Blog

Insurance Due Diligence for Middle Market and De-SPAC Transactions

Insurance and risk management due diligence often take a backseat to operational, legal, financial, or accounting diligence. But, if executed poorly, acquirers and investors alike may leave themselves exposed to increased risks that could negatively impact EBITDA in the short term and diminish long-term value of the asset in the long-term. Including an expert insurance advisor on the due diligence team will help avoid these risky land mines, protect the investment in the short and long terms, and ensure a cleaner exit.

We understand insurance due diligence is not the top priority for a deal team, but it should be one of the priorities. It's important to understand the risks faced by the target company and to work with speed and certainty pre- and post-close. Having worked in the private equity and venture community for over 25 years, we recommend performing insurance due diligence to identify, quantify, mitigate, diminish, or otherwise transfer the potential risks that could negatively affect EBITDA for the portfolio company.

With the recent proliferation of Special Purpose Acquisition Companies (SPACs) over the past 12-18 months, the number of SPACs now in search mode for a target to begin a De-SPAC process, and how many SPACs are still looking to price in 2021, the importance of insurance due diligence and having an expert broker-partner team to help the management team navigate the de-SPAC process has only increased.

This 2021 Guide to Insurance Due Diligence for Middle Market and De-SPAC Transactions explains how we help our private equity, growth equity, and SPAC clients on hundreds of transactions per year—and, more importantly, why.

Why Does Insurance Due Diligence Matter?

- Understand how EBITDA is being protected at the company level. The overall goal of due diligence is to uncover the potential land mines that can negatively affect EBITDA for an acquisition in both the short and long term.

- Understand the foundation of insurance and the general risk management strategy that has been implemented historically to protect the business prior to investment. How has the management team viewed insurance and risk management up to the point of selling the company? Which of the company's risks are uninsured, underinsured, deficiently insured, or adequately insured? How has the team developed, implemented, and maintained the Employee Benefits offering?

- For de-SPAC transactions, prepare for the critical transition from a private company to a publicly traded company. In every de-SPAC transaction, the target company will be merged with the publicly traded SPAC, and the private company will be publicly traded post-close. There are several key components to this transition, the most important of which is the transition of the Management Liability (D&O) program from private to public.

- Watch for implications on total cost of risk. Uncover opportunities for cost structure improvement post-close. Is the target company overpaying (or underpaying) for insurance? Are there opportunities for the target company to take on more risk (via retention or deductible strategies) that will improve the cost structure and EBITDA over the long term? Are there ways of restructuring the Employee Benefits program or adjusting contribution strategies to the advantage of the company while also broadening the overall Benefits package?

- Avoid exclusions or issues with the Representations and Warranties insurance process. In almost every deal where RWI insurance is a component, the underwriter will request a report or memo for the insurance and benefits programs in place. The insurer will also ask questions about historical Employee Benefits offerings as well as run-off and go-forward implications for coverages like Directors and Officers Liability, Cyber Liability, and Professional Liability. If not answered correctly and adequately, exclusions may be added to the RWI policy.

- Understand historical losses. Frequent losses are indicative of management's approach to risk management. Are historical losses likely to persist post-close? Is the current program set up to handle those losses? Do the losses indicate a potential for higher retentions or loss sensitive financing arrangements to better control risks?

- Coordinate run-off policies: Some existing policies could be exposed to run-off provisions. Insurance due diligence helps the deal team understand the potential risks of buying run-off or tail policies at close (or not), ensures protection of the asset from close, and provides a clearer understanding of who is responsible for what risks, why, and when.

- Get a sense for evidence-based benchmarking. How much commercial insurance does the target purchase? Is it enough? Is it too much? How does the Benefits program compare to peer companies?

- Identify potential new program needs. A new Property, Casualty, Management Liability, and/or Employee Benefits program may need to be implemented at close depending on the transaction structure and agreement language.

- Respond to lender requests. When new lenders are being added to the financial structure, they will require certificates naming them as additional insured and/or lender's loss payable on the insurance program. Like RWI insurance underwriters, lenders will require a base review of the insurance program. There will be certificates required for closing.

Having an expert insurance advisor included on the due diligence bench will enhance a deal team's understanding of the target acquisition pre-close—so no surprises come up post-close.

