Blog

Is the Cannabis Insurance Market Still Half-Baked?

Last year, after walking into my local bodega, I came face to face with a new, shiny, sleek bitcoin ATM. It stood quite conspicuously next to the old-school, regular, boring, and slightly grimy cash ATM, clearly proclaiming its superiority. Having practiced as a securities law attorney for many years and having worked with money transmission systems, exchanges, and related regulations around the world, I immediately imagined all the things that could go wrong with having a bitcoin ATM prominently featured at a local corner store. I imagined excited shoppers feeding dollars into the machine. Images of multiple exchanges, located no-one-knows-where that would immediately skim large chunks off those dollars sprung up before my eyes. I saw scrambled codes and keys, lost or stolen, floating in the nether sphere, and the disappointed faces of shoppers trying to extract cash out of the machines only to be faced with red, blinking signs of "cash not available."

I must admit, I never tried using the machine, but for all I know, all of this could have happened, because as I walked into the same bodega a few days ago, the bitcoin ATM machine was very prominently absent. Instead, the checkout counter shelves were laden with multiple varieties of CBD gummies and candies and hemp oil products.

I chuckled at the business sense and creativity of the bodega owner. Clearly, they, to their credit, are deeply in tune with the ever-changing winds of consumerism. But my thoughts now turned to all the things that could go wrong for the said bodega owner should their strategy of diving into the exciting world of cannabis go wrong.

Insurance Problems and Solutions

When things go wrong for any business, one of the first questions, surely, is whether its insurance policy would cover the costs. For a cannabis business, or for a business dealing with, or providing services to, a cannabis business, the thought process is the same, but the situation is a bit different.

Increasing Cannabis Legalization is Spurring Huge Business Activity

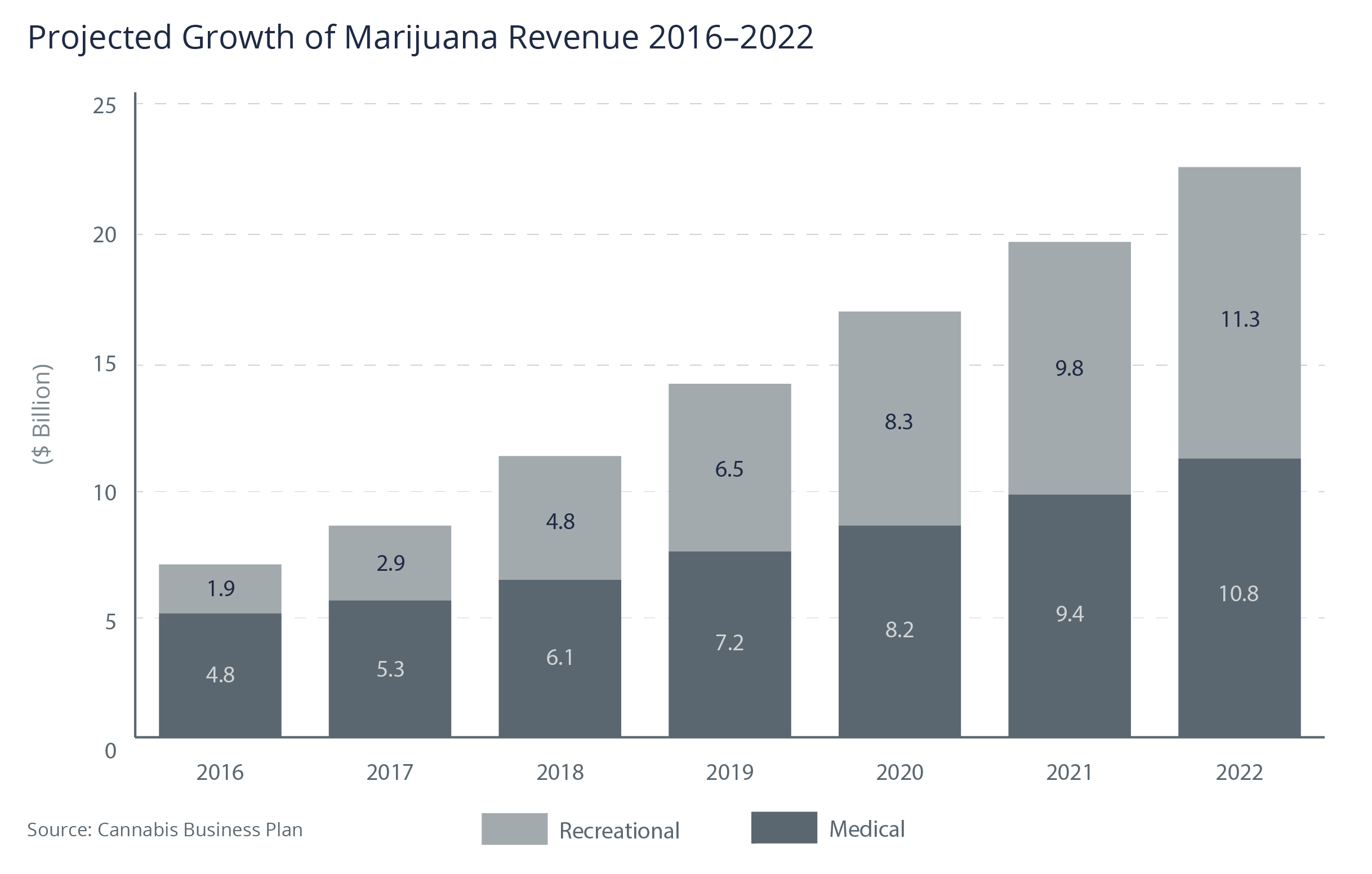

As things currently stand in the United States, cannabis remains illegal on the federal level. At the time of this writing, 33 states and the District of Columbia have legalized medical use and 11 out of those have now legalized recreational use, with Illinois being the latest state to do so. In Canada, cannabis has been legal since October 2018 and has spurred an impressive growth in business activity of all kinds, including financing deals, companies going public and trading on Canadian and US exchanges, and companies merging and acquiring assets. At least the same level of growth is projected for the US market, with revenues from both medical and recreational use expected to exceed $20 billion by 2022.

