Blog

Advisen’s Year-End Report and Thoughts about 2015

Advisen just released its “Quarterly D&O Claims Trends: 2014 End of Year Wrap-Up" report with some interesting finds. I had the pleasure of being invited by Advisen to offer my views on what to expect in 2015 with regards to the trends within the report (which we’ll discuss later in the post). Let’s first discuss the data.

Before digging into the details, it’s worth taking a moment to understand Advisen’s data collection methodology. Advisen’s goal with its report is to “examine all sources of securities-related suits that impact the underwriting and placement of management liability insurance other than ERISA liability suits.”

In doing so, Advisen has taken on the enormous task of tracking D&O-related litigation across a large number of categories that go beyond securities class action suits.

Advisen’s data collection methodology is such that “Advisen counts each company for which securities violations are alleged in a single complaint as a separate suit.”

This methodology is consequential. For example, merger objection suits are included in the total count, and presumably each of these suits is counted as two suits since merger objection suits typically name both the transaction target and the acquiror.

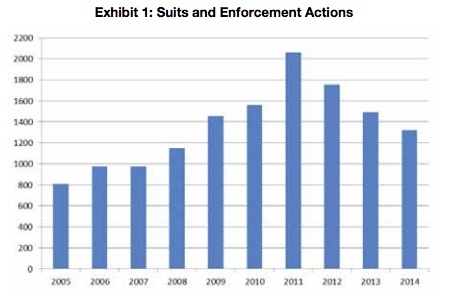

This year, Advisen reported a 10 percent decrease from 2013 to 2014 in lawsuits that “could trigger coverage under a D&O policy” (from 1,492 to 1,342).

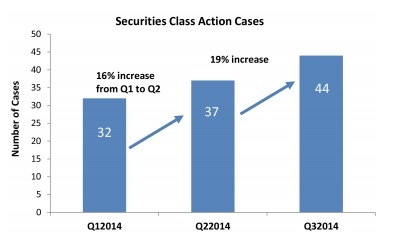

Advisen’s report thus emphasizes a different point than the one emphasized by Woodruff Sawyer’s Flash Report published in Q3 2014. That report showed a steady increase in securities class actions in 2014.

The difference, of course, is related to Advisen’s different approach to data collection. While Advisen’s report shows a universe in which the frequency of D&O-related claims is down by 10 percent, Woodruff Sawyer’s data makes the point that one of the highest severity risks for Ds and Os – securities class action lawsuits – were steadily increasing during 2014.

Advisen’s report also discusses derivative suits, one of the most concerning areas of D&O litigation. These suits are concerning in part because settlements of derivative suits typically cannot be reimbursed by a director’s company. This puts a lot of pressure on the D&O insurance policy to respond.

The Advisen report, on one hand, is very comforting when it comes to derivative suits: the total number of cases declined again in 2014, as it has since 2011. On the other hand, however, Advisen reports that there has been a number of nine-figure derivative suit settlements in the last few years.

You can find more data in the Advisen report itself, and you can also head over to Kevin LaCroix’s D&O Diary blog for more insights on the report.

A Closer Look at the Trends of 2014, and What It Means for 2015

Of course, the past is in the rear-view mirror. Advisen’s report asks the better question: what can we expect in 2015?

While the overall drop in events in 2014 could mean that bad acts and frivolous lawsuits are on the decline, Advisen states that the data should be looked at through the lens of longer term trends.

From the report:

The three year decline is further evidence that the era of high frequency credit crisis related litigation has ended. Nonetheless, a nearly across-the-board decline in lawsuits is atypical when compared to historical trends. More typically, plaintiff firms reallocate resources to different types of litigation to respond to changing conditions. If this is in fact occurring, it appears that those resources are possibly being allocated outside the realm of D&O-related litigation.

The Advisen report quotes my belief that there is nothing to indicate that the U.S. Securities and Exchange commission is slowing its momentum in identifying and prosecuting bad actors at public companies, and this will certainly make more headlines in 2015.

The SEC’s priorities in 2015 will range from enforcing the laws against insider trading to making sure firms – as well as individual Ds and Os – adhere to basic federal securities laws, including regulatory filings.

When it comes to insider trading, of note recently were comments made by the SEC’s chair, Mary Jo White, on the Second Circuit's decision on insider trading liability (follow the link to learn more about the case).

White called the decision an “overly narrow view of the insider trading law,” signaling the SEC’s stance on the matter in 2015; no matter how far removed an alleged inside trader may be from the insider him or herself, it may not be enough to prove innocence in the SEC’s book.

And let’s not forget about the SEC’s crackdown on adherence to basic rules in 2014, like properly filing Section 16(a) forms on time … or else. With those actions, we see an agency that takes enforcement seriously, and that will be looking for violations both large and small in 2015.

While some types of D&O claims experienced a decline in 2014 according to the Advisen report, others skyrocketed – like the settlements paid out in 2014 due to cases under the Foreign Corrupt Practices Act (FCPA), which primarily target bribery and books and records. One case settled for $772 million.

Why might FCPA cases be on the rise in 2015?

I shared with Advisen my view on this question. First, the U.S. Supreme Court expanded whistleblower protections in 2014. This decision along with the Dodd-Frank whistleblower incentive program at the Office of the Whistleblower creates a welcoming environment for reporting wrongdoings at a company.

A second source of encouragement is the Supreme Court’s decision in 2014 in the United States v. Joel Esquenazi and Carlos Rodriguez, a case that further defines "instrumentality," who counts as a public official, and how that factors into bribery.

This case supports the SEC’s and the U.S. Department of Justice’s (DOJ) broad view of instrumentality, and provides incentive to go after corruption. In fact, in November 2014, the head of the DOJ’s Criminal Division said FCPA prosecutions will increasingly target individuals, not just corporations. (Stay tuned for a more in-depth post on FCPA matters coming soon to the blog.)

So, as we gear up for another year, it’s time to ensure risk management is securely in place, and that means crossing those “t”s and dotting those “i”s in preparation for the scrutiny that may come from government bodies, shareholders and their legal teams in 2015.

And as always, a well-brokered D&O policy can provide critical financial protection when individual directors and officers are faced with investigations or litigation.

The views expressed in this blog are solely those of the author. This blog should not be taken as insurance or legal advice for your particular situation. Questions? Comments? Concerns? Email: phuskins@woodruffsawyer.com.

Author

Table of Contents