Blog

Claims 101: Carrier, We Have A Problem (Part 1)

This is an overview of notice for management liability policies, which includes directors and officers (D&O), errors and omissions (E&O), employment practices (EPL), cyber, crime, and fiduciary insurance policies. Coming soon - part 2 - an overview of notice for occurrence-based policies. -- Zac Overbay

Consider this scenario: Jill, a former employee, angrily emails you, throwing around words like discrimination and lawsuit. She also makes a demand for tens of thousands of dollars. The question to ask yourself is whether or not to let your insurance carrier know about that email.

The answer is usually yes.

Based on our experience, if an issue has matured into a claim that can be submitted to insurance then you should notice the claim. “Noticing” is simply letting the carrier know that a claim has come up—a claim broadly being a written demand for relief.

When Jill quit, there wasn’t a claim. But when she wrote her grievances in an email and demanded money, it became a claim.

(Jill’s angry email would be covered by employment practices liability insurance. If the potential for that angry email doesn’t convince you for the need for adequate employment practices liability insurance, consider that there were over 89,000 charges filed with the EEOC in fiscal year 2015 alone.)

We recommend noticing–and noticing early—for a number of reasons, including transferring risk, minimizing uncovered pre-notice costs, appropriately arranging defense counsel and preserving renewal policy limits. Let’s visit these reasons in turn.

Risk Transfer

Insurance transfers risk from a company to the carrier for a certain cost. If a company purchases insurance, that company should submit claims as they arise. To do otherwise would be to throw more money out after the premium.

Let’s say that the policy you purchased covering Jill’s claim cost your company $30,000 with a $10,000 deductible. If your company incurs $50,000 in defense costs, at the conclusion of the claim, the insurance carrier will reimburse your company $40,000. You would be recouping the cost of insurance plus $10,000.

If you don’t submit the claim, however, your company has lost at least $40,000. Even worse, if it’s the only covered claim this policy year, you’ve effectively lost $70,000—the $30,000 premium plus the $40,000 insurance would have paid out.

If you are concerned that submitting claims may affect the pricing at renewal, either because of value or frequency, speak to your broker. Very often, there is little to no impact of claims submitted in your current policy period on your renewal pricing.

For context, per a recent guide by the carrier Hiscox, the average deductible for a sampling of small to medium-sized business with employment practices liability insurance with reported claims was $35,000. Without insurance, these companies would have been out pocket an extra $90,000.

Sometimes, a company will want to wait before submitting notice to see whether or not the matter develops. This is a poor strategy. By not waiting, your company can avoid several common pitfalls found in the policy provisions, particularly the late notice bar on coverage.

Late Notice

Management liability policies are claims-made policies, meaning that a claim has to be noticed to the carrier within the policy dates or within a limited amount of time afterward. This noticing window ends anywhere from 30 to 90 days after the expiration of the policy.

If a company does not notice within the prescribed timeframe, the carrier will reject the claim. If your notice window ends on March 30, and you don’t get around to noticing a lingering claim until April 15, you will be out of luck. It’s nearly impossible to have an insurance carrier recognize a claim that falls outside the notice window.

Let’s go back to our example from earlier. Let’s say on December 15, you received a claim: that angry email from Jill. It’s January 1, and your company just renewed its policy. What do you do with Jill’s claim? You would notice Jill’s claim to the previous policy because it’s still within the notice window, and the claim was first made in that previous policy period.

But imagine that your company receives Jill’s claim in December but does not notice until May. The previous policy window is unavailable because late notice is an absolute bar on coverage. Don’t unnecessarily limit your options.

Pre-Notice Costs

Any costs incurred prior to notice—pre-notice costs—will not be credited toward your deductible or reimbursed.

Let’s revisit the scenario from above.

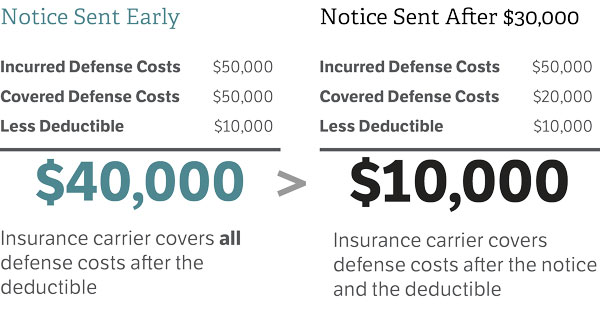

Your company spends $50,000 in defense costs defending Jill’s claim on a policy with a $10,000 deductible. Unfortunately, you don’t notice to that policy until the company has already spent $30,000. Here, the carrier will only credit $20,000 to insurance, of which $10,000 will be credited toward the deductible.

At the conclusion of the claim, the insurance carrier will only pay out $10,000 to your company, as opposed to $40,000. The lesson is straightforward: notice, and notice early.

Counsel Considerations

Some management liability policies are duty to defend, meaning that the carrier has the right to appoint counsel. Too often, clients reach out to us to notice a matter, and discover that their duty to defend policy requires that they switch counsel midstream or risk the carrier declining coverage. This can disrupt existing relationships and cause unnecessary delay.

Similarly, other policies may have panel counsel requirements (in which insurers require the company to select from a list of approved counsel) or rate caps (in which insurers cap the amount per hour paid to counsel). Reaching out to discuss counsel implications will save headaches—and relationships—down the road.

Keeping Your Renewal Fresh

Even where you are unsure whether something even constitutes a claim, it’s worth discussing the issue with a claims specialist. Claims-made policies allow you to lock in a potential claim to the current policy period by “noticing a circumstance” under certain conditions.

When a claim is noticed, and an insurer pays out, the aggregate limit of liability available on that policy is consumed. The aggregate limit of liability is the total amount of money that an insurer will pay out on that policy.

By noticing a circumstance to the current policy period, a company can make sure that any limits that are consumed are for the earliest policy period available, and that later policies have their full limit of liability available.

Contact Your Broker

Whether it’s avoiding late notice and awkward conversations or getting your money’s worth, notice and notice early. Your broker and claims specialist are in the best position to walk you through the policy, its processes and effects. When you receive that demand, ask yourself: should I contact my broker?

The answer is definitely yes.

Author

Table of Contents