Blog

Board Self-Evaluations

Is your corporate board of directors the right board to take care of the interests of shareholders today?

This is the underlying question that every board is asking itself when it comes to self-evaluations.

All good boards engage in some sort of self-evaluation process. NYSE’s corporate governance guidelines require such a process: “Conduct a self-evaluation at least annually to determine whether it and its committees are functioning effectively.”

Although I’m unaware of any evidence that boards that conduct self-evaluations provide their shareholders with better returns than those that do not, it’s a generally accepted best practice today for a board to conduct a self-evaluation.

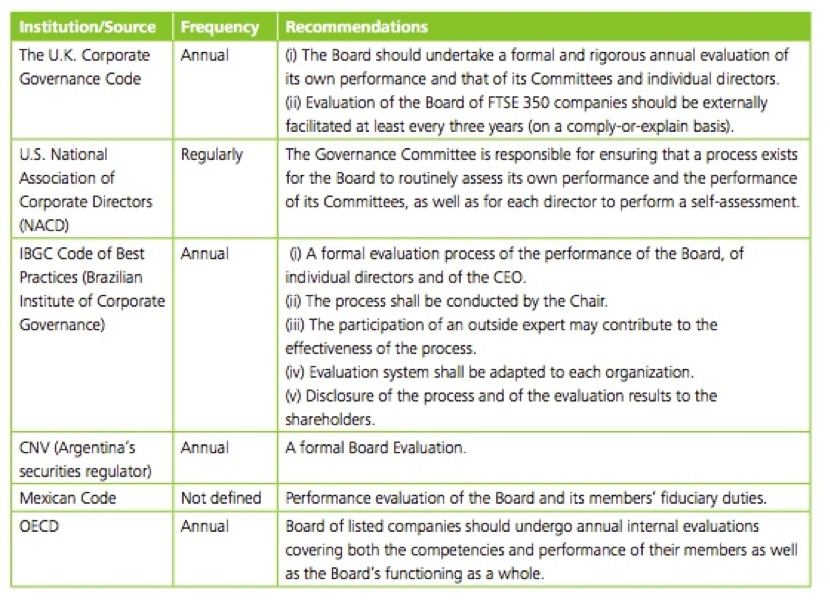

It’s not just the NYSE that thinks board self-evaluations are important. Numerous other corporate governance organizations also promote board self-evaluations, as we see from the following graph pulled from the Deloitte Performance Evaluation of Boards and Directors report:

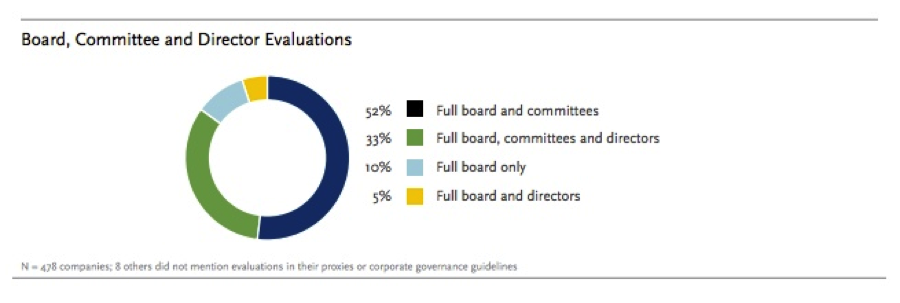

Boards have found this guidance compelling: only eight – or 2 percent – of the S&P 500 boards in 2015 did not report whether they conducted an annual evaluation of the board, according to the Spencer Stuart Board Index:

But beyond the simple rule of actually having a self-evaluation, there are no strict guidelines on how to carry out the self-evaluation process.

Let’s look at some common ways to conduct the self-evaluation process, and what to watch for …

Ways to Conduct the Board Self-Evaluation

Oral vs. Written

An oral or written evaluation is the choice du jour, though most evaluations have some aspects of both – meaning that even if the evaluations are oral, the process is documented.

