Report

Q4 2023 Commercial Insurance Market: Moderating Property Premiums, Stable Casualty, and Record-High Ransomware Activity

Carrier competition continues downward pressure on rates in the D&O and cyber markets, while the market continues to be characterized by stabilization and moderation in Casualty and Property.

For the most part, commercial insurance pricing trends in the fourth quarter followed the same pattern buyers experienced throughout most of 2023.

Carrier competition continues to put downward pressure on rates in the directors and officers (D&O) and cyber markets, although increased cyber claims may soon change the direction of pricing. The casualty market remains stable, with workers’ compensation remaining profitable. Property rates are moderating, but war in the Middle East may lead to limited capacity for insureds with exposures in the region.

In this Q4 2023 Commercial Lines Insurance Market Update, we review insurance rates and pricing trends in the D&O, cyber, casualty, and property segments. Read on for a summary of our key insights or download the full report below.

D&O Market: Decreasing Premiums Expected to Continue

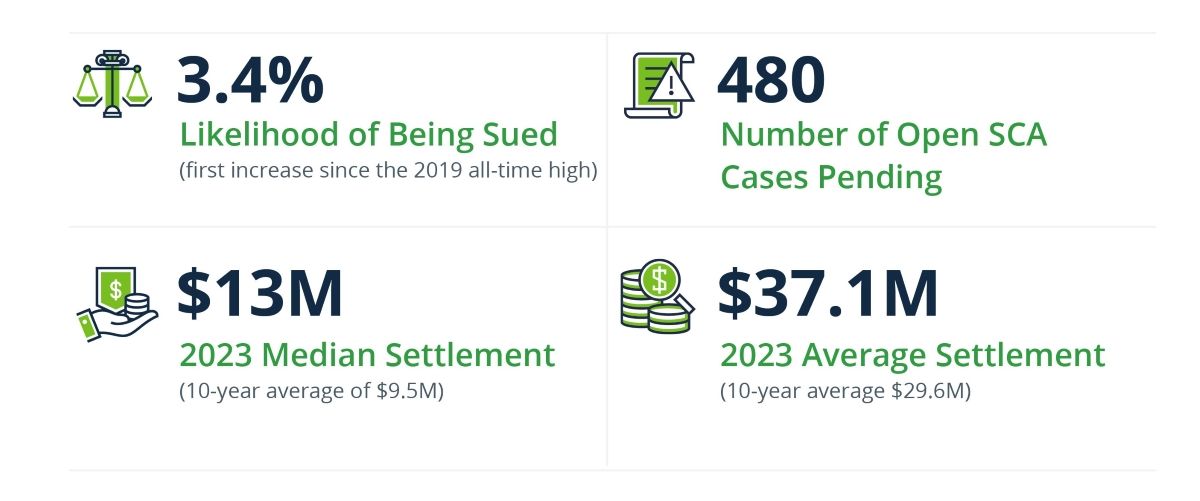

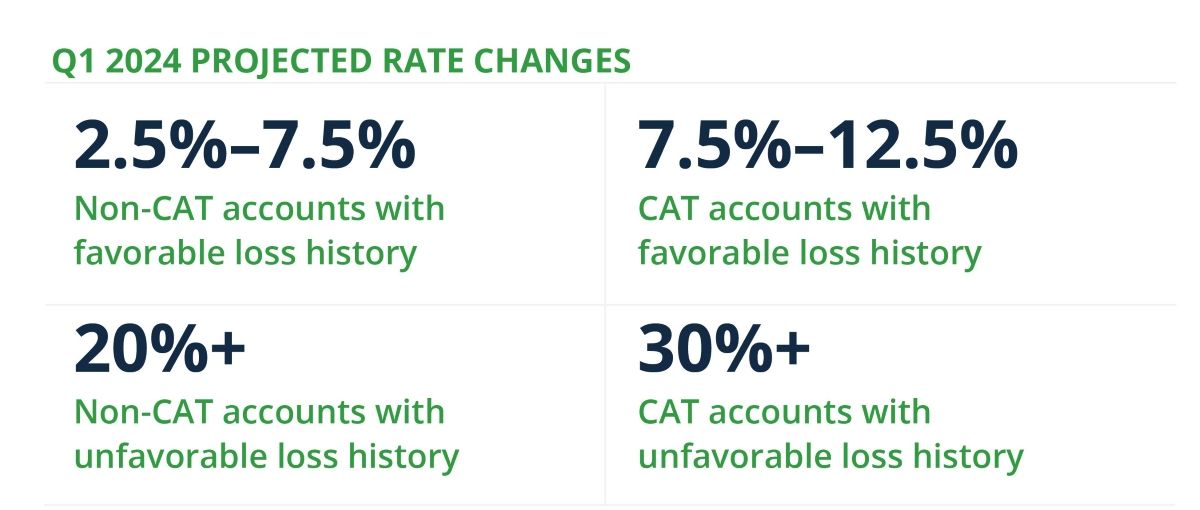

Insurers have been signaling that loss costs are increasing in this segment, and the number of public company security claims seem to support this assertion. Securities claims reached their record high in 2019 and dropped every year until 2023 when the number of public company suits increased 12% from 2022.

Macroeconomic challenges that were in focus for the past few years (inflation, higher interest rates, threat of recession) were mostly resolved in 2023. However, geopolitical factors, including the wars in Ukraine and the Middle East, as well as numerous pivotal elections around the globe, will loom large in 2024.