Transaction Timeline From an Insurance Perspective

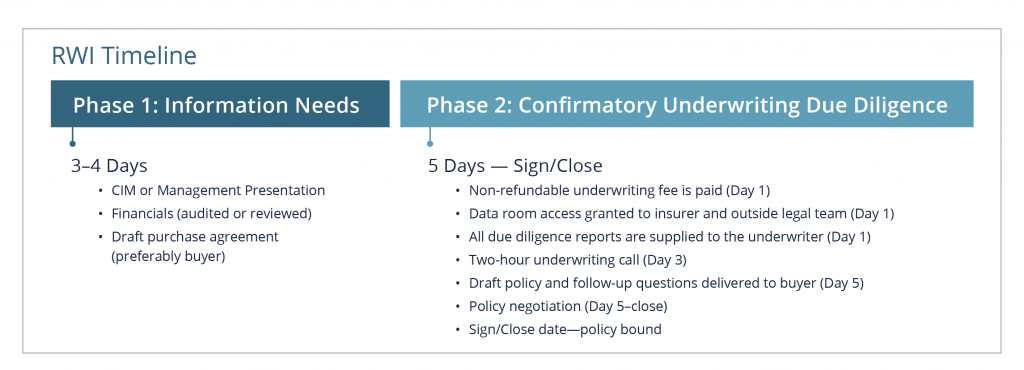

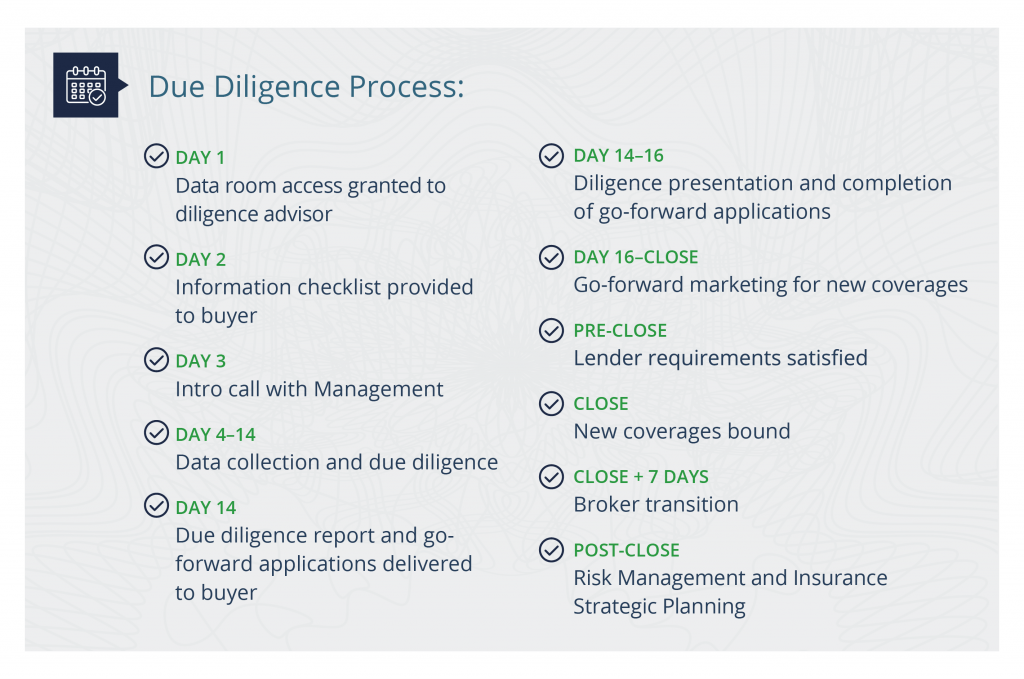

In any given transaction, myriad items can arise that will lengthen (or shorten) a transaction timeline. The two main insurance-related workstreams are the RWI process and the due diligence process. Understanding how these two simultaneous workstreams weave into the broader transaction timeline will help avoid delays at the end of the process.

Here is the typical process for a stock buyout transaction:

Get more insight into the RWI process and other issues concerning M&A.

