Blog

SPAC Current Events Roundup: SPARCs, Settlements, and Liquidations

This month marks the two-year anniversary of the SPAC Notebook. Many thanks to all our readers, viewers and listeners for your continued support and interest!

No seismic market shifts or mind-boggling legal decisions or theories took place in the last month, but to keep our readers updated, below are a few interesting developments that are worth tucking away into your SPAC subconscious and/or keeping an eye on. We offer our perspective from the risk/insurance angle on each, which we hope you will find helpful.

The Ackman SPARC Is Alive

After two years, Bill Ackman’s SPARC finally got a green light from the Securities and Exchange Commission (SEC). A SPARC (special purpose acquisition rights company) is similar to a SPAC (special purpose acquisition company) except it does not hold the funds in trust while it is searching for a target. Instead, once it finds the target, it offers SPARC investors rights to invest in that target. Ackman's hedge fund Pershing Square has pledged to invest between $250 million and $3.5 billion into the SPARC as an anchor investor. The search term for the SPARC can be up to 10 years compared to the typical two-year term for a SPAC.

The insurance angle: The D&O coverage for the SPARC’s directors and officers may need to be renewed on an annual basis while the SPARC is looking for its target. Insurers were willing to offer two-year policies for SPACs to match the SPACs’ search period, but they are unlikely to offer a 10-year policy if the SPARC ends up taking that long to get to a deal. And for the SPARC, it wouldn’t make sense to pay for a 10-year policy when it can renew on an annual basis as it goes about its search. The risk of lawsuits is arguably smaller for a SPARC versus a SPAC since no money is being held in trust.

