Guide

D&O Insurance for Foreign IPOs: A 2025 Step-by-Step Guide

Foreign companies eyeing a US listing often spend months perfecting financial disclosures and engaging with bankers, yet they sometimes underestimate a critical piece of the process: their directors and officers (D&O) insurance strategy.

When you’re a foreign company entering the US markets, preparation of your director and officer protection strategy can’t wait until the final days before your stock begins trading.

A strategic D&O insurance process, if started early, can do more than merely transfer risk; it can signal to insurance underwriters and potential independent board members that your company understands what it means to be a listed company on a US stock market.

Woodruff Sawyer’s annual Guide to D&O Insurance for Foreign IPOs and Direct Listings offers helpful guidance for foreign filers going public on a US exchange.

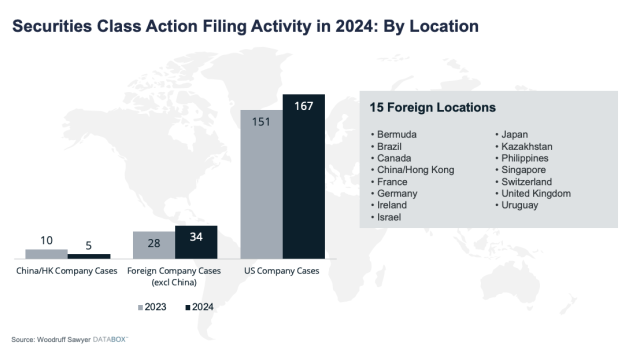

Nearly 1 in 5 Securities Class Action Suits are Targeted Against Foreign Issuers

In 2024, 19% of all securities class actions were filed against companies headquartered outside the US across 15 different countries, including China, Ireland, Brazil, and Japan. This is according to Woodruff Sawyer’s D&O Databox 2024 Year-End Report.

While filings against China-based companies declined from 10 in 2023 to 5 in 2024, securities suits involving other foreign issuers rose modestly from 28 in 2023 to 34 in 2024.

Household names like AstraZeneca, BioNTech, and Toyota all faced securities suits last year, proving that even well-established foreign issuers are not immune.

It’s also worth noting that foreign-headquartered companies contributed to 2024’s record-breaking year for settlements.

One of the largest was Alibaba, which paid $433.5 million to resolve a long-running securities suit originally filed in 2020.

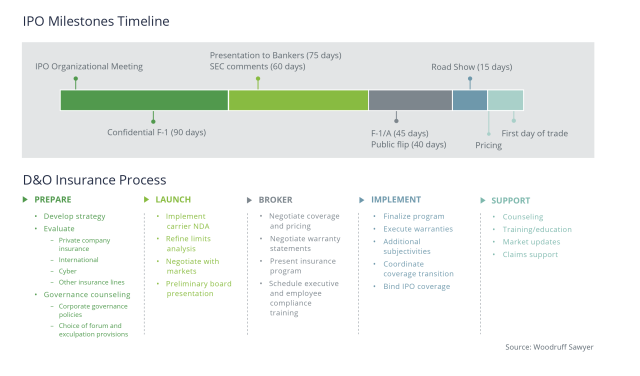

The D&O Insurance Timeline to Protect Leadership on Day 1

When preparing to go public, the timing of your D&O insurance placement is everything.

For foreign filers, the private-to-public journey brings layers of complexity that their domestic peers may never encounter: cross-border legal exposures, jurisdictional requirements, and coverage that differs from local market norms.

Below, I’ll discuss four key moments in the going-public timeline when D&O insurance planning should be in lockstep with your broader IPO strategy.

Prepare Early to Build the Foundation (90 to 60 Days Before Listing)

Long before your stock begins trading, you’ll want to begin crafting your D&O strategy.

That includes discussions around any special or unusual risk exposure, your philosophy on risk transfer versus retaining risk, and other important considerations.

