Blog

Claims Cost Transparency: Using Data to Optimize Medical Benefits Costs

Claims cost analysis allows you to drill down into the data and see what you need in your health plan to boost utilization and get your employees and their families better care.

How much would you get back in your budget if you could save up to 10% on your medical and Rx benefits costs? Employee benefits are the second largest budget item in employee compensation, with medical benefits consuming the bulk of that cost. Yet, companies with fully insured medical plans often have limited financial transparency and control when it comes to managing these costs. Try viewing the actual, full cost for a broken ankle, and you'll see that pricing is not so transparent.

Claims Cost Transparency: Why Is It Important?

Companies that know and understand their medical & Rx claims can make decisions that will improve plan utilization and reduce overall costs. Claims cost analysis allows you to drill down into the data and see what you need in your health plan to boost utilization and get your employees and their families better care.

Fully Insured Plans Offer a Simple, But Inflexible Solution

Many small and mid-size companies have fully insured plans, allowing for a fixed monthly cost. The carrier creates a pool, lumping your company with others. The carrier may determine your rate based on costs for the entire pool, meaning you'll pay a set cost whether your company's claims are higher or lower than average.

When it comes to data, however, fully insured plans may not provide transparency or flexibility. They offer some claims data, but the carrier owns all of it, including your high claimant utilization. Even if you could fully analyze the data in more detail, you have limited actionable options to adjust your plan, as you are pooled with other companies for your rates. For a company with a relatively healthy employee population, this could mean inflated costs with few options to meaningfully adjust your plan. However, you can potentially still use this data to do things like increase employee communication targeted to specific needs and uses.

Self-Insured Plans Offer More Reward

Self-funded plans allow companies to take control of their data and take a deeper dive into analytics. When companies own their data, their broker can help drill down on what to address to mitigate risk while ensuring members get better care. You have control to adjust plans, setting your own rates and finding meaningful point solutions to better suit your employee need.

And it's not just medical costs where better claims data transparency can help. Claims cost analysis, and more control through a self-funded plan, can also help reduce pharmacy costs.

| Reducing Rx Costs: Pharmacy spend is about 20% on average of the total plan cost. Of this 20%, about half is spent on specialty drugs, according to CVS Caremark—and those costs are going through the roof. Your broker can market to pharmacy benefit managers (PBM) to seek better contracts and efficient formularies. You may decide on a narrow formulary that's less expensive while taking advantage of rebates to reduce overall drug costs. |

Is Self-Insurance a Good Option for Your Mid-Size Company?

Self-insurance and claims data analysis are often thought to only be available to large companies, but there are ways mid-size companies can also benefit from this strategic approach. In fact, full control of your plan, data, and costs may make self-insurance an enticing option.

