Report

Numbers Are Up for SCA Filings and Settlements—A Repeat of 2023? [REPORT]

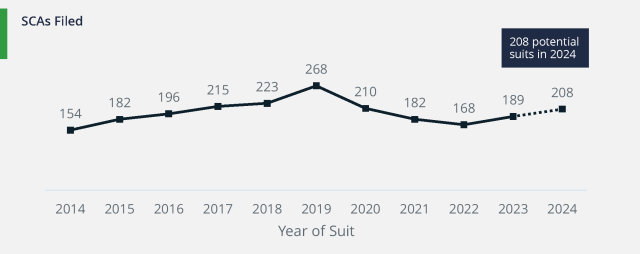

It has been two years since public companies saw a marked decrease in the number of securities class action filings against them.

In 2022, 168 class actions were filed, a record low since 2014; however, 2024 activity is heating up, and we could be on track for more than 200 filings by the end of the year, according to our analysis in Woodruff Sawyer’s 2024 Mid-Year D&O Databox Report.

Trends in Class Action Types

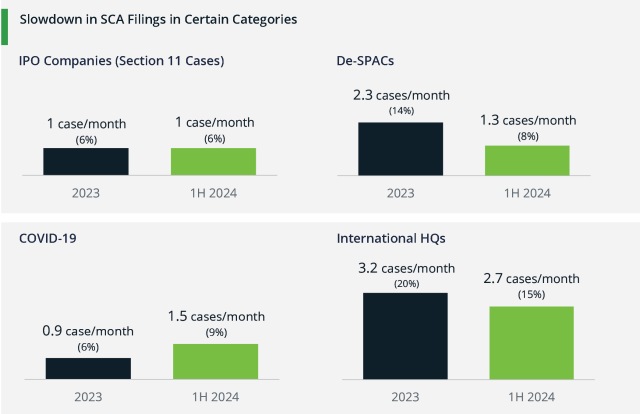

While the number of filings is up, specific categories of filings we have been tracking are down in the first half of 2024. Although filings against IPOs remained the same, filings against de-SPACs experienced a dramatic decrease—from 14% in the first half of 2023 to 8% in the first half of 2024. Much of this is surely attributable to the recent continued decrease in SPAC activity overall.

Most-Sued Industries in 2024

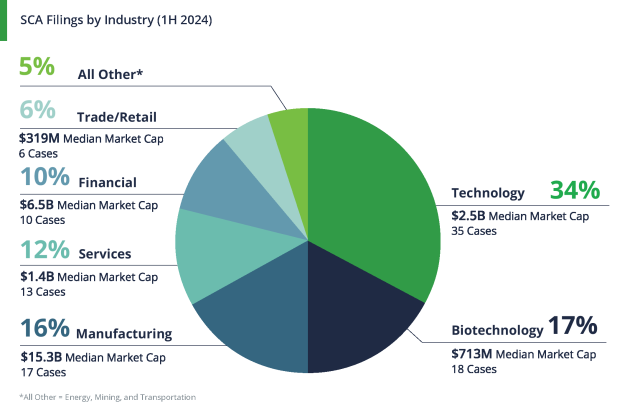

The top industries sued tend to stay constant, but they switch in rankings from time to time. For example, biotechnology moved from third place in 2023 to second place in the first half of this year. Manufacturing moved down to third place.

In total, class actions in the first half of 2024 targeted the following top three sectors:

- Technology: 34%, with 35 cases filed

- Biotechnology: 17%, with18 cases filed

- Manufacturing: 16%, with 17 cases filed

While the technology industry had the highest number of filings, it ranked third for median market cap size of company at $2.5 billion. On the other hand, the manufacturing industry led in terms of median market cap of companies sued at $15.3 billion.

Settlements in the First Half of 2024

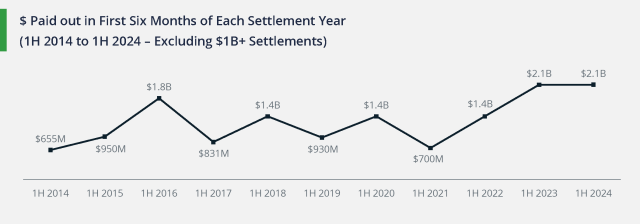

This year is on track to be expensive for public companies and their insurers in terms of class action settlements. In the first half of 2024 alone, 40 settlements reached $2.1 billion.

The image above shows settlements for the first half of each year for the past 10 years; 2024 is currently competing with 2023 for a record dollar amount of settlements. Plus, settlements exceeding $20 million make up 44% of all settlements in the first half of 2024, a 5 percentage point increase from 2023.

Which industries saw the highest payouts? The technology and manufacturing industries comprised 78% of total settlement dollars ($1.7 billion).

Our Analysis: Enjoy the Soft Market While It Lasts

Although there were only six Section 11 class action cases against IPO companies in the first half of 2024, 11 companies that went public in the past three years were sued for violating Section 10b-5 of the 1934 Exchange Act.

In other words, IPO companies are still at risk for lawsuits even if the suit is unrelated to the IPO. Indeed, 16% of all suits filed in the first half of 2024 were against companies that went public in the past three years.

For SPACs, only two of the eight cases against recent de-SPAC companies included claims related to the de-SPAC merger. All eight companies had Section 10b-5 claims and faced class actions within three years of the de-SPAC merger.

Companies that undergo a de-SPAC transaction are like IPO companies in their exposure to shareholder and investment community scrutiny.

What does the data in our mid-year report mean for D&O insurance pricing? Rates continue to be competitive; however, the large settlements highlighted in this report may mean that the seeds of the next hard market are being planted now.

We’ll discuss this in more detail in our end-of-the-year class actions report and in a webinar on September 17 at 1pm ET/10am PT.

Download your copy of Woodruff Sawyer’s 2024 Mid-Year D&O Databox Report for more data points on the information covered in this article and more.

Author

Table of Contents