Blog

IRS Begins ACA Penalty Collection Process Under the 4980H Employer Shared Responsibility Rules

Background

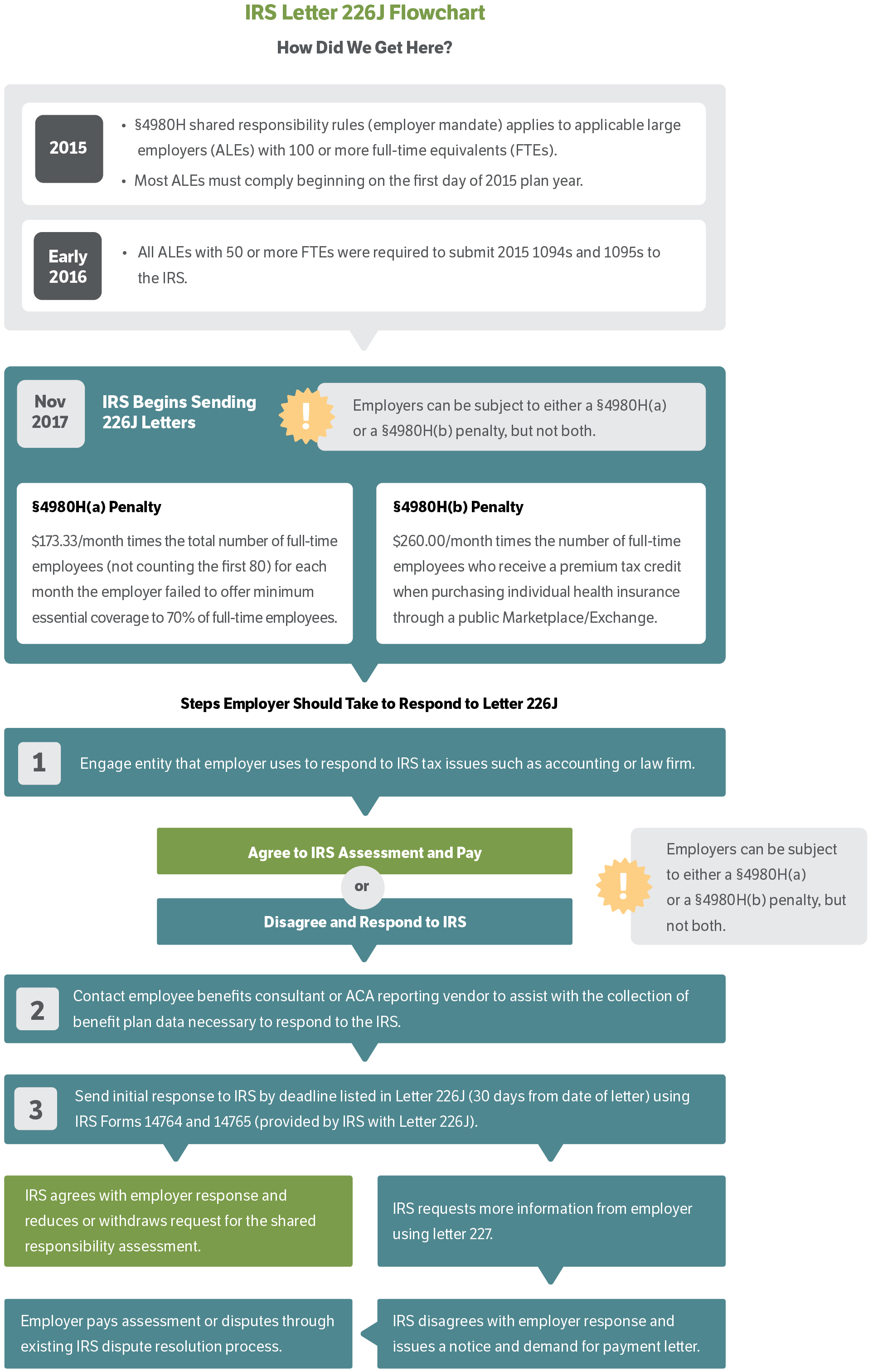

The IRS has begun to send Affordable Care Act (ACA) penalty letters (known as Letter 226J) to employers who the IRS believes may have failed to meet the Employer Shared Responsibility Rules under Code 4980H during the 2015 plan year. The penalty calculations are based on the ACA reporting data provided by employers to the IRS on Forms 1094 and 1095. As a reminder, under the Employer Shared Responsibility Mandate, an Applicable Large Employer (ALE) could choose to Pay or Play. If choosing to Play, an employer could avoid any 4980H ACA penalties by (A) offering coverage to a substantial number of full-time employees and (B) making such coverage both affordable and adequate. Therefore, there are two different penalties (the A-penalty and the B-penalty) that could apply to an ALE, but the IRS will only assess one of the two penalties (not both) for any particular tax year.

We believe that many of these 226J letters are being sent as a result of simple mistakes (such as coding errors) made on the ACA reporting forms, rather than due to an actual violation of a 4980H requirement. This has proven to be the case for most of the letters that have been received by employers thus far.

4980H(a) Offering Coverage to Substantially All Full-Time Employees

The A-penalty is based on whether the employer made an offer of coverage to a substantial enough number of their full-time employees. For the 2015 plan year, an employer who failed to offer minimum essential coverage (MEC) to 70% of all full-time employees (and their dependent children) faced a potential penalty of $173.33/month, multiplied by the total number of full-time employees (not counting the first 80).

Example of the A-penalty:

An employer with 200 full-time (FT) employees failed to offer coverage to 70% of the FT employees for 9 months of 2015.

- $173.33 x 120 FT employees (200 minus first 80 employees) = $20,799.60/month;

- $20,799.60/month x 9 months = $187,196.40 in assessed penalties for 2015

