Blog

Keeping in Compliance and Out of Trouble with the DOJ: The Benefits of Board Education Training

“I want to serve on a board because I’m in love with compliance,” would be an odd way to interview for a board.

Most board members will tell you that they serve because they love business and are interested in strategy. These same board members would also, of course, acknowledge that “board oversight of management”—another way to say “compliance”—is an important part of the job.

In a post-Enron, post-Sarbanes-Oxley, post-Financial Crisis, post-Dodd-Frank world where every foot fault (or real problem) is amplified by social media, there are no other options.

Nevertheless, just 34 percent of boards on publicly traded companies received compliance and ethics training. This is according to the “2017 Compliance Training and the Board Survey” by the Society of Corporate Compliance and Ethics, and the Health Care Compliance Association.

Worse, when they did receive training, only 18 percent of board members were very satisfied with it.

As I’ve written in the past, finding out how a company manages its compliance is one of the “10 Questions” anyone should ask before joining a board. While there’s no substitute for the experience of being a working board member, the best board members seek new, relevant information, which is exactly what a good training program brings.

The Business Case for Board Training

Board training isn’t just about empowering board members to make sound decisions when tough issues arise. Formal training is also about remaining in compliance with relevant laws, rules and regulations on a consistent basis, as well as staying off the radar of agencies such as the US Department of Justice (DOJ).

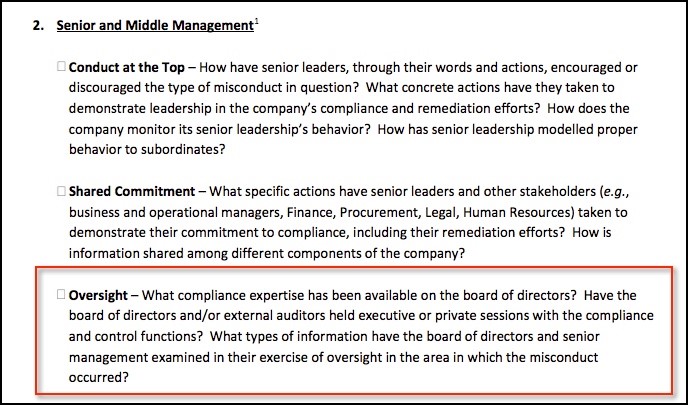

Take the Foreign Corrupt Practices Act (FCPA) as an example. In early 2017, the DOJ released information on how it evaluates corporate compliance programs when it comes to the FCPA. The DOJ wants to know, specifically, what compliance expertise exists on the board.

From the DOJ’s document on “Evaluation of Corporate Compliance Programs”:

The Federal Sentencing Guidelines are another reason for compliance training at the board level. A significant amount of credit is afforded to corporations that can demonstrate the presence of a robust compliance program. The Sentencing Commission is explicit:

These guidelines offer incentives to organizations to reduce and ultimately eliminate criminal conduct by providing a structural foundation from which an organization may self-police its own conduct through an effective compliance and ethics program.

Remember that “tone at the top” always matters, so having compliance training at the board level can be meaningful.

What Types of Training Work?

Given that the majority of board members are not very satisfied with their compliance and ethics training, how do we ensure boards get the training they need in a way that’s relevant to them?

Few public companies require that their board members attend external training sessions, but many public companies encourage their board members to attend a training session such as Stanford’s Directors’ College or other similar conference every one to two years.

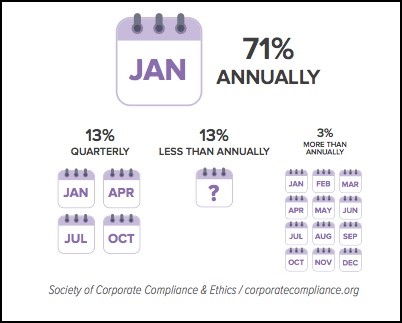

For those that do require compliance training, 71 percent require it annually, according to the report I linked to earlier.

While methods of training can vary, the majority of board members go to live sessions (73 percent, according to the compliance training report) while 27 percent attend web-based education or consume education that is delivered in writing.

In reality, continuing education can be comprised of a mix of both, where the live events take a deep dive into important issues, and the web-based education, like webinars, can offer timely reviews of trending topics.

At Woodruff Sawyer we find that companies with a strong culture of continuing education tend to do well when individual board members attend the training they want and report back on what they have learned to the rest of the board.

Some board members make it a point when attending a multisession live event to go with more than one board member. This allows the board members to “divide and conquer,” which is to say, cover multiple breakout sessions that may be running concurrently.

The other advantage is being able to sit down at the end of the day to discuss what they’ve learned and how those insights apply to their own board.

Something we’ve also seen in the world of onboarding new board members is to send a new board member to a formal director education program and also ask an experienced director to accompany the new director.

This practice can accelerate the new member’s getting up to speed on the board’s culture.

It’s also worth noting that this approach is valuable no matter what age or stage of experience the new board member is in, given that all boards have their own culture.

To the extent that the new board member is also much less experienced than the other board member, the time together can also help facilitate and foster a mentor/mentee relationship.

As a reminder, you can download your copy of the Woodruff Sawyer 2018 Board Education Resource Guide for a robust guide to director education in the coming year, complete with extensive programs, one-day events and online educational activities.

In addition, we offer our D&O insurance clients live board training as well as insider trading and FCPA compliance training for management and staff at no additional charge. You can contact your account executive to learn more about these training sessions.

Author

Table of Contents