Blog

Reps and Warranties Claim Trends: A 2023 Review

In 2023, overall mergers & acquisitions (M&A) deal volume was much slower than in prior years; however, as expected, there was a surge in claims during this period.

From mid-2020 through mid-2022, we saw a large uptick in the number of policies and limits bound, and so it stands to reason that the number of reps and warranties (R&W) claims received by insurers has increased in the past year. Statistically, claims are most likely to arise within the first 12 to 18 months after a policy is bound, since the first audit cycle of the target company’s finances may bring to light certain breaches—leading to the current increase in claims.

Since deal volume fell precipitously in 2023, premium rates followed suit as the smaller number of transactions and a higher number of carriers offering the product resulted in a highly competitive marketplace. Self-insured retentions (SIRs) also decreased, both the initial retentions and the drop-down rates. Over the years, most R&W claims resolved within the policies’ retentions, so the lowering of SIRs serves to both address the competitive nature of the current market and the fact that carriers have always shown a profit in the R&W space. If lowering retentions along with premiums allows for a greater success rate in attracting business, the resulting potential losses in reducing SIRs may just be a temporary hit the carriers have agreed to take as a trade-off.

At the end of each year, many insurance carriers provide overviews of their R&W claims. Two of the most influential carriers in the marketplace, Euclid and AIG, have significant claims statistics, which provide a review of claims trends and can serve as bellwethers for the overall state of the market. We’ll go over the statistics from these reports and analyze the trends.

| It’s good to remember that R&W policies have a six-year coverage period. General reps are covered for three years, while fundamental and tax reps enjoy the full six years of coverage under these policies. The SIRs are aggregate, meaning that any claim covered under the policy will erode the overall retention; no separate retention applies to each claim. Further, the SIRs will generally drop after the first 12 months the policy is in effect. Therefore, any claim tendered to a carrier after that drop-down date will have a smaller SIR. |

Euclid Study: Number of Claims Rises in 2023

Euclid was founded in 2016 and has quickly grown to be the most successful managing general agent in the transaction liability space. In its seven years of existence, Euclid has paid out over $561 million (with 97 claims paid in total). In 2023, it saw a surge in claim activity, receiving claims in record numbers.

However, its latest report (covering the period from July 2016 to June 2023) shows that the frequency of claims it has received as related to policies issued remains steady at approximately 20%. Of those claims where losses exceeded the SIR, 20% of payments were at least $10 million.

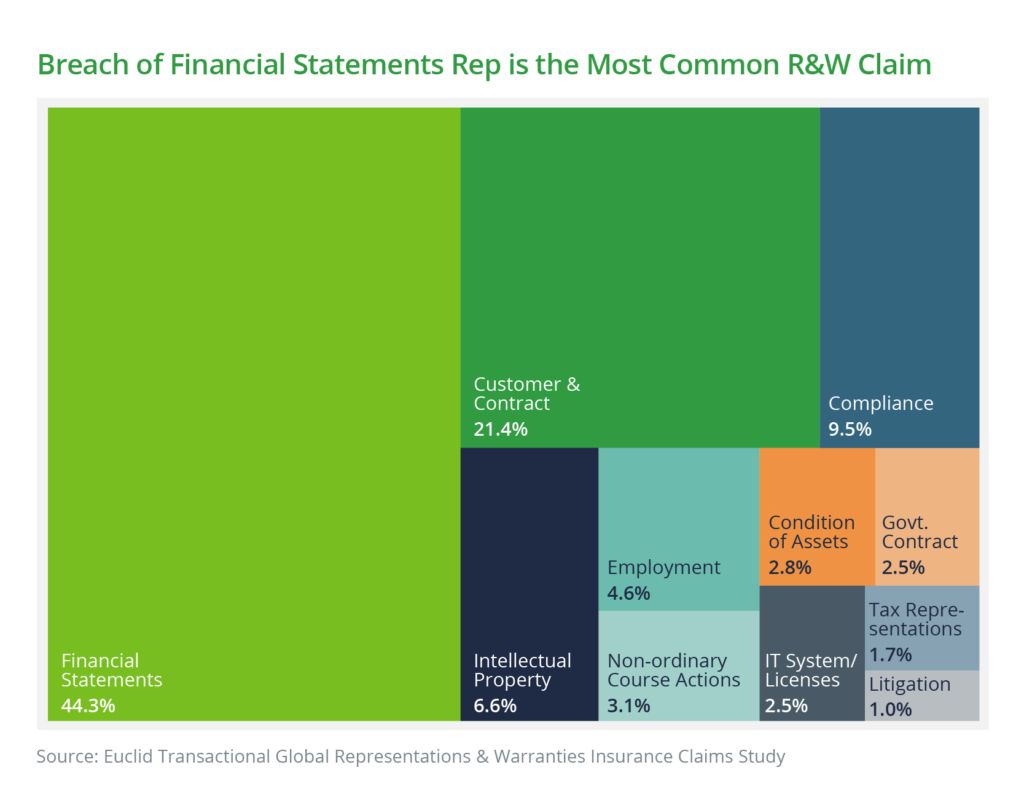

The two largest categories in which claim payouts were made continue to be breaches of financial reps, and customers and contracts. Those two categories account for almost two-thirds of claim payments, with compliance of laws coming in at a distant third.

The majority of claims tend to arise within the first 12 months of the policy period, and the earliest reported claims tend to result in severe losses since these material matters are often discovered shortly after the deal has closed.