Phase 1: Pre-LOI Through Execution of LOI

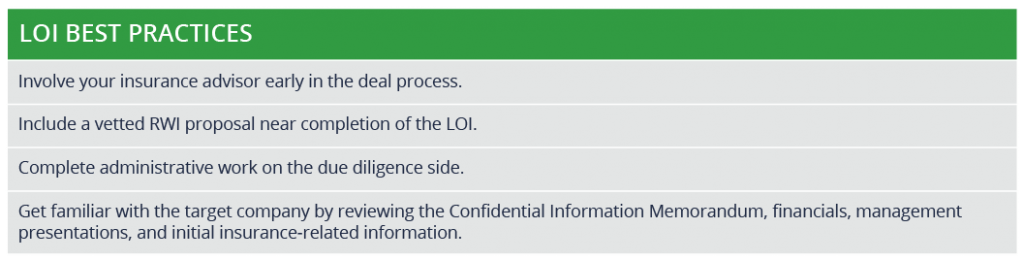

One oversight many deal teams make is involving the insurance advisor too late in the process. This is typical because, as previously mentioned, insurance tends to be a lower priority item with everything else going on during a deal. We have found that insurance due diligence advisors are not typically engaged until an LOI has been executed and there is a definitive timeline and action plan to close. Pre-LOI, there is very little insurance due diligence to be performed, and private equity firms typically do not initiate the insurance diligence workstream.

However, pre-LOI is often the time when an RWI broker partner is selected and gets involved. We recommend including a fully vetted RWI proposal when a private equity firm nears completion of the LOI and looks toward submitting a second or final round bid for a target. This demonstrates to a seller that the prospective buyer is not only committed to procuring an RWI policy as part of the transaction, but that the buyer has also engaged with a broker and has gone through the initial stages of obtaining quotes and vetting out initial terms, conditions, and pricing. This sends a clear signal of the bidder's intent.

Reps and Warranties Insurance to Cost More in 2021; Areas of Underwriter Scrutiny to Expand

In addition to RWI procurement, the pre-LOI stage is a good time to get the administrative work on the due diligence side completed, such as mutual NDA execution, formalized engagement letters, initial diligence information checklists, data room access, etc. At this stage, the team can also get familiar with the target company by reviewing the Confidential Information Memorandum, financials, management presentations, and initial insurance-related information located within the data room.

With this step complete, the insurance advisory team can hit the ground running as soon as the LOI has been executed and there is a definitive closing timeline established.

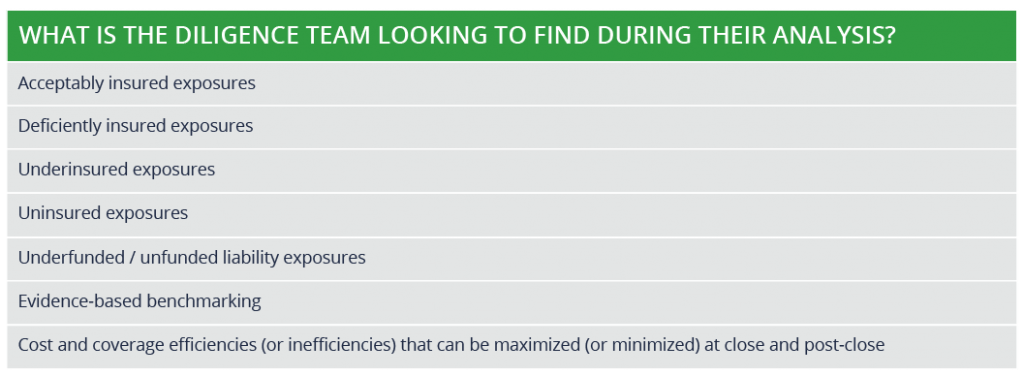

The goal of the insurance due diligence process is to uncover any instances or exposures that could negatively affect EBITDA for the target company pre-close, at close, or post-close in the short and long term.

Phase 2: Period of Exclusivity and Insurance Due Diligence

Once the LOI has been executed and there is a definite close date on the horizon, the buyer will typically kick off all third-party diligence workstreams. Insurance and Employee Benefits due diligence should be one of these workstreams.

First, the advisory team becomes more acquainted with the target company by having a call with the management team and providing updated information checklists based on the data initially provided in the data room. As more information is gathered and supplied to the buyer's diligence teams, checklists are constantly refined, and the insurance advisory team begins work on the due diligence.