FAST Acquisition Had to Settle

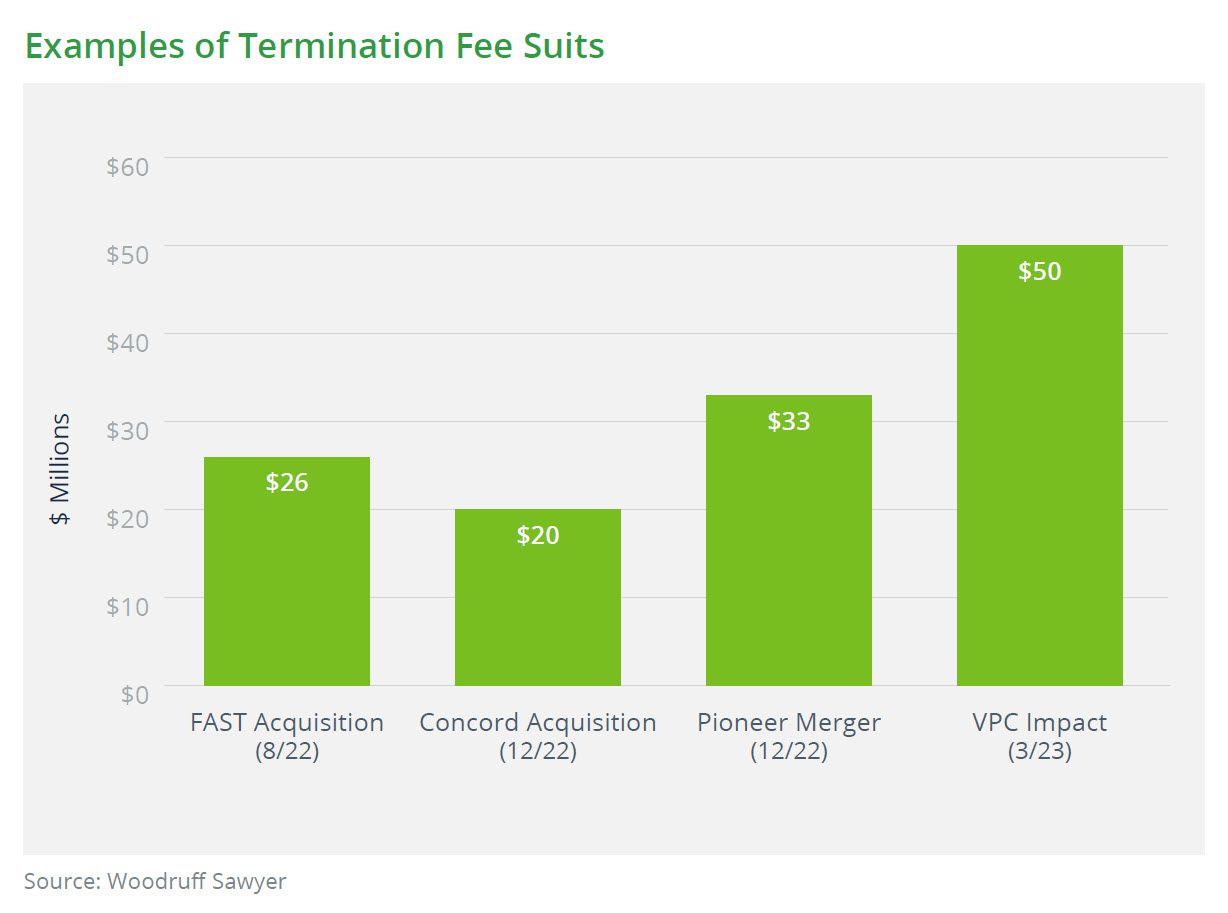

If you remember, the FAST Acquisition Corp. lawsuit from August 2022 was the first in a series of lawsuits in which the plaintiff investors objected to the SPAC team keeping the entire $26 million termination fee in the aftermath of a broken deal. FAST Acquisition had negotiated the termination fee but failed to share it with its investors upon liquidating the SPAC after the deal disintegrated. Other similar suits followed shortly after—a few examples and their corresponding termination fees are shown below.

Fast Acquisition recently settled for $12.5 million to resolve termination fee claims from its investors. Other similar settlements are sure to follow.

The insurance angle: These kinds of settlements and the related attorney fees will undoubtedly end up in the lap of the SPAC’s D&O insurance carriers.

Not All Claims of SPAC Misrepresentations Are Valid, and Not All Misrepresentations Are Nefarious

Danimer Scientific, which closed a deal with Live Oak Acquisition Corp. in December of 2020, “got a judge’s nod to toss allegations that the company and its officers knowingly misled investors in disclosures.” The lawsuit was originally filed in May of 2021.

The insurance angle: The SPAC’s directors and officers were named in the lawsuit, so their D&O insurance policy, or more specifically, their SPAC tail policy, would have responded to this lawsuit and paid for the attorney fees associated with the defense.

Liquidation? What Liquidation?

There have been reports of several SPACs backing out of an announced liquidation. Global Partner Acquisition II is the latest example. While it’s completely up to the investors to support a turnaround and/or a potential future deal, it’s up to the directors and officers of the SPAC to think about how the liquidation flip-flop will affect their D&O insurance coverage.

The insurance angle: If the SPAC’s D&O insurance policy doesn’t expire until after the liquidation flip-flop, then once the SPAC is in the letter of intent (LOI) stage and has a sense of how long it’ll take to close the deal, it should seek an extension of its policy to cover it until closing. There might be difficulties with the extension if there’s a change in control resulting from a new team taking over as part of the liquidation flip-flop.

If the SPAC’s D&O insurance policy is about to expire amid the liquidation flip-flop, has already expired and hadn’t been extended because the parties were anticipating a liquidation, or the parties had already elected tail coverage, then the SPAC would need to find new coverage. Finding new coverage at this stage may prove difficult because few insurers would want to be exposed to the multiple angles of risk at this stage of the SPAC’s process. For example, there could be risk from existing SPAC shareholders unhappy with the liquidation decision or unhappy with the reversal of the liquidation decision. There could be risk from old or new team members coming into or leaving the SPAC. There could be issues around sufficient disclosure of the events surrounding the flip-flop and financial outcomes of it. If the target is in the picture, its shareholders may be unhappy with the decisions being made and the timing of the deal. In summary, convincing carriers to issue a new policy amid a liquidation flip-flop (which could expose them to all these issues) is going to be difficult, if not impossible, and costly.