Euclid’s data-crunching unearthed interesting claims trends:

- Transactions involving targets with audited financials (versus unaudited financials) often result in greater losses and a higher likelihood of claims alleging financial rep breaches. Payments for financial statements claims involving targets with audited financials averaged 41.4% of the policy limit, whereas this figure is only 22.1% for payments involving companies with unaudited financials.

- Most deals (77.8%) bound had a corporate parent or financial sponsor as the insured, and these buyers also make up most of the claims paid (82.8%).

- One-third of total claim payouts made by Euclid involved the 25 largest private equity funds in the world.

- North American clients tend to report claims arising out of litigation much more frequently than clients from other continents, and they are also much more likely to assert that a multiple applies in their loss calculations.

AIG Study: Slight Decrease in Claim Activity from 2012 to 2021

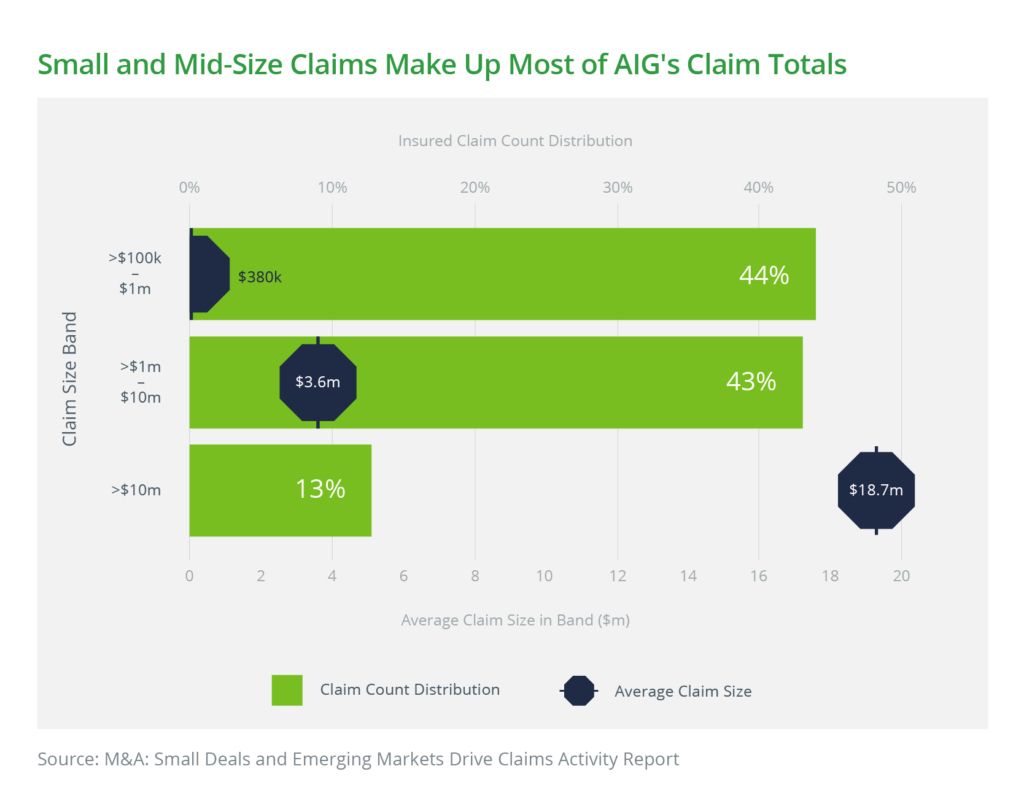

As one of the original US markets to offer R&W insurance, AIG has consistently been the leader in both claims handling and statistics. In its newest claim study, covering claims from 2012 to 2021, AIG noted a slight decrease in claim activity during this period. (Note that this does not include claims submitted to AIG during the last two years.) Data from past years showed that, globally, approximately one in five policies resulted in a claim; AIG’s current report reveals one in six policies had claim activity. However, even if notifications have decreased slightly during this time, the number of claims with loss payments (those above the SIR) increased. Globally, 25% of claim payments were between $1–$10 million, and 7% were over $10 million.

Significant claim activity is increasingly on the smaller end of the spectrum, with deals of less than $250 million enterprise value resulting in 60% of claim payouts.

Significant claim activity is increasingly on the smaller end of the spectrum, with deals of less than $250 million enterprise value resulting in 60% of claim payouts.

Smaller deals show a higher incidence of breaches related to compliance with laws reps and operations, whereas in larger transactions, breaches of intellectual property and tax reps are more common. There is still a high incidence of claims for breaches of financial reps among deals of all sizes.

For AIG, most claims are reported within the first 24 months of a policy’s issuance, and the largest (most material) claims also tend to be reported earlier in the policy period. For smaller deal sizes, claims are often noticed later in the policy period, suggesting that there are still quite a few claims that will arise from policies bound in recent years.

Stay Updated on R&W Claim Trends

Though other carriers and peripheral entities have also issued their claim reports, AIG and Euclid continue to be the market leaders in this area. Their data is worth studying to understand R&W claim trends, since claim coverage and payouts may very well affect how underwriters approach future deals. At Woodruff Sawyer, we have years of experience handling both the placement of R&W policies and any resulting claims and have strong relationships with both carriers’ claim handlers and coverage law firms. We will continue to monitor claim trends to best serve our clients.

Author

Table of Contents