Blog

SPAC Liquidations and Extensions Create D&O Insurance Riddles: Part 1

Extend or liquidate? Those are the two options for a special purpose acquisition company (SPAC) that has not completed a business combination but is approaching its deadline for finding a suitable target.

SPAC teams that are confident they’ll be able to pin down a decent deal in the next few months opt for an extension. However, while SPAC sponsors are typically aware that they’ll need shareholder approval or additional funds for an extension, most don’t consider the added costs or difficulties of extending their directors and officers (D&O) insurance coverage to match their investment period extension.

Two of the most common questions my clients have been asking in recent months are:

- What happens to our D&O policy and coverage if we must seek an extension to close our deal?

- Will we be covered if we liquidate the SPAC?

Considering the SPAC market over the past few months, neither question is a surprise. What is surprising is the fact that not every SPAC sponsor is asking these questions.

Despite popular market predictions that most SPACs that went through an initial public offering (IPO) at the beginning of 2021 will need an extension and that between one-third and one-half of all current SPACs will need to liquidate, many SPAC sponsors remain optimistic that their SPAC will not need to ask the two questions above.

But lack of planning for these scenarios can cause all sorts of missteps. For many SPAC teams, once they realize an extension or liquidation is unavoidable, there might not be much time to negotiate an insurance solution. As a result, the costs associated with that solution could be much higher than they anticipated or could have commanded had they been prepared.

To help you prepare, we will examine each scenario in turn. This article will discuss extensions, and our next post will tackle liquidations.

What is a SPAC Extension?

SPACs have only a limited time—typically 18 to 24 months—to find a company to acquire and complete their acquisition.

If a SPAC does not have a built-in extension and needs more time, a SPAC sponsor can request that the shareholders approve an extension.

A widely watched example of a SPAC seeking an extension recently was the Digital World Acquisition Corp. SPAC, aka DWAC, aka “the Trump SPAC.” Like many other SPACs, DWAC, which went public in September 2020, sought earlier this month to extend its time to find a target before its deadline ran out.

Unlike many other SPACs of the same vintage, however, DWAC has an announced deal on the table, which makes things a lot easier for it from the insurance perspective.

How Does SPAC D&O Insurance Work?

Nearly all SPACs that have gone through an IPO and are out looking for merger targets are covered by what I’ll refer to as a “SPAC IPO D&O Policy.” This policy covers the SPAC and its directors and officers for things like securities class action settlements and defense costs related to SEC investigations and enforcement actions.

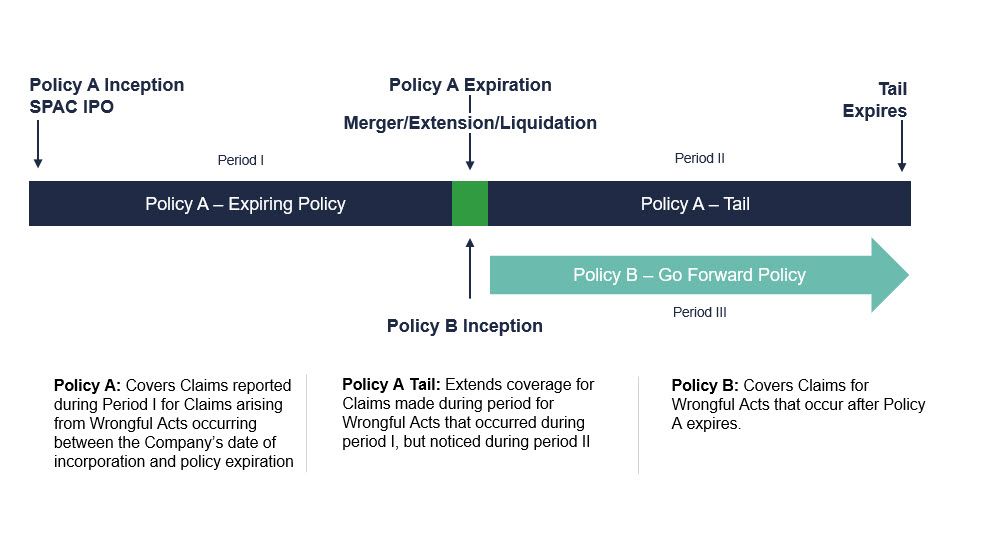

This policy typically starts running at the IPO and tracks the SPAC’s initial investment period.

