Blog

Gearing Up for the Next Wave of SEC Whistleblowers

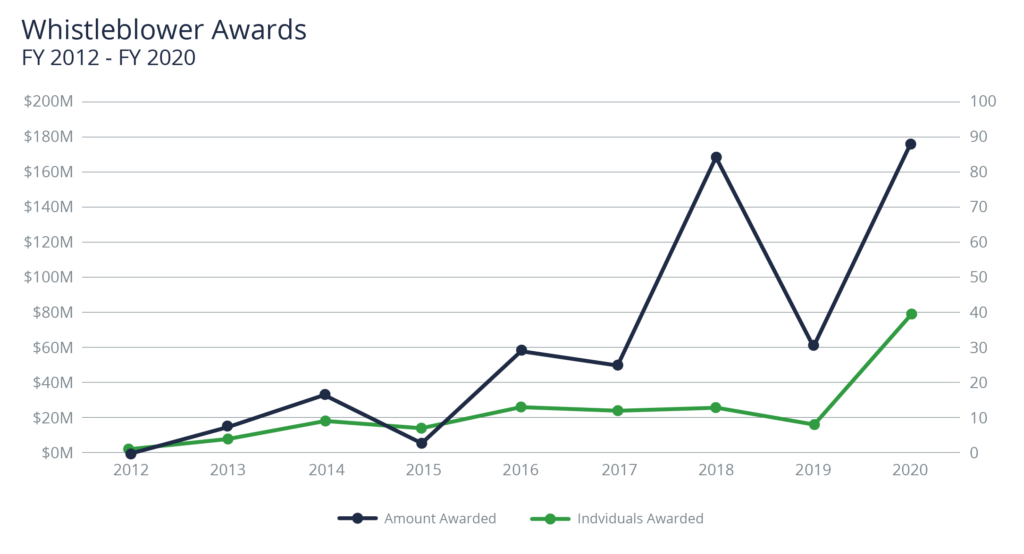

The Securities and Exchange Commission's whistleblower program doled out a record-breaking $175 million to 39 individuals in fiscal year 2020. Both the amount awarded and the amount of people it was awarded to was greater than any other year in the program's history.

[caption id="attachment_27339" align="aligncenter" width="1024"] Source: SEC Division of Enforcement 2020 Annual report, page 20[/caption]

Source: SEC Division of Enforcement 2020 Annual report, page 20[/caption]

"Over the past ten years, the whistleblower program has been a critical component of the Commission's efforts to detect wrongdoing and protect investors and the marketplace, particularly where fraud is well-hidden or difficult to detect."

-SEC Chair Jay Clayton in a September 2020 Statement on Strengthening the Whistleblower Program

The SEC is betting on the long-term success of this program. In September 2020, the SEC voted to adopt amendments to the rules that govern its whistleblower program to "provide greater clarity to whistleblowers and increase the program's efficiency and transparency."

Key 2020 Amendments to the SEC's Whistleblower Program

More Money, Faster

A big priority for the SEC's Office of the Whistleblower Chief is to get more money to whistleblowers, faster, as outlined by Chair Clayton in his September 2020 address.

The new provision (found here in the final rule) states that "when (1) the statutory maximum authorized Award Amount is $5 million or less and (2) the negative Award Factors are not present, the Award Amount will be set at the statutory maximum, subject to the Commission's discretion to apply certain exclusions."

Keep in mind that, according to the SEC, most of all awards fall into the $5 million or less category. Chair Clayton says that this move provides "greater transparency and certainty" and also reduces "the time the Commission would otherwise spend determining the precise award amounts."

He continued by saying that "based on our experience, we can add more certainty around time and amount in the substantial majority of cases, enhancing the effectiveness of the program for the Commission and increasing incentives for whistleblowers, all with no meaningful countervailing cost."

Uniform Definition of Whistleblower

Another key change highlighted in the final rule was the uniform definition of whistleblower status that affords award eligibility, confidentiality, and retaliation protection. This amendment clarifies "both who is eligible for protection as a whistleblower and also what conduct is protected from employment retaliation."

This was in response to the Supreme Court's decision in Digital Realty Trust Inc. v. Somers that held that the whistleblower protection against employment retaliation under Section 21F(h) of the Dodd-Frank Wall Street Reform and Consumer Protection Act was only valid if the whistleblower had already reported to the SEC at the time the employee suffered the retaliation.

This decision undercut all the SEC's earlier efforts to design rules about employer retaliation that would still encourage employees to report internally first. The benefit of employees being able to confidently report internally first is so to give a chance to resolve situations that are merely misunderstandings and also to more quickly address potential bad behavior even before the SEC gets involved.

Unfortunately, after that Supreme Court ruling in Digital Realty, it would make no sense for an employee worried about retaliation to do anything other than bypass internal company compliance programs altogether and go straight to the SEC.

The SEC's final rule clarifies that whistleblower status, confidentiality and retaliation protection will be afforded to "(i) an individual; (ii) who provides the Commission with information "in writing"; and only if (iii) "the information relates to a possible violation of the federal securities laws (including any law, rule, or regulation subject to the jurisdiction of the Commission) that has occurred, is ongoing, or is about to occur."

Additional Changes and More Details

The SEC's final rules include a plethora of additional details. These details include treatment of things like tools used by the department of justice and state attorneys general such as deferred prosecution agreements ("DPAs") and non-prosecution agreements ("NPAs"). The SEC has clarified that these resolutions are resolutions that still allow a whistleblower to qualify for a monetary award.

The new rules also provide further clarification around filing requirements for tips, complaints, and referrals in order to, as Chair Clayton put it, "reduce the chance of an individual being disqualified from receiving an award simply because of a lack of knowledge of our filing requirements."

These additional details and more which are summarized by some excellent law firm summaries, including offerings by Sidley, Debevoise, and DLA.

Take Whistleblower Complaints Seriously

As the Office of the Whistleblower continues to strengthen its program to incentivize whistleblowers, and as whistleblower claims generally may rise as a result of the COVID-19 pandemic, organizations will want to review their compliance programs.

Historically, the SEC's sentiment is that the whistleblower program is meant to complement but not replace internal controls. However, one sure-fire way to get the SEC involved is to not take complaints seriously.

The good news is that many complaints can first be addressed internally before the situation reaches the SEC. In order to do that, though, you need a strong compliance program where tippers can feel they are being heard and will not face retaliation.

Now is the time to review with outside counsel your whistleblower policies as well as your protocols to ensure there is no inadvertent retaliation against a whistleblowing employee. The later is of particular importance given the guidance on this topic provided by the SEC. Specifically, the SEC notes in the final rules that it the prohibition on retaliation applies to "any retaliatory activity by an employer against a whistleblower that a reasonable employee would find materially adverse, which means it might well have dissuaded a reasonable worker for engaging in [the whistleblowing activity]." (internal quotations, omitted).

Next, make sure you communicate those with your employees, including employees of companies with whom you have contracted. As a reminder, in March 2014, a US Supreme Court decision in Lawson v. FMR LLC expanded anti-retaliation protection under Sarbanes-Oxley to cover employees of companies that contract with public companies.

Finally, remember that whistleblower compliance goes beyond the SEC. Many state and federal agencies have their own whistleblower rules on a variety of topics. A robust whistleblower program that addresses each complaint with an appropriate level of seriousness will instill confidence in employees and enhance the chance that you are alerted sooner than later if something is starting to go wrong.

Author

Table of Contents