Blog

Large Derivative Suit Settlements and Your Side A D&O Insurance

“How much Side A D&O insurance do I need” is a tricky question for directors and officers these days. It’s also a practical question worth exploring given the increasing frequency of large derivative settlements.

This article will review the scope of coverage for Side A D&O insurance, address the question of limits, and also discuss recent derivative suit settlements in five key categories. The article will also highlight considerations to keep in mind should a claim arise.

What Is Side A Insurance?

“Side A” D&O insurance is a shorthand reference to the part of a D&O insurance contract that responds on behalf of directors and officers when something is insurable but not indemnifiable.

Watch the Whiteboard Breakdown:

Standalone Side A, Difference in Conditions Policies

Companies can purchase Side A insurance as a part of their regular D&O insurance program (often referred to as an ABC D&O insurance), as an add-on to an ABC program, or just by itself.

Of course, to understand why and how much Side A insurance to purchase, it helps to understand what are examples of things that are insurable but not indemnifiable.

Corporate bankruptcy is the obvious example. When a company is bankrupt, it can no longer indemnify its directors and officers since the company is out of money. That doesn’t mean, however, that directors and officers will not be sued. That is a great time to have Side A D&O insurance. Look no further than the bankruptcy of Silicon Valley Bank for an example of the importance of Side A D&O insurance.

The other time Side A D&O insurance becomes especially important is the settlement of breach of fiduciary duty suits brought derivatively, depending on the state in which a company is incorporated. These suits can be brought against directors and against officers.

In a recent article, my colleague Walker Newell and I noted that some states allow a corporate entity to indemnify the settlements of derivative suits.

As it happens, however, companies incorporated in Delaware are typically not able to pay these settlements as a matter of corporate law. Side A D&O insurance can step into the breach.

(It should be noted that Delaware corporations can set up and use a captive instead of insurance to handle Side A-type claims. Most companies, however, handle the exposure by purchasing Side A insurance.)

Large Dollar Settlements on the Rise

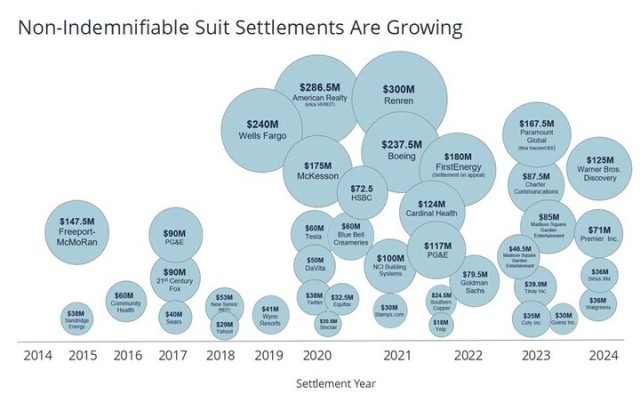

Large dollar settlements related to derivative suits seem to be on the rise. The graphic below visually confirms that, compared to a decade ago, we are seeing more large dollar derivative suit settlements.

Unfortunately, and unlike with securities class action lawsuits, there are not clear, externally observable factors that can help determine a reasonable range of potential settlements before a derivative claim actually arises.

Specifically, with securities class action lawsuits, plaintiff recoveries are highly correlated to a company's market capitalization, the number of shares in the public float, and the size of a stock drop. There are no similar externally observable factors highly correlated to settlements for derivative suits. This is partially because, while the number of large dollar claims is on the rise, there still is not a lot of data on this phenomenon.

While it is observable that larger, better known public companies seem to be ones hit with high-dollar derivative suit settlements, it is useful—and important—to remember that not all derivative suits lead to high dollar (or even any dollar) settlements.

Indeed, data from Woodruff Sawyer's D&O Databox suggests that about two-thirds of all securities class action suits will also have an accompanying derivative suit. However, the overwhelming majority of these cases will settle for relatively small amounts of plaintiff attorney fees (something a company can pay itself if insurance is not available) and promises to make corporate governance or other changes (sometimes referred to as "corporate therapeutics").

That said, a review of large dollar derivative suit settlements reveals that there are five categories of suits in which a large settlement may be more likely.

