Blog

SEC Issues Interpretive Guidance on Non-GAAP Financials: Time to Listen Up

Non-GAAP financials routinely come up as an area of concern for the Securities and Exchange Commission. To be sure, the SEC and public companies both want investors to understand company earnings, and disclosures under U.S. generally accepted accounting principles (GAAP) are meant to provide that information.

GAAP financial measures aren’t always the exclusive or even the best way to show investors what’s important about a company’s business. As a result, companies—usually with very honest intentions—attempt to show their financials using non-GAAP financial measures to help investors understand what’s going on with the business.

Be aware, however: the SEC is signaling very loudly that it plans to crack down on non-GAAP financial measures. On May 17, 2016, the SEC updated its interpretive guidance of non-GAAP financial measures. Companies on an annual calendar are working on their disclosures now for the year-end audit, so this is a great time to better understand this issue.

The Background

Most business people are familiar with using a variety of routinely used non-GAAP financial measures. EBITDA (earnings before interest, taxes, depreciation and amortization) and FFO (funds from operations) are common examples.

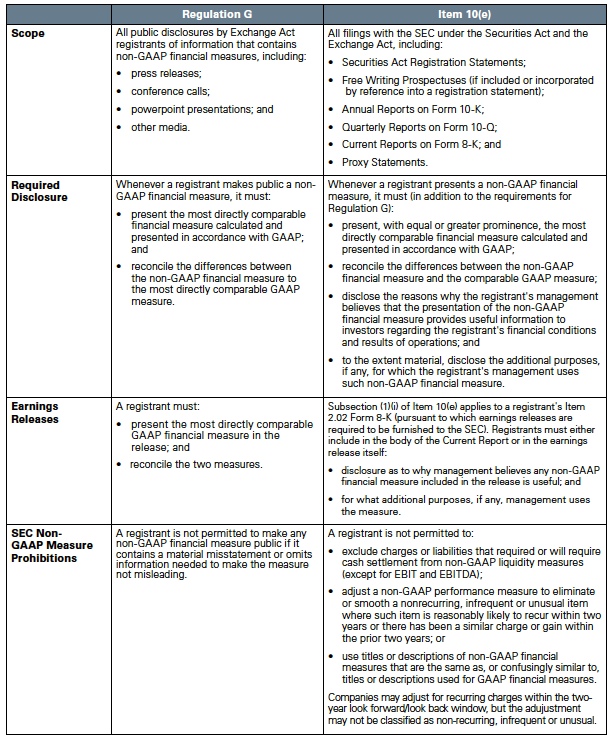

Recognizing this business reality, the SEC allows companies to supplement reported earnings with non-GAAP measures. While the SEC may prefer GAAP-compliant financial measures, it allows for non-GAAP disclosures as long as they are in compliance with Regulation G and Item 10(e) of Regulation S-K.

The conditions for use of non-GAAP financial measures, which include compliance with Reg G and Item 10(e), were originally adopted in 2003 as a consequence of the SEC’s concern about “the improper use of non-GAAP financial measures during the past 30 years.”

It’s fair to say that the regulations were, in fact, a reaction by the SEC to the 2001 financial crisis that the agency concluded was the result of wildly misleading financials.

Reg G and Item 10(e) were created to prevent misleading non-GAAP financial measures. This overview by Skadden includes a table that summarizes disclosures under Reg G and Item 10(e):

Notwithstanding Reg G and Item 10(e), the SEC remains concerned about companies using non-GAAP financial measures in a way that might be misleading. The potential exists for non-GAAP disclosure to confuse an investor’s understanding of a business rather than enhance it.

Mindful of this possibility, in May 2016, the SEC updated its interpretive guidance of non-GAAP financial measures.

SEC Guidance

While this isn’t a rule change, issuers are well advised to pay attention. When the SEC offers interpretive guidance like this, it is to help issuers, but it’s also a signal that the SEC will be reviewing issuer disclosure in this area with some focus in the near term.

The guidance clarified that non-GAAP measures can be misleading and violate Reg G if:

- Certain adjustments are made that cause the non-GAAP measures to be misleading, for example, “presenting a performance measure that excludes normal, recurring, cash operating expenses necessary to operate a registrant’s business.”

