Blog

D&O Looking Ahead Webinar: Experts Discuss Risk, Rates, and Retentions

We recently released our 10th annual D&O Looking Ahead Guide, created to help you anticipate and prepare for your next directors and officers (D&O) insurance renewal. In it, we provide a market update and cover hot topics and expert insights.

On September 28, our D&O experts discussed the findings from the guide in a Looking Ahead webinar. They explained the market trends and provided the context behind the data. In addition, attendees were able to ask panelists their burning questions about D&O trends and forecasts.

Here's what we discussed in the webinar:

- The current state of the D&O insurance market and what we expect to see in 2023

- Pricing trends, including what's causing them and which industries are seeing the biggest pricing reductions

- "Hot Topics" in D&O litigation, including securities class action suit frequency and severity

- What insurance underwriters have to say about the current D&O landscape via our annual Underwriters Weigh In™ survey

Some of our D&O experts chatted about the general mood of the market, revealing their optimism about the D&O insurance marketplace. For the first time in years, clients are starting to see improvements in their D&O rates. Some are even finding (good!) surprises in their budgets.

Underwriters Get Candid About D&O Insurance Trends

During the webinar, our experts talk about the results of our Underwriters Weigh In™ survey. The annual survey gives you a look at how underwriters view the market, including their candid commentary on various topics.

More than three-fourths (77%) of underwriters think D&O risk is increasing, but the good news is this is the lowest number in the last five years. Underwriters cited the bear market, the "terrifying" derivative landscape, and new regulatory exposures as reasons for their pessimism.

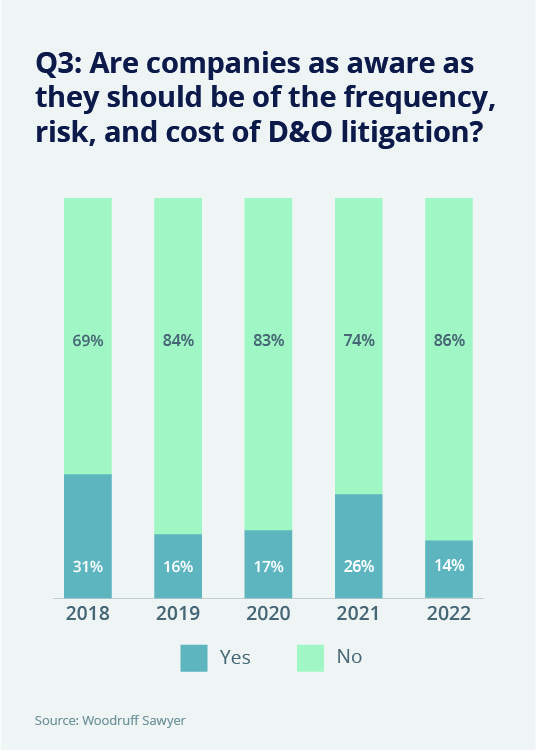

D&O insurance underwriters are also skeptical that companies can accurately calculate their own risk, with 86% of underwriters saying that companies aren't as aware of the frequency, risk, and cost of litigation as they should be.

"Everyone assumes they will never get sued," one underwriter explained.

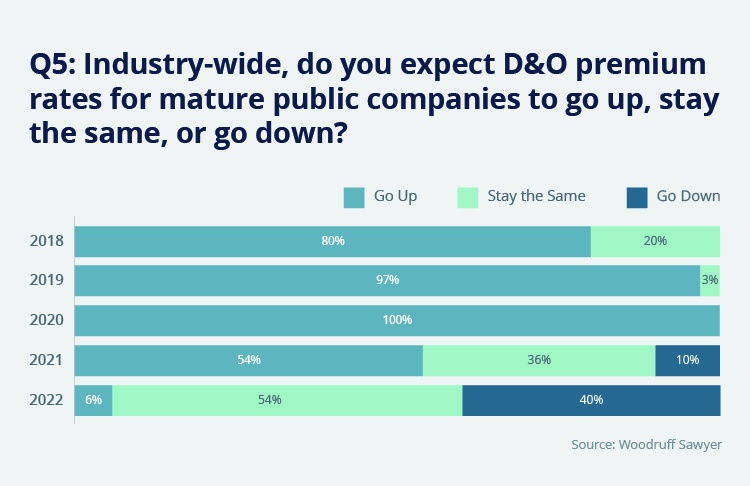

We asked underwriters how they expect D&O rates for mature public companies to change. They report a soft market, with 94% of respondents stating they believed rates would go down or stay the same, a jump from 46% last year.

"The market is still underpriced in this sector, but new market entrants will continue to keep pricing flat to down," an underwriter commented.

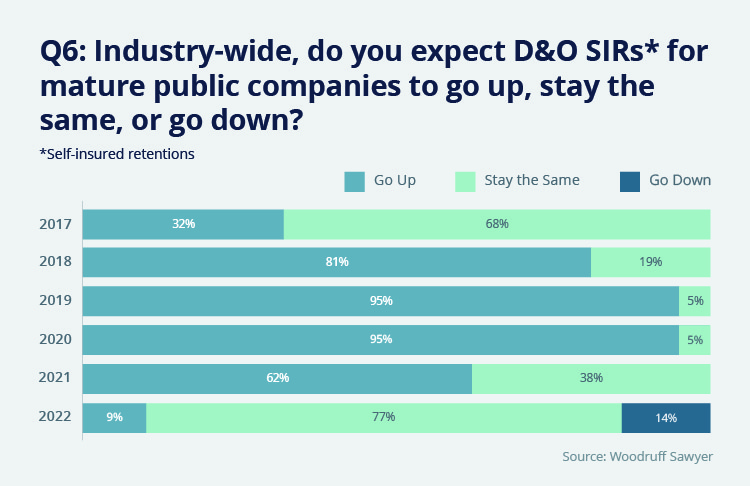

We also asked how they expected self-insured retentions (SIRs) for mature public companies to change. The vast majority (91%) expect them to stay the same or go down. We believe that while carriers may be reluctant to reduce SIRs, competition is making it impossible for them to resist the downward pressure. This is the first time in six years that any underwriters indicated they expect SIRs to go down.

Learn More

Gain access to more insights by downloading the Guide and/or watching the webinar. The 2023 edition of the D&O Looking Ahead Guide covers not just underwriter concerns, but also:

- D&O pricing trends from Woodruff Sawyer and the Council of Insurance Agents & Brokers (CIAB)

- Hot topics that directors and officers need to know about special purpose acquisition companies (SPACs); environmental, social, and corporate governance (ESG); international companies; and much more

- Expert insights on how to succeed at your next D&O insurance renewal.

Get instant access to the full interactive Guide below or download the PDF.

Author

Table of Contents