Blog

ACA Reporting - Offers of COBRA Coverage

On May 19, 2015, the Internal Revenue Service (IRS) released FAQs detailing how employers should report offers of COBRA coverage on Form 1094-C and Form 1095-C. On September 16, 2015, the IRS issued final 2015 instructions for Forms 1094-B and 1095-B (B Forms) and Forms 1094-C and 1095-C (C Forms). The revised instructions make a substantive change in the manner in which offers of COBRA coverage are reported (note: as of the writing of this Benefits Alert, the IRS has not updated the FAQs to conform with these changes).

In the following overview, we walk through how an Applicable Large Employer (ALE) would complete the C Forms for a former employee who is offered COBRA coverage based on the final 2015 revised instructions. Note that a non-ALE plan sponsor of a self-funded health plan would complete the B Forms for all COBRA beneficiaries (insurers would complete the B Forms for fully-insured COBRA coverage).

The IRS also has given ALEs sponsoring self-insured health plans the option of using either the B Forms or C Forms to report Minimum Essential Coverage (MEC) provided to non-employees (COBRA beneficiaries, retirees, etc.). The Social Security Number (SSN) of the non-employee must be recorded in order to use the C Forms.

Facts

Employer A offers two health plans. Active employees pay $100 per month for single coverage on the base plan and $200 a month for single coverage on the buy-up plan. Employer A's group health plan runs on a calendar year (JanuaryDecember).

Chloe was a full-time employee of Employer A for the first half of 2015. She enrolled herself, her spouse, Terry, and one child on the buy-up plan. Chloe was laid off on July 15, 2015, and her health coverage terminated on the same day. Employer A offers Chloe COBRA coverage, which she elects effective as of August 1, 2015, which lasts until July 31, 2016.

2015 Reporting

For the most part, the information required on Form 1094-C (transmittal to the IRS) involves specifics about the plan sponsor, not employees (or former employees). Part I, Line 18 asks for the number of Forms 1095-C the plan sponsor is transmitting, including any Form 1095-Cs sent to employees who terminated coverage mid-plan year (like Chloe in our example).

Lets begin with Form 1095-C reporting. Form 1095-C is comprised of three parts:

- Part I: Identifying information about the employee and the employer.

- Part II: Information about the employer's offer of group health coverage.

- Part III: Information about the employer's self-funded health coverage (if any), including names and Social Security numbers of the employee and his or her covered dependents.

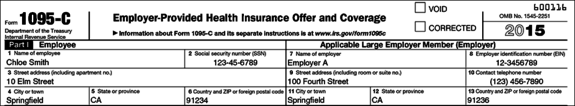

Part I. Employee and ALE Member Information

Part I of Form 1095-C requires identifying information for the employee and ALE.

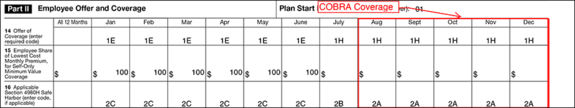

Part II. Employee Offer and Coverage

Under prior IRS guidance, the manner in which an offer of COBRA coverage was reported depended on the nature of the qualifying event (reduction in hours vs. termination of employment) and on whether the offer of COBRA coverage was accepted. However, under the final 2015 Form 1095-C Instructions, an offer of COBRA continuation coverage made to a former employee upon termination of employment is no longer reported as an offer of coverage on Form 1095-C, Part II, Line 14, regardless of whether the employee accepts or declines the coverage. Code 1H ("no offer of coverage") should now be applied to all months for which the ALE offers the former employee COBRA continuation coverage.

It's worth mentioning that an offer of COBRA coverage made to an active employee (e.g., an offer of COBRA continuation coverage that is made due to a reduction in the employee's hours resulting in the loss of eligibility under the employer's group health plan) is reported in the same manner and using the same code as an offer of that type of coverage to any other active part-time employee (if COBRA coverage is elected, the ALE would report the COBRA premium on Line 15 for the lowest-cost self-only coverage providing minimum value offered to the employee).

