Blog

M&A Insurance: 2023 First Quarter Roundup

With March now squarely in the rearview mirror, we thought it was time to look at the first quarter of 2023 from a historical perspective in terms of pricing and retentions and to discuss some emerging trends.

Premiums in Line with M&A Activity

Representations and warranties insurance (RWI) has always been an excellent bellwether for what is happening in the broader M&A market. More deals mean more submissions, which means underwriters can pick and choose their risks. According to Bloomberg Law, Q1 2023 had a global deal volume of $559 billion, the third-lowest global quarterly M&A deal volume in the last 10 years; only Q1 2013 ($502 billion) and early pandemic Q2 2020 ($442 billion) had lower quarterly deal volumes.

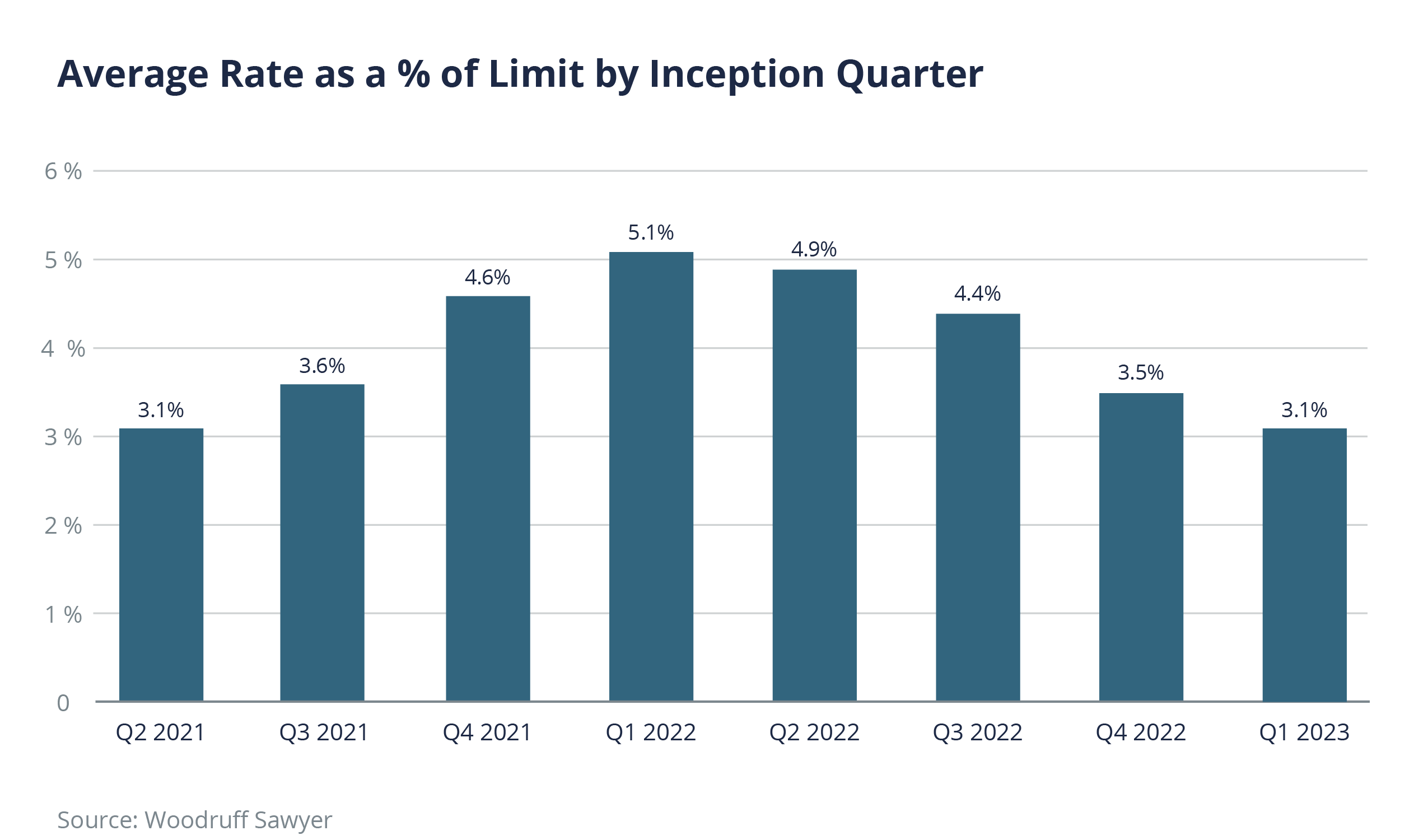

If we look at average premium rates quarterly over the last two years, we see that rates and activity are closely aligned.