4980H(b) Failure to Offer Affordable Minimum Value Coverage

The B-penalty applies if an employer fails to make an affordable offer of minimum value coverage to a full-time employee, and that employee enrolls in individual coverage through a public Exchange/Marketplace and qualifies for the premium tax credit (PTC). For 2015, the (b) penalty is $260/month for each full-time employee who receives a PTC.

Example of the B-penalty:

Two full-time employees were offered coverage that was not affordable. Employee X received subsidized coverage in the Marketplace for 6 months, while Employee Y received subsidized coverage for 12 months.

- Employee X: $260 x 6 months = $1,560

- Employee Y: $260 x 12 months = $3,120

- $1,560 + $3,120 = $4,680 in assessed penalties

for 2015

Actions Employers Should Take Upon Receiving a Letter 226J

It is very important that an employer take quick action because the IRS provides only 30 days from the date of the Letter 226J for an employer to respond. The IRS will initiate a collection process if an employer fails to respond on a timely basis.

We recommend the following immediate courses of action:

- Call the IRS number located on the Form 14764 that is included with the Letter 226J to request an extension of time to respond (e.g., 30 days).

- Review the ACA reporting vendors contract to assess whether it addresses how the vendor will assist with any IRS inquiries or indemnify for any reporting errors on the vendors part.

- Contact the ACA reporting vendor to collect the necessary data/forms to respond to the IRS letter (e.g., a copy of the Form 1094 and a Form 1095 for each of the individuals listed in the Letter 226J).

- Review/audit the Letter 226J to confirm whether coverage was offered for each of the individuals listed on the last page of Form 14765.

- There should be a Series 1-Code and a Series 2-Code for each month to explain whether coverage was offered and if not, why coverage was not offered.

- Contact the ERISA (or tax) counsel who normally handles the companys IRS tax issues.

- See the enclosed flow chart and Q&A for more details on responding to the IRS.

