Blog

Playing It Safe: Private Company Stock and Employee Liquidity

Many private companies are choosing to stay private for longer before proceeding with an IPO or direct listing. Waiting gives companies more time to build value and get their ducks in a row. Thanks to the JOBS Act, private companies are no longer being forced to go public after hitting the 500-shareholder threshold, which gives them more time to prepare.

One challenge for a private company, however, is that their employees holding stock might want liquidity before the company is ready for its IPO or direct listing. The pressure for liquidity has only increased now that we’re in uncertain times, but COVID-19 is expected to delay IPOs in 2020.

As some employees look to convert stock into cash, now is the time for private companies to review and perhaps adopt some new policies and procedures.

Track Your Capitalization Carefully

Make sure all activities related to shares are fully compliant with both the law and company policy. A surprising number of companies wait too long before moving their capitalization records from a mere spreadsheet to proper equity management software.

This can be a problem when it comes time to sell the company or go public; in either case, recordkeeping that shows who owns each and every share of stock must be precise.

A tech platform is going to provide much more control, flexibility, and insight as you organize, execute, and track capitalization. Not only will it help manage complex processes, but it also will do so in a centralized platform that all teams can access for equity-related activities.

Having this information at hand can help you make sound decisions, whether it’s granting options to a key employee, considering new financing, staying compliant, or allowing employees to sell shares.

There are many equity management platforms to choose from. Carta is among the best known, and of course, your team will have to explore which platform is best for your company.

Decide If You Will Let Employees Sell Stock in a Private Secondary Market

Once you get systems in place, you are now in a position to consider whether you will let employees sell their shares ahead of an exit.

As a leading employee benefits broker, Woodruff Sawyer has seen more of our clients allow employees to sell their shares pre-IPO in order to attract and retain talent when competing with public companies that have liquid equity.

A late-stage private company might give employees and others a chance to sell their stock before an IPO to fund life events. Employees may want to sell for a variety of reasons ranging from diversification to simply being under cash-flow pressure. Being able to convert stock to cash as needed is a tangible benefit to employees.

Presumably, the employee selling stock before an IPO would do so at a lower price than if he or she were to wait until later—but of course that isn’t always the case.

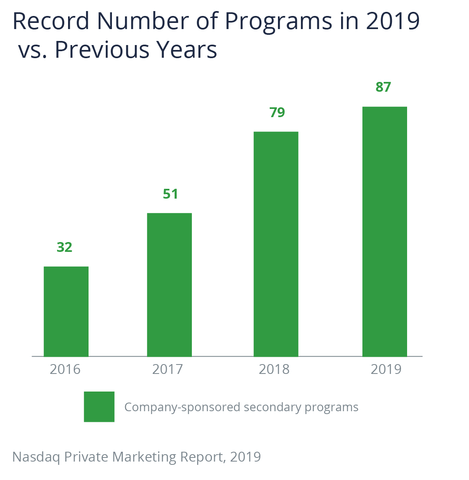

Employees can sell their shares using a private secondary market. Nasdaq Private Market is the biggest one. In fact, it has seen a steady rise over the past several years for company-sponsored secondary programs.

Another private secondary market is Forge, founded in 2014 and backed by Peter Thiel. They each have different business models, so a company will have to do some diligence to select the right one for the company’s needs.

One benefit of letting employees sell on a company-authorized platform like a private secondary market is helping employees find a legitimate path to liquidity.

This makes it less likely that an employee may fall prey to predatory lenders, some of which are now soliciting employees of high-value, late-stage private companies to pledge their shares in return for a loan.

There are concerns that employees may not be reading the small print and thus may not understand what they are getting themselves into. For example, in the fine print—which is often unread––the employee may be making a representation that the employee has a certain amount in investable assets (other than the company stock the employee is pledging) that, if asked directly, the employee would not say is accurate. This employee will now be in default since the representation is not true.

One last note on letting employees sell shares ahead of an exit: in addition to benefiting employees, the company may benefit as well. Sales of common stock in a private secondary market can help develop important pricing information, something Nasdaq notes is especially important for direct listings.

Implement an Insider Trading Policy

Companies usually adopt insider trading programs when they are preparing to go public, be it through an IPO or direct listing process. However, there may be good reasons for a private company to put one into place now.

Insider trading policies help companies carry out their obligations to supervise insider trading. Perhaps more importantly, good insider trading policies are designed to give employees clear guidance on how they can stay out of trouble when it comes to trading their shares.

An insider trading policy can go so far as to prohibit employees from using their stock as collateral for loans, or otherwise pledging or hedging their stock.

This prohibition is customary in the insider trading policies of publicly traded companies and is designed to avoid the situation where an employee might need to sell or transfer shares to cover a loan when in possession of material nonpublic information.

Given the concerns about predatory lenders targeting vulnerable and perhaps naïve employees of late-stage private companies, this is a good policy to put in place sooner than later.

For late-stage private companies that support employees selling their shares on a private secondary market, an insider trading policy helps to make sure that no one is trading inappropriately, which is to say in violation of Rule 10b-5 of the Securities Exchange Act of 1934.

Specifically, an insider trading policy can define the parameters of what is appropriate, including reminding everyone that material misrepresentations are illegal in the context of private company trades as they are for public companies.

The enforcement action the Securities and Exchange Commission brought against Stiefel Laboratories and its CEO is an instructive reminder that insider trading laws apply to private companies as well as public companies.

In its complaint, the SEC charged the CEO with violating Rule 10b-5 of the Securities Exchange Act of 1934. As the law firm WilmerHale notes:

Stiefel Labs sounds a warning to participants in transactions involving private company securities to comply with those anti-fraud provisions, specifically by not engaging in securities transactions while aware of material information regarding the private company that is unknown to the transaction's counterparty.

If you are planning to go public, it is a useful exercise to get employees familiar with insider trading concepts sooner than later.

D&O Insurance

In the current environment, highly valued, late-stage private companies (aka “unicorns”) have seen the cost of their insurance go up. In some cases they are no longer able to purchase “private company”-style D&O insurance and are forced to purchase more narrow “public company-style” insurance.

One way to help an insurance carrier provide better terms, conditions, and pricing is to demonstrate you have good corporate governance.

Having great equity tracking software as well as a robust insider trading policy can be helpful in this regard. More importantly, these steps can help a company and its employees avoid embarrassing or even criminal foot faults.

Authors

Table of Contents