The goal of the insurance due diligence process is to uncover any instances or exposures that could negatively affect EBITDA for the target company pre-close, at close, or post-close in the short and long term.

Members of the deal team are not insurance experts. The insurance advisor should be considered an offshoot of the deal team and a partner in EBITDA protection, as well as in risk mitigation and long-term insurance strategy.

The result of the diligence process should be a comprehensive, clear, and concise memo or formal due diligence report outlining findings. This report should detail historical and go-forward cost implications and recommendations on how to improve the current program at close or moving forward post-close.

Phase 3: Pathway to Close and Closing

Once the due diligence is completed, several things need to happen prior to closing.

RWI Phase II Underwriting Process

Phase I of the RWI process is completed when the private equity firm’s deal team chooses an RWI insurer to underwrite the transaction, executes the expense agreement for the chosen insurer, and wires the non-refundable underwriting fee directly to the insurer.

Phase II of the RWI process can move forward once the primary, underlying transaction due diligence has been completed and reports for each diligence workstream can be provided to the underwriter. The chosen underwriter (and their outside legal advisors) will gain access to the dataroom and "diligence the diligence" by performing a desktop review of all of the due diligence reports put together by the buyer's team. Following the initial review, a 90–120 minute underwriting call is coordinated, after which a draft policy and follow-up questions are delivered to Buyer. From that point until closing, questions are resolved as new turns of the purchase agreement are developed and policy negotiation moves forward simultaneously as the deal is marching toward closing. By the time the deal is ready to close, a fully underwritten and negotiated RWI policy is ready to bind.

Coordination of run-off coverage for any policies that have a Change in Control provision

This typically includes existing Professional Liability, Management Liability, and Cyber Liability policies.

Go-forward coverage solicitation

Depending on the structure of the transaction as well as the underlying policies in place, the insurance advisor should assist with soliciting and proposing coverage for the go-forward entity structure. If the transaction is an asset-purchase, a new Property, Casualty, and Management Liability program should be implemented at close. More on this can be found here.

If the deal is a stock transaction, typically only those policies that include a Change in Control provision need to be replaced at close. This could include Professional Liability, Directors and Officers Liability, Employment Practices Liability, Fiduciary Liability, and Cyber Liability. Any other policies that are being placed into run-off will also need to be replaced at close.

Certificate of insurance coordination

Lenders will need certificates of insurance validating that coverage is in place as of closing. Certain organizations will also need to be added to the insurance program as Additional Insureds or Lender's Loss Payable and may also stipulate cancellation notification provisions. These need to be referenced in certificates of insurance, typically required prior to close, and are coordinated by the buy-side advisor but executed by the existing insurance broker.

Important note regarding certificate requirements for asset transactions: If a new commercial insurance program is being implemented at close (in an asset transaction, for example), it is critical to understand the lender certificate process and timing to avoid delays. The lender will often stipulate the certificates are provided pre-close, including policy numbers, effective dates, etc. However, coverage cannot be bound until an insurable interest is created between buyer and the target company. The insurable interest is created when the deal officially closes, but the lender will not fund the deal until it has the certificates of insurance. The insurance advisor must work hand-in-glove with the lender to ensure everything is ready and everyone is on the same page with regards to these requirements.

