Blog

SEC Investigation Primer for Directors and Officers

| In this first part of his two-part series, my colleague Walker Newell demystifies SEC investigations from his perspective as a former SEC enforcement insider. It’s a valuable perspective for directors and officers to absorb before the SEC comes knocking. – Priya Huskins |

SEC You Soon

Over a long career working for public companies or serving on boards, at some point, you may run into the Securities and Exchange Commission's Division of Enforcement (“SEC Enforcement”). The SEC receives tens of thousands of enforcement tips every year. SEC Enforcement has almost 1,500 staffers and about 1,500 open investigations at any given time across the country. Investigations into public companies and prominent private companies are a priority for the agency and, in recent years, SEC Enforcement has increasingly pursued aggressive cases against individual corporate officers.

An encounter with the SEC can fall anywhere on a wide spectrum of pain, from expensive procedural annoyance to substantive existential threat. There’s a lot to cover in the substantive category—how to reduce your risk of an investigation, how the SEC thinks about building cases, the many ways in which investigations and enforcement actions can impact you and your company, and coverage implications at the settlement stage—but that’s for another day. In this post, I’m going to focus exclusively on the burdensome investigative stage and its associated expenses. No matter the final outcome, SEC investigations are time-consuming and costly. We’ll talk about why this is and what you can do about it (answer: not much). In my next post, I’ll discuss the extent to which you can protect your company’s balance sheet from these costs through insurance coverage.

Everything (Really) Is an SEC Investigation

The Bloomberg financial writer Matt Levine has a saying: "Everything is securities fraud." The basic idea is that if anything bad happens at a public company, plaintiffs’ lawyers and/or the government will find a way to call it securities fraud. This begs the question: What is broader than “everything"? Because the SEC’s bar for simply opening an investigation is even lower, SEC Enforcement lawyers can and will open an investigation any time they believe it is possible that a securities law violation has occurred. In practice, this means that they can open investigations freely, at any time, and for any legitimate, non-discriminatory reason.

