Blog

Governance Disclosure and the SEC’s Proposed Climate Rules

The SEC recently proposed a whole raft of new rules related to climate disclosure. My colleague Lenin Lopez explains the governance-related proposed rules in this week’s edition of the D&O Notebook. —Priya

On March 21, 2022, the Securities and Exchange Commission (“SEC”) proposed rule amendments (the “Proposed Rules”) that would require most US public companies and foreign private issuers to include certain climate-related information in their registration statements and periodic reports.

The Proposed Rules are open for public comment through May 20, 2022, and will undoubtedly attract a significant volume of comments. We can also expect legal challenges. If final rules are adopted this year, they would apply to most filers beginning with their annual reports for fiscal year 2023.

This is a short runway. As a result, companies that expect to be impacted by the Proposed Rules, should familiarize themselves with the Proposed Rules and begin to assess their ability to comply with the Proposed Rules.

The Proposed Rules amount to almost 500 pages. The SEC published an accompanying Fact Sheet regarding the Proposed Rules and several law firms have written about the Proposed Rules. See here for coverage by Cooley, Davis Polk, Latham & Watkins, and White & Case.

In this article I discuss the Proposed Rules’ governance related disclosures, a suggested approach to begin assessing your company’s current climate-related governance framework, and a few other insights specific to risk/liability and insurance.

Proposed Climate-Related Governance Disclosures

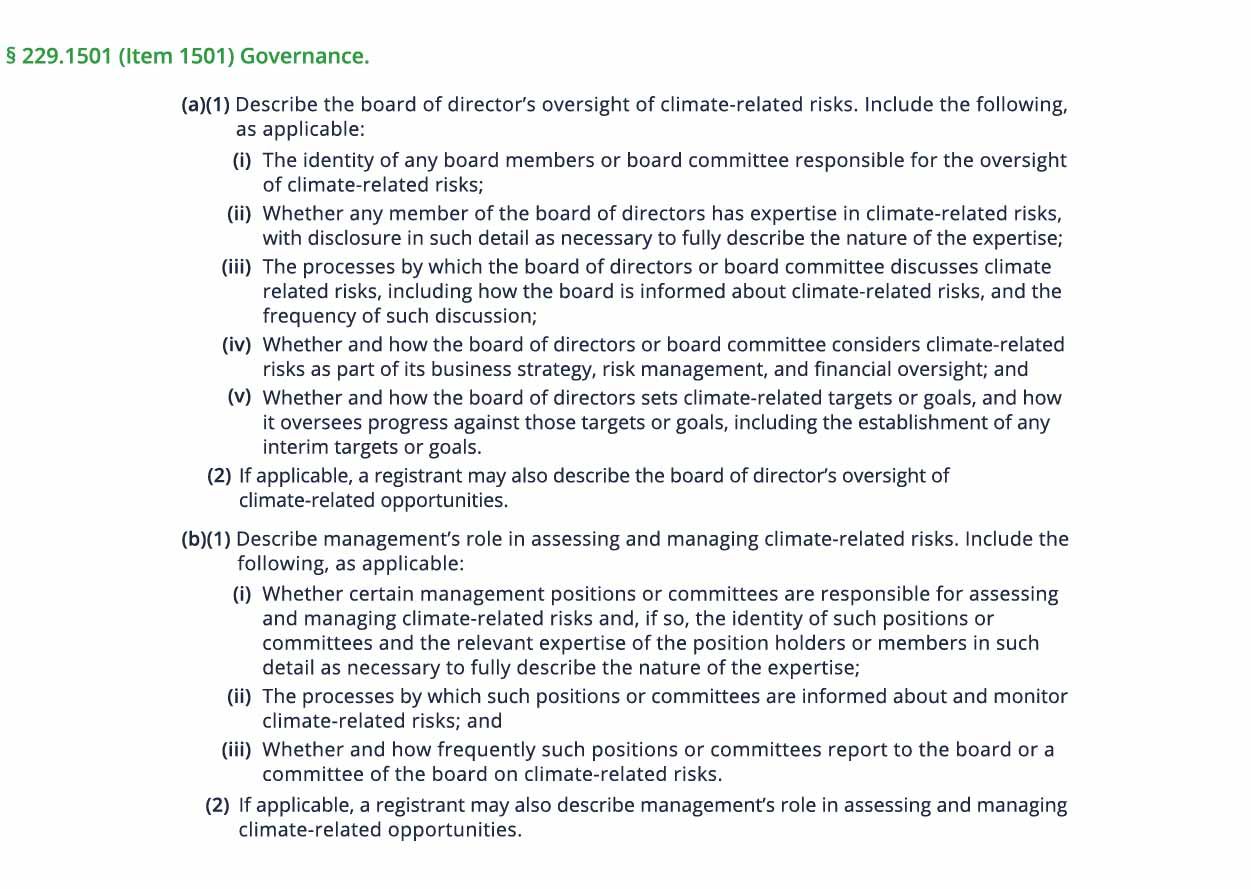

The Proposed Rules’ provisions concerning climate-related governance disclosures are generally divided into two categories—the first covering board oversight and another covering management oversight. The provisions read as follows:

Insights

I. Companies Should Assess Their Climate-Related Board and Management Governance Framework In Light of the Proposed Rules

Notably, the Proposed Rules do not require a particular climate-related board or management governance framework. Instead, the Proposed Rules would require that companies describe what they are using for their governance framework. Companies may be tempted to use the rules as a roadmap for their governance framework. This approach should be avoided.

