Blog

Trends in M&A Risk and Insurance for 2020: A Complicated and Evolving Market

In this Private Equity and Transactional Risk Insurance Trend Report, we discuss in depth what we're seeing in terms of market rates and claims, the types of products being used/introduced to combat M&A risks, and what to expect moving forward into 2020.

Some important topics in this Report include:

Market Turbulence Ahead

As the R&W insurance marketplace remains largely profitable, competitors will continue to enter the marketplace and underwriting appetites will continue to expand. There are some brokers who believe the solution will be commoditized as competition continues to drive prices lower. While we do believe pricing will continue downward in the short term, retentions have remained flat and claims are beginning to rise.

Trends in Transactional Risk Products

The market for representations and warranties insurance (R&W) continues to evolve, but as R&W solutions have increasingly become table stakes for middle market transactions (both the core and now the lower middle market—more on that in this piece), we've noticed the market for innovative transactional risks is expanding.

Cyber Liability Gains Traction at the Fund Level

Aside from the dynamics and risks involved during a portfolio company's transaction itself, PE firms are encountering new cyber risks at the fund level on a daily basis. As we move into 2020, there are several cyber exposures that CFOs and COOs of PE and VC firms are facing:

- Sensitive corporate information

- Ransomware

- Phishing attacks

- GDPR / CCPA compliance

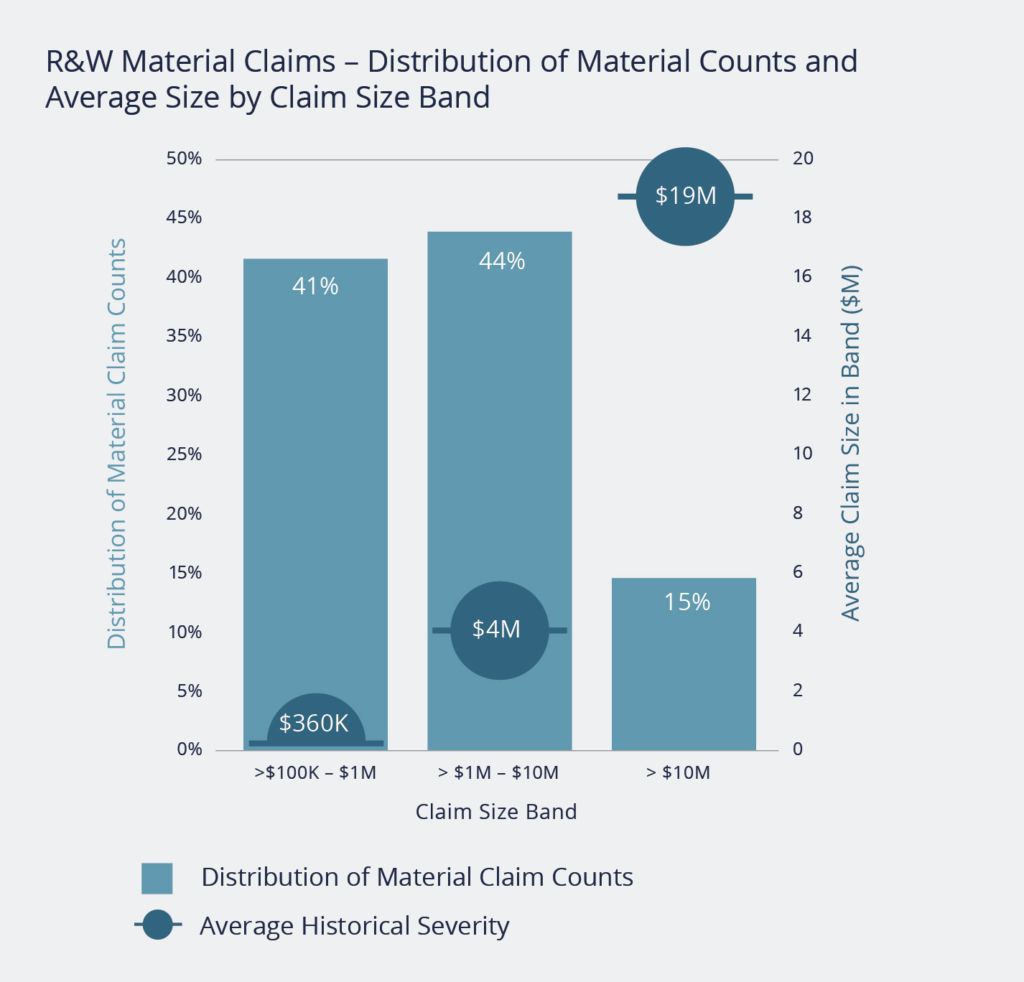

Increase in R&W Claims Severity and Frequency

The proportion of claims over $10 million increased significantly when compared to last year, from 8% to 15%. The overall frequency for all deals on a global basis stands at 20%, a constant over the last few years.

The Rise of Tax Liability Insurance

Tax liability insurance is designed to address a very specific tax-related circumstance rather than provide the general coverage that comes with an R&W policy. A tax indemnity policy could provide coverage for a special indemnity related to tax that is specifically excluded on a common R&W insurance policy. This can often be more "deal critical" as tax issues can have a material impact on the upside of any transaction.

Table of Contents