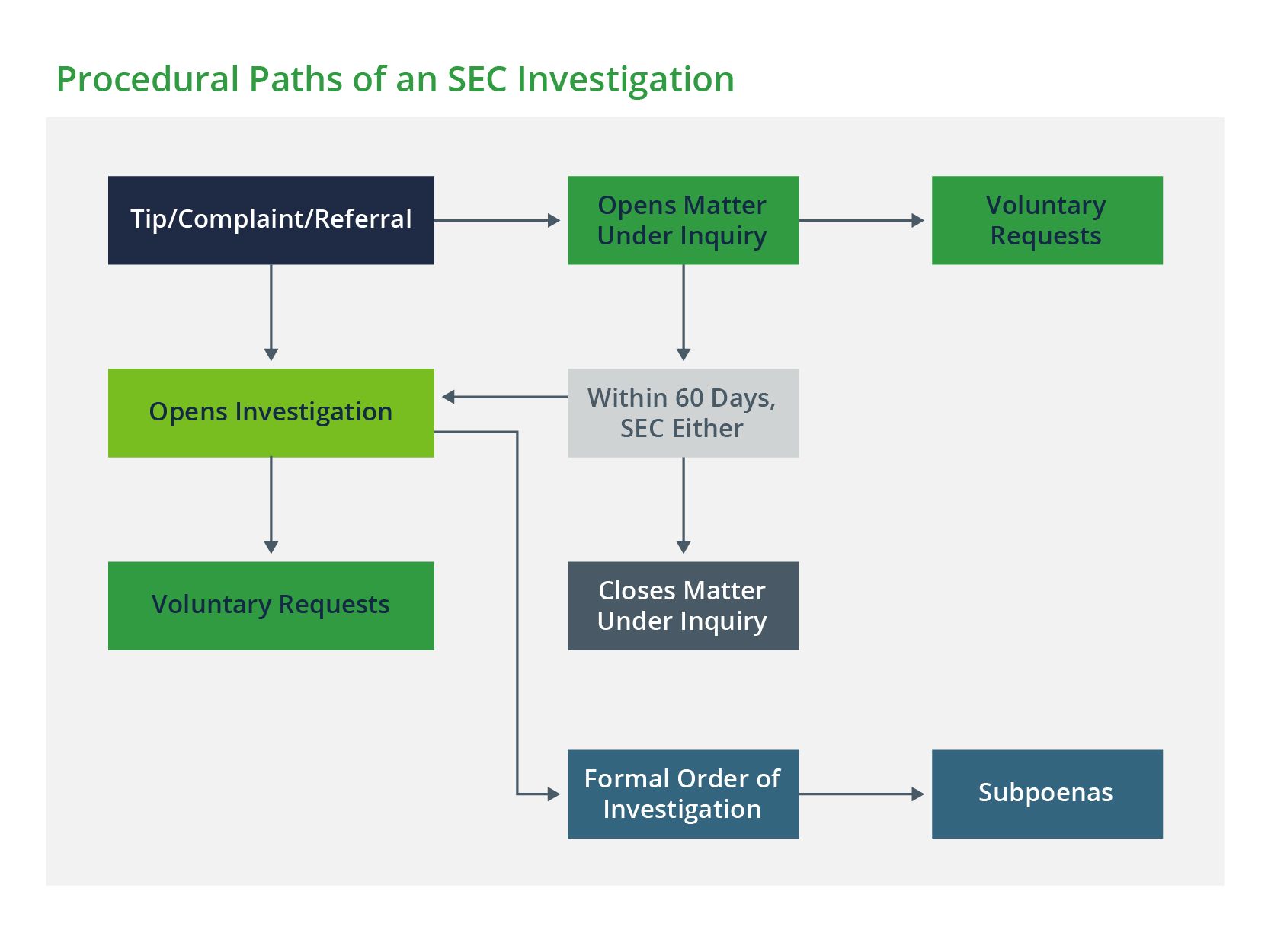

After SEC Enforcement has decided to look at your company, the investigation can take a few different procedural paths. While Kafkaesque, the bureaucratic posture of an investigation can be important: The posture can hint at whether the government is just kicking the tires and may walk away after a limited review or whether they are likely to dig in for the long haul. Also, the formality or informality of an SEC inquiry can have insurance coverage implications (which we’ll discuss in the next post).

After deciding it needs to look at a company, SEC Enforcement can open either a “matter under inquiry (MUI)” or an “investigation.” These are just two slightly different internal bureaucratic procedures; fundamentally, they both mean that SEC Enforcement thinks your company might have violated the securities laws and wants information. A MUI requires less internal paperwork and may suggest that SEC Enforcement isn’t sure a full-blown investigation is worthwhile—or it can mean they are excited about the case and raced to open an inquiry as quickly as possible. Within 60 days, SEC Enforcement is supposed to either close a MUI or convert it into an investigation. An investigation requires a bit more internal paperwork and has no expiration date.

Once either a MUI or an investigation has been opened, SEC Enforcement may send you voluntary document requests. These are exactly what they sound like: The government asks you to provide documents, but there are no technical legal consequences if you say no. This voluntary nature, though, is effectively meaningless. If you fail to comply fully with a voluntary request, SEC Enforcement can (and will) just send you a subpoena with legal force behind it.

Still, a voluntary document request can be an encouraging sign. In some cases, it suggests that SEC Enforcement is just kicking the tires and has not yet figured out if a matter has legs. In other cases, a voluntary request may simply be the first step in a long and tortuous road to an enforcement action.

In many cases, the SEC skips the MUI stage and doesn’t send voluntary requests. Instead, they just open an investigation, get a formal order of investigation, and send you a subpoena in quick succession. A formal order is a document authorizing SEC lawyers and accountants to send subpoenas for documents and testimony. It is approved as a matter of course by senior SEC Enforcement lawyers.