We currently see average premiums like those in the second quarter of 2021. Current deals can expect a rate between 2.5–3.5%. We expect that trend to slightly lower in the coming quarter, and we already have seen attractive deals get pricing around the 2.25% mark.

Retentions

There is a current downward pressure on retentions, a trend that is important and timely.

Claims reports have shown that historically very healthy retentions have made RWI profitable for the markets. Many claims fall comfortably within retention rates, and we think this situation makes the insurance less marketable than it could be.

Like many brokers, we consider the soft market an opportunity to apply downward pressure to retentions, especially on larger deals. We believe there is room for lower retention whilst still maintaining the long-term health of the market, and we are seeing the fruits of that perspective on larger deals.

The first wave of reductions hit deals above $500 million, where we saw retentions drop from 0.75% to 0.5%, with a further drop to 0.25% after 12 months. We have now seen this also impact smaller deals, where most retention quotes come in below 1%, with some as low as 0.5%. However, there isn’t as much of a drop after 12 months as we are seeing with the larger deals.

Who Is Absorbing Retentions?

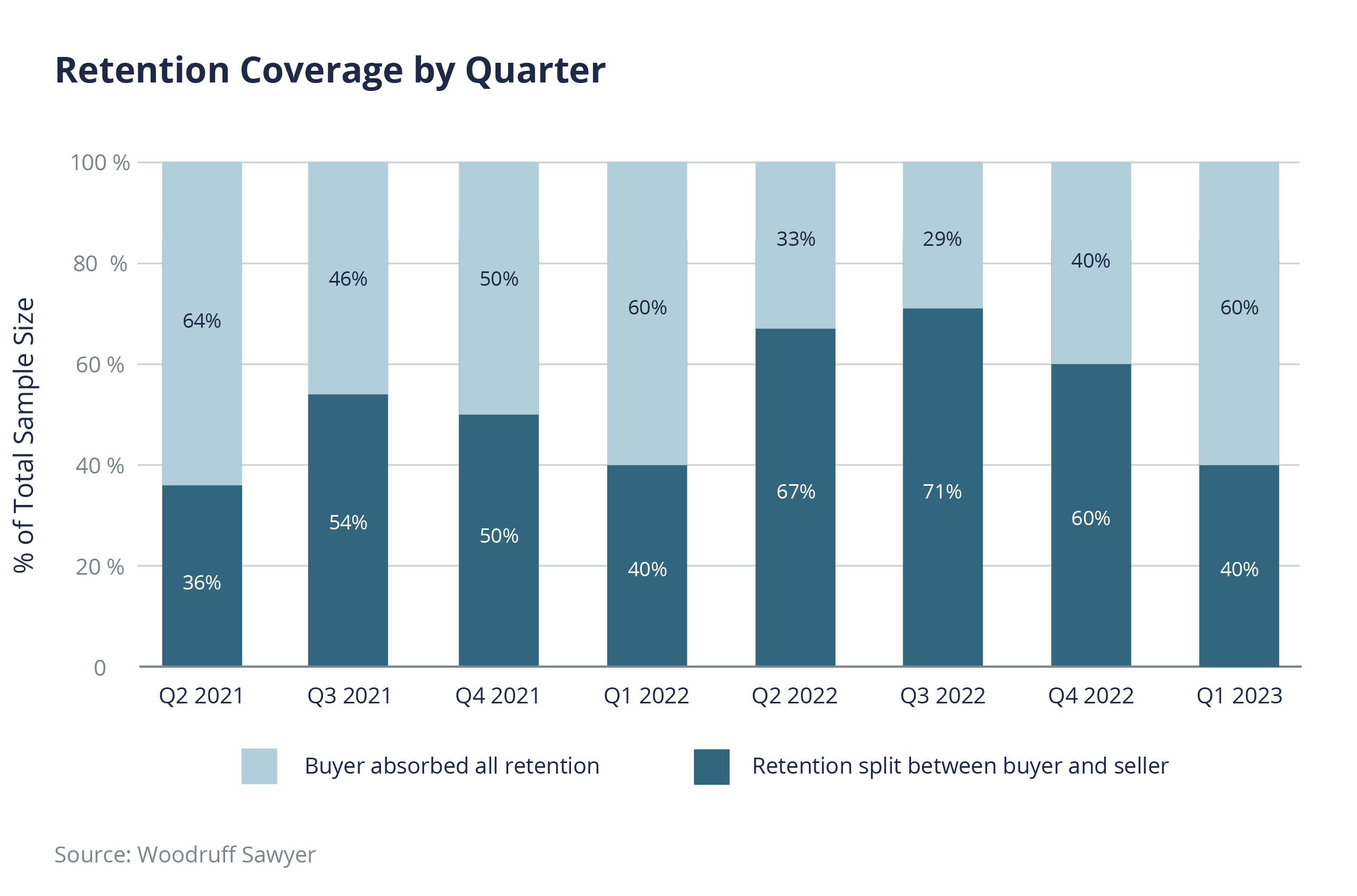

Who pays the retention? Our statistics reveal that this is a complex issue. Hundreds of individual points are negotiated on every M&A deal, and whether the buyer, the seller, or both are responsible for the retention is not necessarily tied to deal flow the way premium is. The above graph shows how our clients have handled this issue on a quarterly basis.

The light blue part shows where the buyer has absorbed all the retention, and the dark blue part shows where the retention has been split between the buyer and seller. What is not shown is the number of times the seller bears all the retention, as that happens rarely enough to be statistically insignificant.

Quote Rates

Quote rates, or the number of quotes given for any risk, are a good indicator of deal activity and the deployment of insurance market capital. There are currently 26 markets quoting domestic American business. When the market was harder, getting more than two or three quotes for each risk was a struggle. With such a busy market, no one wanted to quote more than they could handle. However, now we are in a position of getting 10–15 quotes on each submitted risk. This increase, along with price reductions and broadening terms, confirms the soft market.

Terms

