Blog

Yet Another Set of Executive Compensation Disclosure Rules: the SEC’s Proposed Pay-for-Performance Rules

When it comes to new regulations, including many that seem to be totally unrelated to rectifying the system failures that caused the 2008 financial crisis, Dodd-Frank is the gift that keeps on giving.

Next up: the SEC’s proposed rules to enact Dodd-Frank’s requirement that companies disclose the relationship between executive compensation actually paid and the total shareholder return of a company.

The comments-gathering stage for the proposed rule ended in early July, and some predict these rules will be adopted as early as the 2016 proxy season.

One question many have asked is: do we really need more disclosure on executive compensation? After all, for most public companies:

- The compensation disclosure in annual proxy statements is already several pages long;

- These pages are readily available for scrutiny by both professional and retail investors;

- Proxy advisory services issue extensive reports detailing their view of each company’s named executive officer compensation, often using benchmarking against a set of peers that they have chosen independently (and that may not be congruent with the set the company has chosen);

- Shareholders tell their companies each year whether or not they approve of the named executive officers’ previous year’s compensation through the annual “say-on-pay” advisory vote; and

- Most compensation committees are already going to great lengths to disclose pay for performance.

The answer seems to be that it doesn’t matter whether more disclosure would be helpful or will complicate the proxy and confuse retail investors; the new rules are coming anyway.

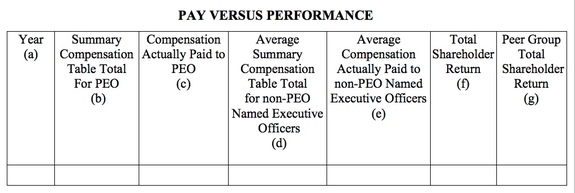

If the proposed rule is enacted, companies will need to disclose information—in most cases for the last five years—in the format of the following table and with tagged data fusing eXtensible Business Reporting Language (XBRL).

The table will include all named executive officers (NEOs) in the proxy statement, with the CEO’s (aka “PEO” or Principal Executive Officer) compensation occupying its own line, and the rest of the NEOs’ pay reported as an average.

As a reminder, XBRL is a computer markup language that allows agencies like the SEC and others to analyze data more easily (we covered briefly the role that XBRL plays in the SEC’s investigations and the filings of financial statements here.)

Actually Paid and Total Shareholder Return

There are two lynchpins of the proposed rules: the concepts of “actually paid compensation” and “total shareholder return.” Let’s examine each of these in turn.

“Actually paid compensation” as proposed by the SEC is the total compensation reported in the Summary Compensation Table, modified to adjust for certain pension costs and equity awards.

In the proposed rules, the SEC says of this model that it believes “using as a starting point the total compensation that registrants already are required to report in the Summary Compensation Table and making adjustments to those figures reduces burdens to registrants and also may enhance comparability of the proposed disclosure across registrants.”

Sounds straightforward, but of course, it’s not. For example, for the purposes of this table, equity is to be valued on the date it vests, not on the date it is granted.

The reasoning behind this is the idea that once, for example, an option has vested, it is up to the executive to exercise it or not. In other words, the choice to liquidate the equity award or not is an individual executive’s investment decision.

The statement that executives have the ability to choose to liquidate their equity awards is a true one. It also ignores the reality that the executive often cannot liquidate an equity award for myriad reasons, including insider trading concerns. As a result, this component of actual paid compensation—while assuredly very valuable—is not really “actually paid” in the sense that the value is fixed and the proceeds are liquid.

Should the company’s stock price decline, the value of the equity award will decline. Also, most companies and their shareholders want executives to hold their equity awards and in doing so, align themselves with their shareholders. This is the opposite of encouraging an executive to liquidate an equity award as soon as it vests.

Another issue with the “actually paid” calculation is the mismatch between pay periods and when performance is rewarded. For example, consider the case where, as is common, a company has implemented long-term incentive award programs with multi-year vesting periods.

These plans have been implemented to better align executives with the interests of long-term shareholders. They are the opposite of “gaming the system”; however, the proposed disclosure will be problematic.

The issue was well described in Pearl Meyer & Partners’ comment letter to the SEC:

The Proposal would require reporting of this grant in the year of vest, and compare it to the cumulative TSR results as of that year, which may or may not correlate to the award’s performance period. As a result, payout and TSR performance measurement will not match … The specific timing of grant and vesting will have an impact on the proposed disclosure, but such disclosure nuances should not be driving Committee decisions in structuring strategic compensation packages.

That executives should care about and have their pay aligned with total shareholder return is not controversial. What is challenging, however, are decisions around what timeframe is appropriate to measure total shareholder return, as well as what weight it should be given.

For example, many companies consciously plow money into R&D understanding that they may be making a trade between a short-term stock price boost and long-term value.

Moreover, share price—particularly on any given measurement date—is often influenced by many factors other than the performance of named executive officers. Unfortunately, the required disclosure of the proposed rules is likely to overshadow efforts to undertake this kind of nuanced discussion.

Publications like DLA Piper's memo, Cooley's memo, and Pearl Meyer's memo on this topic go into more depth about the various components of the proposed rule. In addition, the webinar presented by Equilar, which you can access on demand as it has already streamed, is an informative conversation about the ins and outs of the pay versus performance rule.

The SEC has not announced their timing for the issuance of final rules. While we wait for the final rules, it’s a good idea for general counsels,boards of directors and compensation committees to at least start thinking about the work they will have to do in order to be compliant with the new rules when they are ultimately issued.

The views expressed in this blog are solely those of the author. This blog should not be taken as insurance or legal advice for your particular situation. Questions? Comments? Concerns? Email: phuskins@woodruffsawyer.com.

Author

Table of Contents