Some law firms strongly recommend that evaluations be conducted orally, lest any documentation about individual director performance find itself being used in court as evidence.

It makes sense to be cautious about any written record on a topic as sensitive as board evaluations, whether or not you think the documents might be discoverable. Boards should always be thoughtful about any record that they create, regardless of whether privilege applies or not.

Moving beyond questions of discovery in litigation, some boards just prefer oral evaluations because they believe that an oral process leads to a richer discussion than what one gets from filling out a questionnaire.

However, if your board prefers a written evaluation approach, consider working through your outside counsel and getting advice on what steps to take to maximize the chance that your evaluation will be considered a privileged document not susceptible to discovery by third parties. Merely stamping something “attorney-client privileged” may not be enough.

One thought is that you could go through your annual evaluation process, and after making any necessary plans and concluding the process, delete all documents.

Just like there’s nothing weird or sneaky about deleting an earlier draft of an article, it may be entirely proper to delete evaluation notes if it is the board’s normal custom and practice.

However, the evaluation process itself can and should be documented. This includes things like topic agendas and any action items to be taken as a result.

Now onto other dynamics in a board self-evaluation, like groups versus individuals and who runs the evaluation process…

Group vs. Individual

All boards that do evaluations will do some sort of evaluation of how the board acts as a group. This makes sense because the board, in fact, functions as a whole body, not as a bunch of individuals.

These evaluations tend to focus on board process, including the robustness of the board book and whether everyone has a chance to be heard in board meetings.

There is an emerging trend for some boards to review individual board members. The folks in this camp feel strongly that there could be a lack of honest feedback, as well as a lack of individual accountability, if a board doesn’t evaluate its members individually.

In other circles, however, there is some controversy over the idea of doing individual reviews. This is an acknowledgement that, as we all know, individual reviews can be a way to drive political agendas that can end up factionalizing the board.

Who Runs Point on the Process

The board usually delegates the evaluation process to the governance committee. But who does the actual work?

For some companies, it’s the general counsel who develops the question set, gathers the information, and provides anonymized feedback to the board or individuals as the case may be.

In other companies, it might be the governance chair or the chair of the board that runs the actual evaluation process.

These are both good ways to run a process internally. Another way to handle the process is to hire an outside party like one of the myriad of companies and consultants that do this kind of activity for a living – or even outside counsel.

One of the reasons internal teams might do a better job of conducting board evaluations is that they typically know the business and the people running the business better than an outsider would. Insiders might even know the individual board members very well. This insider knowledge can lead to deeper and more probing questions.

On the other hand, being rooted in the business can also cause someone to be blind to issues or introduce bias. These concerns cut in favor of having an external party to conduct the evaluation.

One would certainly choose to use an external party if the real issue is that the board is already factionalized or is otherwise not working well. In such a case, it’s unlikely that an internal person has enough credibility with all parties to drive change.

What Questions Should the Board Ask?

