Guide

Looking Ahead to 2025: Navigating a Shifting D&O Insurance Landscape

This week’s blog features insights from our 2025 D&O Looking Ahead Guide. Plus, watch the webinar recording as our experts discuss D&O trends and hot topics. –Priya

The D&O insurance market is no stranger to volatility. Recent years have been a testament to that, with premiums skyrocketing to unprecedented levels before sharply declining to more manageable rates.

For more than a decade, Woodruff Sawyer’s D&O Looking Ahead Guide has provided insights into the D&O insurance market so public companies can make more informed decisions on their D&O insurance programs.

In this article, I will share some highlights of the 2025 edition of the Guide, which you can access instantly here.

Shifting Premiums: A Market in Transition

Before delving into the latest trends, let us review the historical data that has shaped the current state of the D&O insurance market.

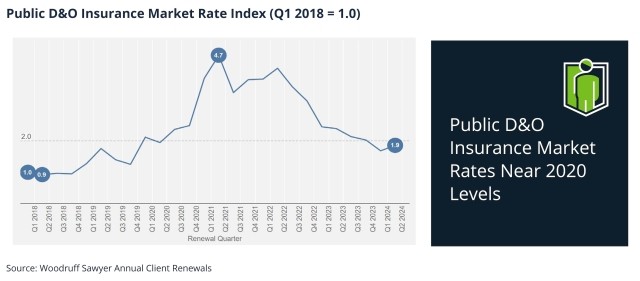

In Q1 2021, the D&O insurance market hit a notable peak, with premiums skyrocketing to 4.7 times their Q1 2018 levels. However, by 2022, the market underwent a dramatic shift as an influx of new capital drove prices down.

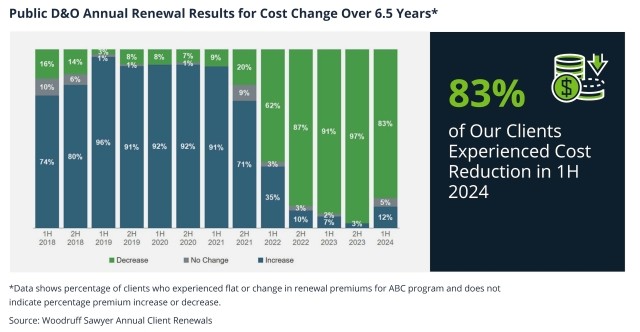

Fast-forward to the second quarter of 2024 when premiums had declined to 1.9 times the 2018 baseline, a level not seen since 2019. Because of this, 83% of Woodruff Sawyer’s public company clients are experiencing premium relief.

However, the number of renewals with flat or increased premiums is on the rise for the first time in 18 months. As we look toward 2025, the market seems to be in another state of transition. Although premium decreases are still prevalent, the pace of the reductions is slowing.

Premiums Fluctuate by Sector and Company Type

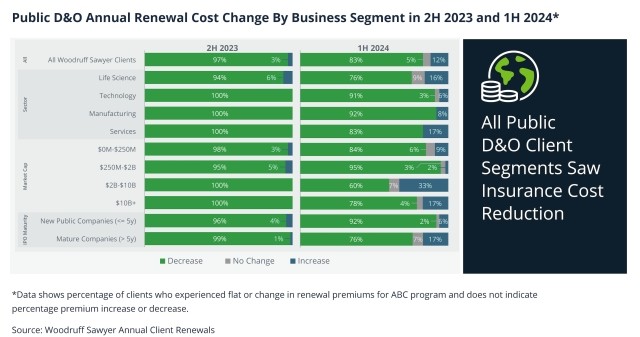

While the overall trend points to premium decreases, the reality is more nuanced. Different companies face different outcomes based on specific risk profiles.

Looking at the chart below, we can see that companies in the life science and services sectors, those with a market cap between $2 billion and $10 billion, and more mature public companies were among those that experienced premium increases in the first half of 2024—and at larger percentages.

Even so, with the current soft market, 2025 presents a compelling opportunity for many companies that may have deferred coverage due to cost concerns in the past to reassess their D&O program limits and structure.

The favorable market conditions provide a chance for companies to right-size coverage to better align with their risk tolerance.

Self-Insured Retention Rates in Flux

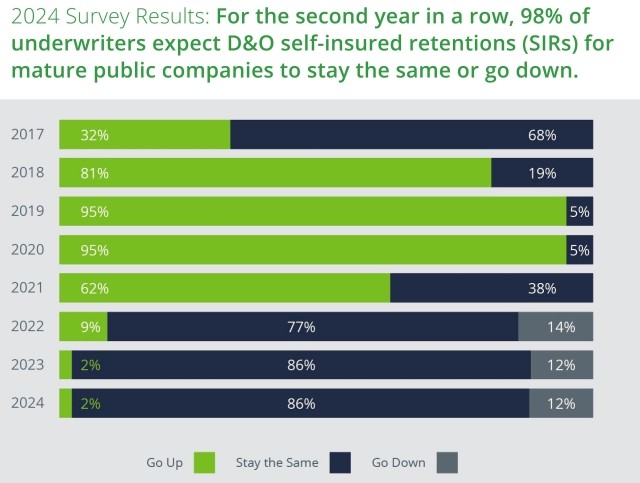

In the first half of 2024, 95% of Woodruff Sawyer’s public company clients renewed their D&O policies with flat or lower self-insured retentions. This trend is expected to continue into 2025 for mature companies.

