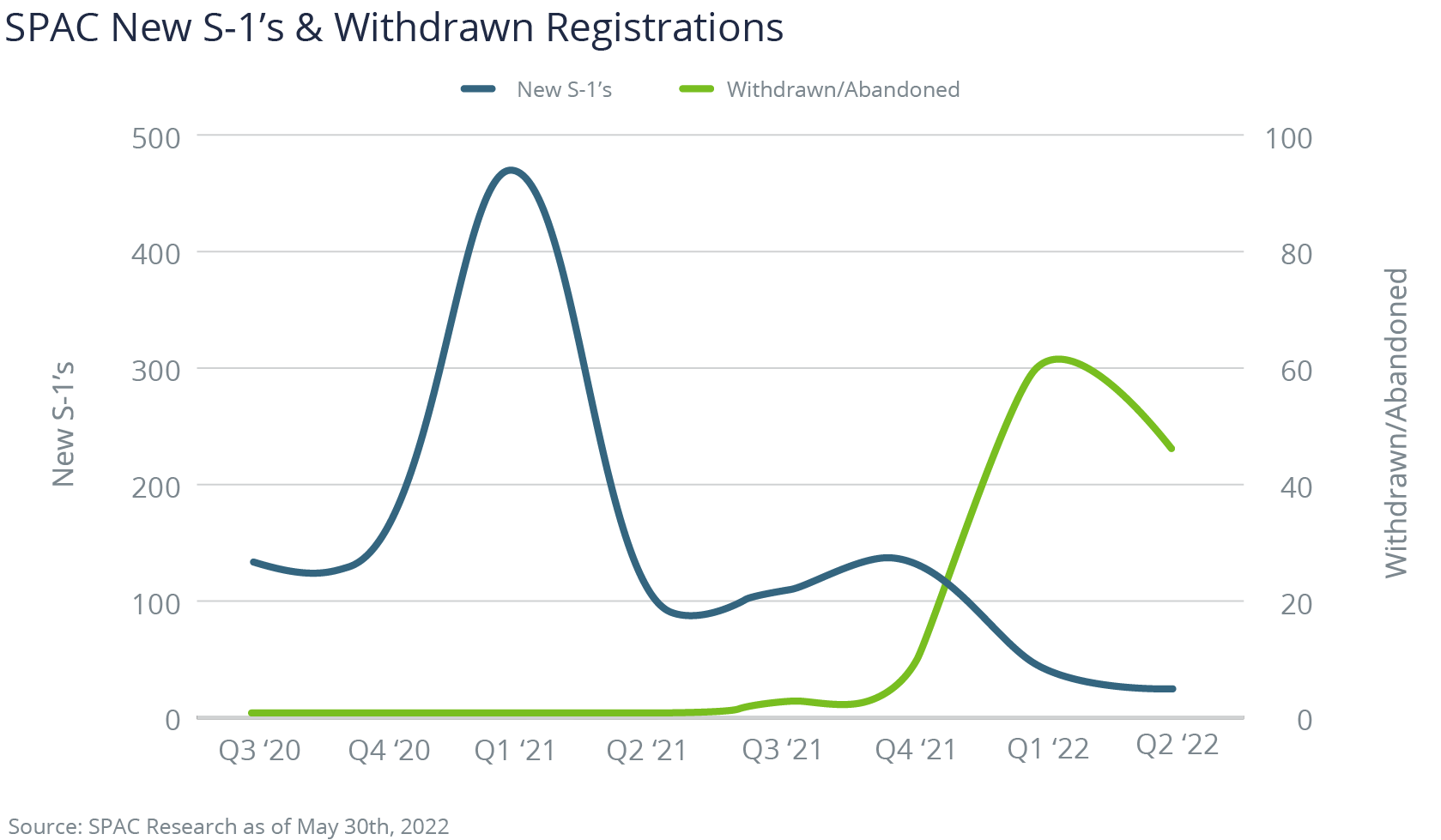

Most participants predicted that the rules would be finalized in October or November of 2022. Some, however, pointed out that the SEC had achieved the current SPAC market stand-still with just the proposed rules and may not be rushing to pass the final rules.