Insurance Industry is Proceeding Cautiously but Coverage is Growing

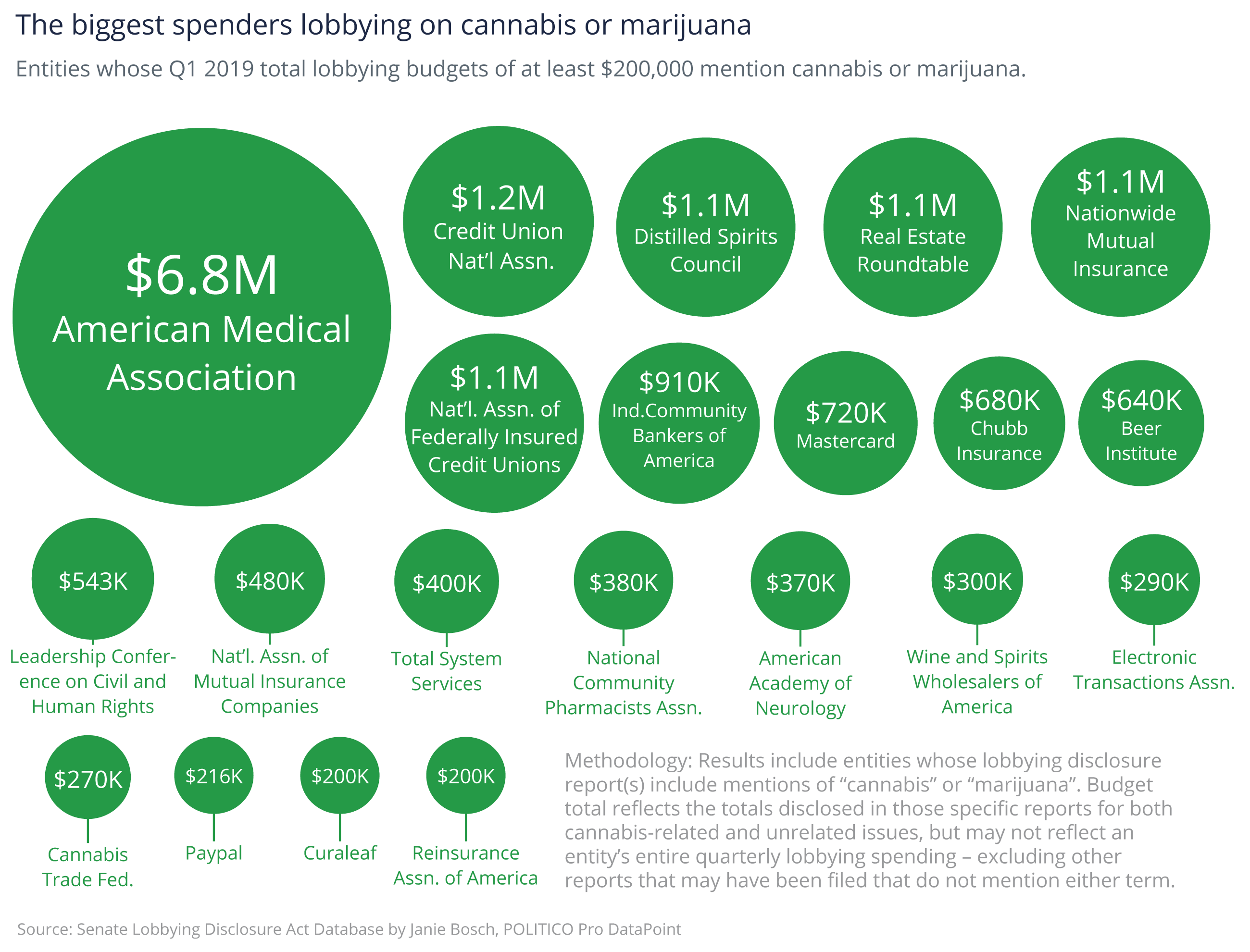

All of this business activity needs the backbone of proper insurance coverage, but because of the regulatory clampdown on the federal level, large financial and insurance institutions that could and are eager to provide support and coverage for the industry are extremely cautious about entering the cannabis market. Still, public opinion is quickly changing towards legalization. Many industry groups and some large insurers are lobbying the US Congress for less restrictive and clearer regulations.

At least two national insurance providers are already vying for a leadership position in the cannabis space(including cannabis SPACs and have already been offering substantial coverage across different insurance lines. Many other national and international insurers are actively exploring wider opportunities in this space.

M&A representations and warranties insurance, management liability, including D&O coverage, cyber, and property and casualty insurance policies have been placed and are increasing in number and sophistication. Several specialists at Woodruff Sawyer have worked with cannabis businesses or cannabis business service providers on their insurance placements. If you are interested in learning more about the current state of the insurance market in the United States, and for more information on the related regulatory and financial background, download your copy of the Cannabis Insurance Whitepaper and feel free to reach out to us at Woodruff Sawyer.

DOWNLOAD THE FULL CANNABIS INSURANCE WHITEPAPER >

Author

Table of Contents