Blog

SPAC Litigation Case Studies: How Insurance Responds

This article was also published in ABA’s Business Law Today

Special Purpose Acquisition Companies (SPACs) have become a popular way to raise funds for public mergers and acquisitions in recent years. However, the directors and officers of a SPAC can face unique exposures. These liabilities can include direct risks to personal assets because the funds the SPAC raises through a public offering must be held in a trust. A SPAC’s trust funds cannot be used to cover its defense and settlement costs and its at-risk capital may not be sufficient to cover these kinds of costs.

The right insurance can offer valuable peace of mind, but there is often some confusion about how it all works. This article will review two recent SPAC lawsuits and examine how an insurance policy—a Representations and Warranties (RWI) Policy or a Directors and Officers (D&O) Policy—would respond in each situation.

RWI Insurance and the Immunovant Case

Although SPACs are an exciting way of fundraising and going public, a SPAC is still, at heart, an M&A deal, making RWI insurance useful.

Let’s look at the recent case involving the biopharmaceutical company Immunovant. In this example, a company developing a new drug to help with a common and debilitating disease connects with a SPAC looking for such a company. The two merge and go public.

However, when Immunovant announced it had “become aware of a potential problem and out of an abundance of caution” was placing a voluntary hold on its ongoing clinical trials, its stock price plunged 42% on February 22nd, 2021.

| Immunovant Securities Class Action Lawsuit |

|---|

|

The plaintiffs’ bar multiplied the amount of money the stock fell (42%) by the number of shares in open circulation and felt the amount was a large enough "pot of gold" to be worth the trouble. They united enough shareholders for a securities class action lawsuit with multiple allegations, including:

|

In terms of the allegation of inadequate due diligence, if the SPAC did not know of these problems, then the issue is not a failure to disclose, but rather fraud on the part of the private company. The allegations typically assert that the SPAC team was incentivized to close a deal by a deadline and didn’t take the time to perform due diligence.

Therefore, the SPAC needs to establish that it did, in fact, perform adequate diligence, and an RWI policy could be of great use. In the Immunovant case, the SPAC had an RWI policy to safeguard against failure of the reps and warranties of the seller of the private company to them.

| Hypothetical: If there were representations given as to the accuracy of Immunovant's records of previous clinical drug trials, the RWI policy defenses would include: |

|---|

|

It’s tough for plaintiffs to make a case for inadequate diligence if a company has gone through the process of acquiring RWI insurance. This insurance requires third parties to review diligence conducted and ask questions and probe the adequacy of the work done by specialists in the area. |

|

RWI speaks very clearly to what was known and not known by the SPAC. In essence, RWI provides Immunovant with a third-party paper trail showing how much they knew, how hard they worked, and how innocent they were. |

|

Beyond reputational damage, there is the lost value of the target company given its diminished prospects. Fraud by the seller is covered by RWI, meaning a claim could potentially recoup some lost money and return it to the original investors in the SPAC, or to the pipe investors if they had purchased RWI insurance. |

The Importance of RWI Insurance to SPACs

RWI insurance can hedge the risk for both the buyer and seller in SPACs. When there is a lack of indemnification from the seller, such as in a public deal, RWI coverage is even more critical. In those cases, we put synthetic reps and warranties in place.

In essence, the definition of loss comes from the insurance policy and not from the indemnification section of the agreement, and the buyer is insured against that loss. When a seller does give indemnification, a standard RWI policy can be easily put in place.

D&O Insurance and the Lucid Motors Case

D&O Insurance is on everyone’s minds these days because of its rising cost. Naturally, many companies are asking about ways they can save on their D&O premiums by reducing coverage.

Clients often ask us if they need D&O coverage at the time of the SPAC’s IPO and whether they can get away with buying the least possible amount. There’s a myth out in the SPAC market that SPACs are not really subject to risk between the time of their IPO and their de-SPAC. Unfortunately, the common belief that all litigation comes after the de-SPAC is just not true and can cause some serious problems for the SPAC and its team of directors and officers. In fact, it is crucial to have coverage between the IPO and the de-SPAC.

