Blog

Derivative Suit Exposure: More Art Than Science

Derivative suits are a topic of discussion that continues to challenge directors, officers, and insurers alike.

The issue is particularly fraught for individual directors and officers because Delaware-incorporated companies (and many other states as well) cannot pay for derivative suit settlements.

This puts additional pressure on calibrating the amount of D&O insurance these companies purchase, lest individuals find themselves on the hook for these settlements.

Unlike securities class actions, which are more predictable in both frequency and severity, derivative suits remain difficult to model and sometimes harder to anticipate.

An often-suggested approach is: Can we estimate our company’s potential derivative suit exposure by looking at the size of a related securities class action settlement?

It is a good question given that it can be the case that the same underlying conduct can animate securities class action and derivative suits brought against the same company. So, wouldn’t the financial impact be proportionally related?

Sadly, the data doesn’t support the theory.

Why a Derivative-to-Securities Settlement Ratio Doesn’t Work

It is understandable that companies want a reliable benchmark for derivative settlements when obtaining D&O coverage, particularly given that large-dollar derivative suit payouts are on the rise.

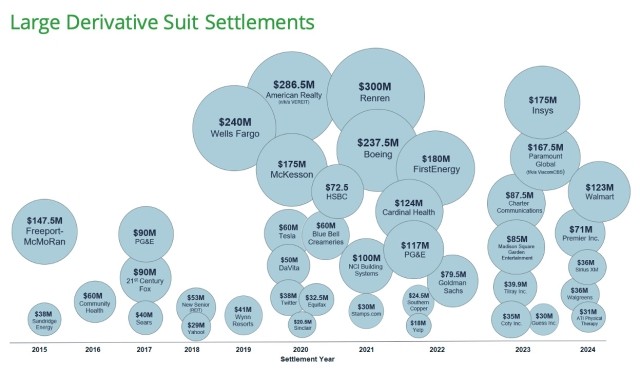

Mining the D&O DataboxTM, Woodruff Sawyer’s proprietary database of D&O-related litigation, reveals that we have seen more large derivative suit settlements in the last decade than in the prior decade. The same is true when you compare the last five years to the previous five years.

If it were reliable, a simple ratio of derivative suit settlements to securities class action settlements would be supremely helpful from a modeling perspective. Unfortunately, it is not that easy.

This is because the data is surprisingly limited, and what we have shows that derivative suit settlements do not follow predictable patterns.

Unlike securities class actions, where settlement values tend to track more closely with market cap and stock drop severity, derivative suits lack a comparable baseline.

While about two-thirds of securities class actions are accompanied by a derivative suit, the reality is that most of these claims resolve for little more than corporate governance therapeutics and plaintiffs’ fees. The plaintiffs’ fees can be paid by the company if insurance does not apply.

Stock Drop Not Required

Consider too that not every corporate scandal that yields a derivative suit necessarily moves a company’s stock price.

If the market does not react with a stock drop, there is not a good securities class action lawsuit for plaintiff shareholders to file. But that does not mean companies and their leadership are off the hook.

A prime example of this is the options backdating scandal of the early 2000s. A shocking number of public companies were caught up in it. Yet only a subset experienced a stock drop significant enough to trigger a securities class action.

Kevin LaCroix over at D&O Diary kept a running tally: 38 class actions but 166 derivative lawsuits. Most of those resulted in settlements.

What the Data Actually Show

An internal review of all large derivative suit settlements from the last decade, 2015 through 2024, included 41 cases. Of these, only 19 had a corresponding securities class action tied to a stock drop.

Of those 19 cases, one was dismissed, 13 have settled, and five remain pending—leaving us with a very small set of completed cases from which to draw conclusions.

And yet, even within that narrow pool, consistency is hard to come by. Where both the derivative and securities class actions resulted in settlements, the ratios varied dramatically.

In some cases, the derivative settlement amounted to just 5% of the securities settlement. In others, it exceeded 100%, reaching as high as 174%.

One extreme outlier clocked in at nearly 6000%, a clear reminder of just how unpredictable these cases can be.

Given that spread, someone might be tempted to suggest a rule of thumb—say, that derivative settlements generally land at around 50% of the securities settlement. But as we see, that is really just imputing a pattern without much evidence for it.

What Directors and Officers Can Do

In the absence of a reliable way to forecast severity, directors and officers are best served by understanding their risk profile and ensuring their D&O program reflects these realities.

For example, in our research we found the following factors have historically led to substantial settlements in litigation:

- Board-level conflicts of interest: Cases where directors may have personal interests conflicting with their fiduciary duties.

- M&A due diligence failures: Situations where inadequate due diligence in mergers and acquisitions leads to unforeseen liabilities.

- Egregious behavior affecting consumers or employees: Instances involving significant misconduct impacting stakeholders, like systemic unethical practices.

- Massive fraud: Cases involving large-scale fraudulent activities.

- Oversight failures: Situations where the board fails to act on known risks, leading to substantial harm.

While these categories may apply broadly, some industries are more likely than others to surface these risks in a way that leads to litigation.

For example, highly regulated sectors such as financial services, pharma, and biotech carry heightened exposure.

With this context in mind, constructing your D&O program becomes a question of matching coverage to a company’s particular risk profile and risk tolerance.

Pay special attention to Side A insurance, which responds when indemnification is unavailable, such as in derivative settlements brought against companies incorporated in Delaware or California.

Learn more about Side A Insurance:

In the end, there is no magic number for derivative suit exposure. These risks remain among the least objectively measurable for boards.

However, that does not mean directors and officers are defenseless.

A well-structured insurance program paired with proactive corporate governance (the “fire sprinklers” of D&O risk, and a topic on which I and some of my colleagues provide complimentary client-board of director training) can go a long way in protecting an organization, its directors, and officers in litigation.

Author

Table of Contents