Five Types of Derivative Suits That Lead to Big Dollar Settlements

| Board-Level Conflicts of Interest | Traditionally the main fact pattern resulting in large settlements. M&A cases are common here. |

| Massive Fraud | It is unusual for SCA-related derivative suits to result in large settlements. Massive fraud cases may be an emerging exception. |

| M&A Diligence | Different from M&A conflict of interest cases, this category relates to discovery in the course of diligence that leads to a diminished sale price. |

| Egregious Behavior Directed at Consumers or Employees | Headline-grabbing, bad behavior directed at individuals. |

| Health and Human Safety | Death or other physical harm. |

Source: Woodruff Sawyer DATABOXTM

1. Board-Level Conflicts of Interest

Traditionally, this has been the main type of derivative suit that has resulted in large settlements. Merger and acquisition cases are common here. Examples of these types of suits include Paramount Global (CBS-Viacom merger) and Tesla (Solar City merger).

Paramount Global

Defendants settled for $167.5 million for a suit that alleged board conflicts of interest during the CBS-Viacom merger that was orchestrated by its controlling shareholder.

Tesla

Defendants settled for $60 million in a case that challenged the company's acquisition of solar panel installer SolarCity—a company that Tesla CEO Elon Musk founded with his cousins. The complaint alleged that the deal inappropriately benefited Musk, his cousins, and Tesla directors who owned stakes in SolarCity.

Remember: Delaware's view of what constitutes director independence continues to narrow. Marchand v Barnhill et. al. provides useful instruction when it comes to director independence and the view of the Delaware Court of Chancery, the premier business court in the United States, as does the Court of Chancery’s ruling concerning the compensation package of Tesla’s Elon Musk.

2. Massive Fraud

Exceptionally large frauds make it easier for the plaintiffs’ bar to argue that the directors were not executing their fiduciary duties with an appropriate level of diligence. Examples where large frauds lead to large derivative suit settlements include American Realty and Goldman Sachs.

American Realty Capital Properties

As one of the largest settlements in a derivative suit to date, American Realty defendants settled for nearly $287 million for alleged intentional fraud to deceive the market and artificially inflate prices. The related securities class action lawsuit, which included allegations of intentional fraud in the company's financial statements, settled for more than $1 billion. The fraud was so egregious that the company's former CFO was sentenced to jail.

Goldman Sachs

The $79.5 million settlement related to oversight failures of Malaysia's 1MDB sovereign wealth fund involved the misappropriation of $2.7 billion and the payment of more than $1.6 billion in bribes to government officials in Malaysia and Abu Dhabi, in violation of the United States’ Foreign Corrupt Practices Act. The Goldman Sachs managing directors involved in the scheme went to jail.

3. M&A Diligence

This type of derivative suit relates to discovery of facts in the course of an acquiror's due diligence that leads to a diminished sale price, or the discovery of facts after an acquisition that make it clear that the acquiror paid too much. Examples include Freeport-McMoRan and Altria.

Freeport-McMoRan

While this $138 million settlement was primarily a suit that concerned conflicts of interest, an important and difficult element of the case was alleged errors by Credit Suisse in the financial modeling it did for the deal.

Altria

Altria Group Inc. settled for $117 million when its investment in JUUL turned into a disaster after the company was accused of marketing tobacco products to teenagers.

4. Egregious Behavior Directed at Consumers or Employees

These types of suits involve headline-grabbing bad behavior that impacts employees or individual consumers. Examples include Google, First Energy, and Wells Fargo.

Google’s $310 million settlement related to rectifying myriad sexual misconduct (#MeToo) and sex discrimination issues at the company.

First Energy

First Energy settled for $180 million for a bribery and racketeering scheme involving Ohio’s house speaker and $60 million in bribes paid by First Energy, leading to higher energy bills for consumers.

Wells Fargo

Defendants settled for a whopping $240 million in a lawsuit that alleged Wells Fargo directors breached their fiduciary duties for failing to stop bank employees from creating fake accounts on behalf of customers without their knowledge to boost sales figures and qualify for bonuses.

5. Health and Human Safety

This type of derivative suit involves death or other physical harm to members of the public. Examples include Boeing, McKesson, and PG&E.

