Blog

An Employer’s Guide to Long-Term Care Insurance

This article describes long-term care coverage, its importance, and answers common questions about this benefit.

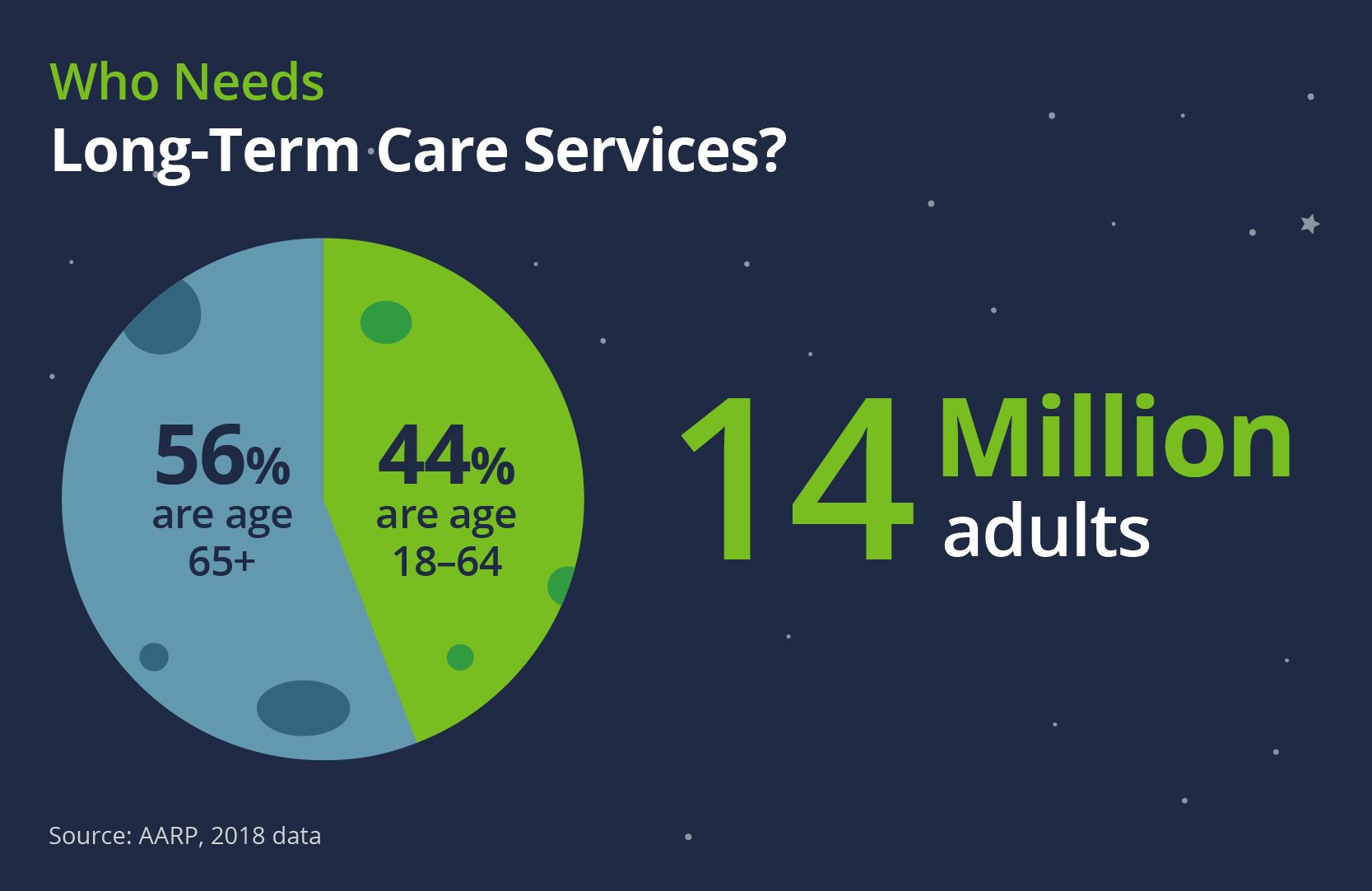

Research shows that 70% of Americans may need long-term care at some point in their lives. Although that need is greatest for older adults, anyone at any age may suffer an accident or illness that results in the need for long-term care services and support. In fact, a report published by the AARP Public Policy Institute reveals that two in five adults with this need are younger than age 65.

The unfortunate reality is that most Americans cannot afford the high cost of long-term care. Long-term care—sometimes called custodial care—is typically not covered by traditional health insurance or Medicare plans. As a result, your employees may have to drain their savings and retirement funds and possibly enlist family members’ help to pay for their care.