As you would expect from a hungry market, terms are broad, and coverage is generous. So-called “deemed deleted/altered language” appears in NBILs, allowing the underwriter to cut certain phrases or words in individual SPAs from the RWI coverage. We see fewer “deemed deleted/altered” language in quotes and fewer industry-specific exclusions at the quote stage as underwriters try to remain competitive. We are additionally seeing a greater willingness to tighten and negotiate on post-diligence exclusions.

In addition, there has been a push by some markets for the severability of fraud in the subrogation provision. These pushes are made by the seller’s lawyers and are handled on a case-by-case basis by underwriters.

Finally, the subject of prosecution costs is up for negotiation once again. Since loss is usually defined in terms of defending against claims, adding prosecution costs gives the insured the ability to sue a third party. An example would be if a third party were using the target's IP illegally, causing a loss.

We are talking in broad brushstrokes here about a highly nuanced point, but it is one we thought was firmly settled and is now open for discussion again on individual risks.

Deal Size

Getting coverage for smaller deals/limits has been possible for a long time. However, we are now seeing specific products geared to this type of risk. For example, one carrier, Fusion, has a product that does not require diligence calls or audited financials and can provide exceedingly small limits. However, this product has non-negotiable wording and only provides coverage for a certain subset of warranties, making it a great choice for very specific circumstances.

Interim Breach Coverage

As expected, the availability of “full interim breach” coverage has not proven appealing to clients. That coverage already existed for breaches that happened before signing but was discovered between sign and close and cover for breaches that happened between sign and close but were discovered post-close.

The gap in coverage is for breaches that occurred and were discovered between sign and close. This is the gap that can now potentially be filled with extra coverage. We have not found this extra coverage to be of game-changing interest to our clients.

The RWI Market Remains in Transition

We are experiencing a soft market in RWI, just a year or so from its very first hard market. However, the market is still very much in transition. A soft market allows us opportunities to get broader coverage at more favorable terms. It’s also a time to push old points previously lost in the hard market.

At Woodruff Sawyer, we anticipate the soft market will persist into the coming quarter and look forward to working with our clients to achieve superlative results. However, this market remains volatile and one of its greatest strengths is its ability to pivot in changing circumstances.

Author

Table of Contents