Many companies based outside the US assume their current D&O policy provided by their insurance broker will provide coverage for being listed on a US exchange. That is actually almost never true.

What you need is insurance placed by a broker that specializes in D&O insurance for foreign filers listing on a US exchange. A specialized broker can ensure you have the right coverage in place—coverage that will actually respond in a robust way should you find yourself the target of a US-style securities class action lawsuit.

The Launch Focuses on Underwriting Readiness and Internal Alignment (60 to 30 Days Out from Listing)

At this stage, companies that are confidentially filing F-1 (or S-1) registration statements with the SEC should ensure their broker is coordinating non-disclosure agreements (NDAs) with potential insurance carriers before sharing any confidential registration statement materials.

It’s also time to analyze D&O limits—and not just by benchmarking peers. A tailored approach that factors in offering size, industry sector, and litigation history will serve you far better.

A sophisticated broker that has experience placing D&O insurance for foreign filers should be able to show you objective exposure data as part of the process.

In parallel, your broker should be helping to brief your board of directors on the scope of their enhanced potential liability. Even seasoned directors may not be familiar with the nuances of US securities litigation or key D&O coverages.

The Broker Phase Negotiates Pricing and Terms (30 to 10 Days from Listing)

At this point, your broker shifts from data gathering to execution, where they negotiate both pricing and terms.

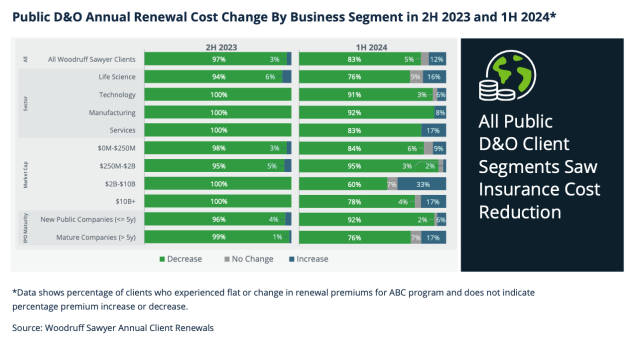

While many companies continue to benefit from improved terms compared to the peak of the hard market, pricing is beginning to stabilize. And for new public companies, pricing is already starting to trend upward. (See our 2025 D&O Looking Ahead Guide for more on this.)

Even the best D&O insurance program won’t inspire confidence if your board doesn’t understand it. That’s why this phase should include a board-level presentation of the proposed D&O structure, highlighting how the policy protects leadership as well as the company.

Finally, don’t overlook the need to prepare employees for life as a public company.

Compliance training—ideally scheduled just before or just after going public—can cover topics like insider trading, disclosure controls, and cyber risk. Your broker, outside counsel—or both—can lead this training.

The Implementation Phase Binds Coverage (Just Before Going Public)

By the time your registration statement is effective, the D&O program should be ready to bind. You’ll want to ensure your D&O insurance is firmly in place before the stock begins trading.

Having said that, this final stage can be deceptively complex.

This is where you may need to execute warranties—certifications that directors and officers know of no issues likely to give rise to a claim. Another key step is addressing all carrier-imposed subjectivities, which are the conditions that must be satisfied before coverage becomes effective.

Finally, once your registration statement is effective and your IPO is priced, it’s time to bind the coverage.

Dive Deeper into the 2025 Guide

The full 2025 Guide to D&O Insurance for Foreign IPOs and Direct Listings walks through every aspect of the process, from strategy development to post-pricing support.

Inside, you’ll find the following and more:

- A clickable timeline that breaks down what to do—and when.

- Practical insights on federal forum provisions and why more foreign issuers are adopting them.

- What to know about roadshow coverage and failed IPO endorsements.

- Guidance on structuring your program to avoid local policy pitfalls.

- How to brief your board, satisfy underwriters, and avoid last-minute coverage gaps.

Get instant access to the Guide now.

Authors

Table of Contents