A Few Regulatory Enforcement Settlements Are Finally Coming In

One of the latest is the Hyzon Motors $25 million settlement, which settled the SEC’s fraud charges of misleading investors about its business relationships and vehicle sales. The SEC also charged Hyzon’s former CEO and another member of its management team for misleading investors; they settled for $100,000 and $200,000, respectively. Hyzon Motors merged with Decarbonization Plus Acquisition Corporation in July 2021. It took over two years for the SEC to resolve this enforcement action, from which we can infer that similar settlements are likely to surface in the next few months.

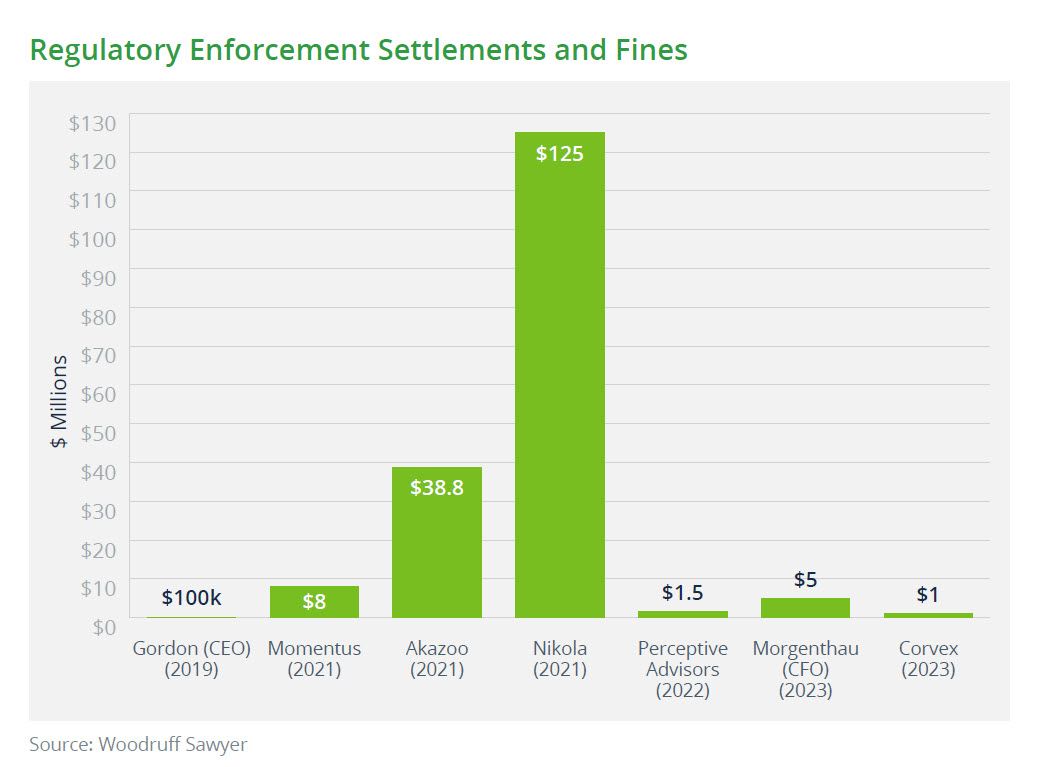

Below is a chart from our mid-year litigation update of other SPAC-related regulatory settlements.

The insurance angle: It is important to remember that in a government enforcement action, the general rule is that a D&O insurance program will provide defense costs for individuals. But due to public policy concerns, fines and penalties are generally not insurable and therefore not covered by D&O insurance.

Reps and Warranties Insurance (RWI) Underwriters are More Open to SPAC-Related Deals Than Ever

The RWI market is experiencing a period of intense competition. Due to still sluggish merger & acquisition activity, many carriers are unable to fill their underwriting quotas and are open to covering more non-traditional deals (e.g., de-SPACs). Current premium rates are between 2.3% and 3.3% of the limit bought. Smaller limits of coverage (e.g., $3 million) are also now more available than before. Read our article on how RWI works for SPACs: Another SPAC Lawsuit That Could Have Benefitted from a Reps Policy.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents