Blog

Facing an IPO This Year? Here’s How to Protect Your Directors

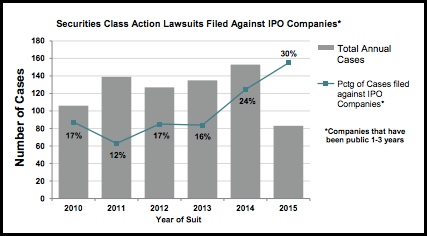

Securities class actions lawsuits against IPO companies are on the rise. In fact, in the first half of 2015 alone, 30 percent of the cases filed were against companies that had been public for three or fewer years.

Why the trend? In its infancy, a new public company’s corporate governance may not be prepared to stand up to the level scrutiny that follows an IPO.

Plus, liability is strict for errors and omissions in the IPO’s registration statement (take the Omnicare case as an example of this in action).

And to boot, the new proxy advisory voting guidelines from ISS scrutinize a company’s bylaws pre-IPO.

Because of this, the plaintiffs’ bar often sees newly minted public companies as an easy target. But that doesn’t mean your directors and officers have to suffer the consequences.

The unlimited personal liability that directors and officers face are safeguarded with certain coverage including D&O insurance.

As we head into the new year, here’s what you need to know about D&O coverage right now …

Beyond Class Actions

Beyond coverage in litigation, D&O insurance:

- Attracts and retains top talent prior to the IPO

- Protects Ds and Os in a merger or acquisition

- Covers the bases during a corporate bankruptcy

Misconceptions About IPOs and D&O

All too often, the D&O policy is relied upon as the risk management strategy, and while it’s meant to provide a safety net when it’s needed, corporate governance is a more proactive first step.

One of the biggest misconceptions is that things like a quick stock drop will result in a securities suit. Yes, it can attract the attention of the plaintiffs’ bar, but it’s only one of the many reasons directors and officers are sued.

The more important issue is whether senior management has developed a risk management strategy prior to the IPO that includes internal policies and procedures that would discourage the plaintiffs’ bar from bringing action.

Additional ways to protect against loss include:

- Strengthening indemnification agreements

- Reviewing insider trading policies and education

- Disclosure counseling

- Training on Foreign Corrupt Practices Act (FCPA)

Private vs. Public D and O Risk

Private company executives and boards face many of the same risks as they would in a public company. The main difference, however, is public companies face heightened exposure to shareholder litigation directly after the IPO.

Keep in mind that private company D&O insurance is often combined with other management liability coverage lines (like employment practices liability, fiduciary liability, etc.).

In the months leading up to the IPO, private companies typically separate the D&O insurance and purchase standalone coverage to ensure the limits available for the directors, officers and corporation will not be diluted for an unrelated claim.

Coverage and Timing of the Liquidity Event

It’s wise to start preparing D&O insurance programs for the liquidity event at least 12 to 18 months prior to the target IPO date. The reason? There are critical terms and conditions in the D&O coverage that need to be amended to respond to the exposures a company will face in the months prior to the IPO.

Getting the Right D&O Insurance Carrier

A lot goes into getting the policy structured well before the IPO. But what matters just as much is aligning with the right insurance carrier. The last thing you need is your D&O policy carrier to leave you at the altar when you need them most.

You’ll find there are several D&O insurers (roughly 25 to 30), but only a small fraction will seriously consider quoting a competitive option on an IPO (and unfortunately, the rise in class actions against IPOs isn’t helping).

So a strong relationship with a carrier that’s well established – and the investment of a few thousand dollars in premiums for a D&O policy now – will be beneficial if the marketplace turns and the capacity diminishes in the future.

Getting the Policy Right

While the insurance carriers will do their due diligence to review the registration statement (and some will even look at the amended filings and attachments), it’s crucial that a pre-IPO company tells its story during the initial meetings and well in advance of the pricing date.

Articulating and highlighting the company’s governance infrastructure and loss control strategies will result in better terms, conditions and pricing.

So, as we begin a new year with new IPOs on the horizon, we should put more emphasis on corporate governance on the front end to ensure less litigation and liability on the back end when you have your greatest exposure, which is typically the first three years after your IPO.

Author

Table of Contents