In our example, Chloe terminates employment and elects COBRA coverage for herself and her dependent effective August 1, 2015 (removing her spouse from the plan).

- Line 14 (Offer of Coverage): Employer A inserts Code 1E (MEC offered to employee and family) for the months that Chloe was an active employee for all days of the month (January June). In July, Chloe was not an active full-time employee for the entire month. Accordingly, Employer A reports that the employee was not offered coverage for that final month of employment by entering code 1H on Line 14. Finally, while on COBRA coverage (August December), Employer A inserts Code 1H (No offer of coverage).

- Line 15 (Employee Share of Lowest Cost Monthly Premium, for Self-Only MEC):While Chloe was an active employee, the lowest cost single coverage offered by Employer A was $100/month for the base plan. Employer A enters $100 for January through June even though Chloe elected to cover herself and her family on the more expensive buy-up plan. Line 15 should be left blank for the month she terminated employment along with the months she elected COBRA coverage.

- Line 16 (Applicable Section 4980H Safe Harbor):While Chloe is an active employee for every day of the month (January June), Employer A inserts Code 2C (employee enrolled in coverage offered) on Line 16. In the month Chloe terminated employment (July), Employer A inserts 2B (if the coverage or offer of coverage would have continued if the employee had not terminated employment during the month, the ALE will be eligible for relief under Section 4980H for the employee's last month of employment). Finally, Employer A uses Code 2A (Employee not employed during the month) for the remaining months that Chloe is on COBRA.

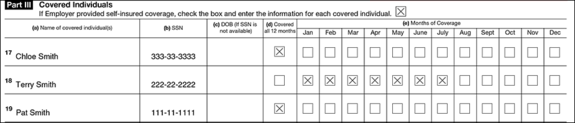

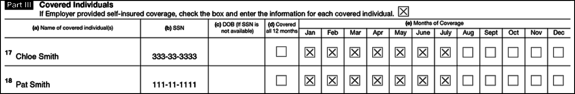

Part III. Covered Individuals if Employer Provided Self-Insured Coverage

Part III replaces B Form reporting for ALEs. If the health plan is fully insured, Employer A would skip Part III. If the plan is self-insured, Employer A would complete Part III, indicating the months Chloe and her family members were enrolled on the plan, including the months they are enrolled in COBRA coverage. On Part III, an ALE reports an individual as having coverage under the plan for the calendar month if the individual was covered for any day of the calendar month.

2016 Reporting

In our example, Chloe maintains COBRA coverage for twelve months, ending on July 31, 2016. 2016 reporting will look a bit different than 2015 reporting.

- Assume the Plan is Fully-insured.In this case, Chloe will not receive a 1095-C for 2016. She was not a full-time employee of Employer A at any time in 2016.

- Assume the Plan is Self-Insured. If Employer A self-funds the health plan, Employer A must issue Chloe a 1095-C (or the alternative Form 1095-B) for 2016 to report Minimum Essential Coverage (MEC) under the Individual Mandate.

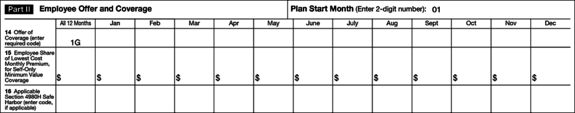

Part II. Employee Offer and Coverage

If the plan is self-insured, Employer A enters Code 1G under the "All 12 Months" column on Line 14, leaving the rest of Part II blank. Code 1G signals to the IRS that Chloe was not a full-time employee in 2016 and that the Form 1095-C is being filed solely to comply with Code Section 6055 related to the Individual Mandate.

Part III. Covered Individuals if Employer Provided Self-Insured Coverage

Finally, on Part III, Employer A will check the months that Chloe and her dependent are enrolled in COBRA coverage during 2016.

We will provide more general and in-depth coverage of B and C Form reporting in the coming months in anticipation of the upcoming 2016 reporting deadlines.

Source: Mike Fowler, Attorney at Law

mike@abferisa.com | www.abferisa.com

Download a PDF version of this update >

Please contact your Woodruff-Sawyer representative with any questions.

Table of Contents