- A non-GAAP measure is presented inconsistently between periods, for example, “a non-GAAP measure that adjusts a particular charge or gain in the current period and for which other, similar charges or gains were not also adjusted in prior periods.”

- The measure excludes charges, but does not exclude any gains, for example, “a non-GAAP measure that is adjusted only for non-recurring charges when there were non-recurring gains that occurred during the same period.”

The guidance also gave examples of when disclosures would inappropriately cause a non-GAAP measure to be more prominent (the updated guidance at the end of the list), such as:

- Presenting a full income statement of non-GAAP measures or presenting a full non-GAAP income statement when reconciling non-GAAP measures to the most directly comparable GAAP measures;

- Omitting comparable GAAP measures from an earnings release headline or caption that includes non-GAAP measures;

- Presenting a non-GAAP measure using a style of presentation (e.g., bold, larger font) that emphasizes the non-GAAP measure over the comparable GAAP measure;

- A non-GAAP measure that precedes the most directly comparable GAAP measure (including in an earnings release headline or caption);

- Describing a non-GAAP measure as, for example, “record performance” or “exceptional” without at least an equally prominent descriptive characterization of the comparable GAAP measure;

- Providing tabular disclosure of non-GAAP financial measures without preceding it with an equally prominent tabular disclosure of the comparable GAAP measures or including the comparable GAAP measures in the same table;

- Excluding a quantitative reconciliation with respect to a forward-looking non-GAAP measure in reliance on the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) without disclosing that fact and identifying the information that is unavailable and its probable significance in a location of equal or greater prominence; and

- Providing discussion and analysis of a non-GAAP measure without a similar discussion and analysis of the comparable GAAP measure in a location with equal or greater prominence. [May 17, 2016]

In addition to these key items, the SEC also provided useful question-and-answer insights in its interpretive guidance.

Tips and Insights

How does one enhance the efficacy of non-GAAP measures? This article by PwC gives some helpful tips, including:

- Benchmarking: Know what metrics are commonly used in your industry to find out what’s useful for investors.

- Transparency: Consider how you label a non-GAAP financial measure to clearly convey the nature of it.

- Consistency: Ensure calculation and presentation is consistent from period to period.

- Expansive disclosure: Enhance the discussion of non-GAAP measures and explain why they are useful.

Finally, remember that issuers must comply with the rules for the disclosure of non-GAAP financial measures, not just in SEC filings but also in press releases, investor presentations and conference calls.

Look to your outside counsel for guidance on how to comply with the SEC’s reconciliation and disclosure requirements in these situations. Even so, the SEC may find your non-GAAP metrics insufficient and challenge it as it did when it recently reviewed General Electric Co.’s disclosure. In other words, it may take some time to get it right.

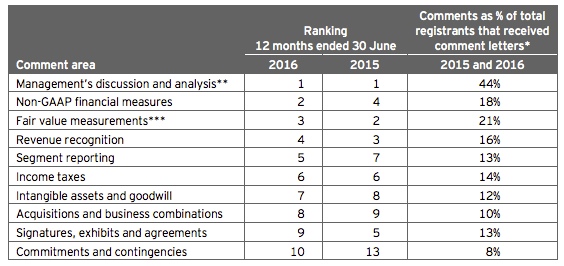

According to a PwC report, SEC comment letters to companies surrounding disclosures has decreased 29 percent in 2016 versus 2015 (for the tech sector), though PwC expects an increase in 2017.

The research also found that “the majority of SEC staff comments in this area are not aimed at meeting specific technical requirements, but rather at enhancing the quality of disclosures to meet these objectives.”

An EY report: “2016 Trends in SEC Comment Letters,” shows that non-GAAP financial measures was ranked No. 2 in the list of the most common SEC areas of comment. Comments in this area are expected to increase.

The Takeaway

Given the SEC’s recent release of its interpretive guidance, now is a good time to review recommendations, revisit procedures and perhaps refine non-GAAP disclosures for the future.

Communications like this are typically a precursor to the agency having a more proactive focus on the matter. It’s best to be prepared.

Author

Table of Contents