SPAC IPO Timeline

For example, if the SPAC’s investment period was set at 24 months, the policy would expire at 24 months, or if the SPAC liquidates earlier, at the liquidation date. The policy does not typically automatically extend to a longer period if the SPAC needs to extend its investment period. This scenario creates a problem because D&O policies are “claims made in nature.” That means that if a claim is brought when the policy is no longer in force, even if that claim relates to actions that took place during the term of the policy, that claim will not be covered. So, if the SPAC team has obtained shareholder approval to extend its search period but neglected to extend its D&O policy and a claim is brought after the expiration of that policy, the SPAC will have to pay out of pocket for the expenses related to that claim. The way around that unfavorable scenario is to request a policy extension from the carrier.

How Will the Insurer React to an Extension Request?

The SPAC’s insurance broker can, of course, go back to the insurer and ask for the policy to be extended. However, many insurers that were happily writing these policies two years ago have since lived through several SPAC-related lawsuits and enforcement actions, and they're not exactly jumping at the opportunity to offer extensions.

They're also not too happy about the uncertainty caused by the Securities and Exchange Commission's proposed rules, which will be finalized later this year. Additionally, insurers are concerned about the negative and disappointing performance of many SPACs.

As far as insurers are concerned, they’d rather sit out their obligatory 24 months, close up shop, and go home. You can, therefore, imagine their response when they're asked to spring up for an extension at the last minute because the SPAC team was not anticipating a need for one.

How Can You Get Better Results?

You can achieve better results with the insurer by addressing some of the following critical factors. First, if a possible extension is on the horizon, the SPAC and its insurance broker need to signal that possibility to the carrier as soon as possible to give that carrier an opportunity to ask questions about the team’s search efforts, the likelihood of a deal, the financial situation of the SPAC, and the financial terms of the extension.

If a deal has been announced, this conversation becomes much easier. Then, presumably, a few months of an extension should tie the SPAC over until the deal is completed. In this case, the insurer may be open to offering a short (three- to four-month) extension at a monthly rate based on the original premium for the SPAC IPO D&O Policy, but it is very far from certain that they will do so.

Many carriers would balk at the idea of a premium rate that would match the rate from two years back. Those rates were about four to five times lower than the current market price, so many insurers would push to increase that rate to current market levels. For a SPAC that is mid-deal and running short on time, negotiation leverage might be thin, so a good SPAC insurance broker with strong carrier relationships will make all the difference.

More Difficult Situations

If there is no deal on the table, proof of a viable letter of intent (LOI) or a well-thought-out investment search plan might do the trick. But, like the rest of us, insurers are very aware of the number of deals that were in LOI or even announced and ended up being terminated.

According to Bloomberg, as of Aug. 15, 2022, more than 40 SPAC mergers have been canceled so far this year. The uncertainty that comes with those cancelations pushes up insurance premium pricing and gives the insurer more opportunity to renegotiate terms.

Getting the SPAC team on a call with the carrier can often help convince the underwriter to be more lenient. If the SPAC team is forthcoming, transparent, and well organized, the negotiation for those extra few months at a reasonable premium can be more successful.

What Could Cause Extension Problems?

On the other hand, insurers may refuse to grant an extension if factors surrounding the extension are extremely unfavorable. Here are some examples:

- Last-minute timing of the request

- A flashy, controversial SPAC or target (e.g., the Trump SPAC)

- Suspicious behavior of the SPAC team

- Lack of information about the proposed deal or lack thereof

- Poor communication from the SPAC team

- Previous lawsuits, actions, or investigations related to the SPAC or its directors and officers

- Negative publicity around the proposed deal

- Drop in SPAC share price

- An extension request of six months or more

Under the above circumstances, insurers may refuse to grant an extension, hike up the premium to an unpalatable level, or impose a slew of exclusions on the coverage. At that point, the SPAC may be forced to accept the insurer’s terms, self-insure, or be forced to look for another carrier, which will likely not offer better terms.

Most SPAC teams were a universe away from considering the questions of extensions and liquidations two years ago when they first embarked on the SPAC path. The bottom line is that at this point, none of them should close their eyes to the possibility of living through one of these scenarios.

SPAC teams need to prepare for these alternatives by reaching out to their SPAC insurance broker, considering coverage alternatives, and budgeting for extra D&O insurance costs. And the sooner they do so, the better off they will be.

Here’s hoping that most SPAC teams do find their ideal matches and won’t need to fall back on their extension or liquidation plans

Be sure to read the next SPAC Notebook for Part 2 of this topic, focusing on liquidations.

Author

Table of Contents