According to Woodruff Sawyer’s Underwriters Weigh In™ survey, 98% of underwriters surveyed predict that retentions for mature companies will either remain stable or decrease.

On the other hand, underwriters agree that retentions for IPO companies have room to drop further (26% think they will go down in 2025 versus 12% for mature companies), but given the exposure under the ’33 Act, some are cautioning against further cuts in retentions for these companies.

Securities Class Action Lawsuit Trends

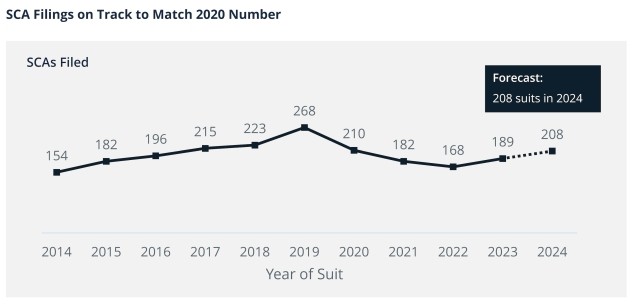

Tracking securities class action (SCA) lawsuits is critical for understanding the broader D&O landscape.

Over the past decade, SCA filings reached their highest levels between 2018 and 2020, with an average of 233 cases filed annually. This surge in litigation was followed by a hard market in 2021, which drove D&O insurance pricing to new heights.

After a reprieve from 2020 to 2022, SCA filings are once again on the rise. The first half of 2024 saw 104 filings, a 10% increase over the same period in 2023. If this trend continues, 2024 could see over 200 filings, the first time that threshold has been crossed since 2020.

For more on the state of securities class actions, read Woodruff Sawyer’s Databox 2024 Mid-Year Report.

Strategic Opportunities Ahead

Although the D&O market remains soft, the pace of premium declines for both newly public and mature companies has slowed, a trend likely to continue into 2025.

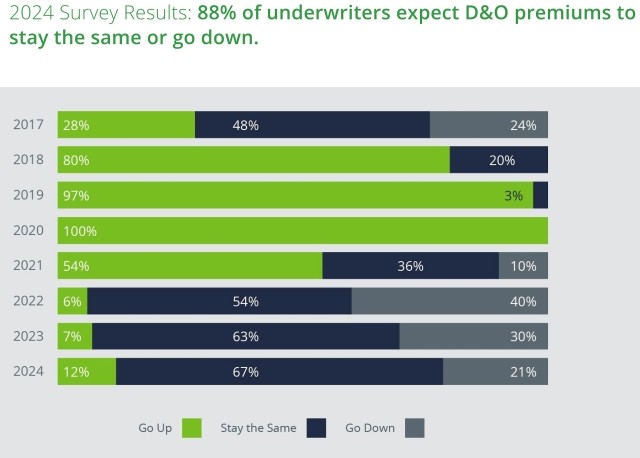

Woodruff Sawyer’s Underwriters Weigh In survey accurately predicted the break in the last hard market. Underwriters are now expressing increasing caution about further rate decreases. Over the past three years, the number of underwriters predicting falling premiums has steadily dropped from 40% in 2022 to just 21% today.

In 2025, we anticipate that public companies will still find opportunities for cost savings in their D&O programs, though most of these savings will more likely come from new market entrants rather than established carriers.

Veteran insurers are likely to maintain rates at what they consider sustainable levels to avoid the pitfalls of underpricing, which could force a return to hard market conditions or even lead them to exit the D&O market entirely.

In 2025, we also expect new insurers to take on more risk in a bid to build market share, while established players focus on defending their positions and closely monitoring claims trends.

Staying informed of market trends and working closely with experienced brokers will position public companies to make strategic decisions that take advantage of the challenges and opportunities of the coming year.

Unlock More Insights

Explore more in-depth data and insights on these topics and more in Woodruff Sawyer’s D&O Looking Ahead Guide, 2025 edition, available for instant access. Plus, watch the webinar recording as our experts discuss D&O trends and hot topics.

In the 2025 Guide, you will find:

- D&O market update

- Hot topics for directors and officers

- Underwriters Weigh In survey

- Expert insights as you plan for 2025 coverage

- Additional resources for further learning

Author

Table of Contents