About Us

We Are

Woodruff Sawyer

Our mission is simple: to provide our clients with deep expertise, thoughtful counsel, and fierce advocacy.

We Believe Business Favors Boldness

Our clients take risks. At Woodruff Sawyer, we protect clients with the right coverage and advocate for you when a claim arises. We make your business more resilient and champion for your success.

Our client-first approach means we’re more than a brokerage or an insurance transaction. We’re a trusted business advisor motivated by doing what’s right for you—based on your agenda. Our people and their unique talents, facets, and expertise is what drives Woodruff Sawyer.

Unbiased and Client-First

We’re Champions for Your Success

We manage your exposures with carefully tailored solutions in accordance with your goals and budget, working as an extension of your internal team.

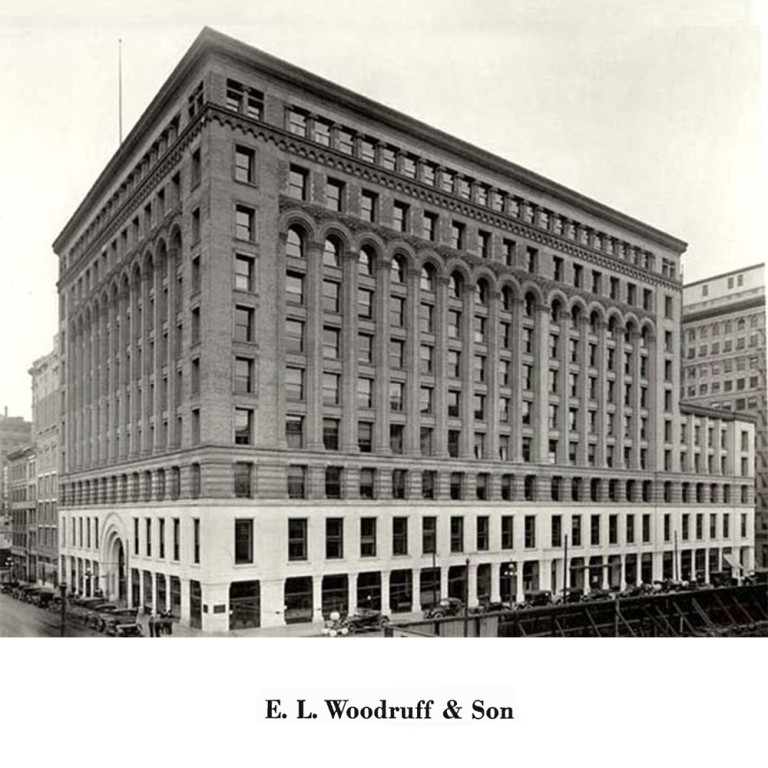

Our History

100+ Years of Expertise

We’ve been insuring creators, innovators, and game-changers for more than 100 years. We’re proud of our history—it’s what drives us into the future. “We’ve constantly had to rethink and reinvent how we solve problems because the products and technologies many of our clients develop, sell, and use are changing the way we live.” - CEO Andy Barrengos

Get To Know Us