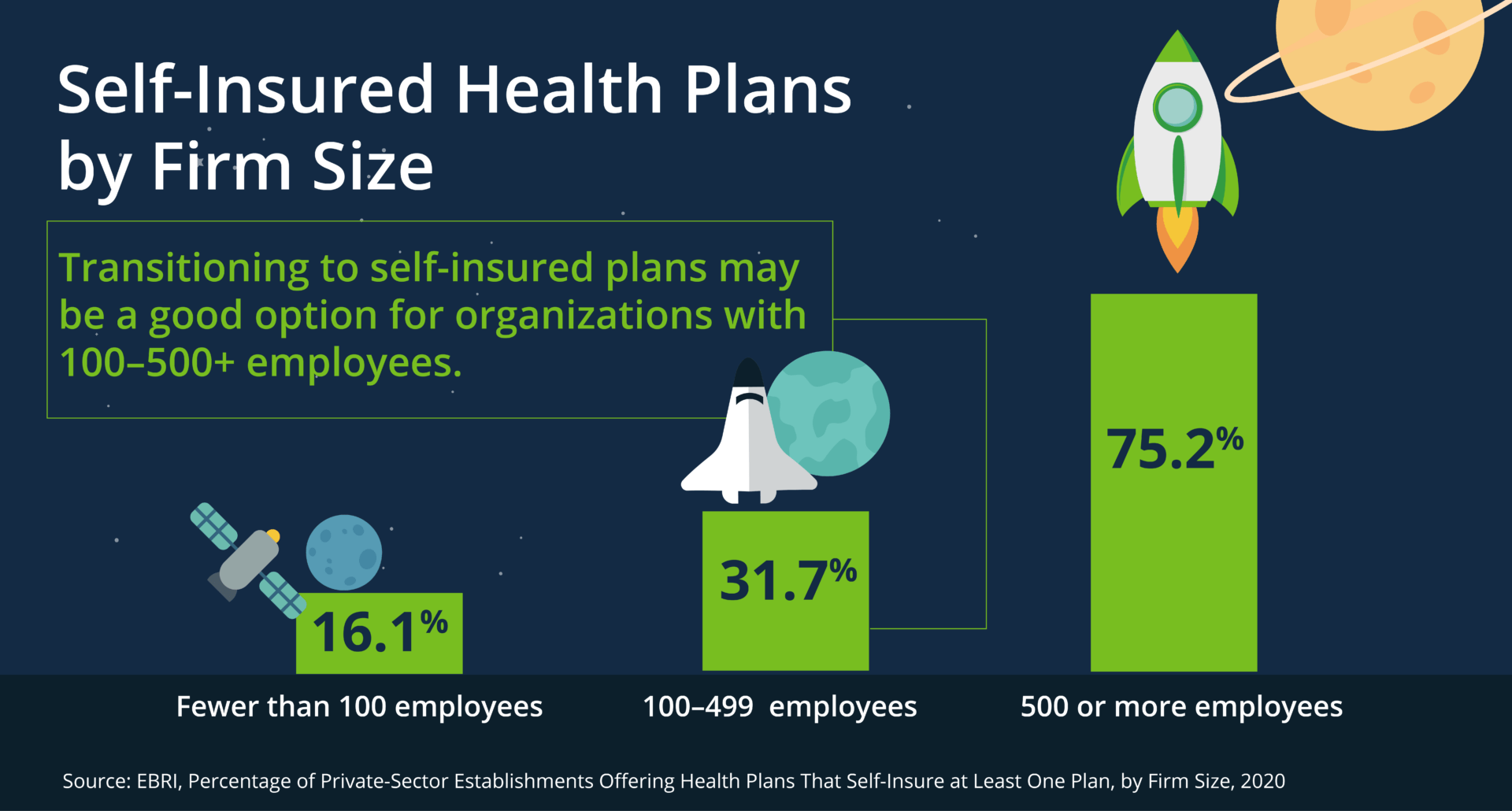

Many factors come into play when considering a self-funded plan design. Transitioning to self-insured plans may be a good option for organizations with 100–500 employees. (Note that large workplaces with 500+ employees are likely already self-funded or have a good reason for staying fully insured.) Third-party administrators (TPAs) can also help manage self-funded programs, from set-up to administration.

If you're considering self-funding, here are some benefits and drawbacks:

Benefits:

- Data ownership and the ability to optimize the plan based on utilization and cost data

- Customizing a plan to meet the needs of your workforce

- More opportunities to select point solutions that align with your culture and goals

- Controlling fixed costs and plan reserves, enhanced cashflow, and maximizing interest income

Drawbacks:

- A learning curve for Human Resources and finance leadership

- Accounting complexity

- Higher potential risk

- Monthly cost variability

It can be intimidating and it’s not for every organization, but depending on your risk profile, you could see up to 10% savings by moving to a self-insurance program.

Work with a Knowledgeable Broker

A strategically focused broker can run a self-insurance feasibility analysis, which projects renewal costs and demographic risk analysis to move to a self-funded plan design. After reviewing the initial data and projections, your broker can then go to market to obtain quotes from your preferred solution providers. Your broker can walk you through what to expect and considerations, as well as the timeline to launching and collecting meaningful data.

Whether you have a fully funded or self-funded plan, data analysis of your claims costs can give you meaningful insights into how you can optimize your benefits offerings to better serve your employees and your budget.

Woodruff Sawyer’s Mission to More series leads you through today’s benefits news and serves as a guide for everything from competitive programs to compliance. For more guidance on using data analytics and transitioning to a self-funded plan, sign up for Woodruff Sawyer’s Benefits newsletter, which includes all Mission to More articles.

Woodruff Whiteboard Breakdowns: Self Funding Your Health Plan

Table of Contents