Guide

Guide to Private Company D&O Insurance, 2025

Most private companies operate for years without ever facing a directors & officers (D&O) insurance claim. That’s why the risks can be easy to overlook.

But D&O litigation isn’t just about major scandals or headline-making fraud. You don’t need to be a unicorn or even on the verge of an IPO to be exposed.

Reliable data that can be used to calculate general rates of litigation against private companies is almost impossible to obtain. However, helpfully, insurance carriers sometimes publish reports on their private company D&O claims.

For example, consider the report published by the insurance carrier AIG in which it examined private company D&O claims of more than $1 million from 2016 to 2020. The interesting results included the fact that regulatory suits and shareholder/fiduciary duty suits each accounted for 20% of claims.

The report also noted that, of the suits examined, the median amount paid by the carrier for the shareholders/fiduciary duty suit claims was $3.1 million. The average was $4.3 million. Given the ever-increasing cost of legal defense as well as social inflation more generally, we’d expect those numbers to be even higher today.

When these sorts of tough claims arise, D&O insurance can step in to protect the company’s balance sheet as well as the personal assets of its directors and officers. For private companies that want to understand their exposure and how to protect against it, Woodruff Sawyer’s annual Guide to Private Company D&O Insurance offers a practical resource.

You can gain access to the report right away or read on for more about private company risk.

Yes, Private Companies Are a Target

It’s true that D&O litigation isn’t an everyday occurrence for most private companies. Having said that, when it does happen, it’s often disruptive and costly.

Take the SEC’s recent enforcement actions against private companies for failing to file Form D on time, a violation of Rule 503 of Regulation D.

These weren’t criminal investigations or scandals. They were technical violations, resulting in fines as high as $195,000. Legal defense costs likely exceeded that amount.

Then there’s the SEC’s lawsuit against the private company Unicoin. Yes, it’s a crypto company. But the story is familiar: regulators allege misleading claims, and suddenly, defense costs start piling up.

This is where a well-structured D&O policy can make a meaningful difference. While fines and penalties aren’t covered, legal defense is—and many policies will advance costs as soon as a claim is made.

And while advancing legal fees is one important feature of a D&O policy, it’s not the only one.

D&O coverage also plays a role in attracting qualified board members, meeting investor expectations, and protecting directors in high-stakes situations like M&A, shareholder disputes, or bankruptcy.

The 2025 Guide

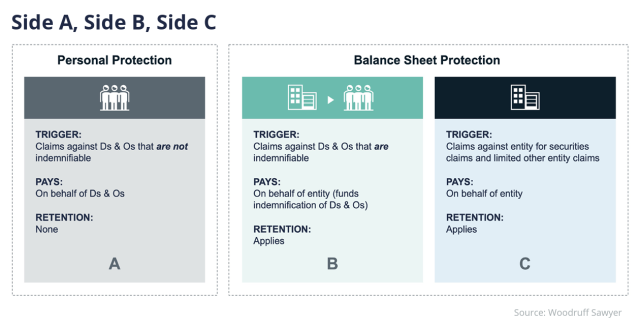

The 2025 Guide to Private Company D&O Insurance walks through the essential building blocks of D&O coverage: how Side A, B, and C coverage functions, what exclusions to watch for, and how to think about limits.

It also responds to the kinds of questions boards are asking, such as:

- How do we benchmark the right amount of coverage? The guide offers insights to help private companies evaluate how much risk they’re carrying.

- What should we negotiate in terms of exclusions? From final-adjudication fraud clauses to carve-backs in insured-versus-insured exclusions, the 2025 guide explains which terms should be negotiated.

- When does standalone Side A coverage matter? For companies navigating M&A, bankruptcy, or potential shareholder disputes, Side A-only policies can offer critical personal asset protection for directors and officers.

- What happens if we’re acquired or go public? Get practical advice on D&O “tail” coverage for M&A, as well as strategies for layering policies ahead of an IPO or direct listing.

Our 2025 Guide is for directors, officers, and risk managers who need to understand their exposure and want clear guidance on how to manage it.

Access your copy instantly here.

Author

Table of Contents