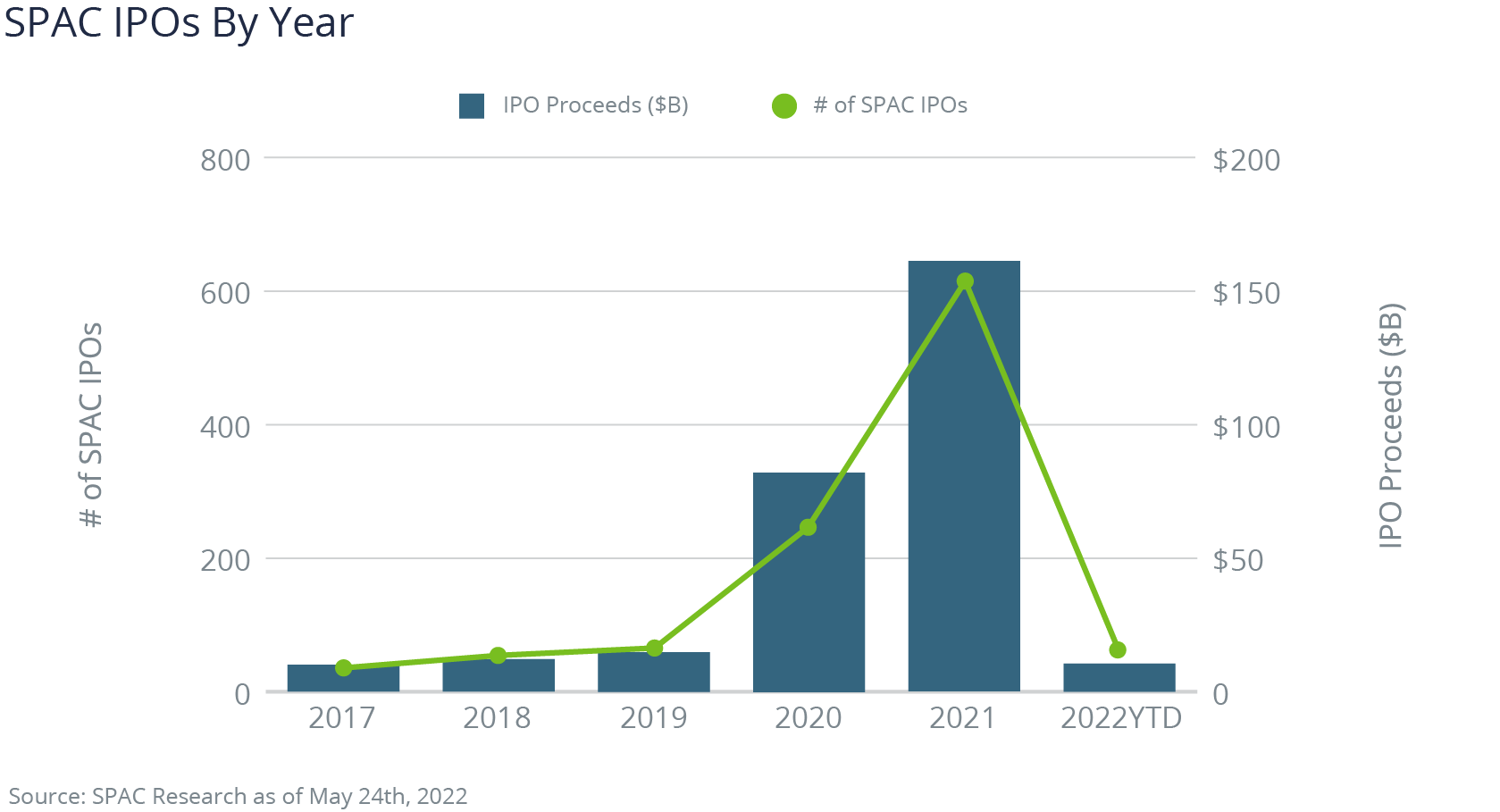

The uncertainty that the proposed rules are creating has put a damper on most new SPAC IPOs and is causing havoc for teams that are mid-deal. Letting the proposed rules linger is a form of cruel and unusual punishment for the SPAC market. Some attendees noted that as far as the current SEC commissioners (setting aside commissioner Pierce) are concerned, that punishment was just the thing the SEC was aiming for.

SPACs Unfairly Blamed for Economic Market Hangover

Several presentations focused on the data and, specifically, the performance of SPACs as compared to traditional IPOs and the general market. The conclusions drawn by multiple speakers were that while SPACs were indeed not performing particularly well, neither were companies that went public through a traditional IPO and neither was the market as a whole.

Many thought that the negative narrative around SPACs was resulting in the public fixating on the negative performance of SPACs and not taking into account the entirety of the financial market. Many pointed out that SPACs happened to hit their peak at the end of a years-long bull market but were getting unfairly singled out when the entire market collapsed.

