Blog

State of the US Private Equity Middle Market: An Insurance Perspective, Q1 2019

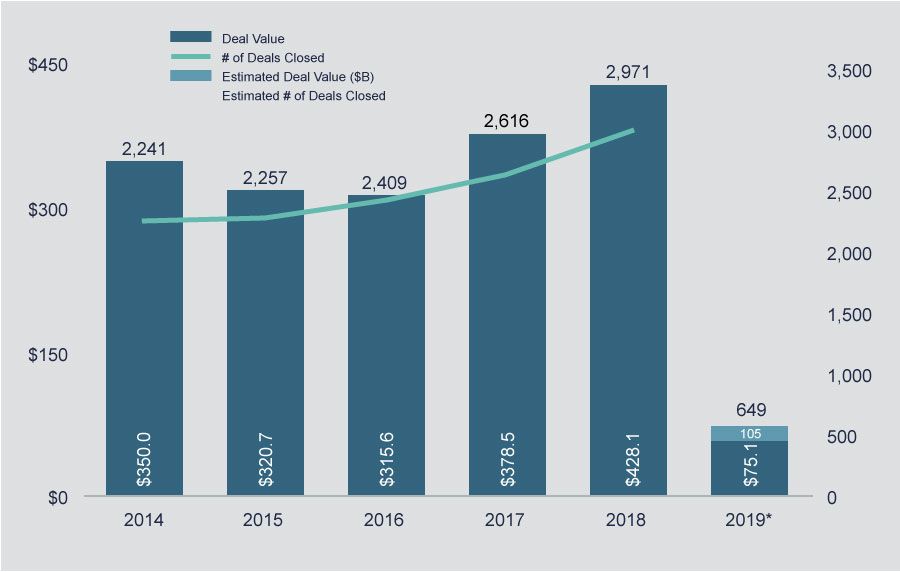

In my last blog post that gave a 2018 recap on the state of the US private equity middle market, I discussed how 2018 was a record-breaking year. At year's end, the middle market space had seen four successive quarters of >$100 billion in deal value and 2,971 total transactions for the year.

Chief among the questions I posed was: How far could the upward trajectory go?

As we see Q1 2019 in the rear view mirror, we now know the marketplace can and will level off (or decline) under the right circumstances.

Prohibitive financing costs, a poor loan environment, the longest government shutdown in history, and several other factors led the US private equity middle market fund managers to be much more restrained in their acquisition approach. In addition, PE-backed IPOs were non-existent for the first quarter since the Great Recession time frame, according to Pitchbook's 1Q 2019 US PE Middle Market Report.

At a Glance: 2019 US Middle Market Sector Recap

- Through March 2019, 649 total transactions (YoY decrease of 17.9%)

- Total deal value: $75.1 billion (YoY decrease of 32.6%)

- Median transaction size: $155 million

- Exits: 137 total exits totaling $27.1 billion (YoY decreases of 41.8% and 46.3%, respectively)

- Fundraising: 25 new funds closed in Q1 2019 with $25.7 billion in value

- Trends in multiples: 5.8x Debt / EBITA (as compared to 5.7x in Q4 2018)

- 5.7x Equity / EBITDA (no change from Q4 2018)

- 11.5x EV / EBITDA (as compared to 11.4 in Q4 2018)

Interpreting the Numbers

If I could describe Q1 of 2019 in a few words, I would say the middle market is showing cautious restraint. Increased market volatility combined with public market performance and a general fear across the GP landscape caused fund managers to be much more restrained in their acquisition strategy in Q1 2019 versus prior quarters.

2018 was a record year, and everyone knew the trajectory could not continue unabated. According to data from Pitchbook, the downward trend in the middle market is slightly better than that of the broader PE landscape.

One key factor of the frothiness of Q4 2018 and prior quarters was the affordable financing landscape of high-yield bonds and leveraged loans to finance leveraged buyouts. That landscape changed in Q1 2019 and GPs are electing to wait until the market improves prior to closing the transactions on the radar.

EBITDA multiples remain high, but some fund managers are likely concerned the seller's market will not last. Simultaneously, per Pitchbook, GPs are more broadly concerned with a looming economic downturn.

These factors are leading more sellers to try to get deals across the finish line in the short-term before the seller's market shifts. If you add on top of this the notion of just how much dry powder is still out there, Q2 has a large opportunity to rebound if financing improves.

Expert Risk Management Advisors Can Help Fund Managers Close Deals

Even with the relative slow performance of Q1 2019, multiples in the middle market remain steady and elevated, and deals are still getting done. A key question then becomes: how are those fund managers successfully inking deals able to beat the competition and get these transactions across the finish line?