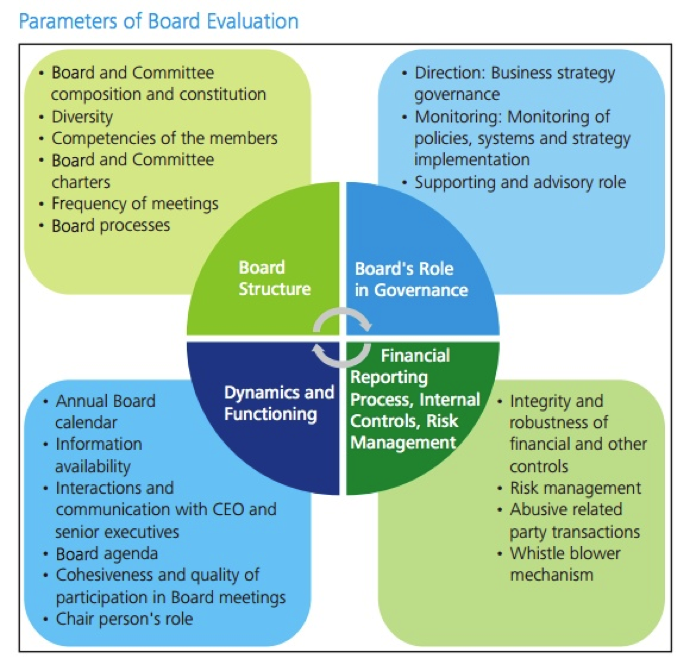

There’s no one-size-fits-all way to conduct board self-evaluations given that different boards will have different contexts and concerns. Moreover, what would be “good questions” for a particular board’s self-evaluation will change over time. Deloitte has done a nice job of diagraming some of the parameters a board might consider when it comes to what questions to ask during the self-evaluation process:

Image source: Deloitte Performance Evaluation of Boards and Directors report

Who Cares?

It turns out that shareholders might care about a board’s self-evaluation process. Indeed, some investors are calling for enhanced disclosure on the topic.

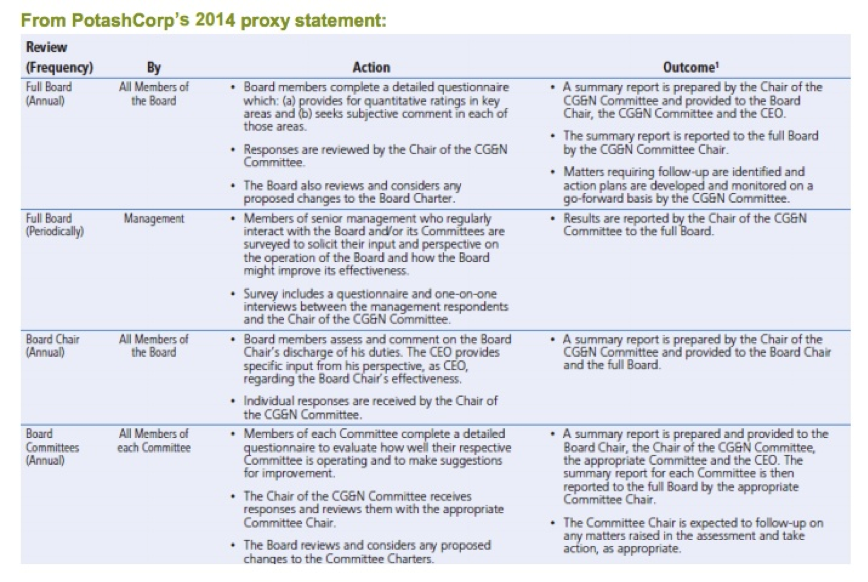

The 2014 Best Disclosure Board Evaluations report from the Council of Institutional Investors outlines two approaches to board evaluation disclosure:

- Explanation of the mechanics of the evaluation process

- Discussion of the most recent evaluation

The report helpfully provides examples of what the Council regards as good disclosure:

Image source: 2014 Best Disclosure Board Evaluations report

What Will Board Self-Evaluations Look Like in the Future?

One thing for boards to think about as they continue to refine their evaluation process is the interest of some shareholders in receiving more disclosure about the board evaluation process.

In some cases, this additional disclosure may well be warranted. It may also be the case, however, that the request for additional disclosure about boards’ evaluation process will be yet another request in the endless parade of requests for more disclosures – disclosures that have made the proxies so long that there is absolutely no way any mom-or-pop investor in America is actually reading them.

Still, of all the ideas to bubble out of the governance industrial complex, and recognizing that there’s little evidence as to the connection between board self-evaluations and shareholder returns, board self-evaluations definitely feel like one of the better governance ideas. Board members have a job to do, and when done well, annual reviews can help them do their jobs better.

The views expressed in this blog are solely those of the author. This blog should not be taken as insurance or legal advice for your particular situation. Questions? Comments? Concerns? Email: phuskins@woodruffsawyer.com.

Author

Table of Contents