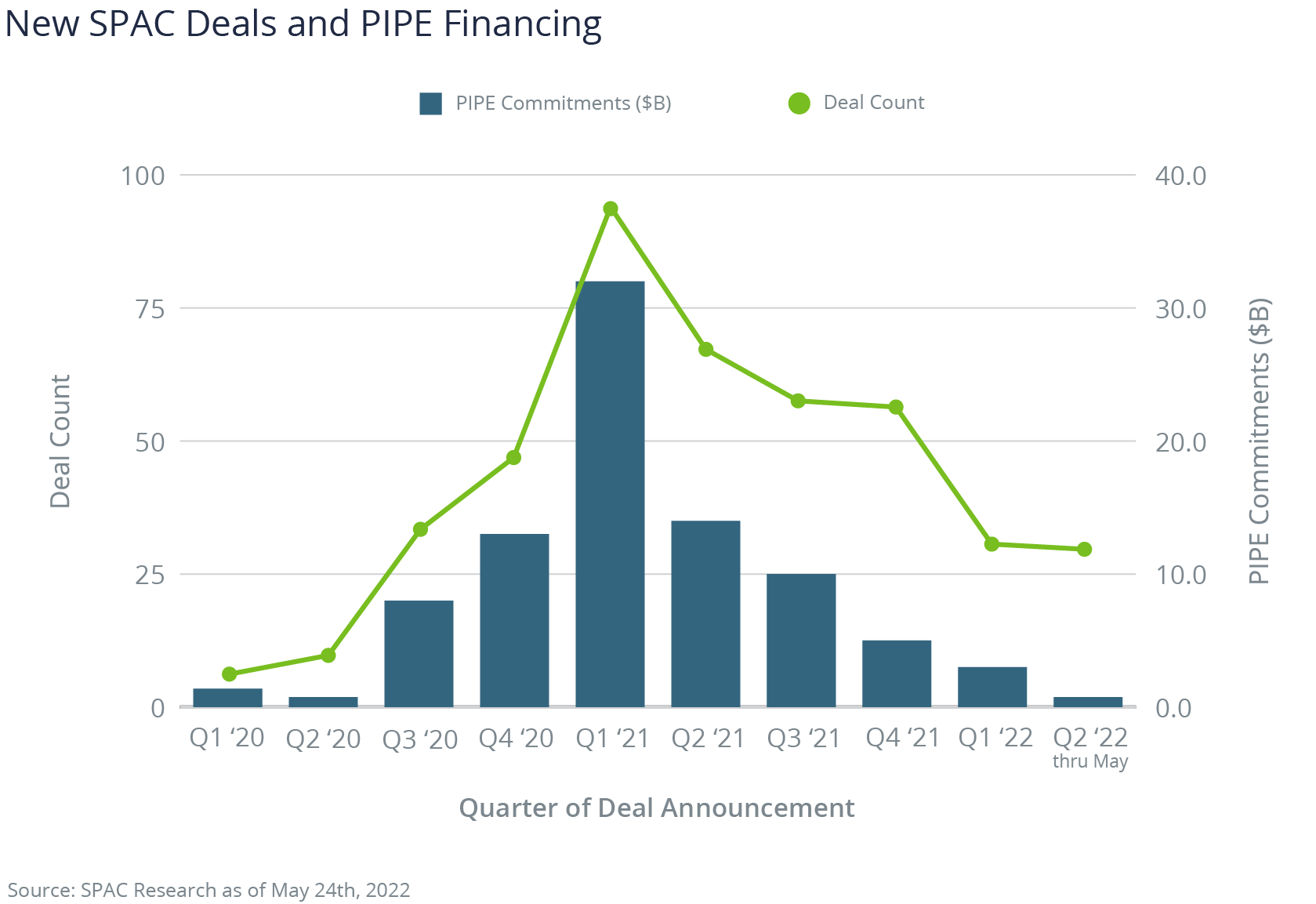

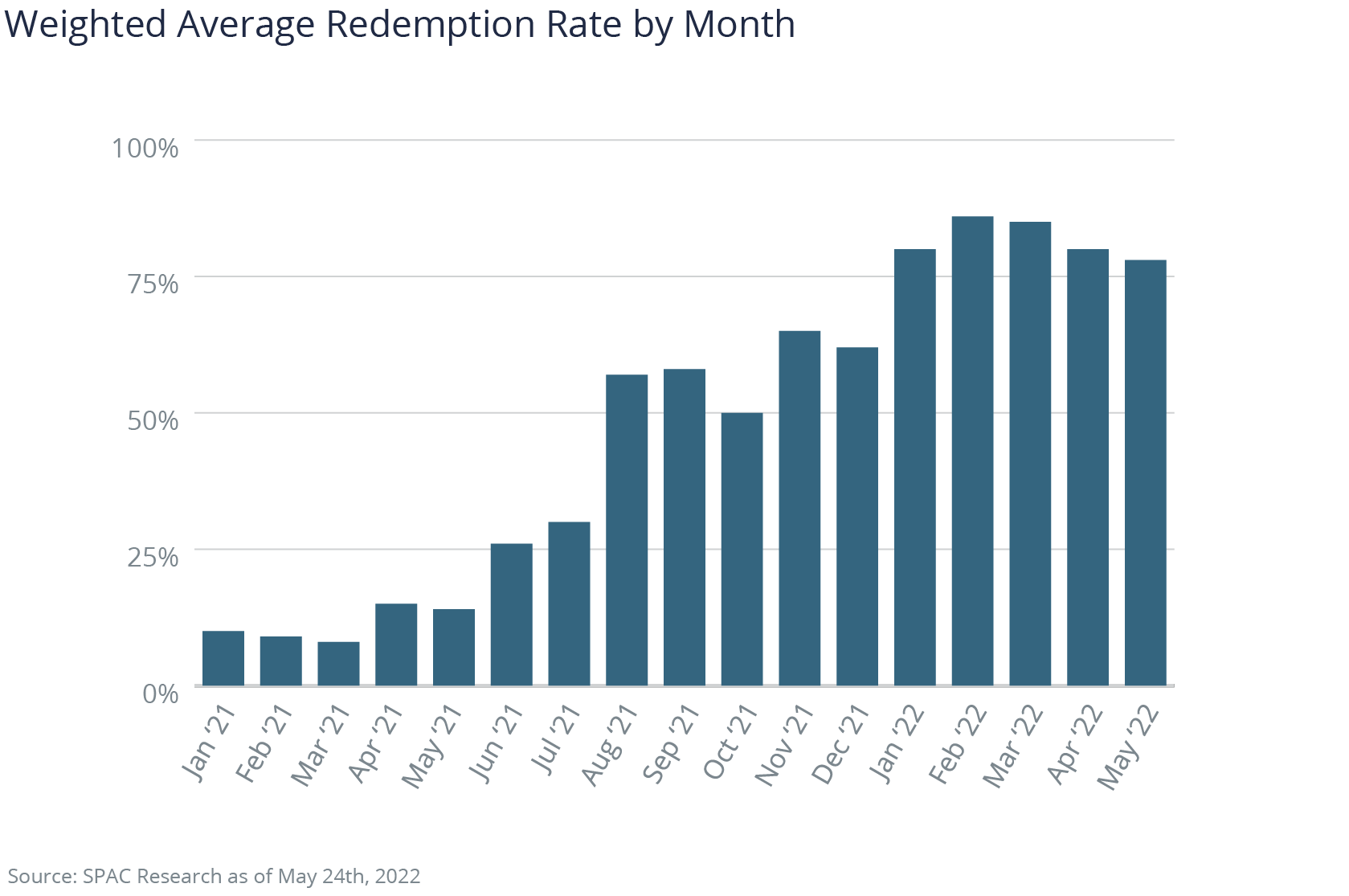

It was clear that a complete halt in the availability of PIPEs, increased investor arbitrage causing excessive redemptions, and the continued negative performance of SPAC stocks was not pointing to any improvement in the SPAC market in the nearest future. Many expressed optimism that we will see a turn for the positive sometime in 2023.

Decreased valuations were also a hot topic. Several speakers offered data on how more sober valuations were causing much smaller de-SPAC deals in the last few months. Whereas last year and in the beginning of 2022, we saw multiple multi-billion-dollar

Costs of Adaptation to Fall on Investors’ Shoulders

So, when things are in limbo, and there are multiple bumps in the road and lack of clarity around final rules, what is a SPAC sponsor, director, investor, and advisor to do? They need to adapt.

All conference attendees I spoke to believed that this is not the end to the SPAC market. Granted, they are somewhat biased, but this was the conclusion across the board even from the most skeptical.