The obvious answer is: those GPs are more willing to overpay for competitive, "good" assets. So, the question then becomes two-fold: (1) Why are they willing to pay a higher multiple than competitors; and (2) how are they able to differentiate themselves over and above a higher bid?

According to Pitchbook, GPs are looking for ways to become more comfortable with paying a higher multiple by better understanding the asset pre-close. They are continuing to intensify the due diligence process to focus on downside protection. When potentially overpaying for an asset, deal teams want to fully understand both the core and non-core risks that could negatively or positively affect EBITDA growth in the five to seven-year holding period.

As a direct result, these GPs are interested in engaging competent service providers outside of the core tax, accounting, legal, and environmental due diligence process to better understand some of the more nuanced exposures faced by a potential acquisition. Putting it bluntly: Deal teams want to know where any potential land mines are, and they want to know how to avoid them.

One of these advisors is an expert insurance advisor with specific expertise in transaction-related advisory services.

Advisors such as Woodruff Sawyer's Private Equity Group can help not only win deals, but also help increase EBITDA of the portfolio company post-close by lowering the total cost of risk. This can thereby mitigate some of the risk a GP will undertake by identifying those potential land mines that could negatively affect profitability pre-close.

The following are examples of where an expert insurance advising team that has worked on hundreds of transactions adds value during a transaction process.

Transactional Risk Insurance Solutions Including R&W Insurance

- In this seller's market, sellers desire to have more proceeds at close. A reps and warranties (R&W) insurance policy allows sellers to reduce the amount held in escrow, thereby increasing proceeds available at close.

- Whether the seller is a founder/operator looking for a liquidity event or a PE sponsor looking to maximize cash distributable to LPs, this is a win-win.

- In an auction process where the total enterprise value is >$50 million, including an R&W insurance proposal in a LOI submission is now the norm. If a prospective buyer submits a LOI for this size transaction without a R&W insurance proposal, the bid will not be as competitive as the other bids received.

- On the other side of the table, Sellers are also more frequently utilizing insurance capital to box-in potential or unexpected liabilities. This can include tax liabilities (sales and use / nexus, transfer pricing, or S-Corp status), contingent liability, and/or litigation buyout. The method by which Sellers can remove these concerns from the negotiation or special indemnity carve-out is by procuring a complex transactional risk solution. Given the complexity, it is critical to engage a broker partner who has experience in negotiating and placing these solutions.

Management Liability

In every management buyout (or any situation in which a change in control occurs), the management liability program in place for a target company will need to be replaced at close. It is critical to perform due diligence on the existing program's structure, terms, conditions, and pricing to understand any deficiencies prior to implementing a new program at close.

- For public middle market companies, the number of class action lawsuits filed against foreign companies rose 39% in 2018. While affecting a smaller portion of the US MM, this has led to significantly elevated premiums for D&O insurance for foreign-based portfolio companies looking to IPO in the US.

Employee Benefits and 401(k) / Retirement

Employee benefits expense is the second-largest expense for a company, second only to payroll. Naturally, this is a significant area of risk to the deal team considering the acquisition, and is one more area where a deep dive during due diligence can help.

- A competent insurance advisor can help by performing a deep dive into current benefits offerings. This should include a detailed review of cost and participation of the broad employee base. The review can be integral in understanding what potential levers could be maneuvered post-close to enhance the program post-close, or improve the overall cost structure by bringing the program within industry and geographic norms.

- Underfunded or unfunded pension plans can also become land mines for buyers that do not consider the long-term ramifications of assuming liability for a pension plan even if it was frozen years ago.

Closing Thoughts on the Current State of the PE Middle Market

It is true the US private equity middle market had a slowdown in Q1 2019, but that is only relatively speaking with the unprecedented results of 2018.

Many factors could lead to further contraction in the MM, chief among them the subconscious fear of a broader economic downturn on the minds of GPs around the country.

Similar to 2018, there are plenty of deals out there and plenty of dry powder to deploy. Competition will remain tough as funds try to put capital to work and get transactions across the finish line in Q2.

An experienced insurance advisor on your diligence team can facilitate the deal process by negotiating transactional risk solutions to help funds win auction processes. This can enhance the due diligence process by uncovering expensive land mines pre-close, and decreasing the total cost of risk long-term post-close.

The Woodruff Sawyer Private Equity and Transactional Risk team has been working with the M&A community for over 25 years. We have worked on hundreds of middle market transactions. From pre-LOI through divestiture, we help our clients not only win transactions, but also mitigate deal-related risk exposures pre-close and post-close while simultaneously having a positive impact on EBITDA.

Author

Table of Contents