Companies would be better served to first assess their current climate-related governance framework and see how it aligns with the Proposed Rules’ provisions concerning climate-related governance disclosures. The results of this assessment could then be leveraged to determine what may be best suited for the company’s needs in anticipation of having to comply with the Proposed Rules.

Here are questions board members can ask assessing their company’s current climate-related governance framework:

1. What climate-related governance framework or processes do we currently have in place?

- Take an inventory of what your company is currently doing around climate-related risk assessments, planning, and goal setting. This would include, among other things, which internal functions are responsible for aggregating data, whether the board or management is involved in setting or approving any climate-related objectives, and whether the company engages third party climate-related consultants.

2. What have we publicly disclosed in the way of climate-related risk assessment, planning, and goal setting?

- The SEC has stated that one of the goals of the Proposed Rules is to mitigate instances of “greenwashing.” As noted in the Proposed Rules, greenwashing refers to when a company engages in misleading efforts to manipulate information available on corporate websites and sustainability reports with the goal of attaining higher environmental, social, and governance ratings.

- Accordingly, you should scrutinize your company’s public statements, including graphs and charts, around climate-related risk assessments, planning, and goals, as well as the processes used to finalize any such statements. A heightened level of diligence is warranted, especially in cases where your company highlights its sustainability efforts. As the Proposed Rules would require companies to disclose their progress against climate-related targets or goals, some companies may want to reassess how aspirational they want to be when it comes to these targets or goals.

3. What have we publicly disclosed in the way of our climate-related risk governance framework or processes?

- If you have already disclosed your climate-related risk governance framework or processes, you should compare that against what may be required disclosure as noted in the Proposed Rules.

- You should also keep in mind that the Proposed Rules will require disclosure in certain documents that you file with the SEC, like your annual report on Form 10-K. This will be a change for many companies that currently instead discuss their climate-related risk governance framework and processes on their websites or voluntary published documents, like a sustainability report. If your climate-related governance disclosure currently sits outside of the Form 10-K, you should begin to consider how you might want to weave into your Form 10-K and what that may mean in terms of changes to your annual report and proxy season planning.

4. Do we have any members of the management or the board that could be considered to have climate-related expertise under the Proposed Rules?

- The Proposed Rules require that companies disclose whether any member of management or the board have expertise in climate-related risks. The Proposed Rules do not define what constitutes “expertise in climate-related risks,” but require disclosure in such detail as necessary to fully describe the nature of the expertise. Some experiences to consider in reaching a determination on whether a member of management or the board has expertise in climate-related risks:

- Prior work experience in climate change risk management strategies at the senior management and/or board level;

- Having obtained a relevant certification; and

- Whether the individual has experience in assessing and/or managing through climate-related threats and opportunities, including the development and implementation of a climate-related transition plans across an organization’s supply chain.

- Specific to directors who are determined to have expertise in climate-related risks, the Proposed Rules do not include a safe harbor as to that designation. Such a safe harbor is included in the rules covering audit committee experts (see Item 407(d)(5)(iv) of Regulation S-K) and also in the SEC’s proposed rules for enhanced cybersecurity disclosures (link). This is important because without such a safe harbor in the Proposed Rules, directors deemed by your company to have expertise in climate-related risks may be subject to a heighted duty, obligation, and liability for climate-related oversight and disclosures in a company’s registration statements.

II. The Proposed Rules Set the Stage for Increased Exposure to Litigation and Enforcement Action

The Proposed Rules call out the potential for additional litigation risk since the proposed climate-related disclosures may be new and unfamiliar to many companies. Companies that are not familiar with preparing these types of disclosures may face significant uncertainty and compliance challenges. This may lead to inadvertent non-compliance, increased exposure to litigation and the possibility of enforcement actions brought by the SEC.

The SEC notes that such concerns may be mitigated by certain safe harbors included in the Proposed Rules. One such safe harbor provides protection from liability for certain statements a company makes, including projections regarding future impacts of climate-related risks on a company’s consolidated financial statements and climate-related targets and goals. Companies will still need to ensure that any applicable conditions specified in those safe harbor provisions are met. Having said that, companies will want to ensure that the level of care taken when preparing climate-related disclosures matches the level of care taken when preparing other disclosures in their registration statements and periodic reports.

III. What questions will D&O insurance underwriters be asking?

D&O insurance underwriters are eager to understand what steps companies are planning to take or have taken in response to the Proposed Rules. In addition, underwriter due diligence calls may now involve lengthier discussions regarding a company’s climate-related risks, governance frameworks and processes.

Lastly, and perhaps most important for insurance underwriters, as the Proposed Rules would significantly expand the type and amount of information companies are required to disclose about climate-related matters, insurance underwriters may be entering into a brave new world where they have significantly more data points to use when modeling risk from everything from property risk to management liability. Time will tell, but more differentiated premiums and even new insurance solutions are not beyond the realm of possibility.

Author

Table of Contents