Once the formal response is sent to the IRS, the following outcomes could occur: (1) the IRS agrees and will reduce or withdraw the assessments; (2) the IRS will require more information and ask that the employer complete a different form (Letter 227); or (3) the IRS disagrees with the employers responses and will demand payment. At that point, employers can then decide whether to pay the demand or appeal.

We strongly recommend that employers consider engaging with qualified ERISA counsel to prepare the IRS responses, unless the penalties are small enough (or theres nothing to debate) that it would be more cost effective to simply pay the penalty assessments.

We Can HelpWe have partnered with an ERISA law firm to provide preferred pricing to our clients who need legal assistance in responding to the IRS, including guidance through the appeals process, if needed. Fees are based on the complexity of the project and how much of the initial data/fact gathering employers have undertaken to make efficient use of legal counsels services. For more information contact your Woodruff-Sawyer Account Executive. |

Letter 226J Q&A

Question 1: What is the IRS process for assessing penalties under the ACA?

Answer 1: The IRS has been busy reviewing ACA employer reporting forms filed for plan years that began in 2015. Based on this review, they started sending Letters 226J in early November. These letters will go to the individual listed as the contact person on line 7 of Form 1094-C. Some employers will have filed more than one Form 1094-C and will have different contact people listed.

Question 2: How do I know if I received a letter from the IRS telling me I owe a penalty under ACA?

Answer 2: Your letter will begin by saying that the IRS has made a preliminary calculation of the Employer Shared Responsibility Payment (ESRP) that you owe. The letter will probably have a label on the bottom right corner that says Letter 226J. It will also include an ESRP Summary Table and Explanation; Form 14764 (ESRP Response); and Form 14765 (Employee Premium Tax Credit (PTC) Listing).

Question 3: What is the first thing I should do if I disagree with the IRS letter?

Answer 3: The first thing to do is look at the dates in the upper right corner on the first page of the IRS Letter. The Response Date is very important. Failure to respond by this date may result in a demand for payment from the IRS and could make it more difficult to challenge the IRS.

Question 4: What are the next steps I should take if I plan to pay the penalty?

Answer 4: Follow the instructions in Letter 226J and include your payment with Form 14764. (You should receive a copy of Form 14764 in your initial letter from the IRS.)

Question 5: What are the next steps I should take if I plan to dispute the penalty?

Answer 5: Consider whether you will engage someone to assist you in dealing directly with the IRS. Who does your organization typically use to respond to IRS tax-related issues? Likely candidates include a lawyer or accountant who can represent you before the IRS. We strongly recommend engaging ERISA counsel to respond to the IRS.

- Your first step should be to call the IRS number located on the top of the Form 14764 (included with the Letter 226J) and request additional time to respond.

- Complete and sign Form 14764 and assemble all supporting materials. Your response must include a signed statement indicating why you object to the penalty, changes you want to make to your reporting forms, and changes to preprinted forms you received along with the IRS Letter 226J.

- Form 14765, Employee PTC Listing Make changes, if any, on the Employee PTC Listing. Include your revised Employee PTC Listing, if necessary, and any additional documentation supporting your changes with your Form 14764, ESRP Response, and signed statement.

- Get moving. We cannot stress enough that a proper response may require significant effort to prepare. So far, the IRS has not indicated whether they will accommodate requests for additional time to reply. Our advice is to move quickly.

- Make sure the IRS receives your completed package BY THE RESPONSE DATE INDICATED ON YOUR INITIAL LETTER FROM THE IRS or any extension granted in response to your request for more time.

Question 6: What happens after the IRS receives my timely objections?

Answer 6: The IRS will respond with a Letter 227. Your Letter 227 will describe further actions you must take. Watch for your Letter 227 and continue to pay close attention to any Response Date. If the IRS is planning to continue the dispute, you will have an opportunity to schedule a pre-assessment conference with the IRS Office of Appeals.

Please refer to the graphic below for more information on the IRS Letter 226J.

Table of Contents