Phase 4: Post-close Brokerage and Implementation

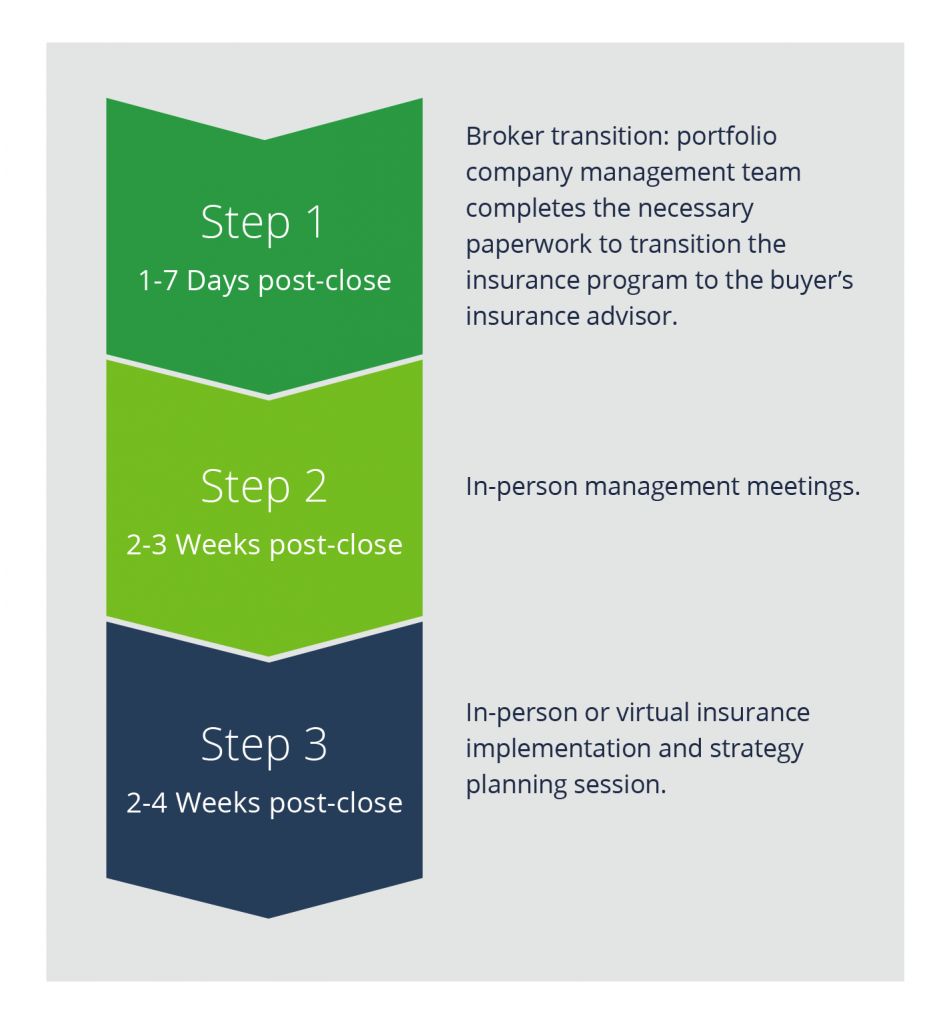

Once the deal closes, the real work and partnership begins between the operating partners of the private equity deal team, the management team of the newly acquired company, and the insurance broker team. Post-close is when the advisor begins to implement any recommendations that could not be or were not implemented at close. It is also the time where the due diligence advisory team works hand in glove with the management team to develop a comprehensive insurance and risk management strategy for the short, medium, and long term.

Post-Close Brokerage Timeline:

Key Insurance Due Diligence Findings in 2021

Here are several key findings that Woodruff Sawyer is seeing in core middle-market private and growth equity transactions:

- No thoughtful, strategic approach to insurance and long-term risk management: While a foundation has been established, no long-term insurance strategy for EBITDA protection has been developed or implemented. The insurance advisor should recommend ways to both professionalize the program and raise the level of sophistication of the insurance program post-close to maximize EBITDA protection over the lifecycle of the investment.

- Key coverages are missing: For many target acquisitions, the deal represents the first time the company has accepted institutional investors or considered a buy-out from a private equity sponsor. This means new board members and potentially a new approach to insurance. What may have been treated as low-priority pre-close (due to cost, for example) may be treated differently with a new private equity owner or growth equity investment because the buyer or investor will always seek to protect their investment.

- Examples of missing coverages include Management Liability (Directors and Officers Liability), Commercial Crime, Cyber Liability, or Product Recall Liability.

- Limits are inadequate. Similar to the above point, a company pre-close will choose a limit for a variety of reasons. We have found the company typically has not performed any benchmarking analysis around limit adequacy. As an institutional investor becomes involved, there should be greater thought around limit adequacy to protect the short and long-term EBITDA of the company.

- Examples of this include Cyber Liability, Business Income and Extra Expense, Contingent Business Income, and Products Liability.

