Blog

Life Sciences Insurance: Navigating Risk from Lab to IPO

In our new webinar series, Risk Management for Your Life Sciences Company, we discuss the insurance and risk management milestones life science companies should prepare for as they move from early funding through clinical trials, IPO, and commercialization.

In the first webinar, we focused on life sciences insurance for biotech executives. You'll learn what coverages matter most at each stage, common pitfalls to avoid, and how to build a scalable insurance strategy that supports growth.

View the full webinar below or read on for an overview.

What Insurance Does a Life Science Company Need?

Our clients often ask about the insurance requirements they must meet. Understandably, they want to ensure they are neither overbuying nor underbuying and how to maintain the appropriate level of coverage.

Workers' compensation (WC) insurance is the only coverage the law requires, and we recommend you have this insurance in place within 30 days of hiring your first employee to avoid state fines.

Your next focus should be on insurance coverage for your incubator or lab space. A commercial package typically includes:

- Coverage for furniture, fixtures, or equipment you own or have in your care, custody, and control

- General liability (GL), including coverage for any injury to third parties on your premises

- Hired and non-owned auto liability, which covers employees driving their own cars on company business

An optional coverage is foreign liability if you have a subsidiary or foreign travel. Another option is employers’ liability, a subset of WC insurance. Umbrella coverage, which is required in most contracts, provides excess limits over the liability policies. It does not sit over commercial general liability.

Here is a key way life sciences insurance differs from insurance for other companies. For most companies, product liability coverage is included in their GL coverage. However, for life science companies, product liability is typically carved out to cover any injury to a third party that may occur during clinical trials or later through use of their product.

For clinical trials in the US, product liability coverage should be in place before the first patient is screened. If you are conducting foreign clinical trials, ask your broker about a master global policy that can serve as an umbrella over local policies.

The earlier we have this discussion with our clients, the sooner we can review our clinical trial database to ensure everything goes smoothly.

What About Supply Chain Coverage?

Another important consideration for a life science company is cargo and stock throughput insurance, also known as supply chain coverage. If your company is at the clinical stage, this policy can cover your inventory as it is stored at third-party locations and in transit anywhere in the world.

The application for this insurance is complex, so we like to sit down with our clients to discuss their specific needs. Here are some of the questions we consider.

- Where are the locations?

- Who are the vendors?

- What values are being shipped, and where are they going?

- What is the potential loss to the company if there is product damage?

- How would a product loss impact your operations?

Read: Cargo Stock Throughput Insurance for Life Science Companies

Another early discussion we have concerns cyber exposure. Cyber liability insurance covers events such as email takeovers, privacy breaches, and ransomware incidents. It is an inexpensive and less time-consuming application process for early-stage companies, so we recommend going through a thoughtful process with your broker.

What Is a Management Liability Package?

For a private company, a management liability package includes:

- Directors and officers (D&O) insurance

- Employment practices liability (claims for discrimination, wrongful termination, and harassment)

- Fiduciary liability

- Crime (theft of money by employees)

A professional employer organization (PEO) typically covers WC, employment practices liability (EPL), and fiduciary liability insurance. EPL insurance is the most frequent source of claims for private companies. The claims may not be as severe as D&O claims for a public company, but they are the most frequently triggered. As a result, some of our clients place a standalone EPL policy in addition to the EPL coverage they have through their PEO.

Register for the Risk Management for Your Life Sciences Company webinar series:

- Navigating Risk from Lab to IPO: A Guide to Insurance for Biotech Executives [On Demand]

- AI In Real Life (Science): Exploring Real World Risks and Implications of Using AI in the Life Sciences Industry [July 22 at 10 am PT | 1 pm ET]

- International Clinical Trials Country Requirements: What You Need To Know [August 12, 10am PT | 1pm ET]

The Importance of D&O Insurance for Life Science Companies

In its start-up or early stages, a life science company understandably wants to focus funds on its lab. Many companies plan to purchase D&O insurance later in the process when they are trying to attract new directors or obtain venture funding.

However, we encourage our clients to consider emerging risks early in the process. Buying this coverage when times are good helps you be ready for the unexpected. For example, if you are on the verge of bankruptcy, it can be almost impossible to obtain D&O insurance.

Additionally, if you are on an IPO path, setting up good private company insurance can make the IPO insurance less expensive. We think of insurance as risk transfer, or balance sheet protection. You're protecting the company from its obligation to indemnify the directors and officers.

If your company has international exposure, you'll want to work with companies that have a global footprint that matches your own and the capabilities to provide policies in those regions.

When you buy new insurance, you may be required to sign a warranty statement, which says that you know of nothing that could give rise to a claim. The earlier you sign this statement, the better, because you don't yet know your trial results. Being thoughtful about how and when you make representations is an important part of the D&O process.

Moving Through the IPO Timeline

As experts in life science company insurance, our process at Woodruff Sawyer is designed to jump in at key points to make things easier for you during this busy time.

We know that insurance is a big-ticket item from a budget perspective, so our goal is to provide you with options. If we receive word about a month before the earliest possible IPO date, we'll put a program in place for the first day of trading.

We help you determine how much insurance to buy, understanding that during the IPO, your valuation might change your estimated market cap. After the IPO, we can help with insider trading training.

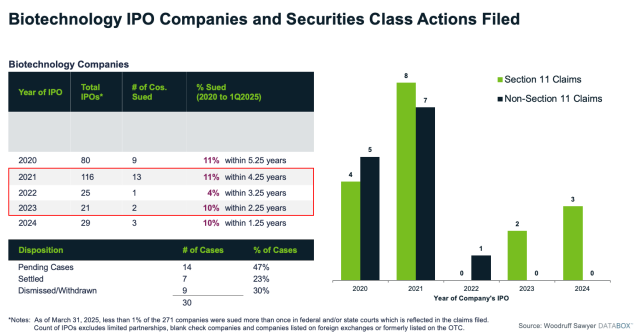

The first few years following an IPO are the riskiest, and it's really not until you're through that three-year window that your risk for Section 11 decreases. You can also get a non-Section 11 suit.

IPO insurance can be expensive, but the good news is that the insurance market is competitive right now. That means you can obtain competitive rates and retention with the right broker.

At Woodruff Sawyer, we use our research and experience in this arena to understand your exposure. We have tools to help clients and boards make informed decisions about how much insurance to buy, including our proprietary D&O litigation database, Databox™

For life science companies, success takes a village. As your broker, we work alongside your outside counsel to help you with policies and procedures, and we provide educational workshops for your board or executive team.

Learn more about insurance for biotech companies by viewing the entire webinar here. You can also register for other webinars in this series.

Authors

Table of Contents