D&O Insurance and the Lucid Motors Case

Now, let us examine a case study that illustrates the importance of D&O insurance. This case started out with some merger rumors that Churchill Capital Acquisition Corporation IV was going to acquire Lucid Motors, an electric vehicle company.

According to the filed complaint, the rumors caused the price of the SPAC’s shares to jump from $10 to $22 per share. Then, the Lucid Motors CEO spoke to the media and mentioned a plan to deliver 6,000 vehicles in 2021. After several other statements to the media, the SPAC shares climbed to over $57 a share. The merger was finally announced on February 22nd, 2021 and on the same day Lucid Motors CEO told the media that, in fact, the production of the vehicles will be delayed.

Documentation filed with merger announcement revealed that only 557 vehicles were planned versus the 6,000 that were previously mentioned and, not surprisingly, the price of the SPAC’s shares tanked. By the time the lawsuit was filed on April 18th, 2021, the SPAC’s shares were trading at $18 per share.

What is interesting to note here is that this lawsuit is not your garden variety merger objection suit in which the plaintiffs allege insufficient disclosure and argue for the merger to be halted. These kinds of allegations and demands are typically addressed through additional SEC filings to close any gaps in the disclosure, and the plaintiff usually goes away for a few thousand dollars in mootness fees. These merger objections suits are not looked upon kindly by Delaware courts, which is why they are often filed in New York and have been commonly referred to as an M&A (and now a SPAC) “transaction tax.”

The Lucid Motors case, however, is a full-blown securities class-action lawsuit brought in federal court against the SPAC, its CEO and CFO, and the Target, and its CEO. It alleges that these parties made or were involved in making false statements and omissions that drove the wild price fluctuations, which then resulted in losses for the SPAC’s shareholders. What’s even more interesting is that this lawsuit is being brought way ahead of the merger for statements made prior even to the merger announcement. When lawsuits of this type are brought, defendants’ thoughts automatically turn to insurance. The questions are:

- Is there an insurance policy in place to protect my SPAC and my directors and officers? and

- Will the limits of that policy be sufficient to cover litigation defense and settlement costs?