- RWI continues to be utilized on most transactions that are greater than $50 million Total Enterprise Value. While rates did creep up in late 2020, we have seen varying degrees of underwriting capacity as a result of the lingering effects of COVID-19. We do expect rates to normalize throughout the next several quarters. Private equity, growth equity investors, and strategic acquirers are continuing to utilize insurance capacity to mitigate rep and warranty exposures and provide alternative solutions for Seller liquidity and indemnification.

- Property, Casualty, and Management Liability rates rising across industries and lines of coverage. Management teams should be prepared for rising rates throughout 2021. Broadly speaking, the insurance marketplace is in a "hard" market as compared to 2018–2020, which means rates are generally increasing across Property, Casualty, and Management Liability coverage lines.

Rise of the SPAC and Implications for Insurance Due Diligence

With 500+ SPACs currently priced and in search mode, many SPAC clients are turning to the diligence phase of their investment life cycle, commonly known as the de-SPAC or business combination phase. This phase includes identification of a target acquisition, gaining shareholder approval, acquiring of the target, and the combined company begins life as an operating company with publicly traded shares. Similar to our previous Insights posts on various transaction types and the insurance implications, the de-SPAC diligence process from an insurance perspective is nuanced and a critical part of the process.

What is a SPAC? Learn what a Special Purpose Acquisition Company is, how it functions, and what specific insurance coverages are essential during and after the process.

De-SPAC Business Combination: Insurance Due Diligence Process

Once the SPAC identifies a target acquisition, several workstreams should commence simultaneously on the insurance side of the equation: (1) RWI solicitation for the transaction; (2) customary due diligence for the target company’s insurance program; and (3) go-forward and tail Management Liability solicitation. When managed appropriately, these work streams work in tandem with one another with a single advisory team handling all aspects of insurance.

The primary goal of the insurance due diligence process is not dissimilar to the goal of a "normal" acquisition process by a traditional private equity buyout. Put another way, the SPAC management team and board of directors want to understand how the target company fundamentally manages risk and protects EBITDA as a stand-alone entity. The nuance with SPAC transactions is two-fold: (1) the SPAC management team adds another layer of complexity into an acquisition process; and (2) the result of the transaction process is not a private-equity-owned entity; rather, the company becomes a publicly traded entity.

Similar to traditional private equity deals, members of the SPAC deal team are not usually experts on insurance. The insurance advisor engaged to perform due diligence should be considered an offshoot of the deal team and a partner in EBITDA protection for the target acquisition both pre and post-close, as well as in risk mitigation and long-term insurance strategy as the newly combined entity begins life as a publicly traded company.

The result of the diligence process should be a comprehensive, clear, and concise memo or formal due diligence report outlining findings that will be delivered to the SPAC board of directors, target management team, investors, and potential RWI insurance underwriters.

Key Findings During SPAC Due Diligence in 2021

In general, our main finding across most transactions is the target’s underlying insurance program, while adequate, is not as sophisticated or professionalized as it needs to be to be a publicly traded company, and both the management team and insurance broker have not developed or implemented a comprehensive approach to risk management and EBITDA protection for the target company.

Below are several key findings that Woodruff Sawyer is seeing on de-SPAC transactions:

- Target has not implemented an adequate insurance foundation: With some de-SPAC targets, the company is pre-revenue and/or the company has not established a foundation of Property, Casualty, or Management Liability insurance.

- Adequate foundation is set, and the core exposures are acceptably covered: Typically, the target does have a form of foundational insurance program in place covering key exposures. Oftentimes, more nuanced coverages (such as cyber liability, product recall, etc.) have been overlooked or simply not purchased due to budgetary constraints.

- Strategic approach to insurance and risk management missing: While a foundation has been established, the target does not appear to have a long-term insurance strategy for EBITDA protection.

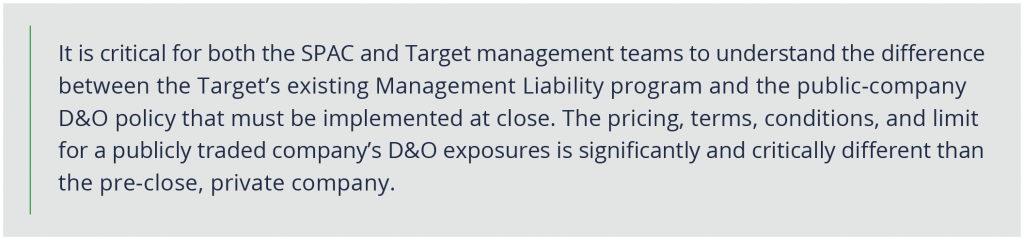

- No (or little) Management Liability coverage in place: If the target has obtained Management Liability coverage, it will typically be a small, private company D&O, EPL, Fiduciary, and Crime policy. This will be problematic if not tackled sooner rather than later in the transaction process.