Many states are considering long-term care programs in response to this need, made more acute by an aging population. Following Washington’s lead, California, Michigan, Minnesota, and New York are actively looking at their own long-term care programs. Other states in the earlier stages of the process include Alaska, Colorado, Hawaii, Illinois, Maine, Missouri, Montana, North Carolina, Oregon, Pennsylvania, and Utah.

To help you prepare for legislation that may be headed your way, this article describes long-term care coverage and its importance, and answers some of the questions about this benefit.

| At-a-Glance Read time: 6 minutes |

||

|---|---|---|

What Is Long-Term Care Insurance?

Unlike traditional health insurance policies, long-term care insurance is for people who need ongoing help with basic daily tasks like bathing, dressing, or eating. It can help pay for personal and custodial care in the home, assisted living home, or other facility. It can also cover modifications that allow someone to remain in their own home.

The cost of a long-term care policy is based on:

- Policyholder's age at the time the policy is issued

- Maximum daily amount the policy will pay

- Maximum number of days/years the policy will pay

- Any optional benefits, such as increases in benefit amounts due to inflation

Frequently Asked Questions About Long-Term Care Insurance

We partnered with LTC Solutions, a long-term care insurance brokerage, to answer some of the most frequent questions concerning group policies that employers may offer.

Q: What types of policies are available? Are there plan design considerations employers or employees can make?

A: There are two types of products:

- Traditional long-term care

- Life insurance and a long-term care rider

Either product can be purchased as part of a group plan through an employer or individually.

Q: How much coverage is offered?

A: The benefit period depends on the terms of the contract. Common options are between two and six years or a lifetime unlimited policy.

Q: Who is eligible, and can employees sign up for this coverage at any age?

A: Generally, the employee and a spouse or domestic partner (18 and older) are eligible. The spouse/domestic partner may have to answer some questions, and their coverage is not guaranteed. The employee’s parents and minor children cannot be added to coverage.

It’s usually best to sign up at a younger age because rates are locked in at a lower price. An individual’s insurability (and need for care) can change at any time, and purchasing earlier ensures they can get coverage.

Q: Are most policies offered guaranteed issue?

A: When offered through a group plan, the carrier doesn’t require employees to fill out a medical form or go through underwriting. If they’re buying a policy after it was initially offered, the carrier may require them to fill out a health questionnaire. Employers should communicate to employees that the carrier may not offer guaranteed issue every year, or only offer guarantee issue to new hires. Individual plans are not offered guaranteed issue.

Q: What are premium rates based on?

A: Group rates are based on an individual’s age at issue and benefit amount. Individual rates are based on those factors as well as gender, with females paying more due to longer life expectancy. Additionally, tobacco status applies to some products.

Q: Who usually pays for the coverage?

A: It varies. There are three common approaches to payment:

- Offered on a voluntary basis, with employees paying premiums

- Employer pays for the policy—often, this is a base-level benefit for everyone, with employees able to pay for a more robust policy

- Employer pays for a percentage of the worker population to meet the participation requirement, which can range from 5% to 20% of the population. To meet this requirement, employers may opt to fund a base plan for employees who have been there for a certain number of years and offer it as a voluntary benefit for everyone else. If the participation requirement is not met, the carrier may decline to provide coverage.

Q: Do most group policies allow employees to take their policies with them (portability) if they leave the company?

A: Yes. Employees can continue paying the premiums on their own after they leave their employer. This allows them to pay the rates from their original issue age rather than forcing them to reapply at their current age or possibly not qualify due to newly developed health conditions. This is valuable coverage for someone who may have otherwise become uninsurable. There’s a small window in which they can fill out the paperwork to port coverage when leaving their employer, and inaction will result in a policy lapse. Employers must educate employees about the timeline and the implication of missing the window—potentially much higher rates if purchasing at an older age.

Why Is Long-Term Care Insurance Important?

Depending on the type of care needed, the average annual cost of long-term care services can range from tens of thousands to hundreds of thousands of dollars. In other words, paying out of pocket for long-term care can wipe out an individual’s savings.

Long-term care insurance can help provide a valuable financial safety net and invaluable peace of mind for your team members. Clear communication and employee education are vital in helping employees know how long-term care insurance can best benefit them. It’s also best to introduce LTC insurance off-cycle (not during open enrollment) to ensure it doesn’t get lost among other offerings—this usually results in higher participation.

If you have questions about long-term care insurance and how to roll out this offering to your employees, reach out to your Woodruff Sawyer representative.

Our Mission to More series offers guidance from leading specialists on what employees want and how employers can adapt to the new benefits universe. For more guidance on trends and emerging benefits solutions, sign up for Woodruff Sawyer’s Benefits newsletter, which includes all Mission to More articles.

Author

Table of Contents