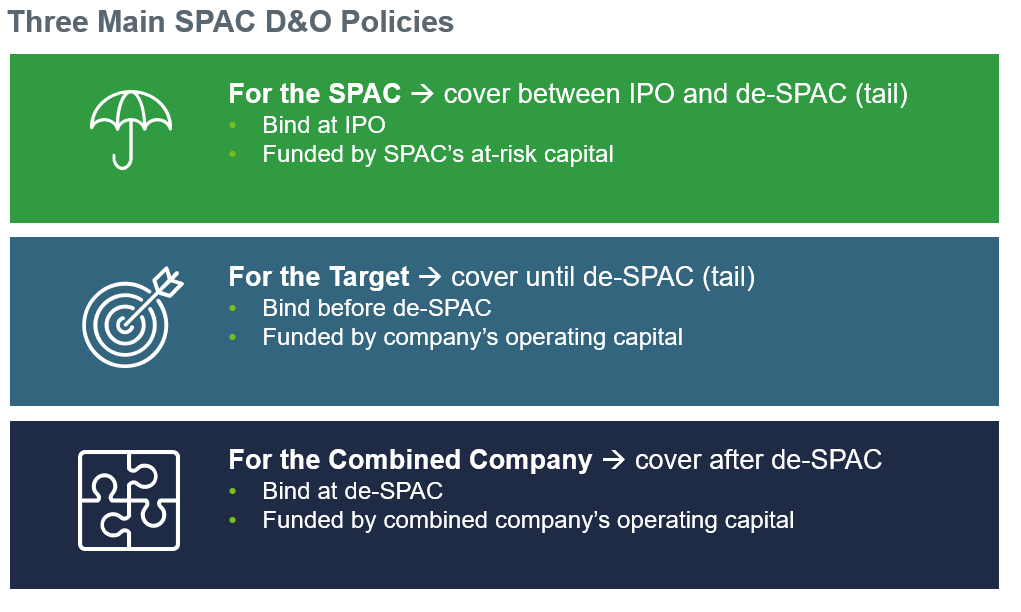

Here we should take a short detour and understand the kinds of policies that a SPAC team will encounter as it proceeds through the life cycle of the SPAC. There are three main D&O policies and it is essential to understand which D&O policies are in play before, during, and after the SPAC merger.

The first policy is the one that covers the SPAC and its directors and officers between the SPAC’s IPO and its business combination. This policy binds at the IPO and is funded by the SPAC’s at-risk capital. It typically has a tail component, which is essentially an extended reporting period for claims that come after the merger. Because a SPAC’s at-risk capital is usually very limited and the current SPAC D&O insurance pricing is quite high, these policies, if not planned and budgeted for properly, can cause a lot of aggravation to SPAC teams.

The second policy is the private company policy that covers the target company and its directors and officers until the company mergers with the SPAC. This policy can also have a tail component but is quite different from the public company D&O policy. It is a lot less complex and a lot less expensive than the public company D&O policy placed for a SPAC and for the combined company after the merger. This policy is typically in place ahead of the de-SPAC and is funded out of the target company’s operating capital.

The third policy covers the combined company and its directors and officers after the merger. It binds at the time of the merger and looks and feels very much like any traditional public company D&O policy. It is also considerably more expensive than the SPAC D&O policy and usually renews on an annual basis.

Lessons from the Lucid Motors Case

The first lesson we can learn from the Lucid Motors case is that serious, expensive lawsuits can and do occur before the de-SPAC and that the period between the SPAC IPO and its business combination is not risk-free. Consequently, the terms and limits of that first policy that covers the SPAC and its directors and officers between the IPO and the de-SPAC should be considered very carefully.

The second lesson is that a lower limit of coverage may not be sufficient to cover defense and settlement costs and can put you at risk. Last year SPAC teams usually considering $20 million in coverage limits for their SPACs because premium pricing was low and affordable. In recent months, however, increases in D&O premium pricing have forced SPAC teams to gravitate towards much lower limits. The majority now purchase between $5 million and $10 million in coverage, and some have even considered limits as low as $2.5 million. While D&O insurance costs are high and at-risk capital is restricted, going for the least expensive policy may not be the right decision for your SPAC and your team.

The importance of risk mitigation is another great lesson to take away from the Lucid Motors case. It is incredibly critical for all SPAC executives and the executives of the target company to pay very close attention to public messaging around deal time. They must be especially careful when making any statements on social or other media because getting sued for even inadvertent misrepresentations can be extremely painful, time-consuming, and distracting in the midst of a deal and, without proper insurance coverage, can lead to serious financial losses.

The SPAC market is extremely dynamic and has grown dramatically in size and sophistication over the last few months. SPAC teams and teams aiming to merge with a SPAC must keep on top of the latest developments in the financial, regulatory, and legal aspects of this market.

Allegations and complaints in the lawsuits like the ones discussed above, while novel now, may become standard in the future. Having advisers who can steer you away from traps and anticipate risks and pitfalls, including guiding you through the most efficient and effective use of RWI and D&O policies is a must-have for any SPAC team. Woodruff Sawyer is the market leader for placing IPO D&O insurance for operating companies and SPACs, and a nationally recognized leader when it comes to RWI insurance.

Guide to D&O Insurance for SPAC IPOs >> |

Guide to D&O Insurance for De-SPAC Transactions >> |

If you have any questions or concerns about these policies and how they can become part of your planning and strategy, please contact us at Woodruff Sawyer and let us know how we can help. And for more news critical to SPACs delivered to your inbox, subscribe to the M&A Notebook.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Authors

Table of Contents