The Documents Phase

Once a formal order exists, you should be prepared for a long road ahead. On average, it takes about two years from the time the SEC opens an investigation to the time it brings a case. (This statistic doesn’t include investigations closed without charges; unfruitful investigations also often drag on for years.) Over the course of an investigation, you will see flurries of activity and then long periods of inactivity and uncertainty. While the government considers the documents you’ve produced and mulls over the next steps, it won’t provide the company with much information about where things are headed.

SEC Enforcement lawyers love documents like a fish loves water. They tend to draft document subpoenas very broadly—for example, they may ask for all emails and texts sent by your C-team for a five-year period. And, again, they don’t need to seek a court’s approval. They just get on their computer, write a subpoena, and email it over to your lawyers.

Responding to a government investigation is not the same as responding to private litigation. Those who are familiar with private litigation are often surprised by the nature of enforcement investigation defense. In an enforcement investigation, your experienced defense counsel will work hard to build trust and rapport with the SEC lawyers. A combative tone and aggressive tactics are dangerous and rarely advisable. Unlike in private discovery—where you can ask a judge to help if the plaintiff is being unreasonable—in SEC investigations, there is no recourse to the courts as a practical matter. You are almost entirely at the whim of the government. While your defense lawyer can tactfully seek to narrow the scope of particularly unreasonable demands, they will almost never succeed in causing the SEC to abandon its requests. And the juice is rarely worth the squeeze—if you fight too hard on document requests, the SEC lawyer may believe you have something to hide and dig in even deeper. Credibility with the SEC on documents can also come in handy in later settlement discussions.

As a result, the documents phase of an investigation is a long and iterative process between your lawyers and the SEC lawyers. While there are many unwritten norms, there are few firm rules to this game, and your mileage will vary significantly depending on the investigation and the actors on the other side of the table. If the SEC lawyers are innately aggressive or think you may have done something terribly wrong, they might demand that you review one million documents and turn over hundreds of thousands of documents. On the other hand, if the SEC lawyers want to take a targeted approach, you may be able to follow a relatively truncated process—at least initially. Unfortunately, there is no limit to how many subpoenas the SEC can send you. If they review some documents and decide they need more, they will not be shy to send you a second, third, or fourth subpoena.

The Testimony Phase

At the end of the documents phase of an investigation (and, sometimes, while you are still producing documents), SEC Enforcement will decide whether they want to talk to company personnel. Sometimes, the SEC simply walks away from an investigation at this point. However, if the SEC has expended meaningful time and energy during the documents phase, it’s likely they will want to talk to people, even if they haven’t necessarily decided that there have been violations. The SEC can either ask personnel to voluntarily appear for informal unrecorded interviews or send subpoenas requiring them to appear for formal testimony with a court reporter. In either case, company witnesses will be required to tell the truth under penalty of perjury.

As with the documents phase, the breadth of the testimony phase varies widely depending on the investigation. In an accounting case, the SEC might spend months talking to your CEO, CFO, COO, controller, lower-level accounting personnel, your external auditors, your Audit Committee, and your business partners. Each witness will need to be extensively prepped on events that may have taken place years before. In many cases, witnesses will need their own individual counsel. Outside company counsel will also remain involved, resulting in many, many billable lawyer hours.

The Only Way Out Is Through

To get past a full-blown SEC Enforcement investigation, you will probably need to produce a ton of documents, and your team will probably need to appear for time-consuming and invasive testimony. There is no magic bullet to stop an investigation in its tracks. In this upside-down world, the only way out is through.

This will be a lengthy and expensive undertaking—even if the investigation is ultimately closed without any charges. Mid-seven-figure bills for investigative legal fees and expenses are common; eight-figure bills are not at all out of the question. Given these costs, you might ask: Is insurance coverage available and/or advisable? That’s the subject of my next post.

Author

Table of Contents