What most are turning their energy to now is adapting to the proposed rules and current market conditions. Many are treating the rules as already final. Most are bending with the wind and advising SPAC teams to get fairness opinions. They are advising that SPACs to continue forth with pared down projections and amplified disclosure around conflicts of interest and sponsor compensation.

I spoke with multiple advisors offering fairness opinion services and with some who are pulling together solutions for public company readiness and more robust diligence processes. My colleagues and I presented our latest solutions involving the combination of Reps and Warranties insurance and Directors’ and Officers’ insurance which would bolster a SPAC team’s diligence defense and increase coverage without increasing insurance costs.

While the larger banks are hesitating on whether they’d like to stay in the SPAC playground, mid-tier and smaller banks are stepping back into the space they were crowded out of by the big players, albeit with different compensation structures.

All of these things, purely innovative or purely reactionary to SEC’s rules, will, unfortunately, add costs to the SPAC process. It is likely that SPAC sponsors will pick up some of these costs, but ultimately, the costs will fall on the shoulders of the investing public. At least one of the comment letters submitted to the SEC emphasized this concept repeatedly and with a bit of humor.

What is important is that the drive to adapt is a natural reaction of market participants who want to see a fair, robust and dynamic market remain a real, publicly accessible alternative to the traditional IPO. Multiple speakers at the event lamented the ever-diminishing number of US public companies and advocated for the need to allow main street investors access to new, exciting companies that promise innovation and growth. Many believed that the SPAC vehicle -- faulty or not -- was extremely successful in getting hundreds of these kinds of companies into the public market in the last two years.

My takeaway is that the SPAC ecosystem will adapt, adjust, improve, and march forth.

Author

Table of Contents