Boeing

Defendants settled for $237.5 million for inadequate safety oversight of its 737 Max 8 jets that led to more than 300 deaths.

McKesson Corp.

Defendants settled for $175 million in a derivative suit that claimed the board didn't have adequate oversight and ignored multiple red flags over suspicious opioid distribution, ultimately fueling the nation's opioid crisis.

PG&E Co.

Defendants’ $90 million settlement concerned oversight failures that led to the natural gas pipeline explosion and fire that killed eight people, injured many more, and destroyed 38 homes. The suit alleged that directors and officers of the company failed to maintain the safety of the pipeline or keep accurate records about it.

Note that derivative suit litigation related to risk oversight, sometimes referred to as a Caremark claim, may be particularly susceptible to increased activity in the future. This is due to a series of cases that started with the 2019 Delaware Supreme Court Marchand v. Barnhill decision (also known as the "Bluebell Ice Cream" case).

In some hopeful news for directors, however, the recent Walgreens derivative case in the category of health and human safety shows that the fiduciary duty of oversight doesn’t mean that you have to get everything right, only that you tried.

Sizing Your Company's Side A D&O Insurance Tower

A first step to determining how large a company's Side A-only insurance program should be is a review of the big dollar cases, with an eye to the categories that are relevant to your company. You will also want to keep an eye on this rapidly evolving area of litigation given that it is clearly in focus for the plaintiffs’ bar.

The cases described in this article demonstrate that a company's size matters, as does the nature of the allegations brought against it.

Another observation, something that the Walgreens case underscores, is that the risk in some of these suits can be mitigated with good corporate governance. While there is no magic pill against fraud or other types of corporate bad behavior, a review of the cases in this article demonstrates that boards that fail to provide appropriate oversight, and/or fail to document their oversight well, are more likely to be hit with big dollar settlements.

For this reason, as important as having an appropriately sized Side A insurance program is, good corporate governance is clearly just as important. Think of corporate governance as the fire sprinklers of D&O risk.

Once the Claim Hits: Preserving Limits

Mike Tyson’s observation that “[e]veryone has a plan until they get punched in the face” certainly applies to D&O litigation.

When things go off the rails, there can be a lot of different types of litigation that hits all at once. In addition, directors and officers may decide that they want separate counsel. When this is the case, a company’s large D&O insurance tower might not look as large as it did before there was any litigation.

For solvent companies, the good news is that defense costs can be paid by the company, and they should be paid quickly pursuant to a defendant’s personal indemnification agreement.

Companies that purchased classic “ABC” D&O insurance may have planned to use that insurance to offset these expenses. On the other hand, if the situation is concerning enough, directors and officers may want to preserve the limit for Side A use if needed.

Here’s an example. Imagine a public company purchases $50 million of ABC insurance and an additional $10 million of Side A DIC insurance.

A company with this D&O insurance program has $60 million of D&O insurance, of which $50 million can be used to reimburse the corporation for its indemnification obligations (Side B) or to defend and settle securities claims against the corporate entity (Side C). $10 million of this program has been segregated for Side A-only use.

If the situation is concerning enough, individual directors and officers may want to refrain from the usual practice of asking the carrier to reimburse costs of defense and pay indemnifiable settlements as each are incurred. Instead, these concerned individuals may instruct carriers to hold the entire $60 million in reserve in case more than $10 million of Side A insurance is needed to settle the derivative suit claim.

As a practical matter, this means the company will be paying all defense bills and the indemnifiable settlement costs for individuals, as well as settlements for the company, out of its own coffers, as these things arise. And it will do so until the company’s directors and officers have more visibility into the actual size of a potential derivative settlement.

Note: There are some traps for the unwary with this strategy, so it is important to work closely with your trusted insurance advisor in this sort of situation.

While losing the time value of this money may be unfortunate for a company, it’s a whole lot better than using up insurance limits only to find out that the derivative suit settlement is larger than whatever is left of the Side A insurance. Such a situation is truly a catastrophe because, if Side A insurance isn’t available, the implicated directors and officers will have to pay out of their own pockets.

Author

Table of Contents