Report

Q1 2025 Commercial Insurance Snapshot: Property Market Continues Downward Trend

The property market continued to soften in the first quarter of 2025 as property insurers reported good profits and lower reinsurance costs, encouraging competitive pricing.

Favorable conditions also persist in the directors and officers (D&O) and cyber markets, as competition in both sectors is driving prices down. However, the casualty market continues to face challenges with rate pressure, and we don’t see this trend changing anytime soon. This blog further explores the commercial market during Q1 2025.

Read the full Q1 2025 Commercial Lines Insurance Market Update here.

Property Market Softens

Driven by favorable reinsurance renewals, insurance company profitability, and insurance company growth goals, the property market continues to soften. Deductibles remain unchanged, but some insureds are looking to increase their limits.

Carrier growth goals are driving competition in this market. Here are some other trends our team is reporting:

- The North Atlantic Hurricane season is predicted to be above average, and severe convective storms remain a concern this year.

- Carriers are monitoring the political environment and its potential impact on valuations. For most, values are trending at 1%–3%.

- Risk quality and risk improvement plans drive better outcomes.

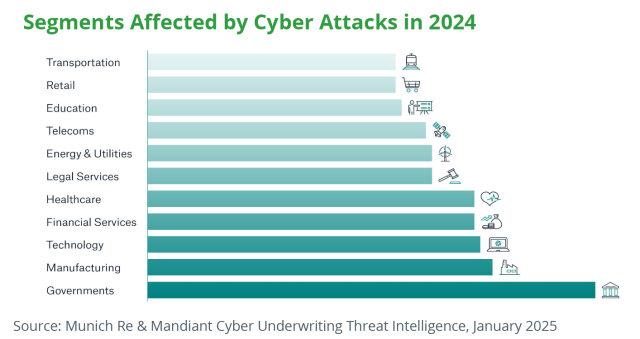

Competition Drives Cyber Pricing

Major cyber breaches may be driving headlines, but competition between carriers is what is fueling lower premiums and rate decreases.

Retailers Marks & Spencer, Co-op, and Harrods all were affected by ransomware attacks recently. Reportedly, only one of these three UK companies purchased cyber insurance. While these individual losses drive the headlines, they rarely result in market changes, despite high dollar losses.

Systemic events—a single attack or outage that ripples throughout many more downstream customers—have driven insurance carrier loss ratios higher. These supply-chain attacks continue to cause aggregation concerns for carriers. Carriers have restricted wrongful collection coverage in response to claims activity.

A moratorium on state Artificial Intelligence (AI) law enforcement, part of the recent US House budget bill, will have a positive impact on claims related to the use of AI in the US. However, the EU Artificial Intelligence Act remains a concern for this market.

D&O Market Favors Buyers

The D&O insurance market continues to favor buyers, and premium reductions are still available. However, the rate of decrease has slowed significantly. After a few years of being in a soft market, carriers are pushing for rate increases, particularly for clients with higher risk profiles.

Carriers argue that ongoing rate declines jeopardize long-term profitability, warning that the D&O market may be heading toward an unsustainable future.

Optimism for a strong IPO market and increased M&A activity has diminished due to uncertainty about the markets and economy.

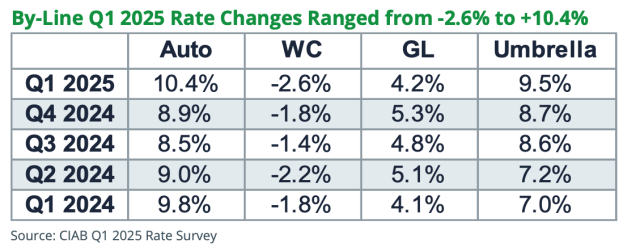

Casualty Market Remains Challenging

Despite the consistently profitable Workers’ Compensation (WC) market and a competitive high-excess market, the casualty segment remains challenging. Auto, general liability (GL), and umbrella markets face continued rate pressure due to adverse loss trends.

Large jury verdicts and liability settlements continue to impact the market as carriers experience increasing loss costs and claims. Legal system abuse, litigation financing, and creative plaintiff tactics are putting upward pressure on settlement costs.

Organizations with large auto fleets, high-hazard products, or significant premises exposures are facing difficult umbrella renewals and reduced capacity deployments. Additionally, enhanced technology in vehicles and supply chain issues are leading to an increase in auto physical damage claims. Longer repair times are also affecting supplemental claim costs.

For more insights into the insurance trends and pricing changes of Q1 2025, including cargo and stock throughput, download our full report here.

Author

Table of Contents