Capital, much of which entered the market when premiums were high in 2021, is still plentiful in this segment. We believe this abundance of capital will be the moderating force to keep premiums from increasing in 2024 despite increasing loss costs.

Property Premiums Begin to Moderate

Property premiums have finally started to moderate—a trend we noticed earlier last year—and everyone was relieved by the mild Atlantic hurricane season. Insurers have found profitability in this line, and we’ve heard that no insurer had trouble finding capacity in their January property reinsurance treaty renewals. We expect these factors to lead to the continued trend of moderating property premiums.

Severe convective storms (SCS) represented about 60% of insured natural catastrophes in 2023. Property carriers will intently focus on limits and deductibles for insureds exposed to SCS. Flood risk will also be a focus throughout 2024 as more precipitation occurs, particularly in coastal cities.

Cargo and Stock Throughput: A Softening Market

A “softening” cargo market will continue to be a source of relief for clients affected by the hardening property market.

However, the conflict in the Middle East is disrupting global trade. Insurers continue to assess exposures in the region with consideration given to reduced coverage or increased premiums for War & Strikes risks. Many reinsurers continue to exclude coverages for Russia, Ukraine, and Belarus as the war continues. Certain carriers are still offering coverage—at a price.

We believe that additional capacity, which generates competition, and an orderly reinsurance renewal season, will continue to stabilize the cargo market into 2024.

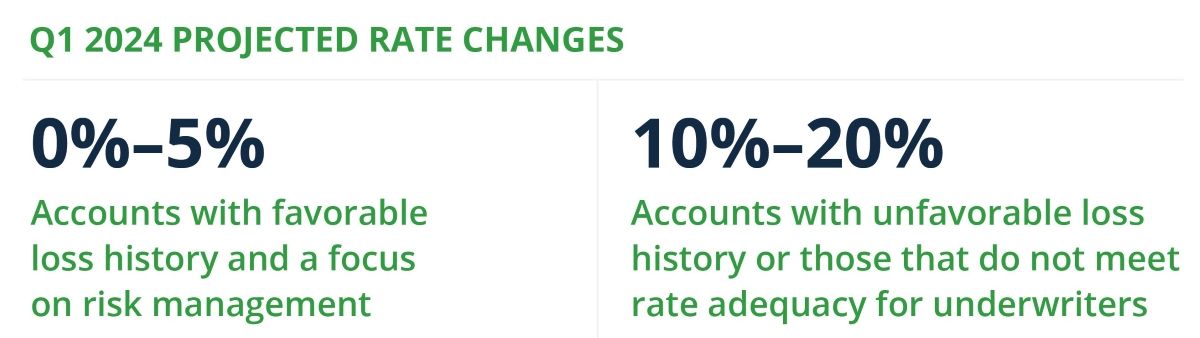

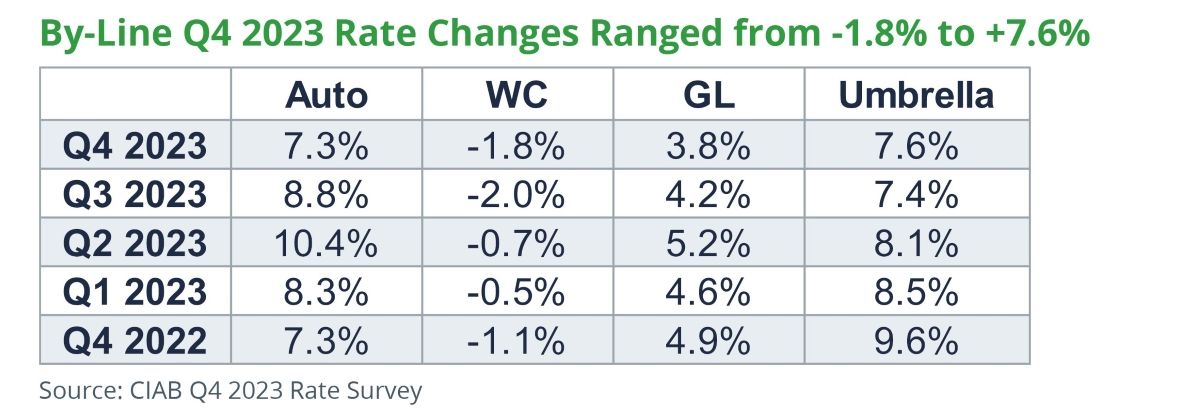

Casualty Market Remains Stable

We are characterizing the casualty segment as stable. However, the auto segment continues to be a difficult line for all insurers due to frequent losses that are increasing in severity.

This trend is also impacting premiums for lead umbrella placements, where rates continue to increase. Workers’ compensation continues to deliver profitability and is the bright spot of all the various segments of the casualty market. Commercial insurance buyers can expect rate decreases in this line.

Cyber Premiums Falling

Cyber is another segment where buyers experienced premium decreases in Q4. Despite falling premiums, insurers have restricted coverage in several critical areas depending on their perception of the level of risk. Ransomware activity set record highs in 2023, so a less favorable pricing environment may be on the horizon.

Artificial intelligence risk is a hot topic among clients, but the use of AI has minimal impact on overall cyber risk. There are privacy considerations to keep in mind, and the use of AI can impact the severity of your loss, but underwriter questions on this topic remain infrequent.

For more insights into the insurance trends and pricing changes of Q4 2023, download your copy of the Commercial Lines Insurance Market Update.

Author

Table of Contents