- Limit adequacy of various coverages: In most cases, the decisions behind limits for various coverages on the underlying insurance program are driven by total annual cost. For example, if the exposure for Cyber Liability is $5 million but the policy is three times what a $1 million limit costs, the insurance buyer may accept the risk and opt for the $1 million limit. As the SPAC seeks to close the transaction, limit adequacy should be evaluated, and the program improved to state-of-the-art terms, conditions, and pricing.

Change in Control and Run-Off Provisions

The de-SPAC target acquisition will likely have several policies that are claims-made versus occurrence-based. This is an important distinction to make as claims-made policies include Change in Control provisions if a 50%+ change in ownership will occur at closing. It is critical to understand what, if any, policies include these provisions and the insurance advisor should identify actionable next-steps on handling those provisions for each policy as the deal approaches closing.

Managing the Management Liability Due Diligence and Transaction Process

The Management Liability (D&O) diligence process is more nuanced in a de-SPAC transaction process as opposed to other transaction structures. There are three separate policies in play at any given time during the transaction process: (1) the SPAC’s own public-company D&O policy; (2) the existing private company D&O policy in place for the pre-close target company’s Management Liability risks; and (3) the new, go-forward D&O program covering the combined entity, a publicly traded operating company. The insurance advisor should be simultaneously performing due diligence on the existing target D&O policy (as this policy’s coverage will matter for tail coverage) as well as engaging the target’s management team to procure options for the post-close, publicly traded operating company D&O policy.

As discussed in our Guide to D&O Insurance for SPAC IPOs and the Guide to D&O Insurance for De-SPAC Transactions, it is customary for the tail policies to have a six-year term. Carriers will charge a one-time premium to be paid at the closing of the business combination for each policy. Note that the cost of the D&O tail policy for the SPAC is typically negotiated when placing the initial D&O insurance policy for the SPAC IPO. Note further there may be situations in which no tail policy will be placed on the private company’s D&O insurance program. You will, of course, discuss this with your broker.

Woodruff Sawyer is a market leader of working with SPACs on both the initial IPO process as well as the de-SPAC business combination. For more information, please visit the Woodruff Sawyer dedicated SPAC page.

The Importance of Due Diligence

Insurance and Employee Benefits due diligence may not be the top priority on a private equity, growth equity, or SPAC deal team's radar. There are certainly myriad other priorities during the hectic deal process. But a comprehensive risk management and insurance strategy can bolster a company's EBITDA and protect against long-term issues. In the case of de-SPAC transactions, there are critical nuances from an insurance perspective that must be implemented at close, when the business combination completes and a new publicly traded company is formed through the merger.

Woodruff Sawyer Expertise in Protecting Private Equity & Venture Capital Firms:

- $200.0+ billion total assets under management insured

- $150.0–$350.0 million average transaction size

- 375+ private equity and venture capital clients

- 250+ active engagements in the last 24 months

- 25+ years of working in the Private Equity and M&A space

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

About Woodruff Sawyer

As one of the largest insurance brokerage and consulting firms in the US, Woodruff Sawyer protects the people and assets of more than 4,000 companies. We provide expert counsel and fierce advocacy to protect clients against their most critical risks in property & casualty, management liability, cyber liability, employee benefits, and personal wealth management. An active partner of Assurex Global and International Benefits Network, we provide expertise and customized solutions to insure innovation where clients need it, with headquarters in San Francisco, offices throughout the US, and global reach on six continents.

For more information

Call 844.972.6326, or visit woodruffsawyer.com.

Find out why clients choose to work with Woodruff Sawyer.

Subscribe for Expert Advice and Insights

Sign up to receive expert advice, industry updates, and event invitations

related to private equity and the venture community.

Authors

Table of Contents